By: Zoocasa

For the second month in a row, new listings have declined more than sales this March in Toronto, reports the Toronto Real Estate Board.

March new listings were down by 5.1 per cent year over year while sales are flat.

“Market conditions have remained tight enough to support a moderate pace of price growth. Despite sales being markedly lower than the record levels of 2016 and early 2017, the supply of listings has also receded,” said Jason Mercer, TREB’s Chief Market Analyst. “This means that in many neighbourhoods throughout the GTA, we continue to see competition between buyers for available listings, which provides a level of support for home prices.”

Home prices have risen a scant 0.5 per cent year over year to $788,335. Detached houses have performed the worst out of any market sector, softening 2.1 per cent across the GTA to $984,782 year over year. Single-family homes in the 416 declined 2.1 per cent to $1,267,598 while 905 single-family homes only declined 1.2 per cent to $910,624. Take the west end as an example of this: Mississauga real estate is only $10,000 more expensive than last year, while Etobicoke homes for sale are around the same. Compared to the steep year-over-year price increases between 2016 and 2017, it’s clear that the market has changed.

This can also be seen in condos, which only posted minor price gains. In recent months, gains have been between 5-10 per cent, but this month they rose only 1.6 per cent to $560,020. Again, the 905 performed slightly better than the City of Toronto. Units in the 905 rose 3.3 per cent to $603,969, while units in the 416 rose 2.3 per cent to $603,969.

TREB blames the mortgage stress test for the underwhelming price growth.

“The OSFI stress test continues to impact home buyers’ ability to qualify for a mortgage. TREB is still arguing that the stress test provisions and mortgage lending guidelines generally, including allowable amortization periods for insured mortgages, should be reviewed,” said Garry Bhaura, TREB president.

Prospective borrowers must now qualify at 5.34 per cent, at least, in order to take out a loan from a major bank. Borrowers who have less than a 20 per cent down payment are also limited by a maximum of a 25 year amortization, which TREB thinks should be extended to 30 years.

Nevertheless, as long as new listings continue to decline faster than sales, it’s likely for prices to rise, however moderately.

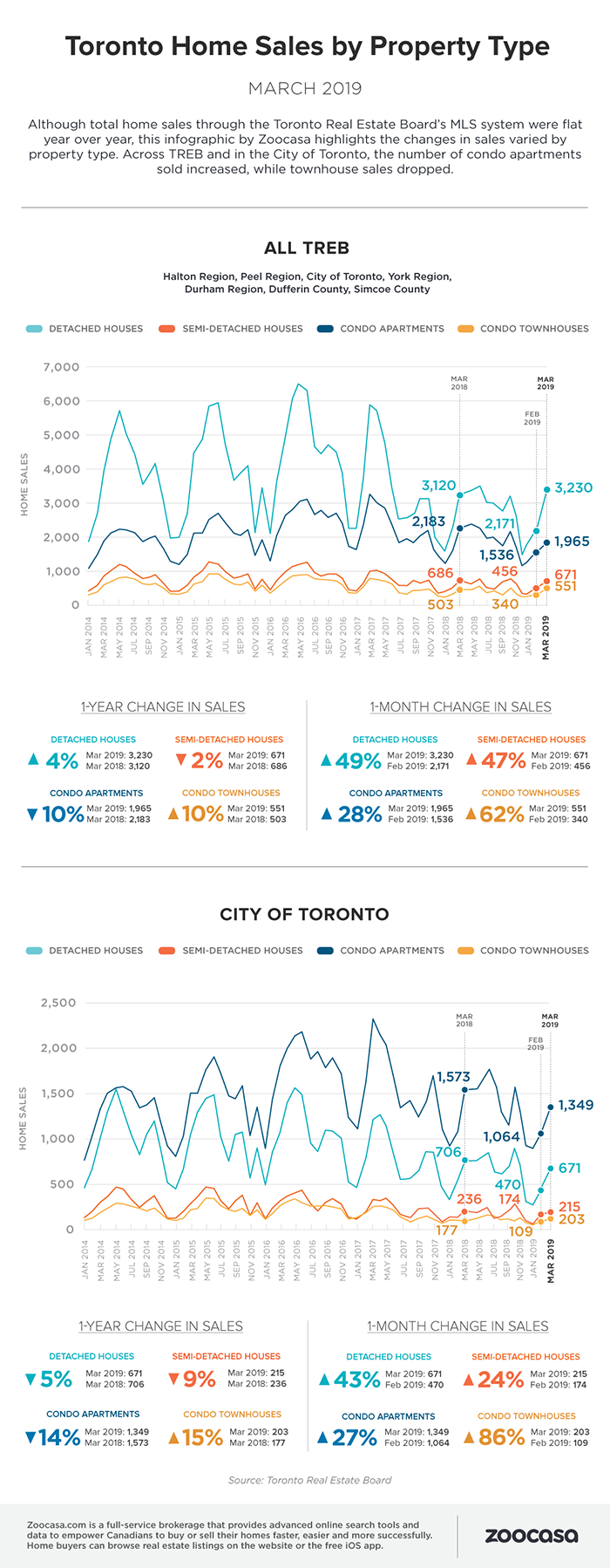

For the full story on March’s Toronto housing market, check out the infographic below:

Zoocasa.com is a real estate company that combines online search tools and a full-service brokerage to empower Canadians to buy or sell their homes faster, easier and more successfully. Home buyers can browse homes across Canada on the website or the free iOS app