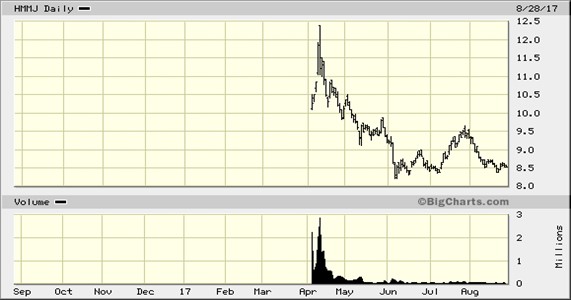

Go ahead, buy some weed stock(s). No doubt it will eventually, be fun; maybe even profitable. With a very few exceptions, they’re not really investments yet, but early likely beats late. There’s even a (Canadian) Marijuana ETF: (TSX: HMMJ) opened in May 2017. The global medical cannabis market is expected to grow from $11.4 billion in 2015 to $55.8 billion by 2025, with a compound annual growth rate of 17.1 percent during the forecast period. Don’t bet the farm, maybe a few acres.

Now, let’s get serious

The through and through wound the resource market suffered is and has been greatly exaggerated. Particularly when one talks of infrastructure, which encompasses myriad types of construction, including resource extraction.

As far as cars are concerned, electric is fine, but energy companies will ensure that hybrids dominate for just about ever.

Don’t mothball that drill bit or length of pipeline just yet.

Infrastructure spending (2017) is US$3.1 trillion. In 2020, US$$4.2 trillion. That’s a CAGR of 6% annually. Needless to say, there is little doubt that infrastructure spending will dominate the next several decades. For context, here is the chart of the iShares Infrastructure ETF.

“Ironically, Enterprise’s share price is somewhat tied to the oil price,” states Leonard Jaroszuk, CEO and President. “The reality is that our business mix of providing specialized industrial rentals and infrastructure solutions and technologies, should actually insulate us against that volatility. As well, the fact that we design and build specialty equipment for our clients—15 patents in place with more coming—means that we can be immediately responsive and relevant to address our private or Government customers’ unique needs, whether resource-centric or straight public infrastructure.”

Investment Appeal? You Bet. Compelling and Enduring Value? Undoubtedly

Enterprise Group provides specialized equipment and services in the build out of infrastructure for the energy, utility, pipeline, and transportation industries. The innovation and expertise of our operating companies and significant repeat business distinguished them among their blue chip and international grade client base.

Enterprise Investment Drivers

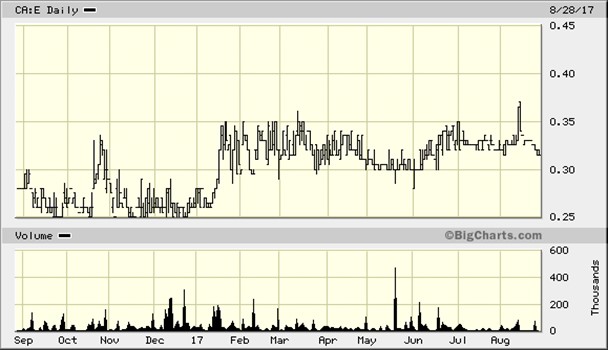

- Stock trades at C$0.33. Breakup approximately C$0.85

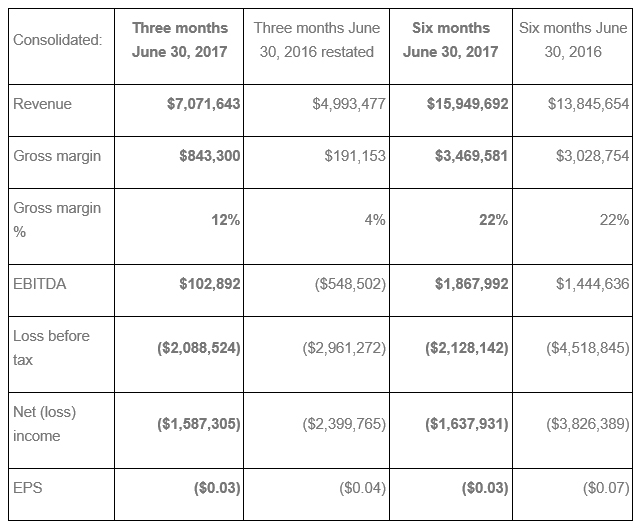

- HY 2017 revenues $16m versus HY2016 $13.8

- EBIDTA 2017 $3.47m versus $3m

- 15 Patents; Ongoing R&D to develop IP technology and processes

- Meaningful increase in activity from its existing customers coupled with a substantial surge in new customers

- Maintain cost cutting/rationalization

- Vigilant to strategic sales, M&A, JV and other partnership opportunities

- Ensure that all divisions; Westar, Hart, Calgary Tunneling and Artic Therm are being cross-purposed and providing complementary services to maximize revenues

"Enterprise has generated positive cashflow every quarter since the downturn with the exception of Q2 2015." stated Desmond O'Kell, Senior Vice President. "Debt reduction, along with sale of redundant assets--$4 million more to be unencumbered in October 2017, will further reduce debt payments by $68K per month. Great lengths have been taken to reduce the cost structure while stabilizing gross margins and service levels to the client. Year over year, G&A was reduced by another $1 million."

On June 7th last, Enterprise announced the culmination of two years of action; an NCIB (Normal Course Issuer Bid) to buy back and retire approximately 5% of its roughly 55.7 million issued and outstanding shares.

The reason? Like most companies who take this action, it is because for whatever reason--markets, low profile, or just hanging on a proverbial meat hook within a tough business sector-- management feels its share price is too low and/or does not reflect fair value in the current cycle. As a strategic action, the buyback increases the nominal value of the shares as well as delivering mandated shareholder value.

The shareholder enhancing/protective decisions the Company has taken in the last three years have preserved value while peers have been crippled or simply disappeared.

Now a much stronger Company than in2014-2015, Enterprise likely has plans that take advantage of its leaner structure, significantly lowered debt and scaling up to meet its business which is already exceeding previous quarters. As well, opportunities for quickly accretive acquisitions still abound in the sector.

Just as Enterprise management took the bold step of increasing its personal holdings from 6.7% to 18.4% (+275%) in the worst two years of the decline, the Company felt it was time to further demonstrate the undervaluation of its shares with the bold buyback strategy.

Rebuild and Rehabilitate Global Infrastructure. Everything Else is Just Noise. (Including Marijuana… at least for now)

Just as Enterprise’s Management took the hard decisions to streamline the Company and ensure it was ready for the impending turn, now, new growth strategies are being deployed.

According to Price Waterhouse Coopers, (PwC) there are five drivers to increase and enhance infrastructure investing:

1) Investors broadening their horizons

Unlisted funds had over $373 billion of assets under management at the end of June 2016, up from only $24 billion in 2005.

2) New political leadership unveils ambitious goals

New leaders in the U.K. and the U.S. have indicated increased infrastructure spending. Elections in 2017 may do the same in France and Germany.

3) Future proofing against obsolescence

Governments and investors alike typically expect an infrastructure asset to last thirty years or more. But the megatrends transforming our planet – rapid urbanization, climate change, shifts in global economic power, demographic changes, and technological breakthroughs – can cause even traditional assets to lose relevance quickly.

4) Sustainable Infrastructure for The Long Term

There’s a growing push to decarbonize economies, use green construction methods, and make cities ecologically sustainable. The 2015 Paris climate agreement known as COP 21 established ambitious goals to fight global warming.

And finally, and most apropos to an investment in Enterprise Group:

5) Commodity-rich regions prioritize infrastructure

Countries rich in natural resources have suffered from the fall in commodity prices, with government budgets taking a hit. However, many of these countries’ leaders see infrastructure as a way to maintain growth, support vulnerable sectors of the population, and eventually transition away from commodity-dependent growth models. Therefore, governments are having to consider innovative private financing options and turning to the private sector to support these plans.

Global Infrastructure grows at a faster rate and amount than most other sectors, for obvious reasons. Just about everything else depends on solid infrastructure to get to and from pretty much anywhere.

Try and have a marijuana industry, or oil or railroads etc. without solid infrastructure. Can’t be done.

Tempted to say, “Put that in your pipe and smoke it.”

Oh.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated ten thousand dollars for its efforts in distributing the TSX:E profile on its web site and distributing it to its database of subscribers. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.