Colored gemstones are drawing the attention of diamond market investors, and in the coming months these investors could be rewarded with a booming market.

International money from the diamond market—valued at $80 billion—is now flooding in to colored gemstones.

Market research analyst Technaviot predicts that the global gems and jewelry market will reach $292 billion by the end of next year.

And colored gems are now fetching premium prices, with one Colombian emerald sold for a mind-blowing $5.5-million at a recent Christies auction - just one of many indicators that diamonds are no longer the only jewels of the gods.

And Fura Gems (TSX.V:FURA; OTC:FUGMF) is thinking big—diamond market big. It’s aiming to use business practices with emeralds and rubies that De Beers used with diamonds.

Fura is aiming to take the colored gemstone market to new heights, emulating the diamond industry in the booming international emerald and ruby trade.

And, just weeks ago, Fura just acquired the mine where the “Guinness Record Emerald” was unearthed. The best part: This mine is only partially explored – so there is plenty of potential for more record breaking stones to be found.

People are increasingly fascinated by the “Big Three” precious gems— emeralds, rubies and sapphires, and the high-fashion industry is joining in, hungry for something rarer and more distinctive than lab-grown diamonds.

With the colored gemstone industry now enjoying annual retail sales of $18 billion-$21 billion, we’re witnessing the age of color and the era of the ‘new diamond’.

And smart money is getting in early, with heavy hitter Forbes & Manhattan backing the Fura Gems team that is leading this revolution. The diamond jewelry market, valued at over $80 billion in 2016, may soon have some competition.

Investors should pay attention because Fura is sitting at the top of some peoples’ ‘best gem stock’ lists for 2018, and when production starts at its new acquisitions, it will be the start of a new era for Fura.

Here are 5 reasons to keep a close eye on Fura Gems (TSX.V:FURA; OTC:FUGMF) right now:

#1 Colored Gems with Diamond-Market Valuation

What you don’t know about diamonds is this: The diamond jewelry market has grown to reach over $80 billion because the segment has been led by huge, organized companies. The colored gemstone market is fractured and unstructured, with a host of bit players and artisanal miners who haven’t been big enough to take emeralds, rubies and sapphires into the diamond league.

This could change. And the timing is brilliant because diamond money is already flowing in to the colored gemstone market.

Why? Because consumers want color, and rubies, emeralds and sapphires are now all the rage.

"Buyers are really going for the beautiful natural gemstones. Most of the top 10 lots are emeralds, rubies and sapphires,” says Vickie Sek, director of jewelry for Christie's Asia.

In fact, an 18.04-carat Colombian emerald just sold at a Christie’s auction for a whopping $5.5 million.

Colored gemstones have a longer history than diamonds, and can be more expensive. A red ruby sells for more at auction per carat than a white diamond. But the colored gemstone industry has always been dominated by disorganized players.

Gemfields is the only organized player in the space that has managed to capture 10 percent of the market over the last 10 years.Dev Shetty, Fura CEO and president, and the man responsible for turning Gemfields into a colored gemstone giant.

Diamonds have become increasingly generic in the world of high fashion. “Anybody can go to a chain jewelry store and pick up a generic diamond ring,” Gary Roskin, Executive Director of the International Colored Gemstone Association (ICA) recently told reporters.

Diamonds haven’t just lost a bit of their luster over color, though. They’ve also hit some other roadblocks, from mining conditions to lab origins that leave them with no detectable differences, unlike colored gemstones.

So as smart money starts moving into colored gemstones, Fura is working to acquire more gemstone properties and it’s a very open playing field…

#2 Unlocking Surging International Demand

Colored gemstones are an international phenomenon, with top jewelers are calling this the “decade of colored stones”.

Emeralds, discovered in Egypt, first donned by Cleopatra and representing hope for some, and in the past even the ability to see the future or protection from evil spirits, have become increasingly alluring.

That’s why today, the emerald is in the haute‑joaillerie spotlight, and many designers say it’s even dominating the luxury jewelry market.

Rubies, representing passion, prosperity and protection, are also moving towards center stage, making a dent in the popularity of diamonds.

Seductive, scarce and causing market scarlet fever, Rubies are on fire. In the gem jewelry world, rubies have now become the main attraction, New York-based fine-jeweler Mish Tworkowski told the Financial Times.

That’s why the top seller at an October auction at Sotheby’s in Hong Kong was a ruby and diamond ring that fetched $10.5 million, compared to only $2 million for a fancy yellow diamond ring.

That’s also why Gemfields, the only company in production in the Mozambique ruby market, has seen an upturn in demand for all of its colored stones recently.

Millennials are buying fewer diamonds—they’re buying more colored gemstones than previous generations. And they’re making the switch for a variety of “ethical, financial and even expressive reasons”. Colored gems are the new engagement ring, just for starters.

But they may not be less expensive for long.

"In auction, we're seeing prices that we never saw before [for colored stones]”, John Benjamin, an expert in antique jewelry, told The Guardian.

This is a very different marketplace now, he said, and in recent years “prices have absolutely skyrocketed.”

Demand is looking as bright as gemstones themselves, and again—it’s all about color.

#3 Cornering Colombian Emeralds: The Biggest Supplier in the World

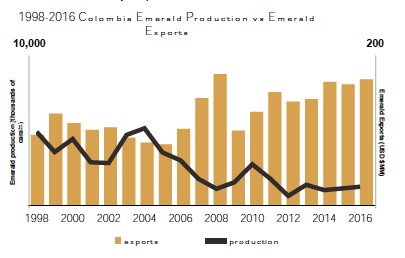

Colombia is the emerald capital in the world, yet its production has collapsed and until now it’s been undercapitalized and controlled by a smattering of local companies with little expertise.

With supply of emeralds not organized enough to meet the demand coming out of the fashion industry, this is a rare opportunity to get in on an industry that is ripe to be turned on its head, by Fura Gems and other producers.

Colombia is the world’s largest emerald supplier by volume, responsible for half of the world’s emerald value supply. More than that, Colombia’s emeralds fetch a higher value per carat than emeralds from Zambia and Brazil, its main competitors.

It’s also one of the best venues in the world for colored gems because of its legal framework for the emerald mining industry. Colombia is dead set on attracting foreign investment and is playing a huge role in transforming the industry.

This is exactly where Fura Gems (TSX.V:FURA; OTC:FUGMF) has just acquired an existing emerald mine that is scheduled to start producing in just four months. This is the same mine that produced the largest emerald the world has ever seen.

In October, Fura entered into an agreement to acquire the Coscuez emerald mine in Colombia.

But this isn’t your average emerald mine: This is an iconic mine that has been in existence since 1646. By 1966, 95 percent of the world market for emeralds came from Colombia, dominated by Coscuez. And it is home to the Guinness Emerald, a 1.759-carat emerald that broke the Guinness World Book of Records.

Fura’s Coscuez mine has a huge ore resource in the first 300 meters below La Paz level, all of which is thought to contain emeralds.

When Fura acquired a 76 percent interest in this mine, it acquired a massive interest in a new, lucrative future for this colored gem that is now taking the fashion world by storm. What was once only traditionally mined, with no investment in geology, infrastructure or long-term plans, is now about to be infused with modern mining methods and efficiencies.

It also holds a 100-percent stake in another Colombian emerald exploration concession.

And there is a reason to pay attention, for investors: Bulk sampling is scheduled to begin this month and production from bulk sampling is supposed to launch in May, with ramp-up by December.

#4 Rubies to Die for in Mozambique

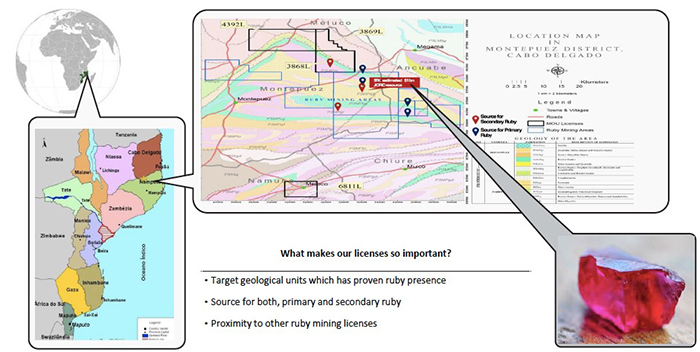

But Colombian emeralds are only the beginning — rubies are shining just as brightly, the best and most precious of which come from Mozambique, where Fura has acquired exclusive rights to sought-after gemstone deposits.

Fura is sitting on four ruby licenses in Mozambique with rich deposits at shallow depths with an 80 percent stake covering over 394 square kilometers.

Like Colombia and emeralds, Mozambique is the world’s largest supplier of rubies by volume, and that’s about to get even bigger: It’s now stepping in to fill the supply gap of rubies from Myanmar (Burma).

And it’s not just about mining rough rubies: The Fura team also possesses something known to very few others: a rare process of heating and treatment for rubies that should allow Fura to unlock significant value even from lower-quality rubies. In other words, the upside here is that it can turn lower-quality rubies into high-value gemstones for the market.

And just like in Colombia, the ruby market of Mozambique lacks capital and structure, and Fura is aiming to bring new systems and organization to its ruby business.

Rubies are the second part of a gemstone awakening – and Fura Gems (TSX.V:FURA; OTC:FUGMF) have access to two very valuable sites.

#5 Not a Family Business Anymore

There’s hardly a more legendary story in this industry than the turnaround of Gemfields—and the mastermind of that turnaround is now the CEO of Fura Gems, Dev Shetty.

In 2009, Gemfields—the only big company operating in the colored gemstone industry in the world—appointed Shetty to the board to turn the company around after it lost over $200 million in a failed strategy. Shetty worked a miracle, bringing Gemfields to a market cap of $525 million in 2015, and its Mozambican ruby mine to a valuation of $1 billion.

For Shetty, it’s all about strategy. And with Fura, the strategy is revolutionary in the colored gemstone industry.

At a recent gemstone industry forum, Praveen Pandya, chairman of the Gem and Jewelry Export Promotion Council (GJEPC), bemoaned the lack of structure in this traditionally family-owned industry, saying “there’s a need to introduce more professionalism … and take it to the next level.”

Likewise, Gemfields CEO Sean Gilbertson noted that “mining is about scale. If you wish to build a national champion, a world-record beater, it’s got to be big. If it’s artisanal or small scale, it is not, in our opinion, sustainable.”

Jamie Lalindeadvisory board

Jim RogersMichael Spektor

The people behind Fura were previously the first to bring Mozambican rubies to the market, through Gemfields, and win that company a huge valuation. Now they’re trying to do it again, with Fura, adding Colombian emeralds to the mix. This team is as revolutionary as the industry they are setting out to upend—and they’re taking cue from the diamond playbook right as the colored gemstone market expands.

Fura Gems (TSX.V:FURA; OTC:FUGMF) is preparing to take Colombia’s iconic emerald mine to a scale never before seen in the colored gemstone industry, and we expect news soon about results of major drilling in two deposits in Mozambique.

With potential assets underground that could be much larger than their current market cap, Fura is on ready, fully funded, and plans to one day be announcing a rainbow of colored gemstone mines around the world.

Bottom line? A small, $41-million market-cap company is sitting on an emerald mine in Colombia which has produced a record-breaking emerald, a mine that’s only been partially excavated and 4 major ruby licenses in Mozambique at a time when colored gemstones are treading on diamond’s traditional territory...

Additional companies in the mining space:

Kinross Gold Corporation (TSX:K) is relatively new on the scene, founded in the early 90s, but it certainly isn’t lacking drive or experience. In 2015, the company received the highest ranking for of any Canadian miner in Maclean's magazine's annual assessment of socially responsible companies. With over 30 million ounces of proven or probable gold reserves, Kinross makes for a solid bet for investors.

The company has managed to outperform the gold miners index GDX as well as its peers Barrick and Newmont in 2017. Investors should expect Kinross to come out with its 2018 production guidance in early February 2018.

Agnico Eagle Mines Ltd (TSX:AEM) Canadian based gold producer, Agnico Eagle Mines is an especially noteworthy company for investors. Why? Between 1991-2010, the company paid out dividends every year. With operations in Quebec, Mexico, and Finland, the company also is taking place in exploration activities in Europe, Latin America, and the United States. This is certainly a company with tremendous potential that grows better by the day.

Investors have certainly taken note. In the past month, Agnico has seen its share prices climb steadily, and 2018 looks to be shaping up to be a promising year.

Yamana Gold (TSX:YRI): Yamana, a significant gold miner is about to complete its Cerro Moro project in Argentina, giving its investors something major to look out for. The company plans to ramp up its gold production by 20% through 2019 and its silver production by a whopping 200%.

Despite a small drop in 2017 gold production, the company still managed to beat analyst expectations. Investors can expect a serious increase in free cash flow as gold prices have risen to 2 ½ month highs.

Newmont Mining Corp. (NYSE:NEM) Founded over 100 years ago, Newmont Mining Corporation is one of the leading mining companies in the world. The company holds assets in Peru, Australia, Ghana, Indonesia, Mexico, and around the United States. Primarily focusing on gold and copper, Newmont has steadily carved out a name for itself among those in the industry.

In Q1 2017 alone, the company secured over 1.2M ounces of gold, and with a $21-billion market cap, Newmont has shown no signs of slowing, making the company an excellent bet for investors.

Cameco Corporation (TSX:CCO) is the world’s largest publicly traded uranium company, accounting for nearly 18 percent of the world’s uranium production. Cameco made it onto this list of miners due to its mining expertise and wide range of assets.

Cameco’s operations are primarily based in North America, Kazakhstan, and Mongolia. Challenged with lower uranium prices, Cameco’s stock has suffered in the past year, but 2018 is looking promising for the company, with some suggesting a huge rebound is in sight.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that Fura Gems can deploy technical expertise to tap into Colombian emeralds; that gemstones will be as much in demand in future as currently expected; that Fura can fulfill all its obligations to exercise its property options; that Fura’s property can achieve mining success for quality gemstones; that Fura has a process that can convert low quality stones into high value gemstones; that Fura will obtain mining permits on its properties; that the gems when produced will be high quality; that tastes will move away from diamonds to colored gems; that bulk sampling and production will begin as scheduled; that Fura will be able to increase production through modern methods and increase the value of its assets through branding and auction sales; and that Fura will be able to carry out its expansion and other business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its acquisitions, expansion or other business plans, aspects or all of the properties’ development may not be successful, mining of the gems may not be cost effective, changing costs for mining and processing; increased capital costs; marketing plans may not work out as well as expected; the timing and content of work programs may change; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further work may not be viable; additional high value gem properties may not be available for Fura to acquire, or Fura may not be able to afford them; competitors may offer better quality or better marketing strategies; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the gems cannot be economically produced on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Fura Gems eighty thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Fura to conduct investor awareness advertising and marketing for TSX.V:Fura. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company, in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher.