Investors are looking for the next post-coronavirus trend...

And it's already here.

While the world is in varying degrees of lockdown...

Investors are home looking to profit from one stealth industry that’s getting big money from investors.

Two years before the lockdown this industry hit $67 billion in revenues globally. But growth was steady rather than spectacular.

Now, it’s rolling out across the globe and one little-known company FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF) could be a winner.

Why?

Forecasts are that its industry revenues will top $286 billion in 5 years at this frantic pace.

Why?

Right now, entire generations -- young and old -- are now turning their attention to the computer screen.

And they are interacting globally in a way they never have before. They’re gaming online in a worldwide frenzy to replace entertainment as we know it.

This Investing Phenomenon Has Happened Twice Before

A stealth bull run has happened twice before in the online entertainment industry:

Some players in the video game industry during the last supercycle in 2015 made a killing …

Electronic Arts (NYSE:EA), of FIFA and Madden NFL video game fame, soared and netted some investors an astounding 1,261% just between 2012 and 2018.

Take-Two Interactive (NYSE:TTWO) increased 1,665% on the wild ride with ‘Red Dead Redemption’ and ‘Grand Theft Auto’.

And they made the massive 690% gain for Activision Blizzard (NYSE:ATVI)—think, ‘Call of Duty’, look like a letdown.

Video game developers barely missed a beat as the video game supercycle spawned an online gaming supercycle.

Activision Blizzard’s ‘Overwatch’ game attracted 20 million online players in only one month when it launched in 2015.

The next supercycle might be starting now and FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF) could be one of the big winners. Why?

GlobalData projects the video game industry to go from $131 billion in 2019 to $300 billion in just three years. Those are numbers even bigger than the 8-18X increases in the first, 6-year supercycle.

A fast-growing segment of the video gaming industry is the online gaming segment, which is more than ready for its next supercycle—and this time a pandemic has already supercharged it.

Even more explosive, mobile gaming, which sees more spend from consumers than all other forms of gaming combined.

Now, in 2020, online streaming and cloud gaming are stepping up to the plate, with Netflix-style advancements.

Even Alphabet’s Google is jumping into this gaming space with its Stadia streaming platform. But the rivalry is heated with competition for the same from Chinese giant Tencent, Sony and Microsoft.

OVER 7.4 MILLION PLAYERS NOW are streaming on Twitch alone…

With hundreds of millions of viewers possible.

This Stealth Industry Will Have 645 Million Viewers (Maybe More) by 2022

Online gaming isn’t just for the younger generations anymore.

Business shutdowns, travel restrictions and social distancing mean that masses of people around the world are spending significant time gaming online.

Verizon found that gaming traffic increased by 75% during the lockdown enforced due to the COVID pandemic.

And user bases for gaming companies like FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF) are skyrocketing.

In a three-day period in March alone, Activision Blizzard saw a single game downloaded 15 million times.

There are already 2.5 billion gamers worldwide.

That's a billion more than just five years ago. Fortnite, one of the most popular games ever, had over 250 million registered users as of March 2019.

The pandemic is pushing those numbers even higher.

The U.S. gaming industry witnessed record sales across hardware, software, accessories and game cards, totaling $1.5 billion (up 73% year over year) in April alone.

And American consumers spent a record $10.86 billion on computer games, hardware and accessories.

During the pandemic, sports are on pause, and the world is looking for something to replace it with.

Entire generations are turning their attention to high-adrenaline streaming esports. That’s where FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF) comes in.

Global esports revenues will surpass $1 billion in 2020 for the first time. And that doesn’t even account for revenues from broadcasting platforms.

The esports audience will soar to nearly 500 million people already this year. Half of those are ‘esports enthusiasts’ who watch regularly. The rest are newbies—a shocking increase pushed by pandemic.

That’s 6X greater than Television… which is dying… much like the radio it displaced in the 1950s.

Esports is now even getting to be bigger than sports itself. Even major broadcasters are jumping on board.

Comcast (NYSE:CCZ) knows exactly how big the esports industry will be. That’s why it’s recently announced it will build a $50-million arena specifically for esports.

The ‘Fusion Arena’ will be housed in downtown Philadelphia and it will be able to comfortably seat over 3,500 people. It will also have more than 2,000 square feet of LED screens, training facilities and private rooms for players to stream video to their fans.

This will be the home of Comcast’s own esports team, the Overwatch League, but it will also be the East Coast esports hub. And it’s a first: The first-ever arena built from the ground up, solely for esports.

Again, it’s a powerful force …

Technology changes. Viewing patterns change. And when people play traditional sports or online games, the betting isn’t far behind.

Gaming Stocks Are Starting To Rocket

Investors at home are flooding in to capitalize on this new trend. A few well-placed investments could have brought an early retirement for thousands of investors.

That’s because gaming stocks are soaring since the COVID crisis.

DraftKings (NASDAQ:DKNG) shares went from $9.80 to a high of $43.80 … and some project it to go even higher. That’s already a 346% gain for investors in just a few months.

Investors who jumped on this when it went public in April were handsomely rewarded. It’s now valued at around $11.5 billion—bigger than the casino giants.

Penn National Gaming has gone from $18 this time last year to $33--and at least one analyst has got a $39 price target on it now.

Compared to cannabis companies, these are huge gains that are already happening, not waiting on a “magic number” for legalization.

Small cap gaming stocks could also benefit.

And this next stock – FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF) -- is an early stage way to play this megatrend...

No one can predict the future… so one interesting play is this little-known company revealed below that has multiple revenue streams.

This company should benefit whether the coronavirus rages on or not...

It’s covering every aspect of the gaming industry, from betting on real games or high adrenaline esports, to casino games to the proprietary tech that makes it all happen.

This company should benefit no matter which games are popular...

You DON'T have to catch the latest hot sport.

That’s because sports betting powerhouses don’t even need the NFL, NBA, NHL, and MLB.

They offer bets on anything you can think of--from online gaming and virtual sports to award shows and reality TV shows. You can even bet on table tennis, snooker and horse racing.

It’s incredibly flexible. That’s why sportsbooks are still pulling in tens of millions of dollars every month--even more so under COVID.

Investors can now profit even more on people betting on the gaming market…rather than on the gaming market itself.

With this stock below, investors can participate in a company which targets a global video gaming market that is expected to go from $67 billion to $286 billion …

Or

They can target a global sports betting market that is expected to go from $100 billion to capture some of the almost $2 trillion in total sports bets worldwide.

Much like cannabis… sports betting legalization is rolling out, but faster. And there could be a much bigger difference.

U.S. States Need Tax Revenue: Taxes From The Betting Industry Is Entering A Massive Growth Phase

The U.S. is the largest sports betting venue in the world, estimated at more than $150 billion.

That’s why states are rushing to stake their claims on the US portion of the $2-trillion global betting industry by legalizing it—and taxing it.

Right now, any of the 50 U.S. states are at liberty to legalize sports betting in its own jurisdiction.

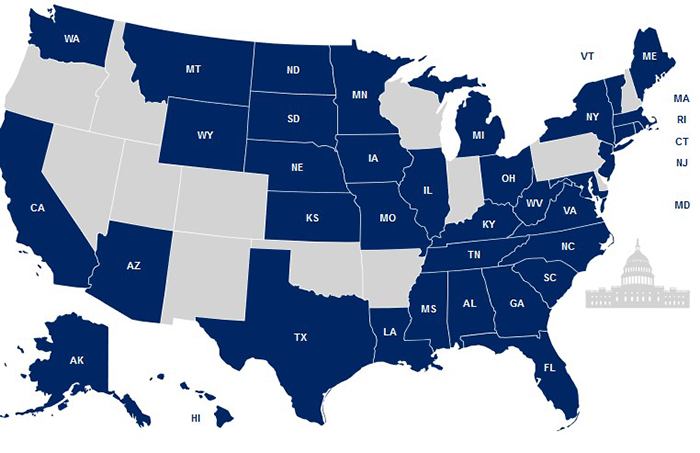

Nearly two years after the shackles were removed, ~75% of US states have introduced legislation to legalize sports wagering, with sports betting legal in one form or another in 24 states.

Source: Legal Sports Report

It’s a huge revenue boost for states—especially coming out of a pandemic when they are even more desperate to fill the coffers.

California is eyeing up to $700 million in revenue alone from online sports betting. And they need it to take a chunk out of a $54-billion COVID-19 deficit.

Colorado, a pioneer in legalizing cannabis, is now eyeing $40 million in revenue for the state from sports betting.

Every little bit helps on the path out of the pandemic depression.

And all those states in need of this revenue could fuel the growth of little-known stocks like FansUnite.

Our Top Small Cap Pick: FansUnite

Our favorite small-cap pick in this space is FansUnite Entertainment Inc. (CSE:FANS; OTCMKTS:FUNFF).

And there are five key reasons that the timing might be perfect:

#1 This industry is all about consolidation right now …

and FansUnite is on a major acquisition binge.

In March, it acquired UK-based McBookie, with its $100M in betting volume in the last three years, and now it’s acquiring Canadian esports giant Askott Entertainment--a key player with Tier 1 partners.

That acquisition should make FansUnite one of Canada’s leading online gaming companies, focused on sports betting, esports wagering and casino games. Now it’s planning its U.S. entry.

#2 Proprietary tech wins this game

This industry is all about the tech, which is where “bookies” become digital gods.

And FANS is all about harnessing its own tech as a solution to other players in the industry.

It’s built out infrastructure to connect the world’s gaming platforms through new technology.

FansUnite (CSE:FANS; OTCMKTS:FUNFF) is targeting the entire industry.

FANS has its own proprietary sportsbook as well as a full-service white label solution aimed at taking in other sports books through the integration of cutting-edge technologies and business growth opportunities, both launching later this year.

It’s not tying itself to just one market.

It’s a business model that thrives with or without COVID-19.

#3 FANSUNITE is government compliant—a huge deal in the online betting world

The company’s tech, and its team, are all about bringing transparency to the online sports betting world.

The founders have over a decade of experience in the sports betting and data analytics industries.

CEO Darius Eghdami’s successful pioneering of transparent, fool-proof tech for the sports betting industry has earning him a place on Canada’s Next 150 Top Entrepreneurs list.

#4 Globally, EVERYONE’s got their game on

The pandemic’s got everyone—young and old—glued to their screen. And they aren’t likely to give it up.

FansUnite, by buying Askott, will be covering every angle of this gaming environment—from propriety tech for a B2B revenue stream, to online gaming, esports and sports betting. That positions it to succeed regardless of which sports are hot, which games are not. They don’t need the NFL.

And they’re benefiting from two massive, interconnected industries at once: Online gaming and online sports betting. One which can reach $286 billion in a few years, and one that could get a portion of $2 trillion with legalization.

#5 The next supercycle is now…

And FansUnite (CSE:FANS; OTCMKTS:FUNFF) has a major new acquisition, Askott, which on closing will position it among the top spots in Canada and knocking at the door of the United States, where an economically crippling pandemic is about to push legalization of online sports betting.

The last supercycle saw some investors who jumped into gaming on time leave with big profits. This pandemic-boosted supercycle will net the ones who pick the right “horses” with big profits too.

Other Canadian companies set to benefit from this new investment trend:

ePlay Digital Inc. (CSE:EPY)

ePlay is a leader in the development and operation of live broadcast technologies, primarily for sports events. The company has worked with the NFL, ESPN, CBS, and more. ePlay’s solutions seamlessly integrate live TV, social media and web platforms.

Recently, ePlay launched the Big Shot Beta iPhone application, an app which contains a number of features for basketball fans to interact with their favorite teams. Trevor Doerksen, CEO of ePlay Digital explained, “The Big Shot North American Go-To-Market plan, leveraging celebrity, media partners, and others, starts this month. At the same time, we are actively developing similar exciting plans in other big markets, such as China.”

Kuuhubb Inc. (TSXV: KUU)

Kuuhubb is a company active in the development and acquisition of lifestyle and mobile video game applications. Its strategy is to create sustainable shareholder value through its groundbreaking AI and big data applications suggest that its stock is currently undervalued, but it’s not likely this opportunity will last for much longer.

Though it’s focus is on mobile video games, Kuuhubb’s innovative technology makes it a likely target of acquisition and could be a key player in the mobile industry.

Kinaxis Inc (TSX:KXS)

Kinaxis is a provider of cloud-based subscription software for supply chain operations. The Company offers RapidResponse as a collection of cloud-based configurable applications. The Company's RapidResponse product provides supply chain planning and analytics capabilities that create the foundation for managing multiple, interconnected supply chain management processes, including demand planning, supply planning, inventory management, order fulfillment and capacity planning.

Kinaxis is a growing company, but the company has already carved out a significant piece of the pie. As a leader in its field, Kinaxis is a force which investors are keeping an eye on.

Jackpot Digital Inc. (TSXV:JJ)

Jackpot is at the forefront of the digital gaming revolution, providing cutting-edge tech features, industry breaking mini-games, a wide variety of payment options and more. Additionally, Jackpot takes its regulatory responsibility seriously, and is fully compliant with all necessary regulations.

In addition to its online offerings, Jackpot Digital also offers a physical kiosk for casinos around the globe, allowing users to refill their accounts, fund gift cards, register for tournaments, and even allow casinos to add customized marketing displays.

Pivot Technology Solutions Inc. (TSX:PTG)

Pivot focuses on the strategy to acquire and integrate technology solution providers, primarily in North America. It sells and supports integrated computer hardware, software and networking products for business databases, networks and network security systems.

Pivot has seen explosive growth so far, and with the acceleration of the fintech movement and the mobile tech industry, the company is sure to continue drawing investor interest.

Pivot is a standout of the bunch because it is not quite a gaming company, but provides tech that is absolutely essential in dealing with growing regulatory challenges, increasingly complicated IT issues and security of funds.

By. Chris Rogers

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENTS: Certain information contained herein may constitute "forward-looking information" under Canadian securities legislation. Forward-looking statements may include, without limitation, statements relating to future outlook and anticipated events, such as the satisfaction of the conditions precedent and subsequent consummation of the Askott transaction; realizing FansUnite’s plans regarding expanded consumer base, business base, offerings and gaming licenses; that Saxon Shadforth’s contacts and experience will be a major asset; the growth of the online gambling market; its plan to grow by acquisition; the combined companies’ ability to scale their platforms, to enter into new and emerging international gaming markets, to capture the growing demand of gamblers and to become a global gaming leader; the strengths, characteristics and potential of the combined company; the company’s ability to become one of Canada's leading gaming companies; the ability to launch a proprietary sportsbook as well as selling software to other sports books; and discussion of future plans, projections, objectives, estimates and forecasts and the timing related thereto. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of FansUnite to be materially different from those expressed or implied by such forward-looking statements. Matters that may affect the outcome of these forward looking statements include that online gaming may not turn out to have as large a market, grow as quickly or be as lucrative as currently predicted; FANS may not be able to offer a competitive product or scale up as thought because of consumer tastes for its online product, lack of capital, lack of facilities, regulatory compliance requirements or lack of suitable employees or contacts; Mr. Shadforth’s experience and contacts may not result in material benefits; FANS’s intellectual property rights applications may not be granted and even if granted, may not adequately protect FANS’ intellectual property rights; risk factors for the online sports gaming industry in general also affect FANS including without limitation the following: competitors may offer better terms to potential M&A acquisition targets, or no such target may actually be acquired even if agreements are signed; competitors may offer better online gaming products luring away FANS’s customers; technology changes rapidly in the gaming and esports business and if FANS fails to anticipate or successfully implement new technologies or adopt new business strategies, technologies or methods, the quality, timeliness and competitiveness of its products and services may suffer; FANS may experience security breaches and cyber threats; regulators may impose significant hurdles to online gaming companies; FANS may not receive applied for gaming licenses; FANS’s business could be adversely affected if consumer protection, data privacy and security practices are not adequate, or perceived as being inadequate, to prevent data breaches, or by the application of consumer protection and data privacy laws generally; the products or services FANS distributes through its platform may contain defects, which could adversely affect FANS’ reputation. Additional information regarding the risks and uncertainties relating to the Company's business are contained under the heading "Risk Factors" in the Company's Non-Offering Prospectus dated March 27, 2020 filed on its issuer profile on SEDAR at www.sedar.com. Accordingly, readers should not place undue reliance on forward-looking statements.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Financialmorningpost.com, Joint Salty Holdings Corp., and their owners, managers, employees, and assigns (collectively, “we” or the “Company”) has been paid by the profiled company to disseminate this communication. In this case the Company has been paid by FansUnite seven thousand US dollars per month on a 12 months contract for market awareness including postings and articles. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by FansUnite to conduct investor awareness advertising and marketing for CSE: FANS. Financialmorningpost.com receives financial compensation to promote public companies. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of FANS. The profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

SHARE OWNERSHIP. The owner of FinancialMorningPost.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of FinancialMorningPost.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of FinancialMorningPost.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.