Iconic billionaire investor Warren Buffett has made no bones about generally being a gold bear. So when it became known Monday morning that his Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) took at $564 million stake in Barrick Gold (NYSE: GOLD)(TSX: ABX), gold bugs sprung to attention with the blessing from the Oracle of Omaha. Many older traders remember the late 1990s when Berkshire started amassing a massive silver stockpile of nearly 130 million ounces at less than $5 per ounce. In 2006, he sold the holdings when silver was about $13 an ounce.

Needless to say, Buffett investing in gold speaks volumes to the upside opportunity of the precious yellow metal owing to protracted low interest rates by central banks and easy-money economic policies for the foreseeable future. Effectively, he just gave a thumbs up to the idea that he thinks gold is going significantly higher in the coming years.

A name to know in the gold space is Gatling Exploration (TSX-V: GTR)(OTCQX: GATGF) considering the company has been delivering on every promise at its flagship Larder Gold Project in the famous Abitibi greenstone belt in Ontario, Canada.

Growing Up in the Land of Gold Giants

The 3,370-hectare Larder project is strategically located in the Kirkland Lake-Larder Lake mining district between Kirkland Lake Gold’s (TSX: KL)(NYSE: KL) eponymous project (24 million ounces gold) and contiguous to Agnico Eagle’s (TSX: AEM)(NYSE: AEM) advanced exploration project hosting multiple deposits with over 3.5 million ounces of gold defined collectively.

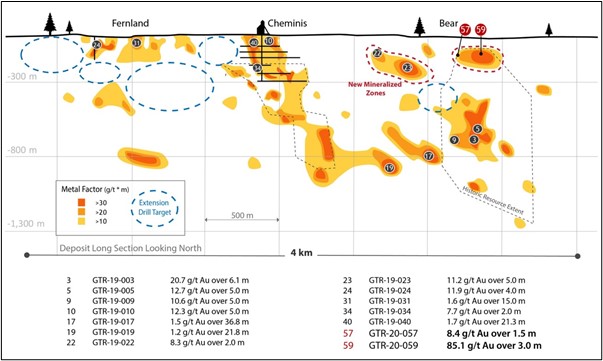

Gatling could well have a gold bonanza of its own. Certain areas at Larder have been extensively explored independently, but it was Gatling that put it together that the three known gold deposits (Bear, Chemenis and Fernland) are all actually part of one connected gold system in a trend over 4.5 kilometers long.

In March, we detailed how Gatling was strategically proving its contention, with drilling results establishing a 2.5 kilometer strike length of gold mineralization connecting the Bear and Cheminis deposits. Highlights from the drill program included intercepts in all three deposits ranging as high as 85.1 g/t Au over 3.0 meters, 20.7 g/t Au over 6.1 meters, 10.8 g/t Au over 8.0 meters, and 11.9 g/t Au over 4.0 meters.

In June, an uptrend was starting for Gatling underscored by gold prices rising and the company demonstrating that there could be more gold at Larder than anyone ever imagined. That trend continues today.

Building Value Using Cutting Edge Technology

Now it is time to connect the Cheminis and Fernland deposits, while simultaneously exploring yet another new gold finding. In doing so, Gatling has engaged the Artificial Intelligence (AI) experts at Windfall Geotek. Using its Computer Aided Resource Detection System, “CARDS” for short, Windfall can identify probable gold targets at Larder through AI pattern recognition and machine learning based off a library of data generated from over 2,000 drill holes, 90,000+ assays, more than 1,000 surface rock samples and in excess of 500 soil samples, as well as geophysics, Lidar survey and bedrock geology at the project.

Furthermore, CARDS makes it possible to analyze and compare the deposits at Larder with those at Gatling’s much larger district peers.

Last month, Gatling laid out the next stage of development at Larder. As promised, drilling has commenced on the first phase on time, consisting of 4,000 meters of “deposit connection” drilling between Fernland and Cheminis. That will be followed by another 4,000 meters of drilling on the western extension at Fernland towards the untested Omega deposit. If successful, this second phase of drilling will stretch out the gold mineralization strike to 5.0 kilometers.

A third phase of 2,000 meters of drilling will explore widespread mineralization that remained open in all directions as determined during the 2019 drilling program.

Gatling also will be conducting field work and 3,000 meters of drilling at the Kir Vit Prospect at Larder to expand upon successful maiden work during discovery of the prospect last year.

The company funded the new exploration via a successful private placement in July that raised gross proceeds of $3.79 million.

A Worthy Board Addition

Three weeks ago, Gatling appointed Jody Dahrouge, P. Geo., to its Board of Directors. Dahrouge is a seasoned geologist and executive that had success in the mining space in addition to founding his own geological consulting service. Notably, he was President and COO of Fission Energy Corp. where he played a key role in the acquisition of several of Fission’s key exploration properties, including Waterbury Lake and Patterson Lake. Fission Energy later spun out Fission Uranium to advance these projects, which was acquired by Denison Mines Corp. (TSX: DML)(NYSE MKT: DNN) in 2013.

Dahrouge is also currently the President of DG Resource Management Ltd., a project generator which has identified, acquired and advanced a number of gold projects throughout North America.

Methodical and strategic. That is the way Gatling is moving forward. They’re keeping shareholder dilution under control by building value with small capital raises and prescient drilling to prove the hypothesis that Larder hosts a very large mineralized system, one that could possibly parallel those of Kirkland Lake, Kerr or Agnico Eagle and potentially one day make a compelling acquisition target in the prolific area by a bigger miner.

Legal Disclaimer/Disclosure: While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our article is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing. Nothing in this publication should be considered as personalized financial advice. We are not licensed under any securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this article is not provided to any individual with a view toward their individual circumstances. Baystreet.ca has been paid a fee of thirty thousand dollars for Gatling Exploration Inc. advertising from the company. There may be 3rd parties who may have shares of Gatling Exploration Inc. and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this article as the basis for any investment decision. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing Baystreet.ca, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.