Written by Ophir Gottlieb

LEDE

While Nvidia Corporation (NASDAQ:NVDA) is growing at breakneck speed in the cloud, artificial intelligence and self-driving cars, its core business -- gaming, does appear to be hitting a soft spot in demand and that could mean some lumpiness for the stock in the near-term.

STORY

We've now read several reports where primary research was conducted surrounding the demand for high end GPUs in the gaming market, and each report concludes that demand is softening in the near-term faster than many had predicted.

Here is a snippet from primary research done by BMO:

We are also starting to track desktop graphic cards shipments.

For 1Q, our data suggests that shipments were down 16% q-q, much lower than three- year seasonality of down 6%. We believe this represents weakness in the channel versus the super-charged growth we have seen in the past several quarters, particularly for NVIDIA's graphics business.

We also believe this data suggests that weakness in NVIDIA's gaming business might show up earlier than we had anticipated. We had expected comparisons to become weaker for this business as the year progressed.

Source: BARRON'S

WHAT DOES THIS MEAN?

In short, the demand for Nvidia's gaming products appears to be falling more than was anticipated with "normal" seasonal weakness. First, let's look at some context. We start with Nvidia's growth by segment as of last quarter:

Across the top we see the growth numbers, and this is the catalyst to the stock's rise.

But, the reality is, for now, Nvidia Corporation does rely heavily on gaming. In the quarterly earnings call on February 9th, the company revealed that 62% of revenue comes from the gaming segment. Now, the segment in general is a very healthy one -- and the headlines do appear to be catastrophizing the slowdown just a little.

If we step outside of "right now," this is the broad segment Nvidia Corporation is looking at -- per their own press materials:

At $100B, computer gaming is the largest entertainment industry in the world.

We've helped drive the PC gaming market for two decades. Today, NVIDIA gaming is $3.5B business.

The increasing production value of blockbuster titles, eSports, emerging markets, gaming-assharing-medium, and VR will fuel this vibrant market.

Our leadership in PC gaming and investments in mobile-cloud technologies have positioned us for growth into the future.

Source: NVIDIA

And then the company also wrote this:

And finally, the company wrote (our emphasis added):

Mobile-cloud will bring gaming to billions.

SHIELD is our foothold in the future of TV and gaming.

GeForce Now is a "Netflix" for gaming for that future.

Investment in SHIELD paved the way for Nintendo Switch win.

So, that's the good and the bad of gaming. Now, Nvidia's future, while gaming is a part of it, looks to other massive opportunities.

BEYOND GAMING

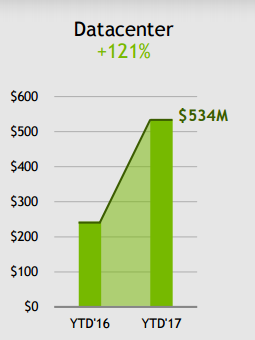

We dedicated a lot of time to the data center and cloud opportunity for Nvidia Corporation (NASDAQ:NVDA), which is booming. Growth came in at 121% and topped half a billion dollars in YTD 2017 according to the December investor packet the company released.

Further, in our dossier "Nvidia Corporation Gets a Cloud Win," we outline not only the firm's big win with Chinese Internet company Tencent Holdings, but also the wider view of growth in the area.

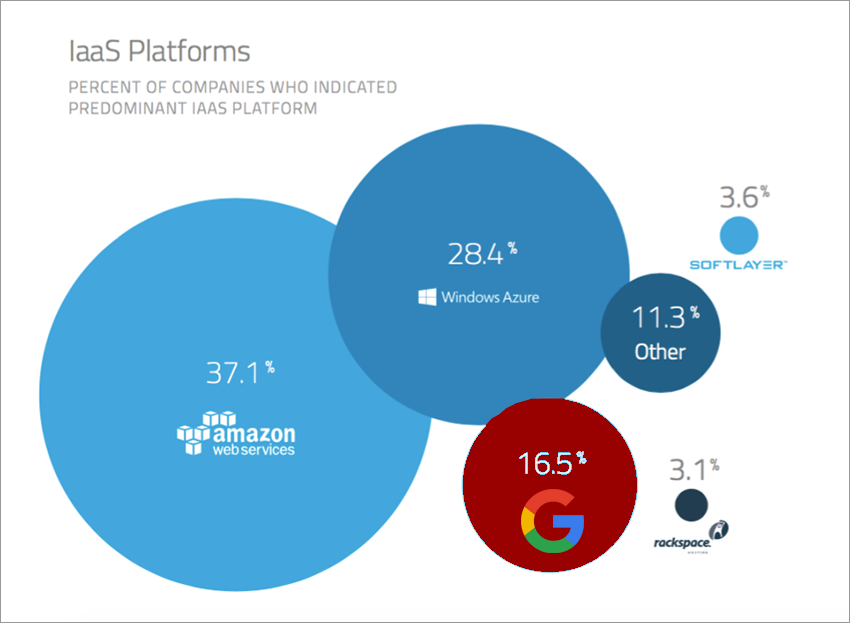

While Amazon.com (NASDAQ:AMZN), Microsoft Corporation (NASDAQ:MSFT) and Alphabet Inc (NASDAQ:GOOGL) all battle to become the top cloud platform provider, Nvidia Corporation has its sights set much higher.

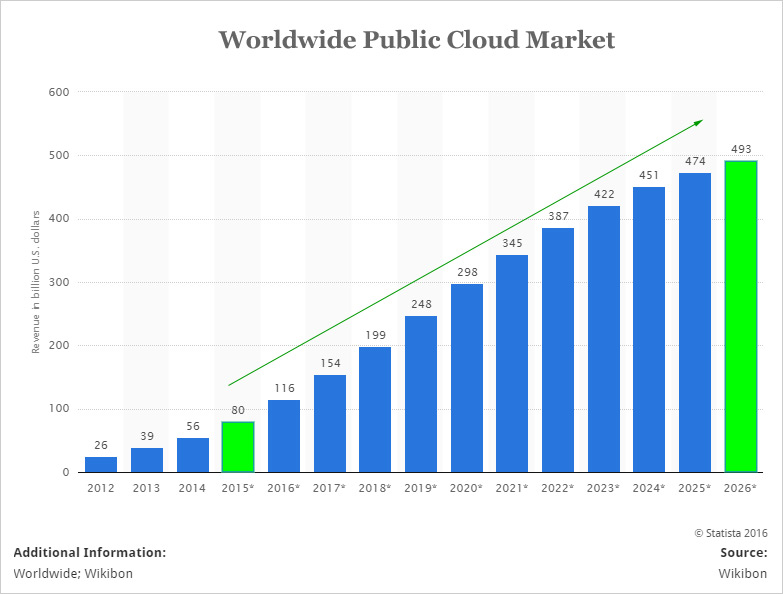

The worldwide public cloud market is forecast to rise from $154 billion this year to nearly half a trillion dollars by 2026. That market has three dominant providers:

But, irrespective of the provider, each computer in the cloud runs on a processing unit (or several processing units) -- most of which are powered by Intel Corporation (NASDAQ:INTC). In fact, latest data reveals that Intel's Xenon processor has a 99% market share.

Even given that moat built by Intel Corporation (NASDAQ:INTC), Nvidia saw its data center revenue grow (as pictured above).

There is too much data and too many connected devices even today, not to speak of the absurdity that is to come, to not have a machine learning driven technology to balance the needs of every website, every app, all the data in complete harmony.

The company has turned its hardware centric focus into a service -- or as the company calls it, "NVIDIA GPU as-a-Service."

And this commentary:

One architecture - from PC to server to cloud to mobile to auto.

Latest Pascal GPU architecture - purpose-built for AI.

AI library engines accelerate every deep learning framework.

NVIDIA DGX-1 - AI supercomputer in-a-box so every enterprise can tap into AI.

New Tesla P40, P4 GPUs and TensorRT software for inferencing.

World's leading cloud service providers offer NVIDIA GPUs.

ARTIFICIAL INTELLIGENCE

Nvidia Corporation is also an artificial intelligence (AI) play:

AI also goes into manufacturing. This may sound unbelievable, but according to the company, there are 2 billion industrial robots worldwide and NVIDIA GPUs for training, GPU-powered FANUC units to drive groups of robots, embedded GPUs on each robot to perform real-time AI are all trends that leave a lot of room for growth for Nvidia.

Even further, AI is a growing trend in healthcare.

Nvidia is pretty bullish on this segment in general -- here's what they wrote:

AI will revolutionize healthcare, from medical imaging to drug discovery to predictive medicine.

Organizations from startups to leading research hospitals using NVIDIA AI platform.

NVIDIA teaming up with the National Cancer Institute, the U.S. Department of Energy and several national labs to bring AI to the "Cancer Moonshot."

In reality, of all the things happening in the world today, it's AI that has the furthest reach.

SELF-DRIVING CARS

We wont belabor the points which we detailed in the dossier "Nvidia Makes Huge News in Self-driving Cars," but take a read if you really want to see the enormous possibilities opening up for Nvidia -- including the self-driving truck world which is best understood by simply watching this one minute sixteen second video:

WHY THIS MATTERS

Nvidia is a marvel, but it's finding the technology gems that will turn into the 'next Nvidia,' 'next Apple,' or 'next Amazon,' where we have to get ahead of the curve. This is what CML Pro does. Our research sits side-by-side with Goldman Sachs, Morgan Stanley and the rest on professional terminals.

Each company in our 'Top Picks' is has been selected as a future crown jewel of technology. Like the the one company that will power every cloud as cloud computing platforms near half a trillion dollar market withing four years. Or the one company that will power every drone, or even the one company that will be the guts behind the genomics revolution, or the company that will power every self-driving car.

Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $19/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.