PREFACE

Selling a covered call against long stock can be one of the great income generating option strategies, but it cannot be done in blind faith. In fact, a covered call can be one of the riskiest approaches to options around. Here's how we can systematically reduce the risk for Amazon, and quadruple the returns while we're at it.

STORY

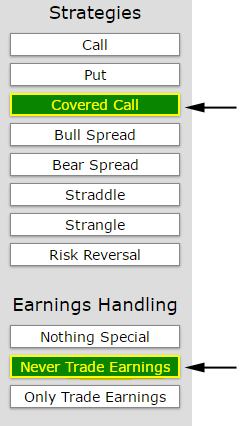

There's just a lot less 'luck' involved in successful option trading than many people realize and AMZN is a prime example. Let's look at a two-year back-test of a covered call with these quick guidelines:

* We'll test monthly options (roll the trade every 30-days).

* We will avoid earnings.

* We will examine an out of the money call -- in this case, 30 delta.

* We will test this covered call looking back at two-years of history.

What we want to impress upon you is how easy this is with the right tools. Just tap the appropriate settings.

RESULTS

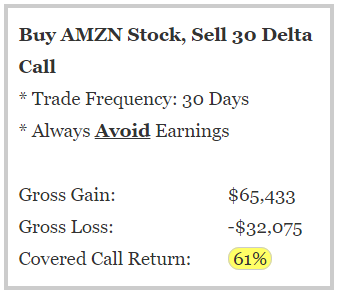

If we did this 30 delta covered call in Amazon.com Inc (NASDAQ:AMZN) over the last two-years but always skipped earnings we get these findings:

Selling a covered call every 30-days in AMZN has been a substantial winner over the last couple of years returning 61%. But here's the nugget of knowledge we needed to really make this work and not get caught with the big loser.

EARNINGS

Just doing our first step, which was to evaluate the covered call while avoiding earnings is clever -- certainly an analysis that gets us ahead of most casual option traders. But let's take the analysis even further.

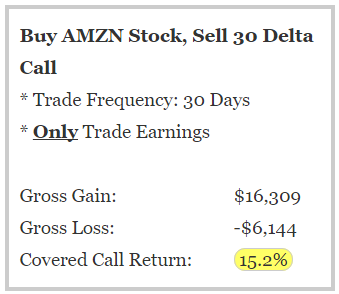

We will examine the same idea, but this time we will only look at earnings.

While selling a covered call in Amazon.com Inc during earnings did prove to be a winner, more importantly, it returned less than the same covered call that avoided earnings and avoided the potential catastrophe of an earnings run. It's the question that each trader needs to ask themselves -- is the risk of earnings worth that small return, or is the 61% while avoiding that risk better? Whatever your personal preference, now you know, exactly, the risk you are taking.

What Just Happened

This could have been any company -- like Apple, Facebook or Netflix, or any ETF. What we're really seeing is the radical difference in applying an option strategy with analysis ahead of time, in this case understanding the impact of earnings. This is how people profit from the option market -- it's preparation, not luck.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.