The next ‘Shared Economy’ is in trash. KKR and Goldman Sachs invested in Rubicon - the 'Uber of Trash' - at a $500 Million valuation, betting technology will disrupt the decades-old monopoly held by Waste Management (WM) and Republic Services (RSG).

But Rubicon is not the 'Uber of Trash' as journalists would have you believe; Quest Resource Holdings - which trades publicly as 'QRHC' at a $65 Million valuation - actually leads Rubicon in 3 of 4 key fundamental metrics (Figure 1, below), and has potential upside of at least 273%.

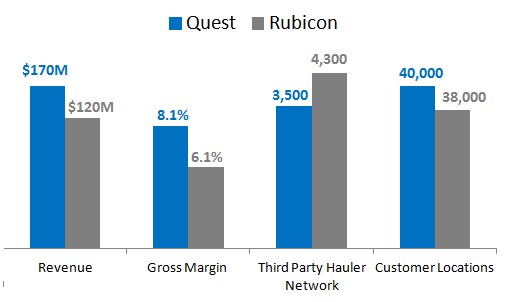

Figure 1: QRHC Has Greater Revenues, Higher Margins and Services More Customer Locations than Rubicon

QRHC clearly leads Rubicon in (i) sales, (ii) gross margin, and (iii) customer base, which suggests a complete disconnect in valuation (Figure 2, below).

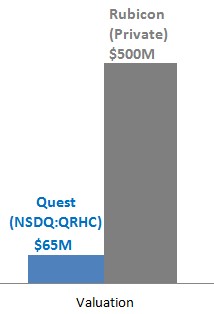

Figure 2: Quest Resource Holdings Has Greater Footprint, But Valued at 1/7th of Privately-Held Rubicon

Rubicon’s $500 Million valuation creates an enormous arbitrage opportunity with QRHC, which is valued at just $65 Million. Importantly, Rubicon’s IPO [1] will create unprecedented awareness for this market inefficiency and buoy the price of QRHC shares.

How do we know? We’ve seen it before; in the last 3 years alone with 3D Systems, Glu Mobile and Advaxis rallying on IPOs of peer companies.

3D Systems, Gluu Mobile and Advaxis Explain Why QRHC Will Rally On Rubicon IPO in 2016

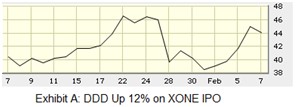

In 2013, 3D Systems (DDD) traded at a valuation of 7.5x sales. Then ExOne (XONE) went public at 12x sales. 3D Systems, which was already public, rose 12% on ExOne’s IPO (Exhibit A, below).

In 2014, King Digital (KING), the maker of ‘Candy Crush’ and other popular mobile games, offered shares in their company at 3.5x sales. Glu Mobile (GLUU), a competing mobile game-maker, rose 16% in anticipation of the King Digital IPO; King’s valuation implied the publicly-traded Glu Mobile was undervalued (Exhibit B, below).

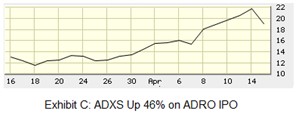

In 2015, Aduro Biotech (ADRO), a J&J-backed immunotherapy company, filed for a $1B+ IPO. Advaxis (ADXS), which was trading publicly at a ~$550M valuation with a near-identical listeria technology, jumped 46% in anticipation (Exhibit C, below) of the Aduro IPO.

Rubicon’s $500M valuation means investors, including Goldman Sachs and KKR co-founder Henry Kravis, value the technology company at 4.17x sales [2]. QRHC is valued in the market at 0.4x sales, even while leading Rubicon in sales, gross profit margin, and boasting a larger customer base.

QRHC and Rubicon both leverage technology to disrupt the $55B U.S. waste management industry, largely monopolized by Waste Management (WM) and Republic Services (RSG).

QRHC Bringing ‘Shared Economy’ to $55 Billion U.S. Waste Management Industry

QRHC’s technology platform connects a network of third party vendors who handle recyclable materials with customers who need their services. Gross profit is derived from locking in a spread between what Quest Resource Holdings charges its customers and what it pays its disposal partners.

Waste management is a gigantic $55B market with multi-billion dollar participants Waste Management and Republic Services, 2nd tier players like Stericycle (SRCL) and hundreds of independent vendors . These companies have concentrated on traditional business of collecting waste for disposal in their landfills.

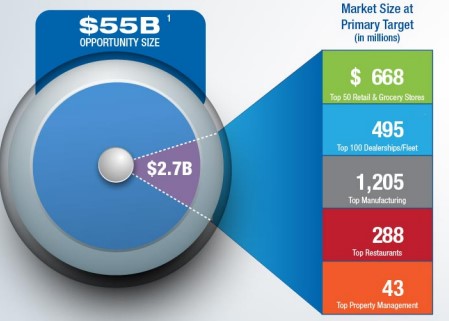

Quest Resource’s primary target is a $2.7B sub-segment of waste management (Figure 3, below) consisting of recycling organics, automotive waste and solid waste (such as cardboard, glass, construction debris, etc.). Pursuing these streams for revenue generation hedges QRHC against commodity declines and limits the company from competing directly with Waste Management or Republic Services.

Figure 3: QRHC Initially Vying for $2.7B Slice of Gigantic Waste Management Market

Because Quest Resource does not manage the fleets or recycling plants, the need for capital assets is minimal. This makes QRHC’s business model scalable, very quickly.

Industry Multiples Suggest QRHC Worth $2.13/Share And Imply Potential Upside Of 273%.

In 2014, QRHC raised $18 Million at 3.5X current market price from institutional investors, at 1.6x sales. Right now, the real ‘Uber of Trash’ – QRHC - trades at just 0.4x sales.

Discounting the clear signal Goldman Sachs and Henry Kravis are sending investors about the fair value of a technology-driven disruptor in waste management, where Rubicon is valued at 4.17x sales, the average EV/Sales multiple in the industry is 1.4x (Figure 7, below).

Figure 4: QRHC Currently Trades at 0.4x EV/Sales; On Average Peers Command 1.4x

On average, waste management companies are valued at 1.4x EV/Sales (as shown above), which is computed as enterprise value divided by sales.

QRHC has a $65M enterprise value (EV). Our projected 2015 sales are $170M. Therefore, QRHC has an EV/Sales multiple of 0.4x ($65M/$170M).

Valuing disruptive QRHC in-line with stale, capital-intensive waste management companies like ‘Waste Management’ or ‘Republic Services’ would put fair value at $2.13 per share ($170M*1.4/112M shares).

Right now QRHC trades at $0.57 per share. If fair value is $2.13 per share, this implies potential upside of 273% (Figure 5, below).

Figure 5: Arbitrage Opportunity – Shares Trade At $0.57 While Fair Value is $2.13.

Insiders own 67.5% of QRHC; the Company’s largest stockholder is Chairman Mitch Saltz at 41% [4].

Saltz created a fortune for himself and investors in Smith & Wesson, the century-old gun maker that he acquired for $15M + debt in 2001. Saltz then transformed Smith & Wesson, which was valued at more than $1.2 Billion in December 2015.

Recently, Ray Hatch was appointed CEO of QRHC. Hatch helped build Oakleaf, which was acquired by Waste Management for $425M in 2011; Greenleaf, now a subsidiary of Waste Management.

While Rubicon, the Goldman-backed deal valued at 4.17x sales lost $16M in 2015; QRHC, valued at 0.4x sales, generated cash flow. QRHC is expanding service lines into higher-margin business and further expanding its broad network of customers and waste management service providers. QRHC’s overhead will grow 23% from 2013 to 2015, while sales are expected to leap 152% during the same period. This reflects the scalability of QRHC’s business model without heavy capital investment.

Key Takeaways:

- QRHC is the real ‘Uber of Trash’ with $170M in sales; but valued at just 0.4x sales versus peers at 1.4x.

- If QRHC traded in-line with peers, shares would be worth $2.13, or 273% higher than current market price.

- Goldman Sachs valued QRHC’s main competitor, Rubicon, at $500M or 4.17x sales, implying QRHC is grossly undervalued.

- Rubicon’s IPO will buoy the price of QRHC shares like ExOne did for 3D Systems and Stratasys in 2013; like King Digital did for Glu Mobile in 2014; and as Aduro did for Advaxis last year.

- Rubicon’s valuation implies QRHC could potentially be valued as high as $6.20 per share, creating an arbitrage opportunity and possible catalyst in 2016.

- QRHC is majority-owned by former Smith & Wesson CEO Mitch Saltz and led by an experienced waste management entrepreneur and executive.

References

[1] http://fortune.com/2015/08/19/rubicon-global-ipo/

[2] http://www.slideshare.net/KyleRoss10/rubicon-57857380

[3] https://www.sec.gov/Archives/edgar/data/1442236/000156459015003038/qrhc-def14a_20150618.htm

[4] http://seekingalpha.com/article/3046136-quest-resource-holdings-qrhc-ceo-brian-dick-on-q4-2014-results-earnings-call-transcript?part=single

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Quest Resource Holding Corporation ("Quest" or the "Company”) as part of a twelve month research coverage services agreement starting February 1, 2016. In exchange for our services, we expect to receive seven thousand five hundred dollars and seventeen thousand five hundred dollars for the first and second month, respectively, and twelve thousand five hundred dollars per month thereafter. We expect to receive one hundred thousand restricted shares of the Company per quarter, however, our agreement is subject to termination at the discretion of Quest. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. Additionally, we are long shares of Advaxis. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/