Silver mining stocks are significantly undervalued thanks to a market anomaly that ignores fundamentals and allows itself to be temporarily sidetracked by post-election confusion, but beware--this bear is looking increasingly bullish.

It’s not the time to shy away from silver. Silver mining costs have plunged exponentially, and the massive gains silver miners made in the bull run of Q2 and Q3 2016 not only cushioned the blow of a Q4 dip, but also created some very solid fundamentals that give us what we have going into 2017: Amazingly cheap mining costs and some very profitable mines, even at Q4 prices.

Silver may be down some 20% from its peak of $20.67 in Q3, but the sell-offs were based on sentiment, not fundamental reality—and this is exactly where smart investment finds hot low-buy opportunities.

We’re sitting right now in the middle of an anomaly that fundamentals dictate will correct itself very soon. Once undervalued silver starts climbing higher again and capital starts pouring in, pushing prices higher, the low-buy opportunities will fade.

Here’s why:

Global investors are magnetically drawn to precious metals in times of uncertainty and instability. Global tensions are as high as they were in the 9/11 aftermath, when precious metals soared phenomenally as everyone hedged bets against global instability.

An incoming U.S. president who is inflation-bound will also give silver a boost—as will a definitive ‘Brexit’ orchestrated by the British prime minister, and the generally explosive global situation. When all else fails around us, silver (and gold) become the instant go-to safe havens.

Right Time, Right Place for Silver

Right now is one of the best times to be a silver miner.

Pan American Silver (NASDAQ:PAAS) reported Q3 earnings of an impressive US$43.4 million—up US$9.2 million over the previous quarter—just for starters.

While average silver prices in the earlier bull run this year jumped from US$14.86 to US$20.67, the costs to produce it per ounce have dramatically dropped over the past four years, starting at US$22.26 in 2012, dropping all the way down to an amazing US$10.10 as of the end of September 2016.

In Mexico, Endeavor Silver (NYSE:EXK) owns three underground silver and gold mines in Mexico’s Durango and Guanajuato states and has seen its costs fall 24% to only US$11.47/ounce in Q32016--at a time when silver was going for upwards of US$19/ounce.

Keith Neumeyer’s First Majestic Silver also realized an impressive all-in sustaining cost decrease of 27% to $10.52 per payable silver ounce on its Mexican silver production. First Majestic also realized an average silver price increase of 30% to $19.72 per ounce.

It’s always good to follow the legendary mining money and see where it leads you. And it’s the new entrants eyeing pure silver plays who have the real strategic advantage in the pre-bullish gear-up.

Companies like Silver One (TSXV: SVE & USOTC: SLVRF ), which has just acquired 100% interest in three silver plays in Mexico, the largest silver-producing country in the world, is taking full advantage of the fantastic set-up. And mining legend Keith Neumeyer sees the silver lining here as well—he’s backing the company personally and as Chairman of First Mining Finance (TSXV: FF)., one of Silver One’s early investors.

Silver One acquired two past-producing mines and one strategically located, high-potential exploration project in August—La Frazada, Peñasco Quemado, and Pluton. Two of these—La Frazada and Peñasco Quemado—have historic resources, amounting to 10 million ounces of silver on one and about 4.7 million ounces on the other. There is further upside here with good high-grade lead zinc. The third, Pluton, is right next to a major, active silver producer--Excellon (TSX:EXN) in Mexico’s famous Mapimi Mining District and nearby Ojuela Mine.

This is a pure play, and in the silver arena, this is hard to come by. The fundamentals for a pure play are much clearer.

With silver outperforming gold year-to-date, pure exposure to silver is looking increasingly attractive.

On November 25, the SPDR Gold Shares ETF (GLD), which tracks gold prices, jumped 12%, while the iShares Silver Trust ETF (SLV) rose 19% on the same day. This looks set to stay on track, setting the stage for an advantage for miners offering pure exposure to silver.

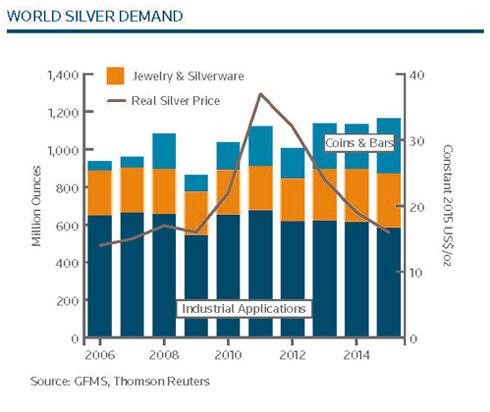

The Silver Institute says that physical silver has seen a major deficit over the past three years as a result of the closure of base metals mines. At the same time, the Institute sees investor demand on the rise, alongside industrial demand. The Institute is even more bullish on silver than it is on gold.

But here’s where it gets even more interesting for silver: The uses for silver are many and varied. From use in anti-smog devices in China, to medical uses and the solar industry, the demand for silver has a much brighter future than even the immediate fundamentals suggest.

There’s been strong investor demand for silver coins and bars and steady growth for the precious metal in the jewelry industry. But what you might not know is that silver is in high demand in the solar industry because it’s a great heat and electricity conductor for solar panels. With solar PV installation set to triple by 2020, demand for silver here could outpace supply.

Hands down, though the biggest reason to get in on silver mining stocks right now is cost and fundamentals. There has never been a better time because silver miners are operating at their most efficient and cheapest. The spread between production costs and silver prices is profitable today; tomorrow, it could be much more than merely profitable.

For any investor, the real money to be made is in the early stage of development. For silver miners, they’ll be looking for low-cash operating costs, ambitious growth plans and funds to back it up with a clear path to future capital.

Silver One ticks all of these boxes, and the undervaluation of this new venture makes for a unique low-buy opportunity. But the bigger picture is about silver itself, which could continue to out-perform gold and while next year is likely to see both precious metals rise, the consensus seems to be that silver will maintain the lead.

Why Silver May Outperform Gold

Forbes analyst Henry To says now is a great time to buy silver. Why?

China’s commodity markets are quickly scooping up commodity pricing power, and this means that Chinese hedge funds and retail investors are likely to start shifting their attention to silver.

“Given the illiquidity and opaqueness of the silver market relative to that of gold […] it will not take much speculative flows to drive silver prices much higher …”, To says.

And with the U.S. and China always among the top three in terms of silver demand, their fiscal policies also significantly impact silver prices.

Under Trump, we’re looking at a possible $1 trillion in infrastructure spending—among other things—that are wildly inflationary. Inflation is one of silver’s best friends.

Says the Forbes analyst: “With pricing growth in the Chinese stock and housing markets no longer a given, Chinese speculators have most recently turned to the commodities market to hedge the depreciation in their Chinese yuan-denominated assets.”

The second big global economic powerhouse—India—is also unwittingly helping out silver by restricting gold imports in an effort to reduce its citizens’ demand for imported gold. While this move is intended to crack down on currency used in the black market, the effect is set to be a boon for silver, which is not likewise being restricted. Silver is set to become a major investment for consumers in India because even the smallest substitution of silver for gold in this massive market will result in a wildly significant increase in the price of silver. And the same situation is unfolding in Venezuela.

But we can also see where demand is headed further out. Typically, industrial demand represents about 50% of silver consumption—and that demand is expected to recover due to a number of factors, including growth in the global solar PV industry and the electronics sector—which continually sees new sources of demand.

In this atmosphere, Silver One--a pure play explorer in the hottest silver venue in the world, fully funded and with access to future capital—has a strategic advantage ahead of the next bull run.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are subject to change without notice. We assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.