The NBA Finals put a spotlight on how powerful athlete endorsements can be with headlines pitting Golden State's Stephen Curry and Cleveland's LeBron James as a battle between Under Armour (UA) and Nike (NKE). Morgan Stanley analyst Jay Sole said Curry could account for 85% of Under Armour's value; Nike agreed to a reported $1 Billion lifetime endorsement deal with LeBron.

Ray Lewis' endorsement of the next generation of field sport surface is completely unknown and creates a powerful catalyst for owning its maker, Sports Field Holdings (SFHI). In a recent call with investors Lewis - a 2-time NFL Super Bowl Champion - said that he "became a believer" and that "this is what we need in the NFL" after running drills on Sports Field's playing surface[1].

Sports Field Holdings secured $15.75 Million in sales contracts in just the first 5 months of the year; the Company had guided for $17 Million for the full 2016 year[2]. In our view, SFHI shares are worth $2 based on the Company's existing backlog of sales and completely discounting any continued acceleration in organic growth or awareness created by Ray Lewis' endorsement. This implies potential upside of 167% to owning SFHI shares.

Recent comments made by Sports Field Holdings CEO Jeromy Olson, however, imply sales are likely to continue accelerating, supporting our hunch that full year 2016 contract sales will exceed the Company’s guidance of $17 Million and strengthen the case for owning SFHI, particularly at current market prices.

In this note we look at athlete and celebrity endorsement deals to illustrate why Lewis’ endorsement of Sports Field Holdings could create a powerful catalyst for owning SFHI shares.

Under Armour Shares Up 85% Since Stephen Curry Endorsement Deal

Under Armour shares are up 85% since signing Golden State Warriors’ Stephen Curry to an endorsement deal in October 2013. The Curry 2 basketball shoe is expected to bring in $160 Million in sales for Under Armour in 2016, according to an estimate by Morgan Stanley analyst Jay Sole.

Figure 1: Under Armour Shares Up 85% Since Stephen Curry Endorsement

But Morgan Stanley is bearish on Under Armour shares. Jay Sole’s ‘bull case’ requires Stephen Curry to carry Under Armour to a $28 Billion valuation, much like Michael Jordan did for Nike with his brand. In his ‘bull case’ Curry’s endorsement is worth 75% of the current market cap, or $14 Billion. Notwithstanding, Curry’s endorsement has clearly contributed to both fiscal and share price performance for Under Armour. Coincidentally, Ray Lewis, who now endorses Sports Field Holdings (SFHI), was an early athlete ambassador for Under Armour.

How Do Celebrity and Athlete Endorsements Affect Earlier-Stage Companies? Fiscally and In Share Price Performance.

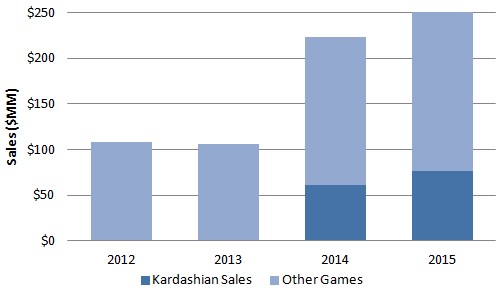

Glu Mobile (GLUU), a mobile gaming developer, teamed up with Kim Kardashian in June of 2014 on a mobile game called ‘Kim Kardashian: Hollywood’. The game proved to be a huge growth driver for GLUU, generating sales of $61.4 million in just the second half of the year and contributing to a more than a 2 fold increase in GLUU’s 2014 revenues, as seen in Figure 2, below. In 2015, Kim Kardashian: Hollywood was once again Glu’s top revenue-generating with $76.7 million in sales.

Figure 2: Kim Kardashian: Hollywood Comprised 27.5% and 30.5% of Gluu Revenues in 2014 and 2015, respectively

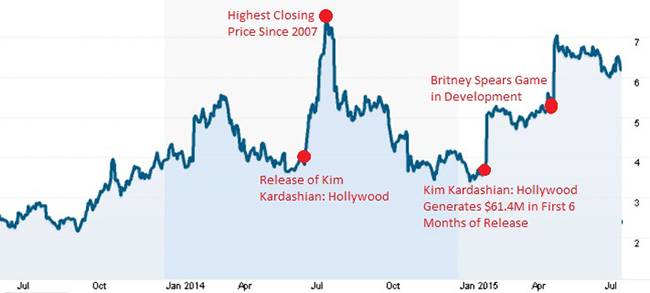

Glu Mobile’s successful collaboration with Kim Kardashian drove the stock to multi-year highs, as shown in Figure 3, below, and validated the endorsement model in mobile gaming. This helped secure follow-on deals with Britney Spears – who released a game in 2015, and an ongoing collaboration with Taylor Swift.

Figure 3: Kim Kardashian: Hollywood Drove GLUU Share Price to 7 Year High

MusclePharm (MSLP), a nutritional supplements company, launched an Arnold Schwarzenegger product line in Q4 2013 to associate the former bodybuilding legend’s brand with their supplements. Schwarzenegger’s endorsement contributed $16.5 million to the company’s top line in 2013 and another $50 million in 2014, resulting in 65% and 60% annual revenue growth, respectively. MusclePharm’s success with the Arnold product line attract deals with athletes Johnny Manziel, a former Heisman trophy winner and NFL quarterback, and Tiger Woods to their endorsement roster. During this time, MSLP’s market cap hit peaked at over $150 Million, as shown in Figure 4, below.

Figure 4: Schwarzenegger Endorsement Led To Fiscal and Valuation Performance for MSLP

What Do Successes For Under Armour, Nike or Glu Mobile Have To Do With Sports Field Holdings And Ray Lewis’ Endorsement? Validation.

Under Armour’s success with Stephen Curry, and Glu’s success with Kim Kardashian have this in common: they prove that athletes or celebrities that endorse a product that is closely tied to their personal brand can be very profitable.

Take for instance Stephen Curry’s on-court performance: every time Stephen Curry excels, subliminally it is perceived to be, at least in part, due to his athletic gear. Of course, that athletic gear is Under Armour’s. Same goes for Kim Kardashian and the game she developed with Glu Mobile. The game is interactive and gives Kim Kardashian fans an opportunity to live vicariously through her day-to-day activities.

Ray Lewis is endorsing Sports Field Holdings’ PrimePlay as the best field playing surface. Lewis is a two-time NFL Super Bowl Champion and spent 17 years in the NFL playing on all kinds of surfaces, including natural and artificial grass, called ‘turf’.

Ray Lewis called PrimePlay the best artificial grass he’s ever played on, after running drills on a field installed at IMG Academy, one of the leading athlete training facilities in the United States. IMG has hosted top brass athletes like NFL MVP Cam Newton, tennis star Serena Williams and NBA Legend Kobe Bryant, among others. Gatorade runs a “sports science institute” on IMG campus to test their products’ impact on athletic performance, and now SFHI is now running studies with athletes on PrimePlay, too.

PrimePlay is an artificial grass, or turf, that mimics the natural cooling effects of grass, has better shock absorption to prevent excessive injury from falls, and uses an organic in-fill material compared to potentially toxic crumb-rubber in-fill used in most synthetic turf fields[3]. The proximity of PrimePlay to natural grass is the driving factor behind Sports Field’s rapidly growing sales. According to Sports Field CEO Jeromy Olson, the Company’s win-rate nearly quadruples when a potential client visits one of their installed fields:

“We expect to win roughly 12% of projects we go after. Amazingly, our win rate jumps to 40% when a client travels to one of our sites.”

Sports Field Holdings’ completed projects at IMG Academy and ESPN’s Sport Science Studio is validation of PrimePlay as the next-generation field sport surface, part of a $6 Billion market. Ray Lewis’ endorsement is validation that SFHI has already executed sufficiently to attract world-class athlete endorsers.

Ray Lewis Endorsement Could Create Catalyst For SFHI Shares; Trigger Inflection.

Sports Field Holdings (SFHI) has traded completely under-the-radar as an early-stage and undercapitalized company. But early signs of traction in the marketplace with an arguably best-in-class product has attracted Ray Lewis. They’ve attracted ESPN and IMG Academy. They’ve added endorsements from Major League Soccer player Chris Wingert and former Major League Baseball star Rick Honeycutt. They’ve guided for $17 Million in deals for 2016 and inked $15.75 Million in just the first 5 month of 2016.

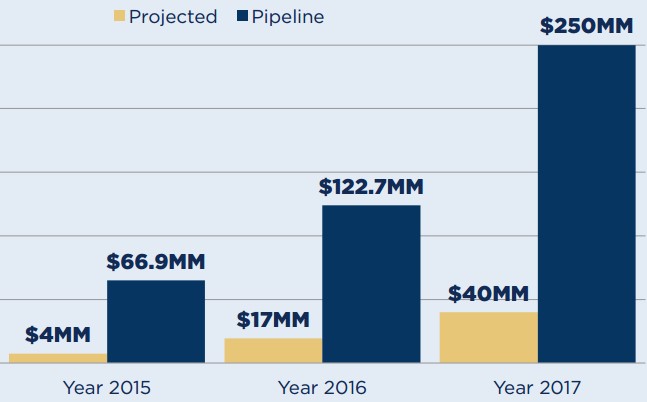

SFHI’s guidance of $17 Million in sales contracts was based on an assumption that the Company would win 14% of potential pipeline business, as shown in Figure 5, below. But Sports Field’s top executive explicitly said that their ‘win rate’ jumps to 40% when potential clients visit one of their existing fields.

Figure 5: SFHI’s projected pipeline and sales

If Ray Lewis’ endorsement can create awareness of PrimePlay at IMG Academy, it follow that Sports Field could close more business. An increase in project wins from 14% to 40% would be a gargantuan change in sales for Sports Field.

In our estimate of fair value for SFHI shares we simply took $17 Million in projected sales to mean $17 Million in forward revenue. Sports Field’s peers in the construction industry – a very conservative proxy for the Company’s business model – trade at 2.2x enterprise value to sales (EV/Sales). We then discounted 2.2x forward revenue at 15% to account for time-value and execution risk. This gave us a fair value of $2 per share, which implies potential upside of 167% from recent market price(s).

If our assumptions were that SFHI is closing business at a rate higher than 14%, say 25%, because of the awareness that Ray Lewis, IMG Academy and ESPN Sport Science Studio can reasonably be expected to generate for PrimePlay, fair value would jump to $3.60 per share.

At a closing rate of 40%, that fair value would jump to $5.78 per share.

We would reiterate that while Sports Field Holdings’ current price is completely disconnected with execution on sales on its own, Ray Lewis’ endorsement and growing awareness of SFHI’s products can only accelerate growth and improve outlook for the Company.

The most obvious catalyst for an inflection in SFHI share price is backlog sales translating to revenue in 2H 2016. SFHI’s sales are seasonally affected, meaning a disproportionate amount of sales are contracted in the first half of the year and construction is heavily skewed towards the second half. This means that announced contracts begin to materialize in the form of revenue and cash flows in the second half of this year. Coupled with Ray Lewis’ endorsement and potential for an improved projects win rate, SFHI is an attractive name to own that currently trades at a 62%+ discount to fair value.

Key Takeaways

- SFHI guided for $17 Million in 2016; closed contracts worth $15.75 Million in the first 5 months of the year

- SFHI ‘win rate’ jumps from 14% to 40% when potential clients visit one of their fields

- Ray Lewis’ endorsement of SFHI’s ‘PrimePlay’ artificial grass could accelerate sales momentum by encouraging more potential clients to visit an installed field

- Under Armour, Glu Mobile, Muscle Pharm demonstrate that a carefully selected endorser can create fiscal and share price performance

- Backlog from 1H 2016 sales expected to translate to impressive revenue and growth in 2H 2016

- Fair value for SFHI is $2, implying potential upside of 167% by owning shares

References & Endnotes

The difference between Sole’s base case and bull case is $14 billion, attributable to success of Curry’s brand. UA’s current market cap is $16.5 billion. Therefore, Curry’s brand could account for 85% of Under Armour’s current market cap. http://www.businessinsider.com/steph-curry-worth-14-billion-to-under-armour-2016-3

[1] http://ir.firstform.com/press-releases/detail/21/nfl-great-ray-lewis-talks-with-sports-field-holdings-ceo

[2] Sports Field Holdings Investor Deck http://content.equisolve.net/_38bfa098f9eb5fa440f6317d1beb6228/firstform/db/213/383/pdf/2016.06.02A-Firstform+Investor+Deck.pdf

[3] https://www.epa.gov/sites/production/files/2016-02/documents/federal_research_action_plan_tirecrumb_final_2.pdf

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Sports Field Holdings, Inc. ("Company") as part of research coverage services entered into February 2016. As of the date of this report we have received sixty-two thousand five hundred restricted shares and expect to receive up to twelve thousand dollars per month in addition to sixty-two thousand five hundred restricted shares of the Company on the 180-day, 270-day and 360-day anniversary of our agreement. However, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, One Equity invested into Sports Field Holdings through a 12% convertible note to voice our support and belief in the Company's growth outlook. The terms of the convertible note are fully described in an 8-K filing with the SEC at https://www.sec.gov/Archives/edgar/data/1539551/000121390016011285/f8k021916_sportfieldhold.htm Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/