LEDE

This is an alert to a possible breakout -- not an alert of a breakout that has happened. But, if you want to stay ahead of the curve, sometimes you make note of a pattern, even if it could yield no trigger.

Even though we can see that Zoetis Inc (NYSE:ZTS) stock is up 140.19% over the last 5 years, in that same time frame, using a technical signal with an infrequent trigger, has created larger returns of 553.7%.

At some point, after all the social media craze and pundits on financial television drawing lines on stock charts, we need to stop the noise and just answer, once and for all, has technical trading actually worked in the past?

Answers, empirical and explicit, not just some lines on a chart -- that's what we're after.

ANSWERS: Zoetis Inc (NYSE:ZTS) TTM Squeeze Technical Trigger

The idea is simple -- stocks tend to move in tight ranges for the majority of the time, and then they move in bursts for the remaining periods.

Here is a simple graphic, where the gray line is the daily stock price, the blue bars comprise the tight squeeze zone, and then we see the break out into a bearish move. Roughly speaking, this is the pattern that this technical indicator is attempting to identify and back-test.

ZTS is now in its fifth day of a squeeze, as of 11:37am PST, and it takes six days for the trigger to be possible. We can look at a 4-month stock chart and note two things:

First, on the far right, we can see the 'low volatility' period that has created a squeeze.

Second, we have highlighted the last time ZTS completed a squeeze and then signaled a bullish trigger. In the two days to follow (Sep. 5th 2017 to Sep. 7th 2017) the stock rose from $63.17 to $64.85, turning the 40 delta call into nearly a 200% winner in two trading days.

The goal, of course, is to find these breakouts before they occur and to scan the market for the best historical performers.

Rules

* Open the long 40 delta call (out of the money call) on the day the TTM Squeeze has been broken with upside momentum.

* Close the call after that signal has seen a consecutive two-day reversal.

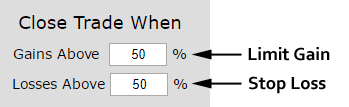

* Use a 50% stop and a 50% limit on the back-test.

* Use the options closest to 15 days from expiration

* Never trade earnings -- irrespective of the technical indicator, this trade will close 2-days before a scheduled earnings announcement.

This is a straight down the middle bullish bet -- this trade wins if the stock rises and will lose if the stock does not.

RISK CONTROL

Since simply owning out of the money options is an aggressive directional bet, we test this approach with added risk limiting parameters, namely, the back-test uses a 50% stop loss and a 50% limit gain.

This also has the benefit of taking profits early, before the bullish signal ends -- that is, before two consecutive reversal days appear.

DISCOVERY

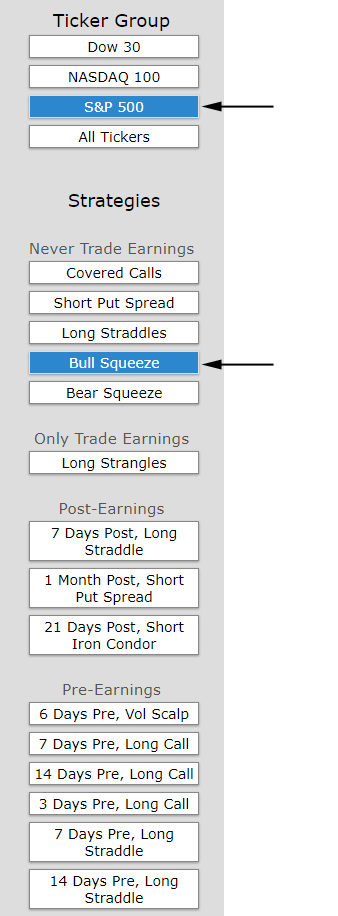

We found this back-test results by going to the Trade Machine Pro Scanner, looking at the S&P 500 and then the "Bull Squeeze" scan.

We found that ZTS is in its fourth day of a squeeze and we see today's stock price remaining calm, so pointing to a fifth day.

Keep in mind, not only does ZTS have to stay in this low volatility band for at least another trading day, but in order to be a bullish trigger the 1-day stock change on the day it breaks out of the squeeze must be at least a 1% rise and the stock movement has to break out of the squeeze. If the positive move is less than 1%, then the trigger in Trade Machine is not turned on.

This is an alert to a possible breakout -- not an alert of a breakout that has happened.

RESULTS

Owning the 40 delta call in Zoetis Inc (NYSE:ZTS) over the last five-years but only held after a TTM Squeeze was triggered yielded these results:

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 553.7% back-test return, which is based on 10 trades in Zoetis Inc. A bullish breakout from the TTM Squeeze is a technical signal that doesn't happen often, but rather is designed to mechanically identify the times when a stock is in a low volatility period and may be about to thrust higher. It's a signal based on probabilities, not absolutes, so it won't work all the time.

Looking at Averages

The overall return was 553.7%; but the trade statistics tell us more with average trade results:

- The average return per trade was 68.28%.

- The average return per winning trade was 92.87%.

- The average return per losing trade was -30.06%.

Looking at the Last Year

While we just looked at a multi-year back-test, we can also hone in on the most recent year with the same test:

Now we see a 133.6% return over the last year and a 67% win-rate.

- The average return for the last year per trade was 84.65%.

- The average return for the last year per winning trade was 154.04%.

- The average return per losing trade was -54.12%.

Technical Details

For the details about the TTM Squeeze, how it works, when it's triggered, why it's relevant and what it means, you can learn about scientific technical trading from the link (which leads to a short video).

WHAT HAPPENED

This is one way people profit from the option market -- whether it's technical analysis, momentum trading or non-directional option trading. Take a reasonable idea or hypothesis, test it, and apply lessons learned.

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.