Smart investors are now capitalizing on the fight against the growing wave of cyber crime.

In 2004, the global cybersecurity market was valued at $3.5 billion.

By 2015, that figure had risen to $78 billion, and it's projected to soar to $120 billion or even as high as $175 billion by the end of 2017.

That's a 5000% rise in just 13 years.

Cyber criminals these days appear to have the entire world in their hands.

From holding government hospitals ransom, to disrupting the global shipment of goods, or even influencing the biggest election in the free world… cybercrime is booming.

And no one seems to be immune to attacks.

Even the elites are having a tough time securing their information, with reports of Russian hackers selling the email information of 1000s of UK politicians and staffers online.

Make no mistake, cybercrime is beyond a nuisance. It's big business.

And the cyber criminals are going after big business—in the UK, 42 percent of big businesses have already experienced an attack, in particular, those with at least 100 staff.

In response to such a surge in cyber attacks, so too has there been a surge in the growth of the global cybersecurity industry.

It's a problem being tackled by most major tech firms, including Microsoft and Google, especially after fellow e-giant Yahoo suffered a massive breach last year that exposed one billion users.

One company, Identillect Technologies Corp. (TSX-V:ID; OTCQB:IDTLF) is solving that problem.

It's seen its subscriber base grow over 877% since commercialization of its patented secure email platform plug-in for Microsoft and Google in April 2015.

With its incredibly effective, and user-friendly moat system called Deliver TrustTM, Identillect is not only primed for taking its own healthy share of the potential $175 billion cybersecurity market, but it's also in a very investor-friendly stage of its story.

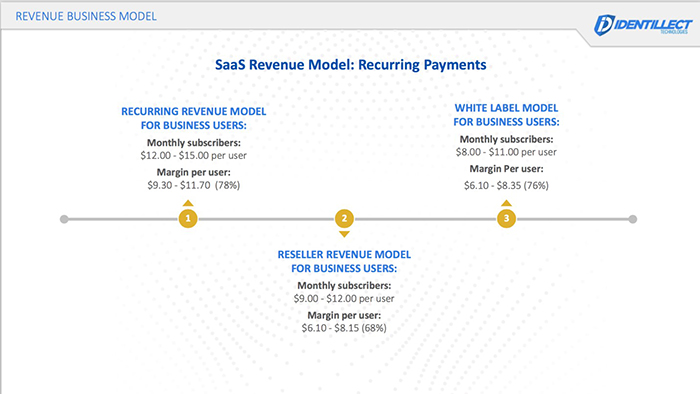

For every additional 1,000 new users Identillect attracts, that presents a potential addition of up to $180,000 per year in revenue, and $140,400 in annual profit.

This $6-million market cap company is already projected to hit 35,000 users this year, and is growing exponentially since it launched commercially in 2015.

Early-in investors could see some very big profits in the years to come, as Identillect's patented technology's margins are very healthy, and could leave the company as a very attractive acquisition target.

Preventing $2 Trillion In Lost Company Value

Cybercrimes are projected to cost the global economy over $2 trillion by 2019.

And it's only getting worse, as more personal information and accounts came online, the frequency of cyber attacks rose 38% in 2016 from 2015.

In 2016, more than 29 million records were exposed in 858 publicized breaches across sectors including financial, government, health care and education.

This trend will only go up. It's expected that the average cost of a data breach in 2020 will exceed $150 million by 2020, as more business infrastructure becomes connected.

The latest scheme that's being employed by cyber criminals is what's called ransomware. Companies are seeing their employees' access to their systems and databases being held ransom by hackers, who are demanding payment in Bitcoin.

The threat has driven companies to stockpile Bitcoin in preparation of such ransoms.

However, despite the financial threat, the company reputation threat, and the operational threat, it seems that majority of companies and individuals still haven't taken the appropriate precautions to protect themselves.

Only half of the world's internet traffic is encrypted. And according to a 2016 study done by IDG Enterprises, 52% of all security breaches are caused by human error or system failure, while the rest are caused by acts of malicious intent.

According to the Ponemon Institute, the average cost of a data breach is $4 million. In the U.S., that figure rose to $7 million.

While $7 million isn't a huge loss to a mega-corporation, the loss of trade secrets and potential for massive fines could be catastrophic.

World Governments Are Legally Mandating A Solution

Governments around the world are taking the security of everyone's private data online very seriously.

Laws are being enacted in the U.S. and Canada both federally and at the state/provincial level to require companies to not only protect data, but be forthcoming about any breaches they encounter. These types of laws are also being rolled out in Asia, in particular in Japan and India which have massive amounts of web traffic.

In Europe, those laws are going to be even stricter, with a far stiffer penalty. In May of 2018, the European Union is enacting what's called the GDPR to protect personal data. Companies found guilty of breaches can be fined as high as 3% of their annual revenues. For a company such as Google, which reported close to $100 billion in revenue in 2016, that would represent a $3 billion fine.

So, for any companies wanting to do business with North American, European, or Asian customers, cybersecurity and data protection are now becoming imperative to deal with.

Companies are scrambling to implement the necessary changes, but many can't adjust fast enough, and many also can't afford it.

Where Identillect (TSX-V:ID; OTCQB:IDTLF) holds an advantage over costly overhauls, is both in affordability, and the speed of implementation.

For example…

If a company wants to use Microsoft Office 365's security system for Outlook called Ajure, it's likely going to take up to a month or more to implement.

There will need to be several IT precautions made, including new servers, hiring technical know-how on board, and so on…

The same goes for most major email server security measures from other majors such as Google, Citrix, Proofpoint, and Zix.

Identillect's Deliver Trust takes 2 minutes to install, and achieves the same level of security.

Identillect Has A Patented Secure "Smart Email" Solution

What Identillect's brain trust set out to invent was a system so simple and inexpensive to incorporate, that businesses will be foolish to pass it up.

Deliver Trust implements a plugin that bypasses the expensive system overhauls promoted by its competitors.

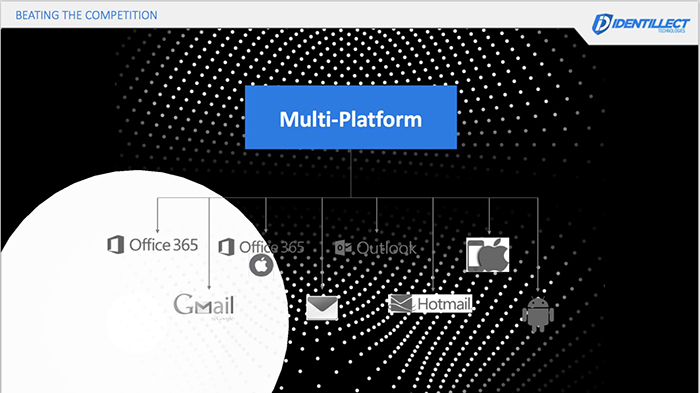

And it's also compatible with their competitors' email platforms!

Deliver Trust works with Outlook, Office 365, Hotmail, and Gmail… PLUS it has a phone app that works on iPhone, Android, Windows and more.

Each account is assigned to a single email address; thus, the user can use the protection on all of their devices…all with an install time of only 2 minutes.

Users need not change their habits or email platforms. They merely install the plugin and go back to their business, with more peace of mind.

But Deliver Trust goes far beyond simple encryption.

Protecting Email Users From Themselves Is Big Business

There are currently only approximately 250 professional cryptographers working in the United States…

Identillect has 2 of them… And they've employed their expertise very wisely.

Deliver Trust does more than just protect emails.

For companies that employ the software across their business, the platform can enforce company communications policies, and can go even further.

It can protect users from themselves.

One major tool that the platform provides is recall, wherein the sender can recall an email at any time, making it unreadable on the other end once the sender decides to pull it back.

This is a very useful tool for businesses, especially if they're in competition for contracts, and want to protect their offers from being shared.

Senders can also protect their emails from being printed, or even forwarded.

And while all of the extra security features would impress the IT support team, it's the user simplicity that would impress c-level executives.

Deliver Trust drastically reduces the chance of company wide user error too.

For instance, even if a lower level employee forgets to encrypt an email containing sensitive data like a credit card number, Deliver Trust's smart scan system scans the email and triggers the user to encrypt before sending.

And most importantly, Deliver Trust doesn't require the recipient of the email to sign up for the service. Emails and their attachments are both encrypted on behalf of the sender.

But what gives Identillect (TSX-V:ID; OTCQB:IDTLF) a major advantage is that it takes 2 minutes to set up. While other systems require up to a month or two for a business to convert to.

In short: Deliver Trust was designed from the ground up to deal with the end user in mind. First, not requiring the user to change the email platform they are using... And second, preventing them from making errors that would violate company and government mandated security policies.

Identillect's Deliver Trust Demand Is Rising

Because Identillect's Deliver Trust platform can be installed over a coffee break... vendors are showing keen interest.

With the onslaught of cyber attacks being reported almost weekly now, customers (both corporate and individuals) are lining up to ratchet up their security.

They have to… otherwise they'll be fined, or worse, lose valuable company trade secrets.

And as stated above, the average data breach costs U.S. companies $7 million. That's easily remedied, with careful planning, and enlisting a plan such as Identillect's.

Often companies dip a toe by securing their accountants email first, and then rolling out the system for the rest of the company the moment they see the value. Identillect's system is in full regulatory compliance.

The One Cybersecurity Stock To Buy Now?

Smart investors know cybersecurity is one of the fastest-growing sectors in the tech industry.

According to industry expert Steven Morgan in his Cybersecurity Industry Outlook: 2017 to 2021, global spending on cybersecurity will be worth $1 trillion over the next five years.

And cybercrime damages will cost the world $6 trillion annually by 2021.

The Identity Theft Resource Center (ITRC), reported breaches involving emails are the second most common type of breach incident.

This is where identillect's sweet spot is.

And the company has seen incredible growth since officially rolling out Deliver Trust.

Armed with a very strong reseller program with more than 95% retention, Identillect has grown its subscriber base over 877% since commercialization in April 2015.

That's 19 out of 20 customers who stay enrolled.

The company expects to break even at 35,000 subscribers by Q4 of 2017, and for its subscriber count to continue its exponential growth that compounds monthly.

Overall the company's recurring revenue model is on target to hit 70% profit margin this year.

Those profit margins stand to grow even more, as the company increases its footprint, and lowers its internal costs.

Timing Is Everything

Identillect has already seen exponential growth throughout its story, but the real boom is still on the way.

The company's growth pattern is undeniable. Identillect recently announced 18% growth numbers in April alone.

Identillect CEO Todd Sexton attributed some of these successes to helping companies meet their regulatory requirements, stating:

"We are seeing such a progressive change in the requirement for secure communication at all regulatory levels, with additional movement around the state regulatory demands. The features and security that our Delivery Trust email security service offers, help businesses and end users to meet these ever-increasing regulations."

The company is on its way to Silicon Valley, and is starting to aggressively market itself to gain even higher subscriber growth.

With its ease of use, price point, and 2-minute install, Identillect's (TSX-V:ID; OTCQB:IDTLF) Delivery Trust is just too simple a solution to pass up.

Honorable mentions in the space:

BCE Inc. (TSX: BCE): This Canadian telco giant has three massive segments, including Bell Wireless, Bell Wireline and Bell Media. It's paying a quarterly dividend of $0.7175 per share right now. It's had some great results, even if net income has declined a bit in the most recent quarter. It's still blowing other telcos out of the water.

Sierra Wireless (TSE:SW) is a multinational wireless communications equipment designer and manufacturer headquartered in Richmond, British Columbia, Canada. Sierra has seen its share price double year-to-date, but has fallen back a bit since. We expect Sierra to hold gains as the Canadian economy recovers.

Celestica Inc. (TSX: CLS): Celestica Inc. is a Canadian multinational electronics manufacturing services (EMS) company headquartered in Toronto, Ontario. Celestica's global manufacturing network comprises more than 20 locations in 11 countries in the Americas, Europe and Asia, delivering end-to-end product lifecycle solutions. In addition to manufacturing, the company's global services include design and engineering, systems assembly, fulfillment, after-market services and supply chain services.

Shaw Communications Inc (TSE:SJR.B): Shaw Communications Inc. (Shaw) is a diversified connectivity provider. The Company operates through four divisions: Consumer, Wireless, Business Network Services and Business Infrastructure Services. The Company offers wireless services for voice and data communications through its Wireless division. Shaw is a giant in the Canadian market and despite its recent share price drop, we expect the company to see a strong back half of 2017.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.