Two megatrends are converging to create an investment opportunity that could ramp up like the smartphone revolution.

Total annual sales for one could eventually be worth $8 trillion.

The other already topped $30 trillion last year.

And a company such as Facedrive--which innovatively straddles these two megatrends with a carbon-neutral 2.0 version of shared mobility-- is becoming an exciting opportunity.

And it’s all going down in the transportation industry. Right now.

A seismic shift is occurring in the global transportation sector, and the implications of this change are going to be profound for consumers and businesses everywhere.

Back in 2016, when Mary Barra, CEO of General Motors, said she believed “the auto industry will change more in the next five to 10 years than it has in the last 50”, it was the same year that Facedrive (TSXV:FD,OTC:FDVRF), Canada’s answer to sustainable ride-hailing, grabbed on to this megatrend.

They saw where the winds were blowing--and where big capital was shifting its money--and they launched in 2019 with a company that fixes things Uber got wrong by offering a carbon-neutral and a carbon-offsetting form of ride-sharing that taps into the $30-billion sustainable investing trend in the transportation sector.

Now they’re expanding, and it’s not just about catching a lift--it’s about an eco-system of revenue based on the company-rider relationship of convenience.

It’s transportation, sustainable or “ESG investing”, merch, healthcare deliveries, food deliveries, long-distance car-pooling, and even COVID-19 contact tracing.

It’s shared mobility. It’s shared … everything.

But last week, Facedrive Foods provided a glimpse as to how serious the company is in targeting the Canadian food delivery industry. To kick-off its aggressive expansion drive in the segment, Facedrive Foods entered into a binding term sheet to acquire assets of Foodora Canada. This move is especially significant because Foodora Canada is a subsidiary of Delivery Hero, a $20 Billion European multi-national food delivery service that operates in over 40 countries internationally and services more than 500,000 restaurants.

Facedrive Foods’ acquisition of Foodora Canada’s assets would give Facedrive a big revenue boost and huge jump into the space of its major Canadian food delivery competitors such as Uber Eats and Skip The Dishes. Facedrive would obtain instant access to hundreds of thousands of Foodora Canada’s customers, and 5,500 new restaurant partners. With this move, Facedrive Foods would overnight position itself into the top echelon of Canadian food delivery services and turn up the heat on major incumbents in the space.

And while this deal hit the scene explosively, another Facedrive deal this week grabbed even more attention amid the coronavirus pandemic.

Over 650,000 members strong across North America, LiUNA - The Labourers’ International Union of North America announced it would adopt Facedrive’s TraceSCAN digital COVID-19 contract-tracing app to protect the health and safety of its Canadian 130,000 members.

That’s a huge boost for a brand new, high-tech app developed in a joint initiative by Facedrive Health and the University of Waterloo.

The TraceSCAN app and wearables provide contact tracing to help mitigate the spread of the COVID-19 virus. Using Bluetooth technology, TraceSCAN alerts users with a notification if they have come in contact with an individual who has tested positive for the COVID-19 virus.

The next logical step here for Facedrive is to see other unions and councils—and possibly even the Canadian Federal and Provincial governments to adopt the TraceSCAN application.

Times Have Changed Dramatically

Fifty years ago, buying and owning a car was considered the quintessential sign of adulthood; the badge of your independence and your ticket around town. But following rapid urbanization, our increasingly gridlocked roads, ever-rising CO2 levels and the fact that we use our cars only 4% of the time, this mindset is rapidly disappearing.

Transportation-as-a-Service (TaaS) aka Mobility-as-a-Service (MaaS) has emerged as the biggest shift in mobility since the rise of automation, and could be about to turn the $5 trillion global transportation industry on its head.

TaaS is a radical shift away from a transport model that involves ownership of vehicles towards mobility solutions that are consumed as a service just like Uber (UBER) and Lyft (LYFT).

It’s a megatrend that could become bigger than the smartphone revolution that took the world by storm…

Facedrive is one company strategically positioned to exploit the unique TaaS-ESG nexus.

The likes of Uber, Didi, Lyft, GETT, Ola Cabs, Hailo, Meru, Addison Lee and BlaBla Car have been leading TaaS 1.0...

But Facedrive (TSXV:FD,OTC:FDVRF), is moving to lead TaaS 2.0 by offering riders something they can't get from Uber or Lyft: A carbon-offset way to share a ride.

Facedrive is Canada’s first peer-to-peer, eco-friendly and socially responsible TaaS network.

Facedrive's business model puts the "people and planet first", and that means planting trees and offsetting CO2 for every ride hailed. The company's innovative, state-of-the-art, in-app algorithm calculates estimated CO2 emissions for each car journey and allocates a monetary value to the local organizations to plant trees.

Last year alone, in partnership with Forest Ontario, they planted over 3,500 trees in their soft launch phase.

The TaaS industry

TaaS is about to hit a tipping point, and when it does, it’s going to change us.

From the way we eat, shop, work, and travel… to the value of our homes and even where you live. It will radically change the price we pay for everything from airline and train tickets to a tank of gas, and even household goods.

TaaS is sitting at the intersection of four macro trends: Electrified vehicles (EVs), connectivity, the sharing ‘gig’ economy and ESG investing.

The TaaS market is projected to eventually hit $8 trillion encompassing ride sharing in personal transport, freight, food and drone delivery and distribution.

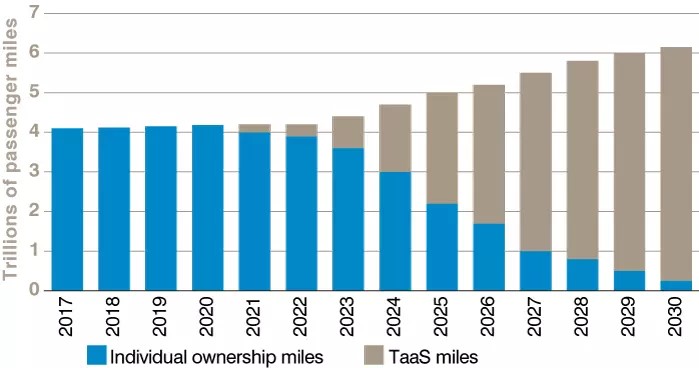

Rethink Transportation has projected that TaaS miles could overtake individual ownership miles as soon as 2025 and by 2030 almost all of the forecast six trillion passenger miles will be driven on a TaaS basis.

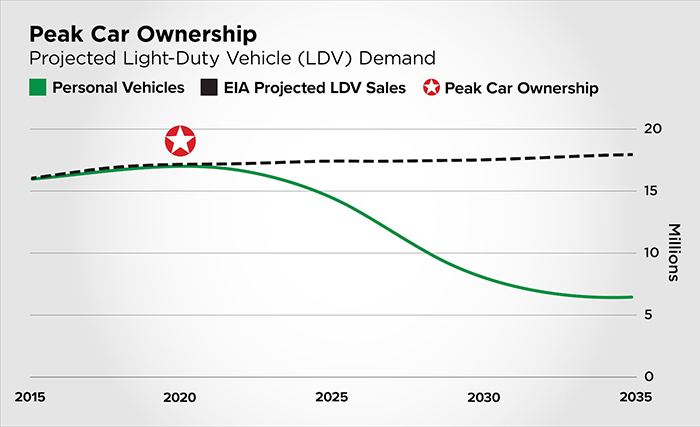

This is clearly happening as we speak, with global car sales contracting 4% in 2019 for the first time in a decade.

Source: GAM Investments

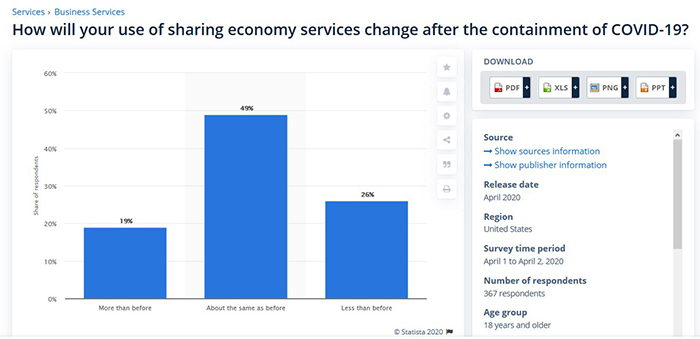

It’s a megatrend that’s clearly geared to survive Covid-19, with more than two-thirds of people saying they intend to continue using shared economy services just as much or even more than before the pandemic struck.

Which is not hard to understand considering that 33 million Americans have already lost their jobs with ~40% likely to be permanent layoffs.

Source: Statista

TaaS will likely take the world by storm and become mainstream much more rapidly than many people are guessing...

Uber started in an apartment in 2009, and within just seven years, was booking more rides than the entire U.S. taxi industry!

And it all happened for one simple reason… the same reason TaaS fleets could soon rule our streets…

Economics.

TaaS will be 10 times cheaper than buying and operating your own, gas-powered vehicle, and will completely eliminate the need to hunt around for a parking spot when you reach your destination.

As thought leader and SV entrepreneur Tony Seba has declared:

“I have looked back at disruptions going all the way back to Guttenberg. Every time there’s a 10x improvement in cost for the same product or service, there has been a major disruption. Every single time. I know of no case where 10x improvement did not lead to disruption.”

Estimates are that TaaS will lower the total costs of transportation by 10-times for many car owners, compared to owning your own vehicle.

2020 could be the point at which car ownership will begin its long descent into oblivion.

Back in 1985, AT&T (T) hired the world’s leading consulting firm, McKinsey, to predict the adoption rate of cellphones.

McKinsey’s “experts” predicted the cell phone market would total 900,000 customers by the year 2000.

But they were off by more than 100-fold… because the actual number turned out to be 109 million.

TaaS could soon drive down our costs of transportation to just a fraction of owning a car per mile!

Today, it costs about 80 cents per mile in our gas-powered cars, according to AAA.

In a couple of years, it will most likely be the norm to hail an electric vehicle via an app on your phone, just like you hail a Lyft and Uber ride today.

And instead of paying $50,000 for a new car… plus $3,000 a year to fill up your tank… and $1,000 to $4,000 a year for insurance, you'll instead spend something like $150 a month for a set number of rides with a TaaS subscription.

Facedrive fully recognizes the implications of the powerful TaaS megatrend and encourages its customers to use its readily available fleet of EVs.

Trees and the New Investing Mega-Trend

There are three realities that have come together to position Facedrive to change ride-sharing forever.

First, ESG (environmental, social and governance) investing isn't just a fad anymore--it's minting millionaires and billionaires. It's in high demand, and it's pressuring companies to make major changes. It's the ethical squeeze of the century. From Jeff Bezos' $10-billion commitment to a Global Earth Fund to BlackRock CEO Larry Fink, we're now seeing major ESG assets under management. BlackRock will increase its ESG assets from $90 billion to $1 trillion within a decade.

The second reality is that ride-sharing is already huge and set for more growth in our "sharing" economy. The global market is already worth $235 billion, according to Canada's commercial banking giant, Scotiabank, which has jumped on the Facedrive bandwagon as it embraces ride-sharing 2.0.

The third reality is that this same explosive ride-sharing growth is also having a huge negative impact on the environment. A recent study by the Union of Concerned Scientists estimates that the average (U.S.) ride-hailing trip results in 69% more pollution than whatever transportation option it displaced.

Facedrive is positioned to tackle this critical environmental problem by changing the footprint of ride-sharing, forever--and their goal is to do it without sacrificing profit. Although Facedrive offers competitive journey fares, riders do not pay a premium for CO2 emissions offsetting while drivers do not lose any of their fare to pay for the green initiative. Facedrive allocates the money from its commissions with a goal of planting trees in places where carbon has been emitted.

Facedrive’s green strategy is simple yet highly effective and cheaper than fancier solutions being adopted by the so-called big companies.

Each year, plants remove about 25% of the carbon emissions produced by human activities such as burning fossil fuels while a similar amount ends up in the oceans. So, Facedrive is getting back to Mother Nature--and millennials and investors are loving it.

According to researchers, it would require $300 billion to plant enough trees to remove enough CO2 to avert catastrophic climate change, working out to less than USD$1.50 per tonne of CO2 removed. In contrast, the best carbon capture technologies boast a breakeven point of ~$50/tonne of CO2 removed, or about 33x the cost of planting trees.

This next-gen ride-share company also offers customers a choice for every ride; whether they want an EV, a hybrid, or a conventional car and then offsets the CO2 for ALL types of rides.

Uber and Lyft spent billions of dollars bringing ride-sharing into the mainstream, but Facedrive jumped in when it could get ahead of the game, pinpointing the major problems the ride-hailing explosion created for the environment at a time when investors are squeezing companies over ethics.

The future of transportation is already upon us, and Facedrive is fixing its flaws.

Other companies taking advantage of the TaaS trend:

GrubHub (GRUB)

GrubHub was America’s dominant food delivery force for some time, but like Uber, it spent a lot to get its market share to that point. Not only that, it’s received a lot of criticism for the layers of fees it places in every order. While customers don’t see most of what restaurants are being charged, restaurant owners find the service difficult to work with, as the fees cut significantly into their own profits.

Natt Garun in an article for The Verge wrote,"Though Grubhub is upfront with businesses about the terms, the move is being criticized as an attempt to profiteer from business partners that are struggling under the nationwide measures to limit the spread of the novel coronavirus.”

Yandex (YNDX)

Yandex is essentially Russia’s Google. It’s a multi-national internet giant, but it also has its hands in the TaaS pie. And it might even be a better play than Uber or Lyft based on its year-to-year growth. Due to regional legislations, Yandex was able to secure a deal with Uber in which it controls nearly 60% of a joint venture in Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, and Russia. It even offers its own food delivery service, Yandex Eats.

Not only is Yandex exploding in the TaaS field, though, it is also diversified well beyond that niche. It’s an internet giant, after all. A search engine, advertising provider, eCommerce giant, tech developer, and much much more.

Dominoes (DPZ)

Dominoes has seen some rough times in the past, but it’s worked hard to get to where it is now. After a major makeover, Dominoes burst back onto America’s pizza delivery scene and has made major waves ever since. The company has worked hard to secure its own deals with the other delivery giants to ensure its own market share was able to survive, and even added a number of little tricks to improve the customer experience and encourage its fans to order directly instead of via a third-party application.

There’s no denying that telecom and tech companies are playing a vital role in this movement, as well. Take these Canadian companies for example:

Shopify Inc (TSX:SHOP)

Shopify is a Canadian e-commerce company. More than 1,000,000 businesses rely on Shopify’s real-time e-commerce, including Tesla, Budweiser and Red Bull, among many others. Shopify makes purchasing goods and services easy for anyone – and in a time where convenience is king, Shopify surely has staying power.

In addition to its revolutionary approach on e-commerce, Shopify is also delving into blockchain technology, making it a promising pick for investors, especially given that the sector is red hot right now.

EXFO Inc (TSX:EXF)

EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream. It is laying the groundwork for companies like Uber and Lyft to operate.

Shaw Communications Inc (TSX:SJR.B)

Shaw owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them. Shaw’s dominance in Canada’s telecom sector means that if any internet-based services want to operate, they’ll likely be utilizing the company’s infrastructure. After all, without telecoms, these TaaS companies would not be able to operate.

BCE Inc. (TSX:BCE)

Like Shaw, BCE is a Canadian telecom giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses, including TaaS providers throughout North America and its new LTE-M network is sure to rapidly increase the adoption of these solutions.

Mogo Finance Technology Inc. (TSX:MOGO)

This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

By. Nicola Ferris

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for TaaS and ride sharing services will grow, and TaaS reach $8 trillion; that the demand for environmentally conscientious ride sharing services companies in particular will grow quickly and take a much larger share of the market; that Facedrive’s marketplace will offer many more sustainable goods and services, and grow revenues outside of ride-sharing;that new products co-branded by Bel Air and Facedrive are ready to launch, with pre-orders coming soon on the Facedrive website; that Facedrive can achieve its environmental goals without sacrificing profit; that Facedrive Eats will expand to other regions outside southern Ontario soon and will close its purchase of Foodora; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plan. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; the ability of the company to attract a sufficient number of drivers to meet the demands of customer riders; the ability of the company to attract drivers who have electric vehicles and hybrid cars; the ability of Facedrive to attract providers of good and services for partnerships on terms acceptable to both parties, and on profitable terms for Facedrive; that the products co-branded by Facedrive may not be as merchantable as expected;that Facedrive does not close the purchase of Foodora and even if it does, the purchase does not bring the customers, partnerships or revenues expected; the ability of the company to keep operating costs and customer charges competitive with other ride-hailing companies; and the company’s ability to continue agreements on affordable terms with existing or new tree planting enterprises in order to retain profits. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

ADVERTISEMENT. This communication is not a recommendation to buy or sell securities. An affiliated company of Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has signed an agreement to be paid in shares to provide services to provide marketing and promotional activities to expand ridership and attract drivers. In addition, the owner of Oilprice.com has acquired additional shares of Facedrive (TSX:FD.V) for personal investment. This compensation and share acquisition resulting in the beneficial owner of the Company having a major share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.