The Thin Line Between Winning and Losing

The Coca-Cola Co (NYSE:KO) is one of those blue chips that most of us give little thought to with respect to the stock or options. But it turns out, that little fact, that KO isnb �t memorable as an investment, has made it one of the best option trading instruments in North America, but only if we use some intelligence.

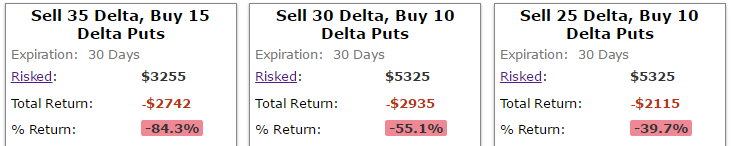

This may sound incredible, but over the last three-years KO stock has traded no lower than $37 and no higher than $47. That's total stagnation. But, that stagnation has not resulted in good option trading during earnings. Check out the last three-years selling out of the money put spreads only during earnings:

Itb �s almost impossible to believe but selling out of the money put spreads during earnings lost as much as 84% when done every earnings period for three-years. But, thatb �s not the point of KO as an option trade b � the point is the "dead times."

Check out the exact same back-test of selling out of the money put spreads for the last three-years but always avoiding earnings.

The results are staggeringly different, and staggeringly good. In a stock that has been strangled by a tight trading range, once we remove the risk of earnings, we go from a 13% gain in stock price to 35% to 71% gain in options.

But, this isnb �t cherry picking. We can do the exact same test again, but this time looking over a two-year period and avoiding earnings:

Again we see giant returns for a dead stock b � crossing over 70% returns as long as we avoided earnings. For completeness we show the one-year back-test ex-earnings in KO:

It's like a record on repeat b � it's a winner when we avoid earnings in KO and sell out of the money put spreads. In fact, the stock is up 2.1% over the last year and we are looking at a risk controlled option strategy that yielded upwards of 80%.

What Just Happened

This is how people profit from the option market b � it's preparation, not luck. But even more, this was just one example in one company, now it's time to find your own edge with your own ideas. Maybe it's technology with Apple, Google, Facebook, Amazon or Netflix. Or maybe it's the banks, or industrials, or even the utilities.

To see how to do this for any stock, for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work