PREFACE

We're going to examine buying and selling out of the money strangles in Apple Inc and find out once and for all what the winning trades have been during earnings releases.

With the right tool kit it's easy to find an explicit answer: Buying out of the money strangles during earnings for Apple Inc has been a winner. This is the information that the top 0.1% have and now it's time for us all to see it.

STORY

By definition trading options during earnings is very risky. But, once we step into that world, in turns out that there is a lot less 'luck' involved in successful option trading than many people have come to understand.

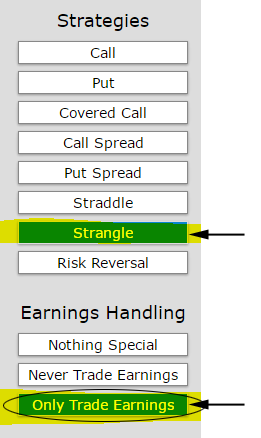

We can get specific with long earnings strangles for AAPL in this dossier. Let's look at a three-year back-test of a long 20 strangle only held during earnings. Here are the rules we followed:

* Test monthly options, which means we are not trading the weekly options (we could so if we chose).

* Only hold the position during earnings. Specifically, we test initiating the position two-days before the earnings event, then hold through earnings, and then close two-days after.

* Test the out of the money strangle -- specifically the 20 delta strangle.

* Test the earnings strangle looking back at three-years of history.

More than all the numbers, we simply want to walk down a path that demonstrates that it is actually quite easy to optimize our trades with the right tools. In the set up image below we just tap the rules we want to test.

Next we glance at the returns.

RETURNS

If we did this 20 delta long strangle in Apple Inc (NASDAQ:AAPL) over the last three-years but only held it during earnings we get these results:

| long 20 Delta Strangle |

| * Monthly Options |

| * Back-test length: three-years |

| * Only Earnings |

| * Holding Period: 4-Days per Earnings Event |

|

| Gross Gain: |

$3,050 |

| Gross Loss: |

-$1,956 |

| Long Earnings Strangle Return: |

98.8% |

| Stock Return: |

58.5% |

|

| Option Out-performance |

40.3% |

We note that while AAPL stock out-performed this earnings strangle, we're looking at just a matter of days of holding period for the options and three-year for the stock.

An earnings event is really just a volatility event that we know is coming ahead of time. What we're really analyzing here is if, historically, the option market has priced the implied stock move too high or too low.

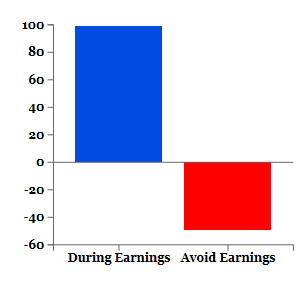

In this case, the option market's implied vol has been lower than the actual stock movement. We can see that a long strangle and only holding the position during earnings in Apple Inc returned 98.8%. But, there's a much bigger picture here. Let's turn to that piece, now.

CHARTING TO BE CLEAR

To make it clear, we can simply plot the returns of the short and long out of the money earnings strangles, below.

Apple Inc Earnings Strangles

TRADING TRUTHS

The concept here is straight forward, friends: securing knowledge before entering an option position constructs a mind set about what to trade, when to trade it and even if the trade is worth it at all. Now we can see this practice taken further, beyond Apple Inc and earnings strangles.

WHY THIS MATTERS

When we wrote that there's actually a lot less 'luck' and a lot more planning in successful option trading than many people know, this is what we meant.

It's not about trying to guess which stocks will go up or down.

In a five minute video, your entire view of the options world and what people mean when they say 'expert trader' will be turned upside down - to your advantage.

Tap here to see the CML Pro option back-tester.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.