Written by Ophir Gottlieb

LEDE

Owning Apple Inc options, without taking a position on stock direction, has been a winner over the last three-, two-, and one-year, but only with a deft hand and a proper understanding of the stock volatility.

PREFACE

Apple Inc (NASDAQ:AAPL) has unique stock volatility, and from those dynamics (or, in English, "patterns"), we can show how an option strategy that owns option premium has been a winner. Here is the two-year stock chart:

What we see, above all else, irrespective of stock direction, is that the price tends to move with momentum. Said a little bit more like English, the stock doesn't have many "quiet periods," rather when it rises, it tends to keep rising or when it falls, it tends to keep falling.

This means there are three critical steps to trading options in Apple Inc we need to address.

STEP I: EARNINGS HANDLING

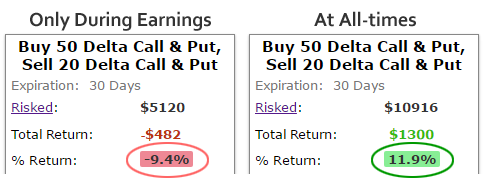

Let's start with a comparison of owning an at the money iron condor and trading it every 30 days. The left side is this strategy done only during earnings, and the right side is done at all times (including earnings):

Owning option premium during earnings has been a net loser, returning -9.4% over the last two-years. But, owning option premium during all-times has been a net winner, with a 11.9% return. It's clear that step one of our strategy is to avoid earnings.

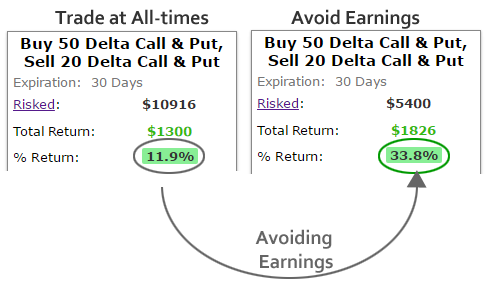

Here are the results of owning that same iron condor, but this time, always avoiding earnings.

As expected given our first test, avoiding earnings takes the option premium owning strategy up to a 33.8% return over the last two-years. Now, on to step two:

STEP II: STOP LOSS

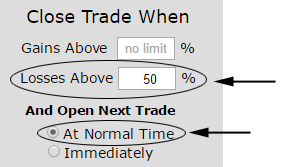

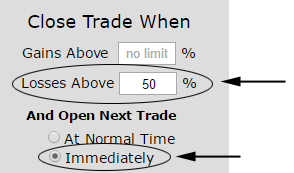

It turns out that closing a losing iron condor when it hits a certain level has actually helped returns. That is, a risk mitigation strategy does both: reduce risk and improve returns. Here is the simple setting in our test:

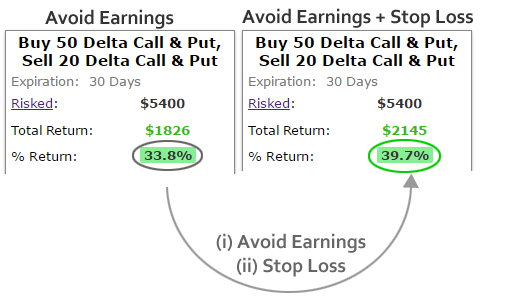

We note that the setting "At Normal Time" is short hand for this implementation: If the stop loss is hit, close the position, and wait the rest of the month before entering a new iron condor. And here are the return differences:

By adding a risk protection that effectively cuts the risk in half, from a possible 100% loss in any month down to 50%, the actual return rose from 33.8% to 39.7%. This is step two, and now we will make use of that stock chart from the top of the article, and implement step 3.

STEP III: STOP LOSS AND STOCK DYNAMICS

We noted that Apple Inc stock does tend to move with momentum. That phenomenon gives us reason to believe that if a stop loss is triggered, which would happen if Apple stock is in a rather low volatility stretch, we might expect that this "quiet period" will end quickly and getting back into owning options sooner rather than later, could be a good idea.

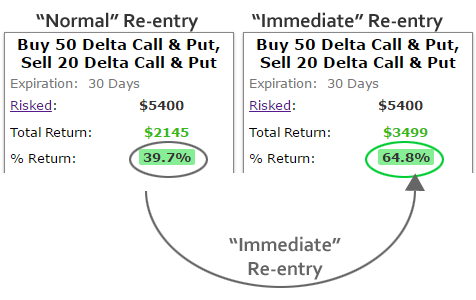

Here is the simple setting in our test:

Notice that this time the "Immediately" setting has been chosen rather than "At Normal Time." This setting is short hand for: "If a stop loss is triggered, close the original position out, and immediately (the same day) open a new iron condor using the next month's options." And here are those return differences:

All of a sudden the return nearly doubles, from 39.7% to 64.8%, and this time the only difference in our strategy was the timing of the re-entry into the option position after a stop loss was triggered.

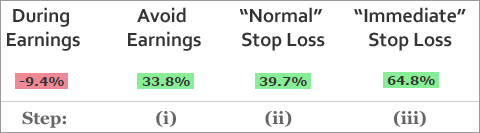

We did a lot here, so let's just take a step back and see it all in one summary:

Our three-step process revealed a 64.8% winner, up from a 9.4% loser, and reduced risk twice by eliminating earnings and using a stop loss. Apple stock is up 12% over this two-year period, so the option strategy returned about five-fold the stock. Even better, it took less time to figure this out with the right tools than it did to read this article. Tap a few buttons -- that's pretty much it.

CONSISTENCY

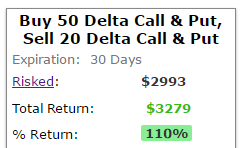

This approach also worked well over an one-year time period.

That's a 110% return by owning the iron condor and (i) avoiding earnings, (ii) using a stop loss, and (iii) re-entering a new position immediately following a stop. Apple stock is up 38% over this one-year period.

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck. Even further, the CMLviz option back-tester is the conduit to finding these results.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long shares of Apple Inc (NASDAQ:AAPL) as of this writing.