Written by Ophir Gottlieb

PREFACE

It's time to update some of the powerful trends that Starbucks Corporation (NASDAQ:SBUX) is following that fall in line with its vision for growth.

As we read these updates remember the core goal here for the firm: Make as much use as possible of the stores that exist which means broader offerings, different offerings for different parts of the day and of course, larger spends per visit.

VISION UPDATE I.

On August 17th, 2016, Starbucks Corporation (NASDAQ:SBUX) notified the world that the company would be adding Almond Milk to its menu of coffee creams. This may sound trivial but it really isn't. Here's a nice little intro quote from TheStreet.com:

"It is not just a frivolous move to attract health-conscious and lactose intolerant consumers. There are good reasons for the company to put almond milk on the menu.

And there are also good reasons for investors to get excited about it."

Source: The Street

Almond milk is non-dairy which adds to the soy milk and coconut milk option for the lactose intolerant crowd and vegan crowd. But Starbucks doesn't add things to the menu for fun -- there's real research here.

In a story written by Kat McKerrow, according to a market research group called Mintel, 49% of Americans consume non-dairy milk. Here's more from that research:

"From 2013 to 2014, sales of dairy milk alternatives such as almond, soy, and coconut grew by 30%. Almond has remained the most popular among the three, grabbing about 60% of the market."

Source: The Street

The trick here for Starbucks Corporation (NASDAQ:SBUX) is that Almond milk will have an extra $0.60 charge attached to it. The amount each customer spends per beverage is one of the key metrics Starbucks uses to measure progress, and "Starbucks believes that almond-milk beverages will attract more customers willing to spend extra money for a dairy alternative, boosting the company's beverage spend metric from $5.20 to nearly $5.40 by 2023."

VISION UPDATE II.

Moving past a higher spend per beverage, Starbucks Corporation is expanding its reach with a move into airports that goes beyond just coffee. While Starbucks has coffee and breakfast down, it is broadly reaching for the evening crowd by adding alcohol to its menu. We're talking about beer and wine, not hard liquor. In fact, Starbucks has updated their corporate website to have section for "Starbucks evenings."

With the great little tag line:

"We love seeing you a little later. Join us for Starbucks Evenings and enjoy all of your favorites and more: a thoughtful selection of wine and craft beer, savory small plates and seasonal menu items."

According to Micheline Maynard of Forbes, "Starbucks launched Evenings service in 2010 in Seattle and has slowly expanded the menu across the United States and at a few locations in Canada. It put on a broader push in 2015, and there are now 450 stores that offer Evenings service, the Starbucks spokesperson said."

Now, this push into airport bars is a slow one. I can confirm five airports thus far: Washington Dulles, JFK International, Los Angeles International Airport (apparently has two) and Louisville.

It may feel subtle, and it is, but Starbucks Corporation (NASDAQ:SBUX) has these wonderful properties that make so much money and serve so many people in brief spurts of time. An evening menu is a great idea in theory, and the airport is a shrewd move should it succeed.

VISION UPDATE III.

This final update is likely the largest and it calls again on this idea that Starbucks stores exist, they are wonder and operated and open for business, sometimes 24 hours a day. But the actual utilization rates are low in when we get away from peak hours. In a sense, there's a huge opportunity just sitting there, with no extra cost, if the company get customers into the stores at off peak times.

Starbucks Corporation is trying a weekend-only brunch menu, and as usual, starting out in just a few locations to test it out. Now this is going to sound familiar, but here's a snippet from another Forbes article:

"While beverages and primarily coffee are Starbucks' main source of revenue, the company also serves a selection of wine and craft beer along with savoury small plates in selected locations as part of its "Starbucks Evenings" program."

Source: The Street

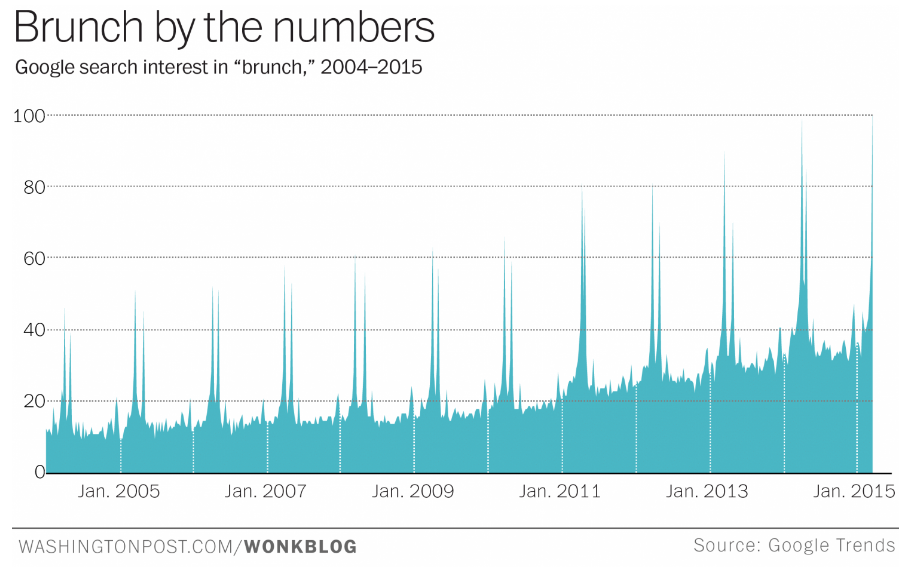

I know, it's almost like the company has a consistent plan. Oddly, the Washington Post pointed out that brunch is starting to become the new black. Here's a chart of Google search interest in "brunch" from 2004-20015:

This is just another way Starbucks Corporation (NASDAQ:SBUX) is looking to raise that average revenue per store number.

CONCLUSION

Remember, this is just a part of the plan. We have written about Starbucks new announcement that it will moving into the full service, on site, bakery business in select stores. You can read that dossier here: Starbucks Just Made a Genius Move.

Starbucks Corporation also did a great job with its "cold bar." We wrote about that here: Spotlight: It's Time to Look at Starbucks, Right Now. That is a truly multi-billion dollar opportunity for the firm.

We also note how wildly successful Starbuck's has been with mobile pay and loyalty programs. In fact, I have called Starbucks a technology company, it's so shrewd with it's pre-order and mobile pay programs. Recall, Starbucks has more money on cards than large banks have on deposit. Read that again... And, here's a chart for us:

These three recent initiatives just further our belief in the company as a long-term winner in the consumer world as it out smarts its competitors in almost every aspect of the business. Finally, let us not forget about the brilliant approach Starbucks Corporation (NASDAQ:SBUX) is taking toward China. That piece of the puzzle is actually in the Top Pick dossier under the section "Genius" (lol).

Thanks for reading, friends.

WHY THIS MATTERS

If you're looking for research authored by analysts with training in finance, mathematics and technology, try CML Pro. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals, but we are the anti-institution and break the information advantage the top .1% have.

Each company in our 'Top Picks' is the single winner in an exploding thematic shift like artificial intelligence, virtual reality, genomics, mobile pay, the Internet of Things, drones, biotech and more. We are offering CML Pro at a discount for just $10/mo. with a lifetime guaranteed rate and you can cancel at any time. We think you'll have a blast when you see what professional research reads like and what a community feels like. Join Us: Get the most advanced premium research delivered to your inbox along with access to visual tools and data that until now has only been made available to the top 0.1%.