Written by Ophir Gottlieb

WEEKLY LONG CALLS IN APPLE INC

Trading long calls in Apple using weekly options for the last three-years has been a winner. But, there was a way to substantially increase returns while literally cutting risk in half -- a 50% reduction in risk. Here's how we do it.

First, we run a three-year back-test of buying the 50 delta (at the money) call option in Apple Inc every week (weekly options). These are the results:

We can see a 219% return, and even though the trades were only winners 40% of the time, the wins were well worth the losses. But that should trigger a thought:

What if we could limit the downside and test it systematically?

It turns out that we can do exactly that. Here is the same weekly long call test but this time we put a stop loss at 50%. In English, if the long call loses 50% of its value, we sell it, close the position, and trade the week after. Here is how that strategy looked:

All of a sudden we see that 219% return spike up to 242%. But here's the real gem -- this test has cut the risk in half. While the original test could have seen a long call lose all of its value (100%) in a given week, now we have limited that loss to 50%. Yes, we see greater returns for less risk.

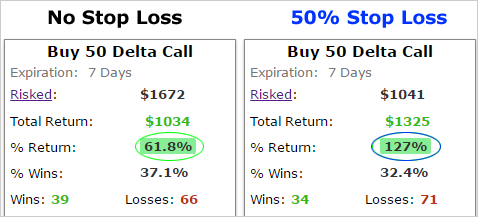

But this approach goes well further than a three-year time period. Let's now do this weekly option trade for the last two-years, and to make the results easier to read, we will put them side-by-side. The left side is the normal weekly call option, the right hand side is the one with a 50% stop loss.

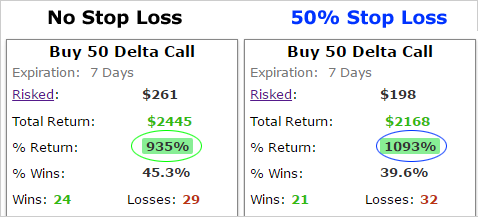

For the two-year back-test we can see that a 61.8% winner turned into a 127% winner. That's more than double the return with half the risk. And we can go ever further. Here is that same analysis over the last year.

Putting a stop loss on the Apple Inc weekly long calls has pushed returns substantially higher while reducing the maximum risk. Now, this is just a tiny sliver of what the back-tester allows you to do -- we haven't even addressed how to change the strategy during earnings releases. But it's so easy and so fast to optimize our tests that it feels almost unbelievable for one simple reason...

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever:

Tap here to see the demo movie

The author is long shares of Apple Inc (NASDAQ:AAPL) at the time of this writing.

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.