Enter Kenadyr’s Asia Borubai Project

In the Kyrgyz Republic (previously known as Kyrgyzstan) lies the massive Zijin’s Taldybulak Levoberejnyi Mine (TBL Mine), a newly built and producing mine –operated by one of China’s largest gold producers -- containing 3.2 million ounces in reserves and resources at a grade of 7.2 g/t.

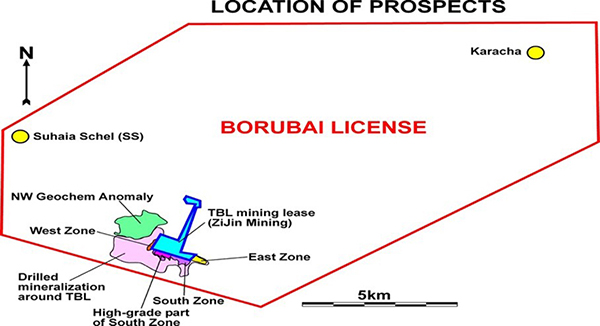

Surrounding that mine is the 164 sq.km. Borubai license, 100% owned by recently TSX Venture listed Kenadyr Mining (KEN: TSXV). The Company appears to have many planks to eventual success as a global mining operation.

And you’ve likely never heard the name.

Out of the gate, investors will note that the Company has no debt, $8,5 million in cash, and a peerless management team that brings extensive Asian contacts, both government and industry as well as extensive global mining expertise.

Kenadyr’s CEO, Dr. Alex Becker has a long and distinguished track record successfully operating in Kyrgyzstan (Kyrgyz Republic).

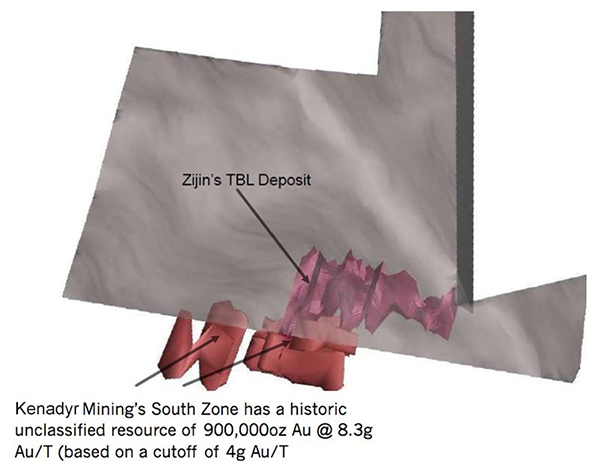

The TBL mine deposit (grey over red) appears to directly connect to Kenadyr’s initial drill target (red extension), the south zone, which was previously drilled by the Soviets. The results are illustrative of the potential of the area.

Borubai may be the only junior currently connected to a producing ‘super major.’

"The European Gold Forum 2017, recently held in Zurich, reinforced our belief that major and mid-tier gold producers have mandates to replace depleting ounces via acquisition,” stated Bryan Slusarchuk, President and Director of Kenadyr.

He continues, “The recent emergence of this trend bodes well for companies with advanced stage gold assets. Kenadyr not only has 100% of a large land package with an underlying geological environment conducive to high grade and size, but the asset is also very strategically located.”

Salient Points Regarding the neighbouring TBL Mine:

- Built at cost of US$269 million

- on August 15, 2011, the national resources table of Kyrgyz Republic stated that the TBL field contains 8,906,100 tonnes of gold ore

- average grade is 7.23 grams per tonne

- initial mining reserve) is 4,949,754 tonnes of gold ore (the average grade is 7.02 grams per tonne

- designed to produce 125,000 ounces of gold per annum.

Kenadyr’s Borubai Project:

- 100-per-cent-owned exploration license covering a contiguous 164 square kilometres located in northern Kyrgyz Republic.

- extensive historic exploration including drilling (98,200 metres in 184 diamond drill holes)

- rock geochemical sampling (2,320 samples), pan concentrate sampling (790 samples), and 100 metres of adits and 184 metres of underground raises

- the entire area has been subject to airborne magnetic, radiometric and gravity surveys, as well as ground-based

- Mining savvy/accommodating government: No expropriation of mining assets

- First mover advantage

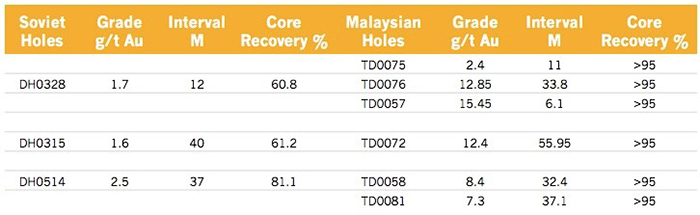

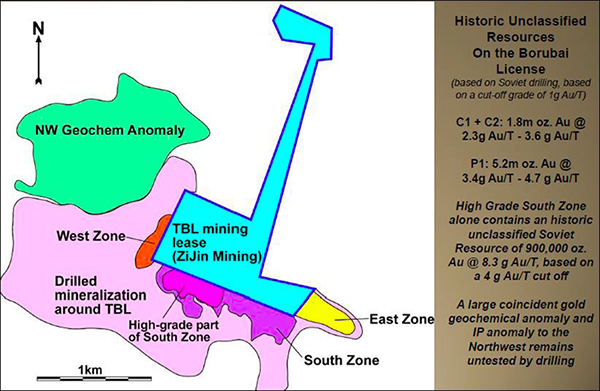

Soviet drilling outlined the TBL Mine’s gold resources and established that the mineralization continued onto the Borubai license. Drilling by Kenadyr in 2016 at SS proved the presence of significant gold in several RC holes drilled to confirm the previous Soviet work.

TBL boasts a high-grade South Zone alone contains a historic unclassified Soviet Resource Estimate of 900,000 oz. Au @ 8.3 g Au/T, based on a 4 g Au/T cut off.

The Company has plans to begin a drilling program by summer 2017.

The world recently went through a period during which very little exploration work was done on gold assets. Now, with a stealth bull market in gold having commenced, companies are scrambling to play catch up through acquisition.

For context, it is always useful to look at comparables. In this case, the comparison to Kenadyr is a selection of Canadian mines and one in Fiji. In market cap and the all-important cash cost per ounce, Kenadyr, while still technically speculative, makes an extremely compelling case.

*historic estimates should not be treated as current mineral resources or mineral reserves as defined in NI 43-101

One issue that is always top of mind, or should be, for precious metals investors is political stability. Coupled with the fact that Senior management has extensive experience in the area and is located in-country. Advantages for doing business in the Kyrgyz Republic:

- Straightforward, supportive, and competitive mining law

- Transparent and certainty of title

- Absence of excessive bureaucracy and red tape

- Low corporate taxes

- Modern infrastructure providing for a low-cost environment

- Experienced and qualified local workforce

- Friendly population: low-risk environment

Kenadyr’s Borubai gold project is adjacent to a historic mining community. It is at only 1700 meters’ elevation, and has no competing land uses, or water issues – it’s only neighbours are Zijin’s TBL Mine and a mining town that needs the jobs created by the development.

Kenadyr’s Borubai Project already has all the permits required for its programs. Borubai is approximately 100 Km away or about 70 minutes driving by paved dual highway from the capital of Bishkek and has low costelectric power available to it.

Bottom Line

In the soon to be famous investment initialism “MMM” (Money, Moxie and Management) Kenadyr hits all three.

The Company has many unique and compelling qualities and investment drivers. Surrounding and apparently sharing reserves of one of Asia’s largest gold mines. While development and eventual production is the goal, the area has had a lot of M&A activity that opens that potential for Kenadyr. Politically, the Company has that covered.

Cash on hand is US$8.5 million and no debt. Moxie and Management are interrelated, as the latter brings one of the strongest features to future success and adding consistent shareholder value.

Brief Bios:

R. Stuart (Tookie) Angus

CHAIRMAN

Mr. Angus is an independent business adviser to the mining industry. For more than 35 years, Mr. Angus has focused on structuring and financing significant international exploration, development and mining ventures. Mr. Angus is the former chairman of the board of B.C. Sugar Refinery Ltd. He is presently chairman of K92 Mining Inc., which operates the Kainantu Gold Project located in the Eastern Highlands province of Papua New Guinea.

Dr. Alexander Becker

CHIEF EXECUTIVE OFFICER AND DIRECTOR

Dr. Becker’s distinguished career in mining includes acquiring the gold potential of the Chaarat deposit in the Kyrgyz Republic (gold resource of 6.5 million ounces) as well as a director of Perseus Mining, Kentor Gold, Manas Petroleum (CEO and director), Action Hydrocarbons, Caspian Oil and Gas, and vice-president of geology for Apex Asia (a subsidiary of Apex Silver Mines). Dr. Becker holds a MSc in geology and a PhD in structural geology.

Bryan Slusarchuk

PRESIDENT AND DIRECTOR

Mr. Slusarchuk has structured complex debt financing transactions in the United States, Canada and Europe with multiple top-tier banks. This includes negotiating and securing the first-ever financing of a mineral exploration company by European Bank for Reconstruction and Development. Mr Slusarchuk was a founder of, and is currently the President of K92 Mining Inc, a gold producer in Papua New Guinea.

Brian Lueck

CHIEF OPERATING OFFICER AND DIRECTOR

Mr. Lueck is a Professional Geologist with over 25 years of experience as an officer and director of Canadian and London public companies involved in mineral exploration, resource definition and feasibility studies. He is a practicing member of the Association of Professional Engineers and Geoscientists of British Columbia and a Member of the Society of Economic Geologists. He is an Advisor to the Board of K92 Mining Inc.

Dr. Alexander Becker, Kenadyr Chief Executive Officer stated: "Borubai is situated in a highly prospective geological setting. Kenadyr will benefit from this setting in combination with excellent logistics and the extensive historical capital invested advancing the project. While we were attracted to Borubai due to the underlying geology, we are also aware the project is well situated strategically."

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated four thousand dollars for its efforts in presenting the KEN profile on its web site and distributing it to its database of subscribers as well as other services. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.