Lithium-ion is about to take on a lot more significance.

This is not about your iPhone anymore.

It’s not even just about your electric vehicle.

Lithium-ion batteries will power a large part of our world in the future and are now an important aspect of a multi-trillion-dollar energy transition.

That makes the world’s handful of lithium producers now finally a hot item to own a piece of.

It makes a lithium discovery about to be acquired by a junior like United Lithium the stuff that should Wall Street excited.

It’s partial vindication for those lithium bugs who jumped the gun years ago by investing in lithium plays that never seemed to go anywhere. Everyone was talking about a looming lithium supply squeeze that never came.

Well, now it’s closer. Those lithium bugs were just before their time.

So was United Lithium (CSE:ULTH; OTCMKTS:ULTHF) and now it’s aiming to reap the rewards.

It has found itself at the center of one of the world’s hottest lithium markets, with a contract to buy a property that already boasts one lithium discovery and indicators that there is much more to come.

At the prime tipping point for batteries, nothing is more precious--or strategic--than lithium, and that makes junior, pure play lithium miners our best bets in the upcoming massive energy transition.

And United Lithium’s story is refreshingly simple … They’ve agreed to buy a property where lithium has been discovered at the absolute prime time for this battery metal, in the absolute perfect location, and now they’ll be working to prove it up, which means a string of upcoming announcements.

Here are 5 reasons to keep a close eye on United Lithium (CSE:ULTH; OTCMKTS:ULTHF) right now:

#1 The Key to the Energy Transition

Apple is a $2.3-trillion company now … partly because of lithium batteries.

Tesla is an $818-billion company now … and it’s powerless without lithium batteries.

But this isn’t just about Apple and Tesla. Not even close.

Lithium-ion batteries are a critical element of the energy sector right now.

We’ve come a long way since the iPhone and the EV. Now, it’s possible for companies to use batteries to both store energy and harvest renewable power.

That’s because battery costs have dropped at such a rapid clip that has demand soaring to the point that in the auto industry alone, they expect to make EVs the same price as conventional cars within 5 years, according to the Wall Street Journal.

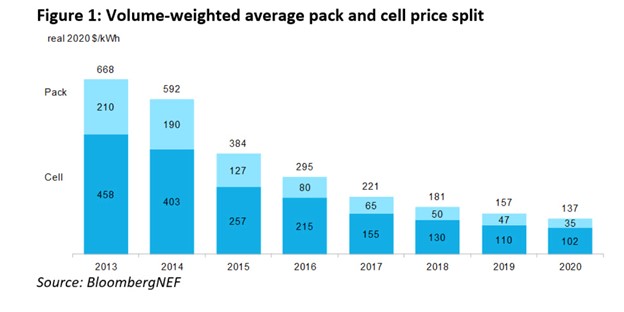

Already by mid-December 2020, lithium-ion battery packs prices had fallen an astonishing 89% since 2010, based on BloombergNEF data.

By 2023, prices are projected to drop another 27%.

#2 A Lithium Location that Beats All

There’s a very good reason that GM hijacked SuperBowl 2021 advertising with actor Will Ferrell vowing to take on Norway, the world’s leader in EV adoption.

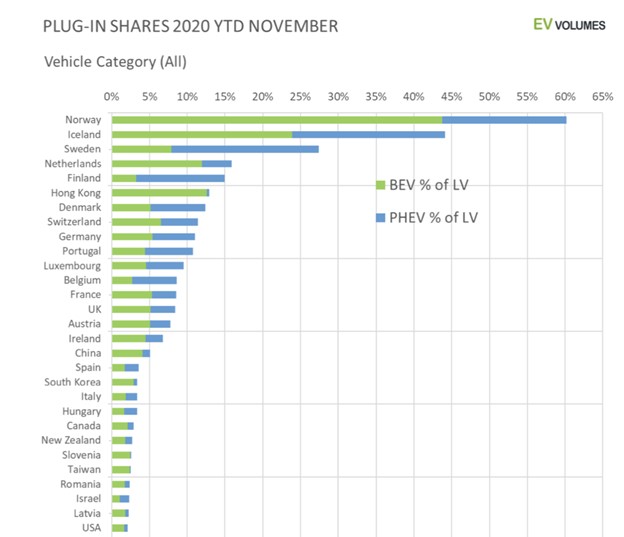

Europe in general is the leader in EV adoption, with a massive 137% sales increase in 2020, compared to 2019.

And Norway and neighboring Sweden are EV superstars.

Battery-EVs made up 54% of light-vehicle sales in Norway in 2020, compared to less than 2% for the United States. Iceland and Sweden aren’t too far behind.

Source: Cleantechnica.com

That’s exactly where United Lithium (CSE:ULTH; OTCMKTS:ULTHF) has positioned itself with its upcoming acquisition of the Bergby Lithium property in Sweden.

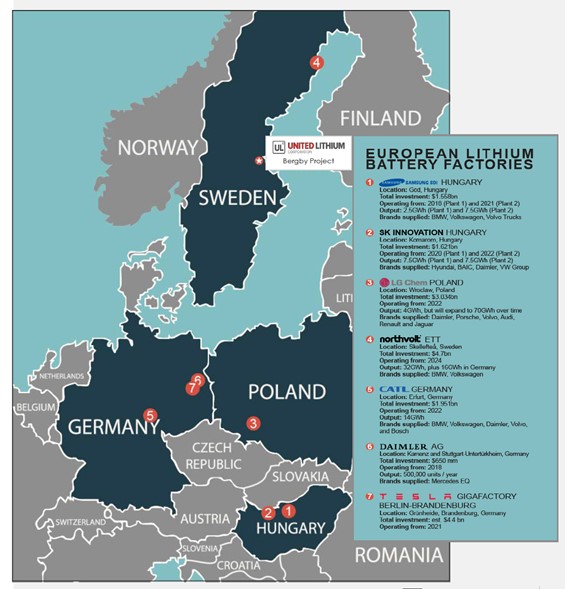

It’s also in the same region as a giant lithium battery gigafactory which is under construction, the Northvolt Lithium Battery Gigafactory …

And the world famous Woxna graphite mine.

That means it’s parked right in the heart of the best EV market in the world, and right next to established mining and transportation infrastructure.

With … even better …. Tariff-free sales to EU lithium customers.

For guaranteeing market share and getting product to market, it’s hard to find a better setup than this …

But still, it gets better than this: Bergby is planned to be a cost-effective surface and near surface extraction. In other words, lithium that’s not only parked right next to the best infrastructure in the world for batteries, but is also cheap to get at.

#3 Planned Production with Direct Access to the EU Market

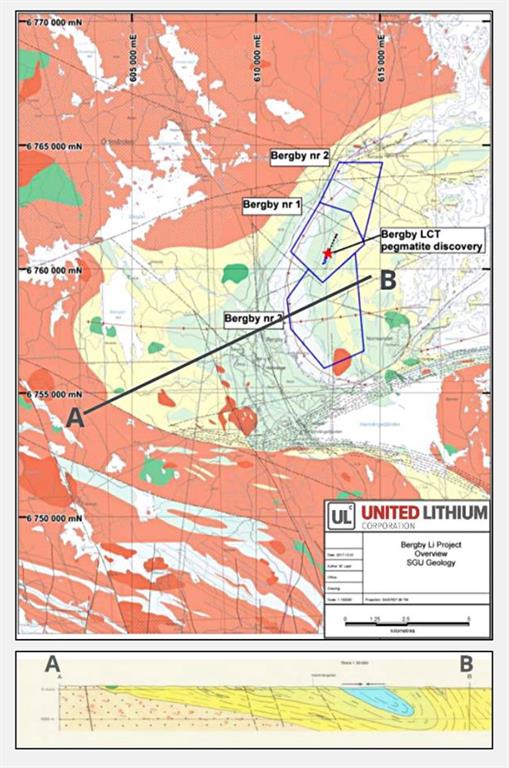

The Bergby project includes three exploration licenses that cover a total of 1,903 hectares of prime EU market-bound lithium potential.

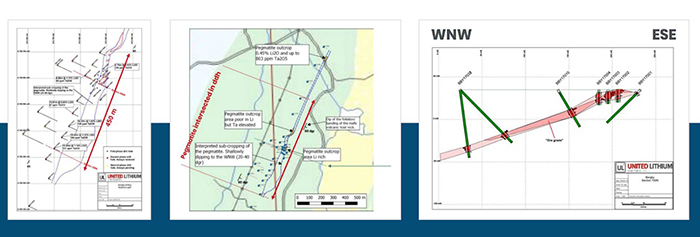

In Q4 2016, the Bergby property showed lithium mineralization in three outcrop areas.

In Q4 2017, the first drill program was completed with 28 of the 33 drill holes intersecting lithium mineralization.

They’ve found three types of lithium mineralization in Bergby’s boulders and outcrops, including Spodumene bearing very coarse pegmatite with crystals up to 30 centimeters in length. All of this is a very promising indication that this will lead to extensive development.

With lithium proven on site already to hand, it gets even more exciting … there are additional known pegmatites in the area that have never been tested for lithium mineralization.

That means we’ve got a tiny exploration company sitting on a potential major lithium discovery that could be far bigger than they know.

That’s the kind of situation that could reap major rewards for an exploration company. And that’s exactly why United Lithium (CSE:ULTH; OTCMKTS:ULTHF) scooped up this discovery last summer.

They believe this is could be a multi-million-ton discovery and a potential quick win for all.

They’re half-funded to get this to feasibility for around $5 million, and investors won’t have to wait long based on ULC’s plans.

By Q3 2021, this has the potential to be the most sought-after pure-play lithium stock on the planet.

It’s already a discovery …

And it’s positioned to take advantage of a huge EU market right next to a battery gigafactory that could be starving for lithium soon enough.

There’s massive infrastructure in place, and now it’s all about defining the discovery, and if as big as hoped, getting production going.

This could prove out to be near-surface, near-market, development stage lithium.

It’s lithium potentially for the taking, five kilometers away from a port and 4-5 hours from a gigafactory. There’s no better setup for the coming lithium supply squeeze if this project produces as hoped.

And that makes United Lithium (CSE:ULTH; OTCMKTS:ULTHF) an excellent lithium play. Once we find out exactly how much lithium they’re sitting on, the market could react very favorably.

Other companies looking to capitalize on the booming lithium market:

Tesla (NASDAQ:TSLA) is without a doubt one of the hottest stocks on Wall Street. And that’s a big deal for lithium As one of the world’s most exciting -and important- car makers, it has made going green a must in this incredibly competitive industry. Its modern design has become the standard. You would have to go out of your way to not see a Tesla when walking around major cities like San Francisco and Hong Kong.

Elon Musk had his eye on prize long before the green energy hype started building. In fact, he released the first Tesla Roadster back in 2008, making electric vehicles desirable when people were laughing at first-gen electric vehicles. Since then, Tesla’s stock has skyrocketed by over 14,000%. Largely thanks to its energy innovation.

In addition to producing one of the most desirable electric vehicles on the market, Tesla is ramping up its solar and battery game, as well. Tesla’s Solar Roof project aims to change the way houses function. It replaces traditional roofs with stronger, and arguably more aesthetically pleasing, solar panels that can power your entire home. It also comes in as the lowest-cost-per-watt solar option in the American market. And its in-home superbatteries will be a game-changer for storing and distributing electricity in the future.

Tesla is leading the charge into a green future, and nothing can stop it. Elon Musk had a brief stint as the world’s richest man, but he could be returning to that position in no time, and perhaps even be the world’s first trillionaire if he plays his cards right.

Blink Charging (NASDAQ:BLNK) an electric vehicle charging company, will play a vital role in the lithium market for years to come. Why? Because its charging infrastructure will fuel even greater demand for the increasingly popular metal. And it’s been a great stock for investors, as well. It’s seen its share price soar significantly over the past year and it’s showing no signs of slowing. A flurry of new deals, including a collaboration with EnerSys have created some support for the relative newcomer.

Michael D. Farkas, Founder, CEO and Executive Chairman of Blink noted, “This is an exciting collaboration with EnerSys because it combines the industry-leading technologies of our two companies to provide user-friendly, high powered, next-generation charging alternatives. We are continuously innovating our product offerings to provide more efficient and convenient charging options to the growing community of EV drivers.”

Another high-profile deal between Blink and Envoy Technologies to deploy electric vehicles and charging stations adds further support to the company’s stock price.

Aric Ohana, CEO of Envoy noted, “We’re excited to work with Blink on the deployment of their fast Level 2 charging stations as part of our exclusive electric car-sharing service. The vision of our two companies is aligned: to advance the adoption of electric vehicles. To continue to drive the growth and success across our expanding locations, we have to ensure that our clients have easy and efficient access to high-quality, reliable charging equipment. Blink has an established reputation as an innovator in the EV market, and we are thrilled to add them as a preferred partner.”

Canada’s renewable energy push is gaining speed, as well. Boralex Inc. (TSX:BLX) is one of Canada’s premier renewable energy firms. It played a major role in kickstarting the country’s domestic renewable boom. The company’s main renewable energies are produced through wind, hydroelectric, thermal and solar sources and help power the homes of many people across Canada and other parts of the world, including the United States, France and the United Kingdom.

Polaris Infrastructure (TSX:PIF) Is a Toronto-based renewable energy giant with a global footprint. The company’s biggest projects are in Latin America. It’s Nicaragua geothermal project, for example, is already producing over 77 MW of renewable electricity. And in Peru, its El Carmen and 8 de Augusto power plants, is set to produce a combined 17MW of electricity in the near future.

Westport Fuel Systems (TSX:WPRT) is a renewable energy provider for the transportation industry. it provides systems for less impactful fuels, such as natural gas. In North America alone, there are over 225,000 natural gas vehicles. But that shies in comparison to the global 22.5 million natural gas vehicles globally, which means the company still has a ton of room to grow!

While renewable providers clearly take the lead, Canada’s tech and telecom giants won’t be left out!

Take telecom giant Shaw Communications Inc (TSX:SJR.B), for example. Shaw is taking a leadership role among Canadian telecom providers through its use of renewable energy, In fact, it is one of the biggest customers of Bullfrog Power which sources its electricity from a blend of wind energy and hydropower. It is also building its own portfolio of clean energy investments.

BCE Inc (TSX:BCE) is another Canadian telecom giant going to great lengths to reduce its carbon footprint. For the past 25 years, BCE has been at the forefront of the environmental movement. Their environmental management system (EMS) has been certified to be ISO 14001-compliant since 2009.

By. Ruby Wexford

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This article contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this article include that demand for lithium will increase in future as currently expected; United Lithium’s business and plans, including with respect to undertaking further acquisitions, completing the acquisition of Bergby, acquiring additional mineral claims nearby Bergby, complying with the terms of the Bergby acquisition and carrying out exploration activities in respect of its mineral projects; that most of the lithium is reachable close to surface; that they can reduce costs compared to many similar projects; that ULC can produce a PEA by Q3 2021; and that they can raise $4M quickly. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its intended drilling programs, aspects or all of the property’s development may not be successful, their methods of mining of the lithium may not be cost effective; the risks that the acquisition does not complete as contemplated, or at all; that United Lithium does not complete any further acquisitions; that they do not acquire the additional mineral claims in the region of the Project prior to March 21, 2021; that United Lithium does not spend $1,000,000 on exploration work on the Project within 18 months from the Closing Date; the Company may not be able to carry out its business plans as expected; changing costs for mining and processing; permits may not be granted for the mining projects; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on historical or even current data that may change with more detailed information or testing; potential mineral recoveries assumptions based on limited test work with further test work may not be viable; competitors may offer cheaper lithium; more production of lithium could reduce its price, or the price may drop for other reasons; alternatives could be found for lithium in battery technology; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties. The forward-looking information contained herein is given as of the date hereof and the writer assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Medtronics Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by United Lithium ninety thousand US dollars for this article and certain banner ads. In addition United Lithium has granted the Company stock options to acquire shares exercisable for 2 years at at price of $0.86 per share. This compensation is a major conflict with our ability to be unbiased. This communication is for entertainment purposes only. Never invest purely based on our communication.

SHARE OWNERSHIP. The owner of Safehaven.com may be buying and selling shares of this issuer for its own profit. In addition, Safehaven has been granted 1M stock options exercisable at a fixed price. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock trade will or is likely to achieve profits. Comparisons made to other featured companies or past performance is not indicative of future results.