Written by Ophir Gottlieb

LEDE

There has been a way to profit from Tesla Inc (NASDAQ:TSLA) irrespective of stock direction, but it takes a deft hand and a clever investor that makes two adjustments to turn in out-sized returns.

PREFACE

Likely the single most important decision when trading options is whether to buy or sell the premium. Even with Tesla Inc (NASDAQ:TSLA) stock's realized volatility, owning options has been a losing trade -- unless we make a smart adjustment.

Owning Option Premium

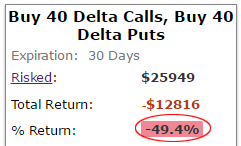

Here are the results of owning naked options in Tesla Inc over the last three-years -- we're looking at out-of-the-money strangles.

Tesla Inc's large stock moves -- this strategy has been a disaster.

IMPROVE

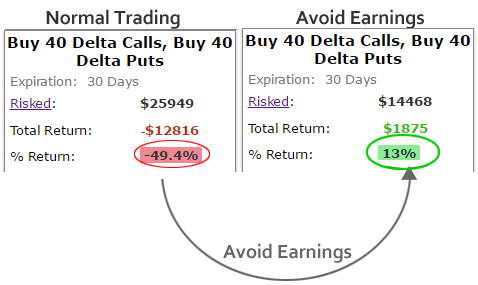

Our first step in improving the results is to eliminate the risk of earnings. Options are much more expensive during earnings periods, for good reason, and it's well worth our time to the see impact on the original strategy of removing earnings trading:

The returns went from a 49.4% loss to a 13.3% gain. But now we make the really important move:

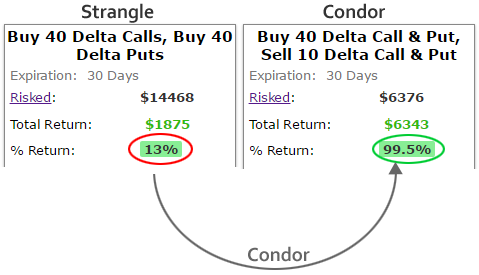

Instead of the naked buying of options in Tesla Inc, we will sell options that are further out of the money to offset the expense of the purchases but still invest in a strategy that profits from stock volatility. The strategy we are going to look at is called a condor (or an iron condor). Here are the results of both avoiding earnings and selling out of the money options against the long options:

It's remarkable, but these are the realities of option trading. The results went from a 49.4% loss, to a 13% gain by avoiding earnings, and now to a 99.5% gain by selling options to offset the long options. During this time period, Tesla Inc stock was up 57%.

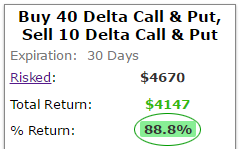

We can do this over the last six-months as well:

Now we see a 88.8% gain while the stock is up 55% in that same time. And again, the appeal to owning options in this way is the removal of stock direction bias -- up or down, the stock direction doesn't matter, it's the volatility that we're after.

WHAT JUST HAPPENED

This is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock, index or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no stock position in Tesla Inc (NASDAQ:TSLA).

Please read the legal disclaimers below.

Legal The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company make no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.