Netflix revolutionized the entertainment industry in 2007 with streaming, and now it’s a $78-billion market cap company. Franco-Nevada (NYSE:FNV), now worth $15 billion, and $9-billion Wheaton Precious Metals, (NYSE:WPM), changed the mining industry forever with royalty-streaming option for precious metals.

For investors, it means diversified, reduced-risk exposure to some of the biggest markets in the industry, and now we can add the multi-billion-dollar cannabis market to this roster.

A little-known Canadian company is going for another first—streaming pot. And it’s aiming to be of the dominant financier of the marijuana industry.

It’s a bold aim for Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF)

But in an expected $8-billion market in Canada alone, and in a country that could potentially dominate this industry because of first-mover advantage thanks to sweeping federal legislation, it’s within visible reach.

Canada’s over 150,000 medical marijuana patients are already complaining about supply bottlenecks, and if Canada’s growers are to meet projected demand for medicinal purposes only by 2021 when users grow to an expected 500,000, they will have to produce another 150,000 kilograms of pot, according to Canaccord Genuity.

And that’s just the medicinal market. When Canada’s bill to legalize recreational use comes into force in less than a year, the country will really have a pot problem. Again, Canaccord Genuity estimates that by 2021 there will be an additional 3.8 million recreational users consuming 420,000 kilograms, or $6 billion of pot.

Canada only has 40 licensed producers right now and last year, they grew only 31,000 kilograms—in other words, 5 percent of anticipated demand, according to the Financial Post.

This is where Cannabis Wheaton makes its dramatic grand entrance. This is the world’s first cannabis streaming company, and it’s backed by a powerhouse team with industry trailblazer and political heavyweights from both conservative and liberal spectrums.

Not only is Cannabis Wheaton jumping into a huge market where supply will struggle to reach demand, but it’s offering a lifeline to new and existing growers who need financing to get off the ground fast.

They need an innovative financing strategy, and Cannabis Wheaton is stepping in to fill the gap with a “royalty” business model that is new to this market.

And for investors, the major upside is that this model removes the risks associated with putting all your money into a single-crop producer.

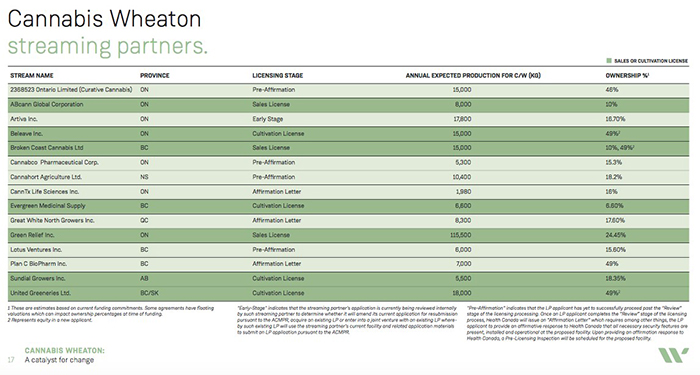

With Cannabis Wheaton, its business model is to ‘stream’ pot, and 15 partners have already been lined up, along with 1.4 million effective square feet of growing acreage.

Here are 5 reasons to keep a close eye on Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF)

#1 ‘Streaming’ Deals Already Lined Up

This pot financing pioneer is the major catalyst for change in Canada’s expected $8 billion market—just for starters.

The company’s royalty business model reduces risk for everyone. For the investor, it means less risk associated with investment in a single-crop producer. For producers, it means more opportunities and avenues of financing to get growth off the ground.

This is the evolution in finance of the traditional licensed cannabis producer—and Cannabis Wheaton is the only company on this track.

And they’ve already sealed 15 partnership agreements in 17 facilities across six Canadian provinces to fund the construction and expansion of cannabis growing facilities and innovations. In return, they get minority equity interests and a portion of the pot produced. They’ve also got 39 solid clinic relationships, and this is growing fast, with access to over 30,000 registered medical marijuana patients.

By 2019, just for starters, Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) will have more than 1.4 million effective square feet of pot cultivation.

But it’s not just about risk, for investors—it’s about exposure. Through Cannabis Wheaton, exposure isn’t limited to a single-crop: You get access to multiple licensed producers to take full advantage of this expected $8-billion industry.

#2 Fast Track Scale-Up

This company is all about scaling up quickly and capitalizing market share. And in this respect, it outshines its peers who are single-crop producers.

The highlight of this quarter was Cannabis Wheaton’s $15-million purchase of common shares of ABcann Global Corporation (ABcann). This initial investment forms parts of a larger investment in ABcann that will net Cannabis Wheaton 50% of the grower’s product on an additional 50,000 square feet of pot production, for 99 years.

That deal closed in August, and it’s just an initial investment, which forms part of a larger investment to fund a major expansion at ABcann’s second production facility.

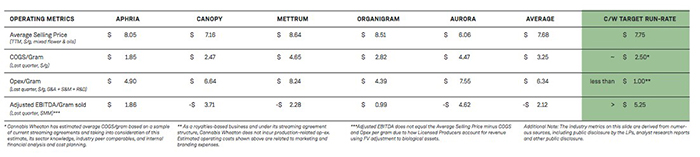

ABcann production is set to come online in the fourth quarter of next year, and it should ramp up to full production in the first quarter of 2020. Using a $4.5/gram margin, that means an expected 70 percent IRR (internal rate of return) on what amounts to Cannabis Wheaton’s approximate $41-million stream purchase, which infuses capital into ABcann in exchange for a stream of revenue from production in the future.

When you combine the equity investment by Cannabis Wheaton, and potential liquidity, according to company guidance, that results in a blended expected IRR of 65 percent.

This streaming/royalty deal is only the beginning.

Cannabis Wheaton’s model means maximizing profits by minimizing operational expenditures.

Bottom line: What Netflix is to movies and TV series, Cannabis Wheaton is to pot. Or, it’s what Silver Wheaton (NYSE:SLW) is the mining industry. Silver Wheaton strikes a deal with a miner to purchase part of its future metal production in exchange for upfront cash. Investors love it because it gives them lower-risk and diversified exposure to the mining industry.

But this is even better because Cannabis Wheaton finances the facility and then takes a ‘stream’ of product that comes out of the facility, but it doesn’t touch the product itself; it just takes the royalty.

#3 Industry Trailblazers and Full-Spectrum Political Heavyweights

The team behind Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) is pioneering, visionary and political savvy. That combination is everything in this sensitive industry.

CEO Chuck Rifici has already led Canopy Growth Corp. to great success, taking it public in April 2014. Today’s it’s the darling of this space, with a $1-billion market cap. It’s the benchmark for success among marijuana growers.

This team is also backed by political heavyweights. That’s because this is an industry that is already huge, and set to explode when recreational use is legalized. Rifici is former chief financial officer of the federal Liberal party, and Cannabis Wheaton’s strategic advisor Rick Dykstra is a former Conservative Member of Parliament and current party president in Ontario.

In June, the company added yet another heavy weight as president and director—industry-leading expert Hugo Alves. Alves founded and built his law firm’s Cannabis Group—the leading cannabis-focused legal advisory business in the country—and this pioneer knows everything there is to know about cannabis licensing and regulations, with the right contacts at every industry vertical. That means that Cannabis Wheaton’s streaming partners get the best of both worlds—financing and highly relevant expertise.

#4 Canada’s Pot Problem: Very Tight Supply

The supply picture is so tight that Health Canada has had to streamline the approval process for growers because medical marijuana users have tripled in number since last year alone, according to Quartz.

When it becomes legal recreationally, Deloitte estimates the economic impact of this industry will be worth $22.6 billion annually—in other words, more than that combined sales of beer, wine and spirits. From Canaccord Genuity’s perspective, growers will have to come up with another 420,000 kilograms of pot to feed the anticipated 3.8 million recreational users hitting this market.

But shortages are where things can get lucrative, and the Canadian government is also keen to make sure supply meets demand. That’s why they moved to make the licensing process a lot easier in May last year.

For Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF), it’s all about helping the streaming partners being the most dominant partners they can be, as Alves says.

The gap Cannabis Wheaton is exploiting is a huge one: “There is a segment of the marketplace where people are trying to get their facilities built and they don’t have access to capital at all,” Alves told us.

Finding money to build facilities when you have no assets is tricky. That’s where the evolutionary genius of Cannabis Wheaton comes in, financing the producer at an aspirational valuation but letting the producer keep control, while Cannabis Wheaton takes an allocation of their production yield.

#5 Mind the (Lucrative) Gap

Cannabis Wheaton (TSX:CBW.V; OTC:KWFLF) is the first company to bring the streaming business model to this market, and its business model makes it easier for investors to get in on this burgeoning market with lower-risk exposure by financing diversified licensed producers.

Pot producers are now under enormous pressure. Massive market share potential is being dangled in front of them in the most tantalizing manner—but without financing that still allows them to maintain control over their product, it’s hard to get off the ground. And investors are wary because this is a risky business.

Cannabis Wheaton is convinced it has discovered the answer that will take this burgeoning industry to the next logical step in its evolution. Producers get the best of both worlds, maintaining control over their companies but gaining access to financing and expertise on everything from regulations and licensing to cultivation. It’s the full package, and a boost for investor confidence. Investors get broad exposure to one of the most exciting markets in the country—without the risk assigned to a bet on single-crop producers. And Cannabis Wheaton, well, it gets a nice, steady stream of pot royalties in an industry that is soon to be demanding much more product.

This is the Cannabis Market 2.0, and Cannabis Wheaton(TSX:CBW.V; OTC:KWFLF) not only has first-mover advantage, but it has only-mover advantage, with the expertise and political weight to back it up. Once Canada is secured, this model will likely be looking to set it set up with first-mover advantage internationally.

Honorable mentions:

OrganiGram Holdings. (CVE:OGI): Organigram Inc. is a licensed medical marijuana producer in Canada, while it managed to maintain its production license this year, the company saw its stock price fall somewhat Year-To-Date, but we see strong upside for this stock as the changing Canadian cannabis legislation could give a massive boost to the market.

OrganiGram Holdings is a customer-first organization with a wide variety of products from which patients can choose. The company specializes in both organic and minerally grown cannabis, and is sure to satisfy the customers’ needs.

Moving forward, OrganiGram’s trajectory is sure to send the company far within the marijuana world. Poised to take a noticeable chunk of the pot market, OrganiGram is equipped with solid leadership and an ambitious drive that investors are sure to follow closely.

Aurora Cannabis Inc (TSE:ACB) which is a producer and distributer of medical marijuana across Canada. The company, formally Prescient Mining Corp, is a Vancouver-based business founded a little over one decade ago. Aurora’s main objective is to bring medicine to the people reliably and economically, which sets it aside from many of its major competitors. In the marijuana industry, patients will often have to jump through hoops to procure their medication, but with Aurora’s caring and knowledgeable staff, patients no longer have to worry.

One of the most appealing things for patients ordering medications from Aurora is the company’s delivery method. This marijuana major sells marijuana by phone and over the internet and then it is delivered straight to the patient’s door.

Aurora is a major player in Canada’s cannabis scene. With a $1-billion market cap and solid growth, savvy investors are watching this stock like hawks.

Emerald Health Therapeutics Inc (CVE:EMH) is another producer and distributer of medical marijuana. Based in British Columbia, Emerald Health is fully licensed by Access to Cannabis for Medical Purposes Regulations (ACMPR) and provides high quality medicine of different varieties. The company’s approach to research is what really sets the company apart from the competition. With the incredible emphasis placed on isolating the most important qualities in each strain and creating new products for patients, it is no wonder their medicine is so popular.

Additionally, Emerald Health has an incredibly talented administration. With over 30 years in the life sciences field, CEO Dr. Bin Huang is leading the company to greatness.

Because the company focuses on quality, both in their leadership positions and in their products, investors can feel comfortable taking the leap into this budding enterprise.

Cronos Group Inc (CVE:MJN) is another Toronto-based cannabis company with a lot of ambition. The company has prioritized its production acquisitions in order to provide geographically diverse products. Loaded with values, this company is comprised of passionate and focused employees.

One of the primary objectives of Cronos Group is to destigmatize the medical use of marijuana and bring medicine to those who need it. Cronos Group has made it their priority to lead as an example for the industry, and provide the best care possible to the community.

For investors, Cronos Group is especially appealing due to their core and strategic assets. Their portfolio is sure to impress, and will assuredly continue to grow in time.

Hydropothecary Corp (CVE:THCX) is a another heavy hitter in Canada’s cannabis scene. With former BC Health Minister Dr. Terry Lake as the VP of Corporate Social Responsibility, and the well-versed Ed Chaplin, who has raised millions for his previous ventures, as the Chief Financial Officer, the company is sure to have a bright future ahead.

With 4 primary products, including Canada’s only peppermint flavored medical cannabis oil sublingual mist, Hydropothecary has chosen quality over quantity. Offering patients the ability to administer their medication in a smoke-free format provides users with an option that is not available just anywhere.

Keep an eye on this stock moving forward as it may just have what it takes to take the industry by storm come June 2018.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

FORWARD-LOOKING STATEMENTS. Statements in this communication which are not purely historical are forward-looking statements and include statements regarding beliefs, plans, intent, predictions or other statements of future tense. Forward looking statements in this article include that new cannabis legalizing legislation will create an $8-billion-dollar industry; that there will likely be a supply shortage; that this industry could have an economic impact of $22.6 billion annually; that medical marijuana demand is expected to grow to 500,000 kilograms per year; that legalizing recreational marijuana could result in recreational demand of about 420,000 kilograms from 3.8M users per year; that Cannabis Wheaton’s business model reduces risk for investors; that there will be $4.5/gram margin and an expected 70 percent IRR on the ABcann investment and 65% overall IRR; that the opportunity for streaming cannabis may be global; that producers will need to obtain additional financing from companies like Cannabis Wheaton; that timeliness of government approvals for granting of permits and licenses, including licenses to cultivate cannabis, and completion of grow facilities will occur as expected; that actual operating performance of the facilities meets expectations, that regulatory change occurs as announced, that competition does not quickly develop; and that Cannabis Wheaton can retain key employees and contacts. Forward-looking information is based on the opinions and estimates of Cannabis Wheaton at the date the information is made, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Forward looking statements involve known and unknown risks and uncertainties which may not prove to be accurate. Actual results and outcomes may differ materially from what is expressed or forecasted in these forward-looking statements. Matters that may affect the outcome of these forward looking statements include that markets may not materialize as expected; marijuana may not turn out to have as large a market as thought or be as lucrative as thought as a result of competition or other factors; Cannabis Wheaton may not be able to diversify or scale up as thought because of potential lack of capital, lack of facilities, regulatory compliance requirements in Canada or outside of Canada or lack of suitable employees or contacts; partners of Cannabis Wheaton may not be granted licenses or additional capacity under existing licenses for them to grow for the cannabis market; foreign governments may not allow Cannabis Wheaton to operate in their countries; and other risks affecting the Company in particular and the cannabis industry generally. The forward-looking statements in this document are made as of the date hereof and the Company disclaims any intent or obligation to update such forward-looking statements except as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Cannabis Wheaton one hundred and seventy five thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by Cannabis Wheaton Income Corp. to conduct investor awareness advertising and marketing for [TSX:CBW.V and OTC:KWFLF]. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, The Company often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND we will not purchase or sell the security for at least two (2) market days after publication.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

LEGAL ADVISORY. Investing in companies associated with the cannabis industry may be illegal in the jurisdiction where a reader resides. Before investing in any public company involved in the cannabis industry, potential investors should check with their legal advisor as to whether an investment will breach local law.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR- OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

All trades, patterns, charts, systems, etc., discussed in this message and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author and do not necessarily reflect those of the publisher. No system or methodology has ever been developed that can guarantee profits or ensure freedom from losses. No representation or implication is being made that using the methodology or system will generate profits or ensure freedom from losses. The testimonials and examples used herein are exceptional results, which do not apply to the average member, and are not intended to represent or guarantee that anyone will achieve the same or similar results.

AFFILIATES. Some or all of the content provided in this communication may be provided by an affiliate of The Company. Content provided by an affiliate may not be reviewed by the editorial staff member. Our affiliates may have their own disclosure policies that may differ from The Company’s policy.

The information contained herein may change without notice.