As we head into New Year 2023, gold prices are on the run. In fact, after closing 2022 out at $1,826.20, the metal is now up to $1,877.80. Pushing gold higher are the ongoing geopolitical tensions, and central bank buying. In fact, according to a Seeking Alpha article, “Central banks around the world, particularly in China, Turkey, and India, have been buying gold at a record pace. This trend has been going on for the past 13 consecutive years, but recently the pace has accelerated. They have been increasing their gold reserves in recent years as a way to diversify their foreign exchange holdings and reduce reliance on the U.S. dollar.” That could be great news for Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF), Barrick Gold Corporation (NYSE: GOLD) (TSX: ABX), Newmont Corporation (NYSE: NEM) (TSX: NGT), B2Gold Corp. (TSX: BTO) (NYSE: BTG), and Equinox Gold Corp. (TSX: EQX) (NYSE: EQX).

In addition, there’s speculation the Federal Reserve could cut interest rates in coming years, perhaps even in 2023. There’s a weakening dollar, war in Ukraine, the potential for war over Taiwan, and plenty of bullish analysts. At the moment, the highest prediction for gold prices is $4,000 from Swiss Asia Capital. Saxo Bank says gold could see $3,000.

Look at Calibre Mining Corp. (TSX: CXB) (OTCQX: CXBMF), For Example

Calibre Mining Corp. announced operating results for the three months and year ended December 31, 2022, and 2023 production, sales, and cost guidance (all financial amounts are expressed in U.S. dollars).

Record Q4 and Full Year 2022 Production

- Consolidated full year gold production of 221,999 ounces:

- Nicaragua full year gold production of 180,490 ounces and Nevada gold production of 41,509 ounces

- Consolidated Q4 gold production of 61,294 ounces:

- Nicaragua Q4 gold production of 49,854 ounces and Nevada gold production of 11,440 ounces

Full Year 2022 Highlights

- Excellent drill results and milestones achieved across numerous assets, reaffirming the Company’s multi-year, grade-driven production growth strategy;

- Pavon Central open pit mining permit approved Q2, 2022, on track for production Q1, 2023;

- Substantial progress made at the Eastern Borosi Project (“EBP”), with production on track for Q2, 2023:

- Receipt of mining permits in Q4 2022 (see news release dated October 28, 2022)

- Advancement of road upgrades, site development and purchase of new mining fleet;

- High-grade gold discovery at Panteon North within the Limon Complex (see news releases dated September 7 and December 6, 2022):

- 52.59 g/t Au over 3.8 m Estimated True Width (“ETW”); 43.09 g/t Au over 3.3 m ETW;

- 22.47 g/t Au over 4.9 m ETW; 17.80 g/t Au over 7.9 m ETW;

- High-grade mineralization over 400 metres will contribute positively to the 2022 Resource and Reserve statement expected in Q1 2023;

- New high-grade gold zone discovered 2.5 km north along the Panteon/VTEM geophysical corridor (see news release dated December 8, 2022), remains open for expansion:

- 11.61 g/t Au over 9.3 m ETW including 23.93 g/t Au over 1.7 m ETW and 15.34 g/t Au over 3.9 m ETW

- Pan Mine drill results demonstrate strong expansion potential (see news release dated August 17, 2022):

- 3.35 g/t Au over 18.3 m; 0.82 g/t Au over 10.7 m; 0.80 g/t Au over 47.2 m;

- Excellent opportunities for growth and, in some cases shallow, higher-grade zones are open for expansion

- Drilling indicates the potential for a new, high-grade, Carlin-type feeder system at depth at the Gold Rock Project (see news release dated November 22, 2022)

- 6.8 g/t Au over 4.6 m and 6.6 g/t Au over 5.8 m;

- Launched the Company’s five-year sustainability strategy, ensuring responsible and sustainable mining practices.

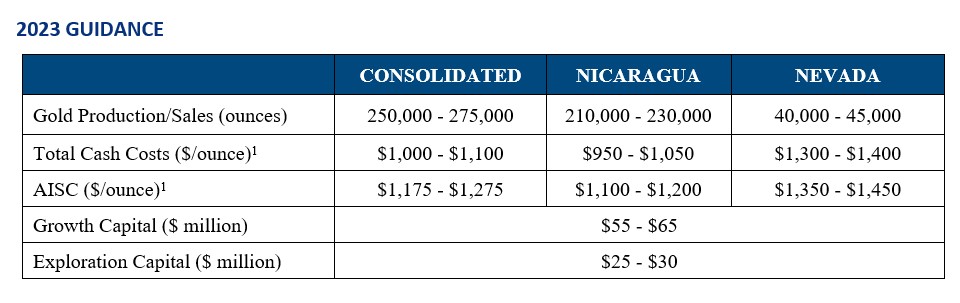

2023 Consolidated Gold Production and Cost Guidance

- Consolidated gold production and sales of between 250,000 and 275,000 ounces;

- Consolidated Total Cash Costs between $1,000 and $1,100 per ounce of gold;

- Consolidated All-in Sustaining Costs between $1,175 and $1,275 per ounce of gold;

- Growth Capital of between $55 and $65 million; and

- Exploration Capital of between $25 and $30 million.

Darren Hall, President & Chief Executive Officer of Calibre, stated: “The team delivered record production in 2022, for the third consecutive year, positioning us well for a further 20% production growth in 2023. Strong cash flows continue to drive Calibre’s organic growth strategy as we progressed development at Pavon Central and Eastern Borosi for production in 2023, setting ourselves up for another grade-driven production increase.

With multiple drill rigs turning across our asset portfolio, our exploration investment continues to yield exciting results as we expand the high-grade gold discovery at Panteon North and the VTEM geophysical corridor that runs north of Panteon at the Limon Complex. Drilling also continues to demonstrate the strong expansion potential at the Pan mine in Nevada as well as at the Gold Rock project where drilling indicates the potential of a high-grade, Carlin-type feeder system at depth.

We continue to integrate our sustainability initiatives across the business, publishing our 2021 Sustainability Report and launching the Company’s five-year strategy, enabling Calibre the social license to operate as we remain committed to delivering positive and sustainable benefits to all stakeholders.

I believe 2023 will be a transformational year, driven by an organic 20% increase in production, strong free cash flow, and significant exploration to expand recent high-grade gold discoveries not included in our multi-year, grade driven production increase strategy. Calibre has a solid, clear, and sustainable path to profitable growth.”

Q4 and Full Year 2022 Financial Results and Conference Call Details

The fourth quarter and full year 2022 financial results will be released after market close on Wednesday, February 22, 2023, and management will be hosting a conference call to discuss the results and outlook in more detail.

Date: Thursday, February 23, 2023

Time: 10:00 a.m. (ET)

Webcast Link: https://edge.media-server.com/mmc/p/5qjci7oa

Instructions for obtaining conference call dial-in numbers:

All parties must register at the link below to participate in Calibres’ Q4 and full year 2022 conference call.

Register by clicking https://register.vevent.com/register/BI868e1e65f2574b20a557a2de7726fd1b

Once registered you will receive the dial-in numbers and PIN number for input at the time of the call. The live webcast and registration link can be accessed here and at www.calibremining.com under the Events and Media section under the Investors tab. The live audio webcast will be archived and available for replay for 12 months after the event at www.calibremining.com. Presentation slides that will accompany the conference call will be made available in the Investors section of the Calibre website under Presentations prior to the conference call.

Other related developments from around the markets include:

Barrick Gold Corporation said that it had completed the reconstitution of the Reko Diq project, having received a favorable opinion from the Supreme Court of Pakistan and the required legislation having been passed into law. One of the largest undeveloped copper-gold projects in the world, Reko Diq is owned 50% by Barrick, 25% by three federal state-owned enterprises, 15% by the Province of Balochistan on a fully funded basis and 10% by the Province of Balochistan on a free carried basis. Barrick president and chief executive Mark Bristow said the completion of the legal processes was a key step in progressing the development of Reko Diq into a world-class, long-life mine which would substantially expand the company’s strategically significant copper portfolio and benefit its Pakistani stakeholders for generations to come.

Newmont Corporation joins the Dow Jones Sustainability World Index (DJSI World), representing the top 10% of the largest 2,500 companies in the S&P Global Broad Market Index. DJSI World membership is based on long-term economic factors, as well as leading environmental, social and governance (ESG) performance evaluated through the 2022 S&P Global Corporate Sustainability Assessment (CSA). In addition to being ranked number one in the Metals and Mining Industry, Newmont received the top score for the Governance and Environment dimensions and earned top decile performance in 23 of the 25 CSA performance categories. The ranking is based upon Newmont’s performance in calendar year 2022. As of December 9, 2022, the company achieved the highest score out of 147 metals and mining companies assessed in the CSA.

B2Gold Corp. announced additional positive exploration drilling results from the Fekola Complex in Mali. In addition, the Company is pleased to re-affirm its 2022 total gold production guidance of 990,000 to 1,050,000 ounces (including 40,000 to 50,000 attributable ounces projected from Calibre Mining Corp.) following consecutive monthly gold production records at the Fekola Mine in October and November 2022.

Equinox Gold Corp. announced that it has sold an aggregate 11,000,000 common shares of Solaris Resources Inc. in the ordinary course for investment purposes through the facilities of the Toronto Stock Exchange through block trades for aggregate gross proceeds of C$70.4 million. Immediately prior to the Transaction, Equinox Gold owned 15,545,487 common shares of Solaris and warrants entitling Equinox Gold to purchase 7,500,000 common shares of Solaris representing approximately 17.88% of Solaris on a partially diluted basis. As a result of the Transaction, including any exercise of the warrants, Equinox Gold’s ownership has decreased to less than 10% of the issued and outstanding common shares of Solaris and Equinox Gold has ceased to be a “reporting insider” as defined in National Instrument 55-104 – Insider Reporting Requirements. Accordingly, Equinox Gold will no longer file insider or early warning reports in respect of its ownership of securities of Solaris, except as required by applicable law.

Legal Disclaimer / Except for the historical information presented herein, matters discussed in this article contains forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from any future results, performance or achievements expressed or implied by such statements. Winning Media is not registered with any financial or securities regulatory authority and does not provide nor claims to provide investment advice or recommendations to readers of this release. For making specific investment decisions, readers should seek their own advice. Winning Media is only compensated for its services in the form of cash-based compensation. Pursuant to an agreement Winning Media has been paid three thousand five hundred dollars for advertising and marketing services for Calibre Mining Corp. by Calibre Mining Corp. We own ZERO shares of Calibre Mining Corp. Please click here for full disclaimer.

Contact:

Ty Hoffer

Winning Media

281.804.7972

[email protected]