Since the dramatic discovery of superconductivity, no gas has been more critical to innovation and billion-dollar industries than helium. At the same time, no gas is threatened more than helium with a devastating lack of supply.

The helium land grab is now in full swing … and oil and gas executives are now shifting to the hunt for this most precious rarefied gas that fuels everything from rocket ships to computer chips.

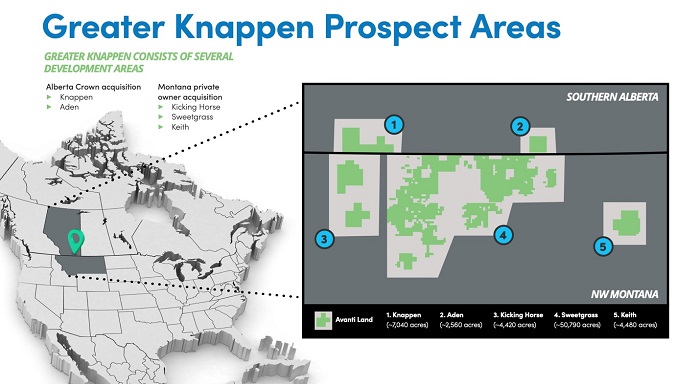

It’s against this backdrop that early mover Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) is preparing to drill its first well in its initial three-well program in the Greater Knappen area that extends from Montana to Alberta, Canada--one of the best prospects for securing our future helium supplies.

Because we’re running out of helium to the point that innovation itself could come to a standstill, first movers on the new helium discovery scene are pinging major radar even as the land grab continues to increase in intensity.

Once Avanti starts drilling its first well in early December, the news may likely roll in at a fast clip because so much is at stake here. The Avanti management team expects to have results sometime early in the New Year.

With up to six-wells planned to be drilled in total from now through the second quarter of next year, investors could be looking at a steady stream of news as the state of Montana pins its hopes on a drilling program that could turn it into a major helium force for the national interest.

Here are 5 things investors should know ahead of Avanti Energy’s initial 3-well campaign:

Helium is a critical gas, and we’re running out of it

Since the height of the Cold War in the 1960s, the United States has been stockpiling helium as a strategic gas, controlling supply and pricing at a Federal Helium Reserve in Amarillo, Texas.

Why is helium so critical?

Because helium is unique among all elements for its ability to reach ultra-cold temperatures. That has made it the key to breakthrough discoveries in medicine, computer technology and space travel. It’s arguably the most important element from a national security standpoint. Helium is the backbone of several high-tech billion-dollar industries, making possible everything from magnetic resonance imaging (MRIs) and semiconductors (which are now suffering from a supply shortage) to fiber optic telecommunications and even space propulsion.

Why are we running out?

Helium is scarce, non-renewable and not bound to earth by gravity. Until recently, some 40% of U.S. helium supply came from the Federal Helium Reserve.

In the 1990s, the federal government decided that helium could be sold to private entities, with the revenue intended to pay off the reserve’s debt. In 2019, the Bureau of Land Management (BLM), which operated the reserve, held its last helium auction, fetching prices that were 135% higher year-on-year. Now, the facility is closed, and federal reserves have been depleted.

The helium supply situation has become so critical that the American Physical Society—the nation’s leading organization of physicists—is calling it a “liquid helium crisis” that threatens to bring innovation to a standstill. Scientists are abandoning research that requires liquid helium due to shortages, high prices and lack of purchasing power, and billion-dollar industries are at risk.

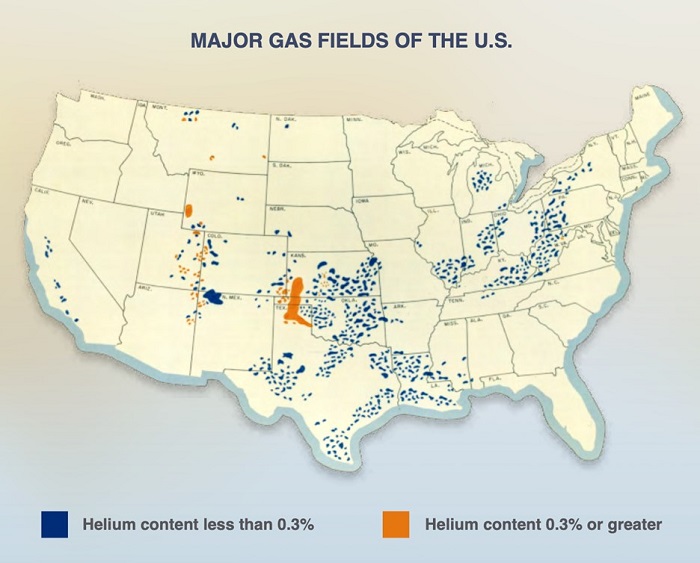

The race is now on for explorers to find new sources of helium in commercial quantity, and the place to look is gas fields, with Montana predicted to be one of the major sweet spots:

Source: Association of Physical Scientists

Avanti’s world-class team is descending on Montana--Fast

Avanti’s world-class team has moved so fast on this one that investors have barely been able to keep up with the news flow.

They signed a definitive agreement to acquire the helium rights to another ~50,000 acres of land in Montana on September 15th, giving them a total of ~69,000 acres.

Since then, things have moved along at breakneck speed.

Just a week later, Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) announced it had acquired 3D seismic data covering over 27 square miles that included several structural highs pinpointed as ideal for trapping helium. Instead of shooting new 3D seismic, Avanti moved at a face pace to acquire the license for this seismic from one of Canada’s biggest oil and gas producers. That saved both time and money.

Days later, on September 29th, Avanti’s technical team outlined 17 initial drill targets in this core area. The drill targets all reside over closed structural highs that exhibit ~80m to >200m of relief and are highly prospective for helium.

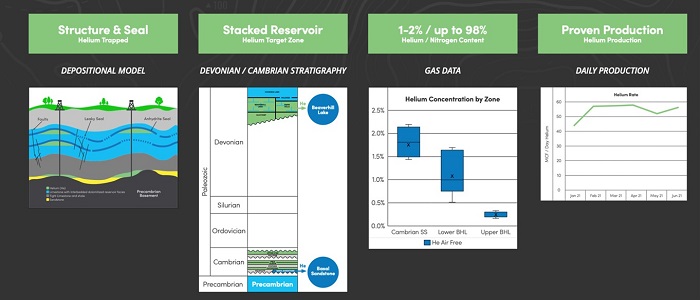

Confidence was high not only because this is a world-class management team that’s done this before, but also because other wells surrounding Avanti’s land have high helium shows in multiple Devonian and Cambrian targets, with helium percentages of up to 2% and nitrogen percentages of up to 96%.

By November 1st, the drill plan was already in motion, with surface operations launched.

A week later, Avanti contracted T&S Drilling for its initial three-well drill program (out of up to six planed wells). The first three wells will target three separate pay zones: two in the Beaverhill Lake formation and one in the Basal Sandstone formation.

They’ll be spudding their first well in early December, and plan to finish up to six by April or May next year.

Results from the first well should come sometime early in the New Year. That likely means a continued steady stream of news from then through Q2 2022 with the up to six-well campaign.

Chris Bakker, Avanti’s CEO, noted in a November 9 press release that “management’s technical interpretation of just 7 of the 10 structures suggest an estimated unrisked and undiscovered resource potential of between 1.4 and 8.9 billion cubic feet of recoverable helium”.

How much exactly could 8.9 billion cubic feet of helium be worth?

It’s hard to put an exact number on it because helium isn’t traded like a commodity—yet. But it’s wildly more expensive than natural gas—even as natural gas prices soar to the $5 level. In fact, some have suggested that the unit price for helium (per thousand cubic feet) has increased by over 135% in just two years.

In 2019, when the BLM auctioned its helium, it went for an average of $280/Mcf. The highest price during that auction hit $337/Mcf.

This means Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) could be sitting on $2.5 billion in helium reserves on just this first property alone. That’s a huge potential pay off for a junior explorer with a current market cap of ~$70 million. If Avanti is able to execute, this junior helium play could be significantly undervalued.

This is a Management Narrative, All the Way

Finding commercial quantities of helium requires far more than a land grab. It requires oil and gas E&P expertise because most of the helium to be found will be in gas fields. More precisely, it requires giants in the field.

And Avanti’s team doesn’t just have an impressive track record of major discovery and development … it has a giant one.

The Montney is North America’s largest natural gas play, and Avanti CEO Chris Bakker and VP of Subsurface Genga Nadaraju were instrumental in its identification and development for the $10-billion market cap giant Encana (now Ovintiv).

While oil and gas executives on this level usually stick with the giants, the shift to hunting for helium produced opportunities that couldn’t be ignored, and shareholders are more than happy to have giant executives at the helm of this small E&P company.

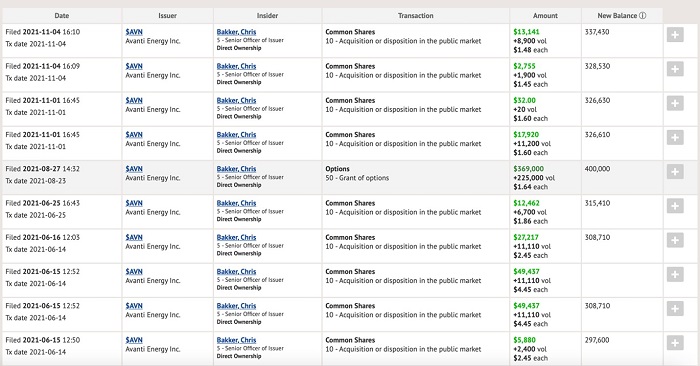

The executive-level confidence in this play is so high that even the CEO has recently bought over $500,000 in stock at levels double where it is now. Bakker was buying up shares as high as $2.91 just in May. Now that drilling is launching, he’s buying again. That’s what investors like to see.

Beacon Securities had a 12-month target price at $3.80 on Avanti as of late September. And it’s all about management: “The technical acumen is a main advantage that Avanti has in its exploration for helium and we continue to have high expectations for the Greater Knappen area,” Beacon wrote in a note to clients. “The initial drilling program is Montana and Alberta will just be the start of a multi-year exploration and development program for AVN.”

In other words, Beacon’s $3.80 price target could just be the beginning. In a world that is running short on a rarefied gas that is the backbone of billion-dollar industries, the first to the punch on a new North American helium discovery stands to make big gains for early-in investors.

With irreplaceable helium now on track to be an $18-billion market by 2025, and a news flow that may be extremely fast-paced, Avanti Energy Inc. (TSX:AVN.V; OTCMKTS:ARGYF) is a standout stock with superior management and a drill bit that says the clock is ticking.

Big Tech could quickly become a winner or a loser in the helium race…

Here are 5 other companies to watch as the tech industry races towards other helium and other natural resources to stay a float…

Apple (NASDAQ:AAPL) has always been one of Big Tech’s most enthusiastically green companies. And that’s largely due to to Steve Jobs’ incredible vision. He paved the way to a renewable future for the company and the industry as a whole. From the products themselves to the packages they come in, and even the data centers powering them, Jobs went above and beyond to cut the environmental impact of his company.

Lisa Jackson, Apple Vice President of Environment, Policy and Social Initiatives has reaffirmed this time and time again, stating, “We support the passage of a Clean Energy Standard which we think will drive large amounts of renewable generation, or new renewable generation, and do so in a way that shows people where they need to go and what they need to get there.”

Though we don’t know much about Apple’s helium use, we do know that the company does use helium in some of its processes due to a leak a few years ago that damaged a huge amount of iPhones, sparking headlines such as “iPhones Are Allergic To Helium.”

Microsoft (NASDAQ:MSFT) is one of the world's most dominant and most valuable companies. A few years ago, the company announced a major reorganization to focus on three areas: intelligent cloud services; intelligent edge experiences; and more personal computing experiences. These changes were made as a result of Satya Nadella’s vision for “cloud-first, mobile-first” technology strategy back in July 2014 when he took over as CEO from Steve Ballmer who has been at the helm since 2000.

Microsoft has made great strides in green energy. One of the latest innovations is a Microsoft data center that will use an innovative process to convert carbon dioxide into fuel, called "carbon capture and conversion." The captured CO2 gas will be converted into methanol, which can then be used as an additive for gasoline or diesel fuels. This new technology could make one of our biggest environmental problems more manageable while also helping power our lives.

Mark Monroe, the principal engineer at Microsoft’s Datacenter Advanced Development Group, explaining the company’s research into hydrogen fuel cells, noted, “Our goal was to scare our engineering group as little as possible by saying that this is just a drop-in diesel generator replacement, so we don’t have to change any of the electrical design.”

Alphabet Inc. (NASDAQ:GOOG) can’t be ignored, either. It has remained one of the technology industry’s most-sustainable and most admired companies for years thanks to its dedicated leadership and groundbreaking innovations. Its bid to reduce its carbon footprint has been well received by both younger and older investors. And as the need to slow down climate change becomes increasingly dire, it’s easy to see why.

Though it is one of the largest companies on the planet, clocking in with a $1.6 trillion market cap, in many ways Alphabet has lived up to its original “Don’t Be Evil” slogan. Not only is it powering its data centers with renewable energy, it is also on the cutting edge of innovation in the industry, investing in new technology and green solutions to build a more sustainable tomorrow.

Alphabet CEO Sundar Pichai explained, “We are committed to doing our part. Sustainability has been a core value for us since Larry and Sergey founded Google two decades ago. We were the first major company to become carbon neutral in 2007. We were the first major company to match our energy use with 100 percent renewable energy in 2017. We operate the cleanest global cloud in the industry, and we’re the world’s largest corporate purchaser of renewable energy.”

Amazon (NASDAQ:AMZN)is one of Big Tech’s green energy leaders, and it’s betting big on the transportation of tomorrow. With a $700 million investment in Rivian, an electric car startup; as well as its acquisition last year for robo-taxi leader Zoox— Amazon has been investing heavily into EVs like never before.

In addition to these two major accomplishments though there are other less widely known initiatives taking place within this company that when put together create quite an impressive portfolio indeed! Whether you're interested how they plan on using hydrogen fuel cells or solar power at some point in your future vehicle.

Amazon’s green approach approach is paying off, as well. Just five years ago, Amazon’s share price was hovering in the $700 range...And now, it’s sitting at $3,443 per share. That’s an over 325% return. And this run could be just getting started. As the company continues to solidify its dominance in the e-commerce market, its green initiatives will only help cut costs and increase profits in time. Simply put, going green will save it money. And at the end of the day, that means higher returns for shareholders.

Hewlett-Packard (NYSE:HPQ) is another computer maker in the hydrogen game. In fact, it even beat Apple to the punch. It was already on the forefront of the push back in 217, designing and testing new and exciting ways to harness the power of hydrogen fuel cells to build carbon-free data centers.

“Hydrogen fuel cells lie at the heart of this strategy. These devices create energy through the electrochemical reaction between air and hydrogen. The electricity produced can be stored in batteries or used to drive an electric motor that powers a vehicle. Daimler and other automotive manufacturers, for example, have been successfully testing fuel cells in cars for many years,” the company wrote on its website, adding, “the advantage of fuel cells over traditional fossil fuel-powered devices is they are sustainable and carbon-neutral—their only by-product is water. This means data centers no longer need to rely on diesel generators or other carbon-heavy backup power sources to cover any power gaps.”

Year to date, the company has risen by as much as 50%. And while it’s not as flashy as Apple or Amazon, it’s a solid pick for investors with a long-term vision for a greener future. As this race heats up, Hewlett-Packard could very well emerge as a surprising force in the industry.

Canada’s tech firms are betting big on a renewable future, as well.

Shopify Inc (TSX:SHOP), for example. It is an absolute beast in the e-commerce world. In fact, because of its simple-to-use platform, it would be hard to have not stumbled onto a shop built with its technology. One key issue to watch is the looming global chipmaker shortage which, Shopify, though it does not produce any hardware, could be impacted indirectly. Whether it’s through limited demand from its numerous tech clients or disruptions in infrastructure shortages.

Global lockdowns accelerated Shopify’s already tremendous growth. Since March 2020 alone, Shopify has seen its price rise from just $495 per share to a high of $1800 per share before settling down to its current price. The company has already shown its potential and its appeal to shareholders who value renewable energy, but as it continues to grow, so will its innovative solutions for businesses, and by extension, its share price.

Blackberry Limited (TSX:BB) is another one of Canada’s tech giants that is embracing the green revolution. While it has pivoted away from its iconic cell phones of yesteryear, it is still very much involved in pushing the tech industry. It’s even building a global digitized healthcare database leveraging blockchain technology. From its high-profile partnerships with the likes of Amazon and more to its key posturing in the Internet of Things explosion, BlackBerry is a great stock that could be trading at a relative discount compared to some of its peers.

The company even launched a new R&D arm, BlackBerry Advanced Technology Labs. “Today’s cybersecurity industry is rapidly advancing and BlackBerry Labs will operate as its own business unit solely focused on innovating and developing the technologies of tomorrow that will be necessary for our sustained competitive success, from A to Z; Artificial Intelligence to Zero-Trust environments,” explained Charles Eagan, BlackBerry CTO.

EXFO Inc. isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

Telus Corporation’s (TSX:T) long-standing commitment to putting its customers first fuels every aspect of its business, has had it a definitive leader in Canada. In fact, Telus Health is one of the country’s biggest healthcare IT providers. And it’s done so with sustainability in focus.

Driven by its goal to connect all Canadians for good, it has contributed over $55 in community giving, reduced emissions by 31% and has four consecutive years on the Dow Jones Sustainability World Index.

Shaw Communications Inc. (TSX:SJR) is a major player in the Canadian telecoms sector. It owns a ton of infrastructure throughout Canada and its cloud services and open-source projects look to address some of the biggest issues that its customers might face before the customers even face them. As online gaming depends on solid internet connections, Shaw will likely become a backdoor benefactor in increased online activity. Not only that, it’s growing higher on ESG investors’ lists, as well, thanks to its forward-thinking approach to the environment and its governance.

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. OpeningTrades.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Avanti Energy Inc. (“Avanti” or “AVN”) to conduct investor awareness advertising and marketing. Avanti paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of Twenty Eight thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by Avanti) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares and / or options of the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that prices for helium will significantly increase due to global demand and use in a wide array of industries (including key technology sectors) and that helium will retain its value in the future due to the demand increases and overall shortage of supply; that the Avanti team will be able to develop and implement helium exploration models, including their own proprietary models, that may result in successful exploration and development efforts; that historical geological information and estimations will prove to be accurate or at least very indicative of helium; that high helium content targets exist in the Alberta and both Montana projects; and that Avanti will be able to carry out its business plans, including timing for drilling and exploration. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that demand for helium is not as great as expected; that alternative commodities or compounds are used in applications which currently use helium, thus reducing the need for helium in the future; the degree of success of the coming drilling campaign; the accuracy of the initial estimates of helium on the land; the commercial viability of any obtainable helium, the ability to get any helium obtained to market; the accuracy of the production timeline estimates; that the Avanti team may be unable to develop any helium exploration models, including proprietary models, which allow successful exploration efforts on any of the Company’s current or future projects; that Avanti may not be able to finance its intended drilling programs to explore for helium or may otherwise not raise sufficient funds to carry out its business plans; that geological interpretations and technological results based on current data may change with more detailed information, analysis or testing; and that despite promise, there may be no commercially viable helium or other resources on any of Avanti’s properties. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://OpeningTrades.com/Terms-of-Use, If you do not agree to the Terms of Use http://OpeningTrades.com/Terms-of-Use please contact OpeningTrades.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. OpeningTrades.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.