PREFACE

The option market has missed the mark with respect to pricing Apple Inc (NASDAQ:AAPL) options and it has made for a windfall of profits for the shrewd investor.

STORY

By definition trading options during earnings is very risky. But, once we step into that world, in turns out that there is a lot less 'luck' involved in successful option trading than many people have come to understand.

We can get specific with long earnings strangles for Apple in this dossier. Let's look at the last year of owning an out of the money strangle only held during earnings. Here are the rules we followed:

* Test weekly options.

* Only hold the position during earnings. Specifically, we test initiating the position two-days before the earnings event, then hold through earnings, and then close two-days after.

* Test the out of the money strangle -- specifically the 20 delta strangle.

* Test the earnings strangle looking back at the last year.

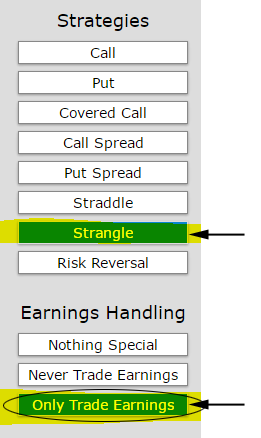

In the set up image below we just tap the rules we want to test.

Next we glance at the returns.

RETURNS

If we did this 20 delta long strangle in Apple Inc (NASDAQ:AAPL) over the last years but only held it during earnings we get these results:

Owning the earnings options returned an incredible 389% over the last years and remember, that's just 16 days of trading.

While the stock has been up 40% in the same time, this clever strategy has beaten the stock by 350%, and again, we're looking at just a matter of days of holding period for the options and a full years for the stock.

And if we're wondering if this is just the natural behavior of Apple stock -- it actually isn’t -- this is strictly an earnings issue. If we held this same out-of-the-money strangle for the full year, but in this case always skipped earnings, these are the results:

That 20.8% return is half the stock return, and 95% less than the results when held during earnings. Yes, there are these rare gems where the option market has under-priced earnings, and yes, it is this is easy to find them.

TRADING TRUTHS

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.