Sports Field Holdings shares, which trade under the symbol ‘SFHI’ have not priced in a likely and predictable 200%+ jump in 2H 2016 revenues. In many instances, earnings, acquisitions, and other unanticipated announcements lead to a sharp rally in the price of beneficiary companies.

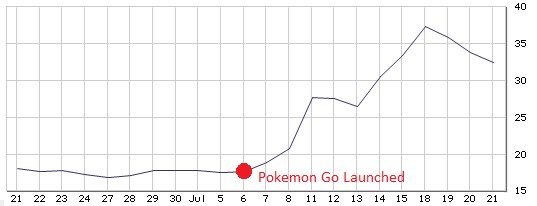

For instance, Nintendo (NTDOY) shares have soared 84% after unprecedented traction with their ‘Pokemon Go’ mobile game. This was not anticipated.

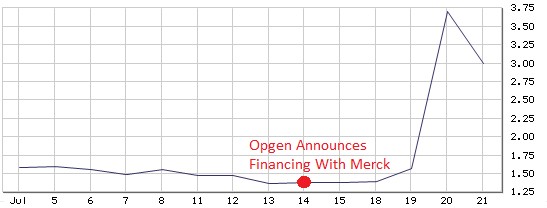

Merck bought 40% of a little biotech company called Opgen – at a huge premium to its market price. Opgen’s shares have risen 170% in response. This was not anticipated.

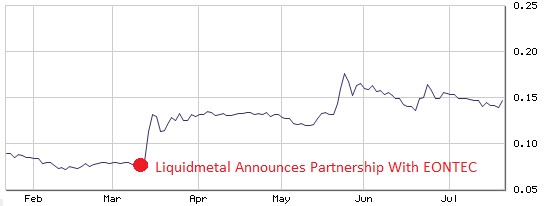

A licensing deal with EONTEC has helped Liquidmetal shares double; this was not anticipated.

Sports Field – the maker of a next-gen turf product for a $1.3 Billion turf installation market - had revenues of $3.9 Million in 2015. As of May 2016, SFHI said sales contracts totaled $15.75 Million and would hit at least $17 Million for the full year. These contacts begin to convert to revenue right now – the busy summer build season. For this reason, a 200%+ increase in 2H 2016 revenues compared to the same period a year ago is not only likely but also predictable. The market price for SFHI shares would not have you believe this – we think they trade at a 60% discount to fair value.

While SFHI shares have recently traded for $0.65, we think fair value is $1.60. Put another way, we see earnings announcements throughout the second half of 2016 as a catalyst for SFHI shares to potentially return 146% to investors this year.

Nintendo, Opgen and Cinedigm Surged On Unexpected News. SFHI To Follow?

Nintendo Jumped 84% Because Users Spent More Time on “Pokémon Go” Than Facebook and Snapchat

In first two weeks following launch, Nintendo’s blockbuster app has generated $35 million in revenue from 30 million worldwide downloads, according to intelligence firm Sensor Tower [1]. Pokemon Go has become the biggest mobile game to ever hit the US, with players spending more time playing the game than any other mobile app [2]. This craze has pushed Nintendo stock 84% higher.

Figure 1: 2 Weeks Post- Pokémon Go Launch, Nintendo Has Risen From $17.63 to $32.42

OpGen Shares Spiked After Merck Invested At 220% Premium To Market

Merck agreed to purchase $5 Million worth of OpGen common stock at a price of $4.40/share, a 220% premium to the market price at the time [3]. Merck, who is now a 40% owner of OpGen, is validating the small biotech’s infectious disease diagnostic testing capabilities and suggesting a potential future takeout could be in the cards. Within a week, OpGen shares rose as much as 170%.

Figure 2: Merck’s Surprising Financing Lifted OpGen Shares From $1.38 To $3.75

Liquidmetal Nearly Doubled After Partnering With Global Manufacturing Firm EONTEC

Liquidmetal’s cross-licensing agreement with EONTEC came with enormous credibility. First, EONTEC boasts a blue-chip client base, which includes General Motors, Samsung and General Electric. Second, the small manufacturing company was able to raise up to $63 Million from EONTEC. Lastly, the synergies are expected to expand Liquidmetal’s molding capabilities while also giving the company access to EONTEC’s mass manufacturing production facility. Shares of Liquidmetal have nearly doubled since the deal was announced.

Figure 3: Liquidmetal Stock Surged From $0.08 to $0.15 Post-EONTEC Deal

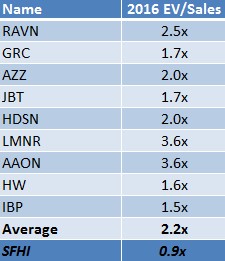

SFHI Shares Trade At 60% Discount To Peers, Ahead of Likely Earnings Catalyst

Sports Field Holdings trades publicly under the symbol ‘SFHI’ – most recently for $0.65, which translates to $11 Million in enterprise value (EV). Companies in the construction industry generally trade at a 2.2x multiple of EV-to-sales (EV/Sales) as shown in Figure 4, below.

Figure 4: SHFI vs Construction Companies’ Forward EV/Sales

Our estimated 2016 EV/Sales multiple for SFHI is 0.9x, based on an EV of $11 Million and 2016 revenues of $11.8 Million (or, conservatively that just 75% of secured sales contracts are executed this year and convert to revenue). But peers (as shown above, Figure 4) are valued at 2.2x, which implies that SFHI shares would need to rise 146% to $1.60 to be fairly valued.

If we were to run with 2017 revenues of $17 Million, which is the projected sales figure for fiscal 2016, fair value would be equal to $2.20/share. We would point out, however, that SFHI has projected far greater 2017 sales.

The important question for investors to ask is (i) is rise in SFHI share price likely to happen and (ii) what could cause that to happen?

Predictable Jump In Revenue Could Cause SFHI Shares To Rise 146%

As in the cases shown above in Figures 1, 2, and 3, Nintendo, OpGen and Liquidmetal shares rose 84%, 170% and 88%, respectively.

What does this have to do with Sports Field?

In all of the cases discussed, investors were unlikely to predict such a sharp rise in share prices for any of the three names because the catalyst that drove the price appreciation was not anticipated and not easily predictable. For example, it would have been unlikely that anyone could have anticipated Pokemon Go to surpass Facebook and Snapchat on daily time spent by users.

However, with Sports Field, growth is not only predictable but likely. The next-gen turf company has already secured contracts worth $15.75 Million after guiding for $17 Million just 5 months earlier. That compares to full-year 2015 revenues of just $3.9 Million. If SFHI were to convert just 75% of these secured sales contracts as revenues in 2016, that would amount to year-over-year growth of 203%, which the market has not yet factored into the share price.

For this reason we believe the likely announcement of triple-digit sales growth will surprise the market and cause SFHI shares to trade significantly higher.

To estimate how high shares could trade, we assumed 2016 sales of $11.8 Million and that SFHI trades in line with peers at 2.2x EV/Sales. This resulted in a price of $1.60/share.

If fair value for SFHI shares is $1.60, the upside to owning shares at today’s prices is potentially 146%.

We would also note that Sports Field’s contacts are not projected but secured, which significantly (in our view) reduces the risk of non-performance. The main risk remains, as is the case for most rapidly-growing small companies, financing and execution. We would note that to-date, SFHI has focused on preserving its capital structure by raising new capital at $1.10 per share. Again, that compares to a market price for shares at $0.65.

We would also note that Sports Field has partnered with IMG Academy, a leading sports complex for student and professional athletes. While this has largely fallen by the wayside, Ray Lewis, a NFL legend, is also an ambassador and fan of SFHI’s next-gen turf, having personally ran drills on the [SFHI] turf at IMG, according to comments on a recent conference call (see “Ray Lewis' Endorsement Could Create Powerful Inflection For This Company's Shares”).

We think SFHI has been unfairly ignored while executing on building shareholder value. While it’s shares have yet to reflect the fiscal progress the Company is making, Ninendo, OpGen and Liquidmetal show just how quickly share price can change with favorable and unexpected news. While a 200%+ ramp in 2H 2016 revenues are likely and reasonably predictable, SFHI shares still trade as if it’s neither. We see 146% in potential upside by playing this misunderstood situation.

Key Takeaways:

- SFHI has likely and predictable revenue growth coming in 2H 2016, but its shares haven’t priced this in

- SFHI shares trade at just $0.65 but are likely worth 146% higher or $1.60

- Nintendo, OpGen and Liquidmetal shares soared 84%, 170% and 88% on unanticipated events that added value to these respective companies

- SFHI’s likely 200%+ ramp in revenues in 2H 2016 should cause shares to trade meaningfully higher and act as a near term catalyst

References & Endnotes

[1] http://venturebeat.com/2016/07/19/sensor-tower-pokemon-go-has-already-passed-30m-downloads-and-35m-in-revenue/

[2] http://finance.yahoo.com/news/pokemon-apple-revenue-000000836.html

[3] http://ir.opgen.com/phoenix.zhtml?c=253977&p=irol-newsArticle&ID=2067591

About One Equity Research

One Equity Research is a leading provider of proprietary and in-depth research crafted by respected financial analysts and domain experts. Our team includes trained finance professionals with diverse backgrounds that include equity research, investment banking, and strategic consulting at preeminent firms. We distribute our research through mainstream media partners and to subscribers of our Intelligence Service. To learn more please visit http://www.oneequityresearch.com/

Legal Disclaimer: This research note has been prepared by One Equity Research LLC ("One Equity") on behalf of Sports Field Holdings, Inc. ("Company") as part of research coverage services entered into February 2016. As of the date of this report we have received sixty-two thousand five hundred restricted shares and expect to receive up to twelve thousand dollars per month in addition to sixty-two thousand five hundred restricted shares of the Company on the 180-day, 270-day and 360-day anniversary of our agreement. However, our agreement is subject to termination at the discretion of the Company. One Equity intends to sell its shares in the Company as soon as it is legally permissible to do so. While issuer-sponsored research is seen as biased, we strive to hold the highest ethical and fundamental standards when evaluating which companies we are willing to cover. We assess issuers prior to entering into a coverage agreement and attempt to cover only those we believe are truly undervalued and deserve greater visibility. Simultaneous to entering into a research coverage agreement, One Equity invested into Sports Field Holdings through a 12% convertible note to voice our support and belief in the Company's growth outlook. The terms of the convertible note are fully described in an 8-K filing with the SEC at https://www.sec.gov/Archives/edgar/data/1539551/000121390016011285/f8k021916_sportfieldhold.htm Our research reflects our actual views. We do not publish investment advice and remind readers that investing involves considerable risk. One Equity urges all readers to carefully review the Company's SEC filings and consult with an investment professional before making any investment decisions. Please read our full disclaimer at http://www.oneequityresearch.com/terms/