Written by Ophir Gottlieb

LEDE

There has been edge in Starbucks Corporation options, and it has led to nearly 200% returns over the last 3-years while the stock was up just 80%.

PREFACE

WHAT IS EDGE? One of the great beauties of option trading is that the market prices the 'greeks,' which serve as a measure of probability.

If a trade wins more often than the probability that is priced in, it has edge.

Here is that same thought process, but in English: A 30 delta (out of the money) put should end up in-the-money about 30% of the time (delta is roughly a measure of probability). In other words, if we sold a 30 delta put, we would expect that we could have a winner 70% of the time.

EDGE

Now, back to our idea of edge. If we can find an option strategy that has a 30 delta, but if selling it wins more than 70% of the time, then we have edge. Even further, even if it wins 'just' 70% of the time, if the net profit is positive, then that's another measure of edge.

When we have both, we have a great trading result, and that is exactly what we find with Starbucks Corporation.

Starbucks Corporation (NASDAQ:SBUX)

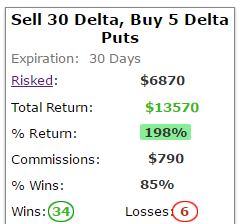

If we test selling a 30 delta / 5 delta put spread, every 30-days, and always avoiding earnings in Starbucks over the last 3-years, this is what we find:

That's a 198% return, versus a stock return of 80%. Even further, and back to our discussion of edge, the strategy had 34 winning trades and 6 losing trades for a win-rate of 85% -- far above a 70% win-rate we might expect.

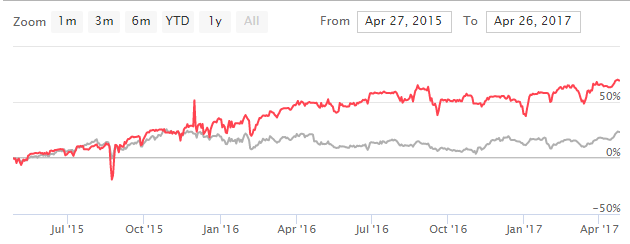

For context here is how the short put spread (in red) has done relative to the stock (in gray).

But this isn't the end of the analysis -- there is one more step we need to make. While the CMLviz Trade Machine (back-tester) allows us to identify edge quickly, it does more than that. Selling a put spread is bullish strategy in that it becomes a winning trade if the stock rises, or, if the stock "doesn't go down a lot."

It's fair to wonder if simply buying a call spread would have been better than selling a put spread. Here is how that approach has done over the last 3-years, done every 30-days.

Even though Starbucks stock has been up 8% in this time period, and even though selling a put spread returned nearly 200%, it turns out that buying the call spread was in fact a losing strategy.

WRAPPING IT UP

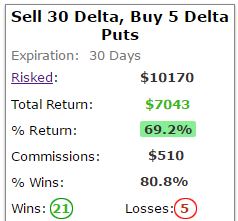

We can do these same tests over two-years as well. First, here is the return of that same short put spread over two-years and always avoiding earnings:

That's a 69.2% return, while the stock was up just 23%. And, even further, we see 21 winning trades versus 5 losing trades, for a 80.8% win-rate.

Here is the strategy (in red) versus the stock (in gray):

Options are volatile over the short-run, but as time progressed, the short put spread vastly outperformed the stock. And, for the curious, here is how the long call spread did during this time:

A 67.7% losing strategy, even though the stock was up. It's not a magic bullet -- it's just easy access to objective data.

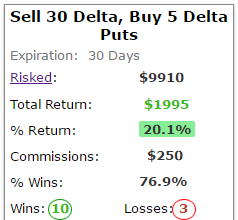

For completeness, here are the results of the short put spread over the last year:

That's a 20.1% return, with a 76.9% win-rate. The stock returned 7.3% in the last year.

WHAT JUST HAPPENED

We don't mean to make you feel uncomfortable, but this is it -- this is how people profit from the option market -- it's preparation, not luck.

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author is long shares of Starbucks Corporation (NASDAQ:SBUX) as of this writing.