Lede: A risk aware options strategy in Oracle Corporation (NYSE:ORCL) has more than quadrupled the stock.

PREFACE

Oracle Corporation (NYSE:ORCL) beat earnings last night after the bell and the stock is having one of its best days in years. But even with this run up, the stock is up just 6% in the last two-years.

The compelling part of Oracle Corporation (NYSE:ORCL) as an investment for option traders is exactly this phenomenon -- it's a large, safe stock that hasn't seen a lot of volatility and that makes it a prime candidate for an option trade -- but, we there is one extra piece of knowledge we need to make it a huge out performer.

Oracle Stock Tendencies and Being Risk Aware

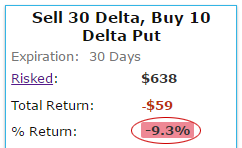

Oracle's stock is calm, as noted above, but oddly, selling a put spread to benefit from that calm has not done well over the last two-years, or that's what Wall Street would have us think. Here is how selling an out of the money put spread every month has done over the last two-years

That's a trade that has returned negative 9.3% in a stock that is up about 6%. But, there's so much more to this story in Oracle Corporation. We can see what happens if we avoid earnings -- that is, while we sell a monthly out of the money put spreads -- when earnings come around, we simply skip that week. Here are the results.

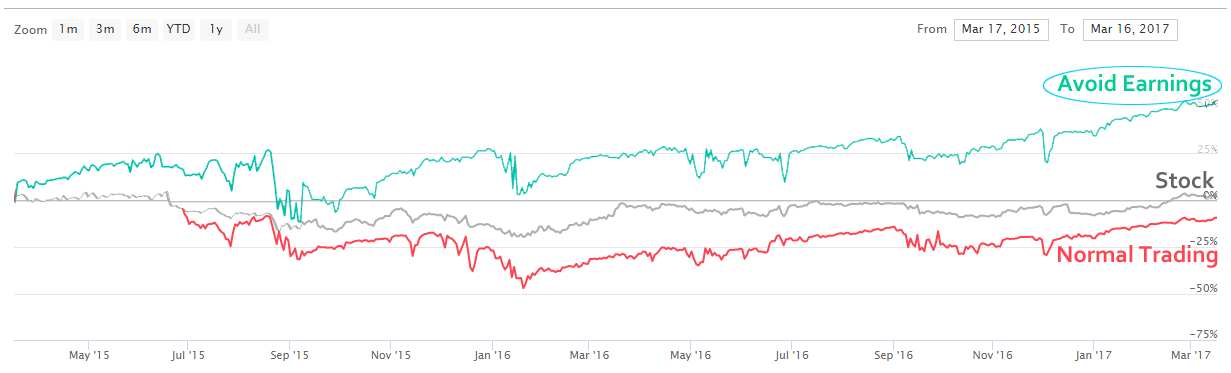

By removing the enormous risk of earnings, the -9.3% return has turned into a 54.1% return, while taking away that lump in our throat called earnings. Here is a chart that shows the return of the layman's short put spread strategy in red, the stock price in gray, and the short put spread that avoids earnings in blue all for Oracle Corporation.

We see the following:

* Normal short put spread: -9.3%

* Stock Price: +6%

* Short put spread avoiding earnings: +54.1% (Risk Aware)

Is This Really Analysis, or Just Luck

Skepticism is natural -- trading isn't a game and that means we have to prove to ourselves that this isn't luck or happen stance. If our trading analysis that is risk aware is correct, this approach should work consistently for all time periods. That is, 2-years, 1-year, and even six-months across the board.

It turns out that this is exactly what we find. Here are the results, side-by-side, for one-year short put spreads in Oracle Corporation (NYSE:ORCL):

It's not a magic bullet -- it's just easy access to objective data. A 29% winner, when shedding a bundle of risk by avoiding earnings, has turned into a 35.5% winner. That's what we're looking for -- higher returns with less risk. We can even look at how this approach worked over the last six-months:

The results over six-months make the math easy -- the short put spread, with less risk, has essentially doubled the normal short put spread. We have seen across the board better returns when we avoided that risk.

What Just Happened

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock, beyond Oracle Corporation (NYSE:ORCL), for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading, friends.

The author has no position in Oracle Corporation stock at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.