Written by Ophir Gottlieb

PREFACE

Apple has under-performed its mega cap tech rivals like Google, Facebook and Amazon. It has been tied to the success of the iPhone, and the product has gone through its cycle of ups and now downs.

But, there is an option strategy that has worked very well for Apple Inc (NASDAQ:AAPL) over the last two years irrespective of the cyclicality of its crown jewel product. The key here is not to guess stock price direction movement.

It’s about finding calm, low stress stocks, and finding the strategies that created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks.

STORY

Selling puts is one of many option trading strategies that can be employed to take advantage of a bull market. But, for Apple, it has been a risky endeavor if employed during earnings releases.

Here’s how we can see it explicitly with the CMLviz.com option back-tester Trade Machine.

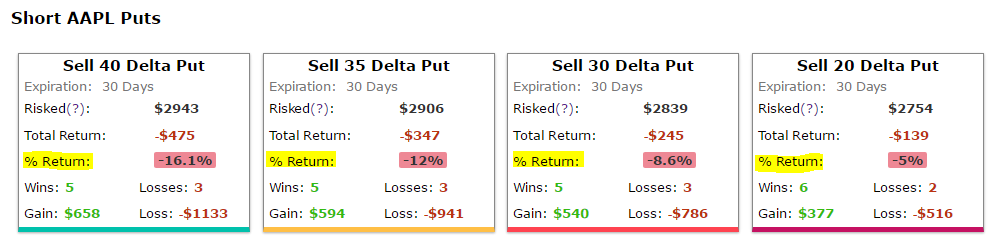

After the set up, we get these results. Again, we’re just looking at trading the dates surrounding earnings releases.

Source: CMLviz Option Back-tester

Just to slow down for a second, what we can see is that selling a put into earnings for Apple has been a loser across the board. We can see that in the ’% Return’ numbers highlighted above, all in red (losses).

For completeness we detail the back-test: The image above summarizes this back-test:

* Sell Puts

* Only during earnings

* Trade monthly options

* Test the strategy for two-years

As we stated, selling puts has been a losing strategy across the board for Apple when held during earnings. But the real analysis we want to examine is how well this strategy would have done if we eliminated the risk of earnings completely.

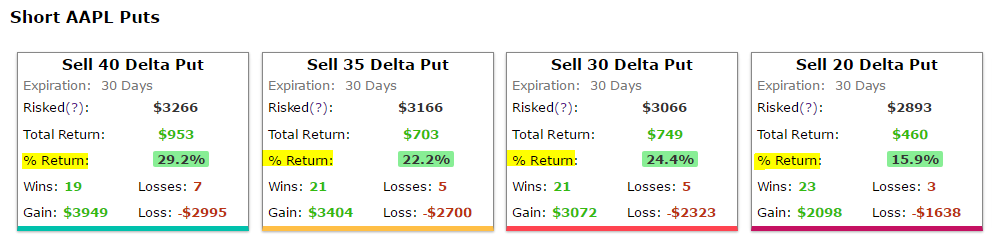

That is to say, if we sold puts every 30-days, but every time earnings approached, we closed the strategy (held no position), then started the strategy again after the volatility of earnings had ended. Here are the results:

Source: CMLviz Option Back-tester

Source: CMLviz Option Back-tester

All of a sudden, the short put options strategy in Apple turned out quite well if we skipped over each earnings release and far outperformed the stock too.

Look at the number of winning trades to losing trades as well — the ratio goes from 19:7 to as high as 23:3. That is, 23 winning trades and 3 losing trades over a two-year period.

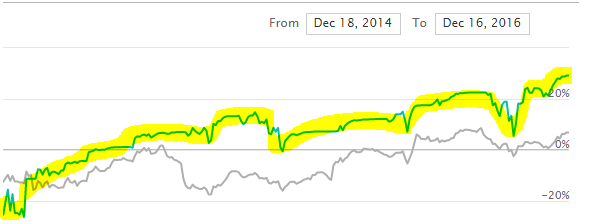

Here is the tail-end of the chart of the option strategy in blue versus the stock in gray, over those two-years. We can see how the two charts move in unison — that is, they are correlated, but the options strategy outperforms Apple stock by a rather large amount.

Specifically, selling Apple puts but avoiding earnings returned anywhere from 16% to 29%, versus the stock price rise of just 7%. For those that don’t like selling naked options, being slightly more conservative did just fine too.

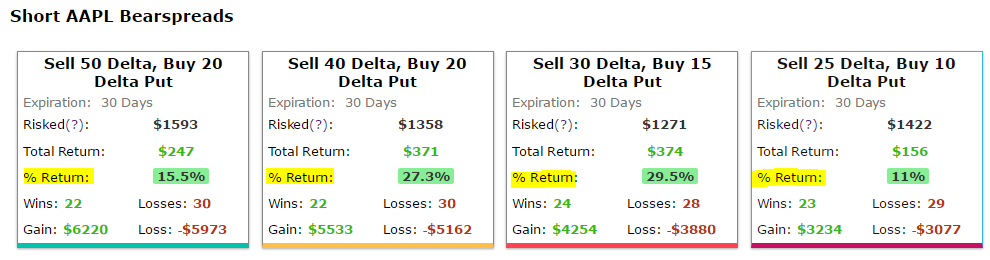

Here are the same test results, but this time selling a put spread, rather than a naked put:

Yet again, we see winners across the board and a substantial outperformance to owning the stock by itself.

We will be peppering in option back-test results into our dossiers moving forward. For a quick review of this process, here is a 2 minute video for Apple that created these results:

TRADING TRUTHS

Returning to the idea of back-testing again, there’s actually a lot less ‘luck’ and a lot more planning in successful option trading than many people know.

But it’s not about trying to guess which stocks will go up or down. That’s likely a losing bet over the short-term and extremely volatile. It’s not about guessing if Nvidia is going to rise 200% again. It’s quite the opposite.

What the back-tester allows us to do is find calm, low stress stocks or ETFs (like SPY, QQQ, etc), and find the option strategies that have created a high percentage of winning trades, gaining profitability slowly, while avoiding unnecessary risks — specifically, avoiding earnings.

When option investors place trades without knowing how they’ve performed in the past, the hedge funds, Wall Street banks, and high frequency trade firms take advantage of that gap in their knowledge. In fact, the very existence of these banks depends solely on having information that others do not have.

But that information asymmetry ends, right now. In a six minute video, your entire view of the options world and what ‘successful trading’, or ‘experts’ mean will be turned upside down — to your advantage.

Tap here to see the CML Pro option back-tester.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.