The Toronto Real Estate Board (TREB) reports that new listings continue to shrink in the Greater Toronto Area, leading to tight market conditions this October.

New listings shrank 9.6% to 13,050 this October from October 2018, yet sales grew 14% to 8,491 in the same time frame. As long as demand from buyers outpaces newly-listed inventory, prices will rise and prospective buyers will face more competition when bidding on their dream home.

“A strong regional economy obviously fuels population growth. All of these new households need a place to live and many have the goal of purchasing a home. The problem is that the supply of available listings is actually dropping, resulting in tighter market conditions and accelerating price growth,” said Michael Collins, TREB president.

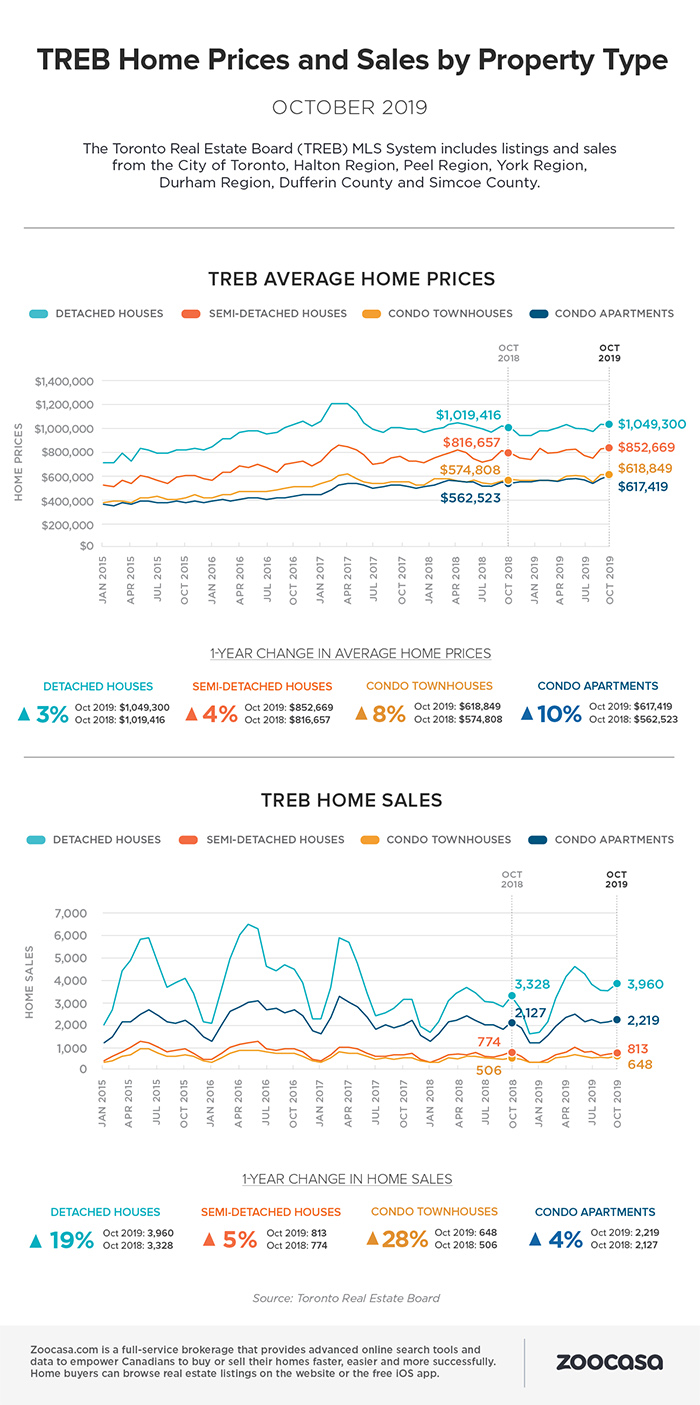

And indeed prices did rise — 5.5% year over year to $852,142. Most of the growth was concentrated in the condo and detached house segments in the 905, both sectors that have been doing particularly well over the last few months.

Since buyers are still facing challenges from the new lending restrictions put in place by the federal-bank regulator in 2018, they likely have little option but to move into lower-priced property types such as condos, or out to the suburbs where homes are significantly cheaper.

Single-family homes in the 905-area suburbs grew 4.2% to $952,574, semi-detached homes grew 4.7% to $690,599, townhouses just 2.7% to $638,672 and condos a full 10% to $506,846. In contrast, single family home prices in the City of Toronto were stable, edging up below inflation at 1.1% to $1,323,015. Semi-detached houses grew 7.1% to $1,099,802, townhouses 3.5% to $795,115 and condos 9.6% to $662,631.

“As market conditions in the GTA have steadily tightened throughout 2019, we have seen an acceleration in the annual rate of price growth,” said Jason Mercer, TREB’s chief market analyst.“While the current pace of price growth remains moderate, we will likely see stronger price growth moving forward if sales growth continues to outpace listings growth, leading to more competition between home buyers.”

The most expensive place to buy a home across the GTA is in the North West corner of Toronto, near Lawrence Park, York Mills and the Bridle Path area, with the average selling price at $2,780,782. Second is the Rosedale, Moore Park and Yonge and St Clair Area at $2,104,416 and third is King City, a comparatively affordable $1,585,526. Comparable prices can be found on both the western and eastern edges of the GTA, with houses for sale in Mississauga going for $816,383 while houses for sale in Scarborough are $827,840.

On the other end of things, bargains can be found in Durham Region in cities like Oshawa at $505,791, Clarington at $560,144 and Brock at $591,359.

For more information on October’s housing market, check out the infographic below:

Zoocasa is a full-service brokerage that offers advanced online search tools to empower Canadians with the data and expertise they need to make more successful real estate decisions. View real estate listings at zoocasa.com or download our free iOS app