- Low-profile acquisition to grow revenue significantly at AKDS, opens tremendous sales opportunity for high-margin "IoT" software business. ADKS could be set for meaningful revaluation higher by investors as revenue increase and margin mix comes into focus.

The blossoming "Internet of Things" (IoT) is going mainstream, even if the term itself is only recognizable to more sophisticated investors. Referring to any internet-connected device that can transfer information over a network and in many cases have their own unique IP address, the IoT now includes clocks, security cameras, watches, automobiles and even implanted "biochip" transponders. But the industrial segment is where most investors are moving.

Industrial IoT To Become a $300 Billion Industry

The business-to-business market for connected "things" is taking off as companies use software and hardware to increase productivity and improve efficiency.

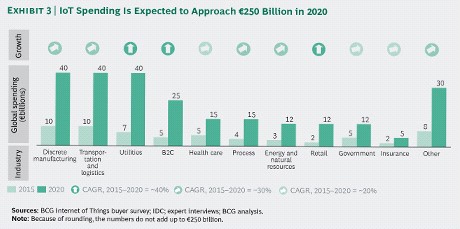

A Boston Consulting Group market analysis found that companies will spend $298 billion on IoT in 2020 (over and above their normal technology spending), and that three categories will account for almost half of this spending: manufacturing, transportation/logistics, and utilities monitoring.

With industrial IoT applications to easily surpass home applications in short order, B2B focused IoT companies are worthwhile investments. Indeed, Nasdaq-listed Splunk (NASDAQ:SPLK) has grown sales of its machine-data software from $200,000 in 2013 to almost $1 bln in 2016 as the stock has rallied 140% to a $9 billion market valuation.

One recent acquisition in this booming sector went mostly unnoticed, but could be turning heads soon among investors as it could portend major new revenues for the quiet Arkados Group (OTCBB:AKDS).

Arkados's business is built around improving energy efficiency for businesses, by using internet-connected gateways and sensors to gather data on energy-consuming machines, devices, lighting, and infrastructure. The target market mostly consists of commercial and industrial facilities.

Their goal is to reduce a facility's energy expenditures - and energy bills as a result - by as much as 25%+, and potentially much more when combined with implementing other energy conservation measures. Arkados performs the installation and servicing of these gateways and sensors but, importantly, derives revenue from their Arktic software platform, which is a cloud-based management package for smart measurement and verification, as well as predictive analysis, on machine performance and energy usage.

After the completion of an energy efficiency audit, the company makes recommendations on reducing energy demand costs (such as converting to LED lighting), reducing energy supply costs (by installing a solar system, for instance), and ways to improve efficiency across all of a facility's systems with a building automation system. Arkados just reported revenue for the fiscal year ended May 31 of $2.346 million, 25% growth over their fiscal 2016's $1.871 mln. The company derives revenue from a service segment, and a software segment.

But on May 8, Arkados Group completed the quiet acquisition of SolBright Renewable Energy, LLC, a renewable energy design and development company based in Charleston, SC. SolBright performs development, engineering, procurement and construction services for the commercial solar photovoltaic market in the Eastern U.S. The company was behind the construction of Rhode Island's largest solar photovoltaic system at the time, in 2014, and importantly, the SolBright acquisition includes a backlog of approximately $40 million in new potential projects.

It's not just this new revenue stream that matters to Arkados - the company is moving into a massive vertical, and opening a whole new sales opportunity for its highly cost-effective, cloud-based software segment.

Why This Acquisition Is So Transformational For AKDS

Arkados Group is making strong headway in the last two years, with 25% year-over-year revenue growth. The bulk of 2017 revenue came from their services business, which consists of evaluation, planning, installing and servicing their high-efficiency gateway/sensor systems. This segment carries gross margins of about 20-30% similar to other construction/engineering companies.

Arkados' ability to differentiate lies in their Arktic software platform and SaaS business segment, which generates gross margins in the range of 90 to 95%, a massive leap in scalability due to this being a software/cloud platform - the costs are minimal.

This is what makes the SolBright acquisition so profound for AKDS.

The SolBright acquisition directly augments Arkados' existing energy service business with solar engineering, procurement and construction, but it also creates a new and powerful sales channel - rolling major solar project customers into becoming SaaS customers, with recurring revenue and exceptional margins. SolBright had $40 mln in their project pipeline as of the acquisition date, according to management, and this creates a tremendous new pipeline for the historical IoT business at Arkados.

Arkados is now selling into the growing solar market, and they're doing this with a one-stop offering whereby the company profits both on the front-end with installation services, and potentially on the back-end, with a "razor/razor blade" software package. The software segment accounted for 40% of Arkados' fiscal 2016 revenue.

Indeed, Arkados reported in their fiscal 2017 annual filing that had the SolBright purchase occurred as of June 1, 2016, the company would have generated pro forma $8.748 mln in revenue, a whopping 274% increase over their reported revenue that year.

Turnkey Solutions Are The Future, AKDS Prepared To Expand

As Boston Consulting Group point out in their IoT market analysis, a turnkey solution, like that of Arkados Group, will be critical to the future of industrial IoT:

"Today’s IoT customers are looking for end-to-end solutions. World-class applications and services deliver value only when the underpinnings (the connected things, communications, backbone, and security layers) work seamlessly with the top layers...it is essential to craft a go-to-market plan that takes into account the customer’s desire for an end-to-end solution."

One can see this playing out over the last few years with companies like Siemens AG (ETR: SIE) and GE (NYSE: GE) scrambling to firm up their IoT digitization capabilities in a whole mess of tack-on acquisitions like Daintree Networks for a reported $77 mln, and Meridium for $495 mln.

AKDS is building out exactly that - a turnkey efficiency service for facilities and businesses that can rapidly lower costs for the business. With revenues growing and the company now primed to expand their software segment, a revaluation higher for AKDS could be in order to better reflect their "growth" potential. A Price/Sales multiple in line with peers like SPLK at 9 times the prior year is not out of the question. Even absent the SolBright acquisition, this would indicate a $21 mln market capitalization, or a 120% increase from prices today. With revenue possibly growing massively into 2018, now's the time to be paying attention to what's going on at ADKS.

About One Equity Stocks

One Equity Stocks is a leading provider of research on publicly traded emerging growth companies. Our team is comprised of sophisticated financial professionals that strive to find the companies and management teams that will outperform the market and deliver investment returns to our subscribers. We are not a licensed broker dealer and do not publish investment advice and remind readers that investing involves considerable risk. One Equity Stocks encourages all readers to carefully review the SEC filings of any issuers we cover and consult with an investment professional before making any investment decisions. One Equity Stocks is a for profit business and is usually compensated for coverage of issuers. In the case of AKDS, we are reimbursed for actual costs of this distribution and may receive in the future up to 100,000 shares of restricted stock for Business Development, Capital Markets and IR related Advisory Services. Please contact us at [email protected] for additional information or to subscribe to our intelligence service.