Written by Ophir Gottlieb

This article is a snippet from the original published to CML Pro members on 4-30-2017.

LEDE

As far as we are concerned, the bullish thesis for Skyworks Solutions Inc (NASDAQ:SWKS) reads so well, and looks so bright, we actually have to tame ourselves when we discuss the company and we review earnings.

On November 28th, 2016, we published It's Time to Pay Attention to Skyworks Solutions.

At that time the stock was trading at $77.30. Today the stock is at $99.74, or fully 29% higher. We say again today, as we did back in November, "It's Time to Pay Attention to Skyworks Solutions" and we urge you to read that dossier. Now let's turn to earnings:

Skyworks Solutions Inc (NASDAQ:SWKS) Earnings Results

The company earned $1.45 per share excluding items, up 16% year over year, on sales of $851.7 million, up 10%, in the March quarter. Analysts expected earnings of $1.40 a share on sales of $840.4 million.

Irrespective of the stock reaction, this was a beat across the board.

For the current quarter, Skyworks expects to earn $1.52 a share, up 23%, on revenue of $890 million, up 18%. Wall Street was modeling for $1.49 and $868 million.

Here is the three-month stock chart:

As an aside, Wall Street is actually on our side with this one:

Skyworks Solutions received at least eight price-target increases from Wall Street analysts following its better-than-expected fiscal second-quarter earnings report.

Source: IBD

We can't help ourselves but to repeat just a bit of the Top Pick dossier, below, before we get to earnings highlights.

THE WORLD IS CHANGING

Let's start with the realities of the world we are facing with respect to a dramatic shift coming our way, before we turn specifically to our Spotlight Top Pick, Skyworks Solutions Inc (NASDAQ:SWKS). We use a lot of data from the Ericsson Mobility Report, which is free for anyone in .pdf format.

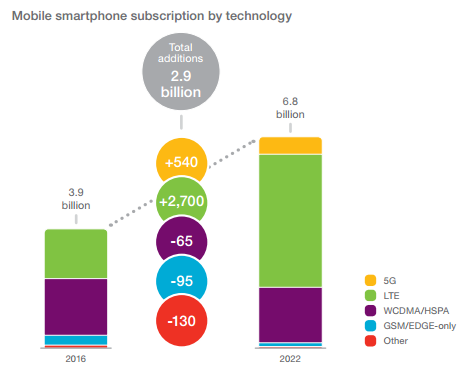

First, we start very basic: mobile smartphone subscription growth projections:

I know this seems like it flies in the face of everything you've read from the main stream media, but, the main stream media often times has no idea what it's talking about. In fact, it's that reality that likely led you to CML Pro. So, to be clear, projections call for nearly 75% growth in mobile subscriptions within six-years.

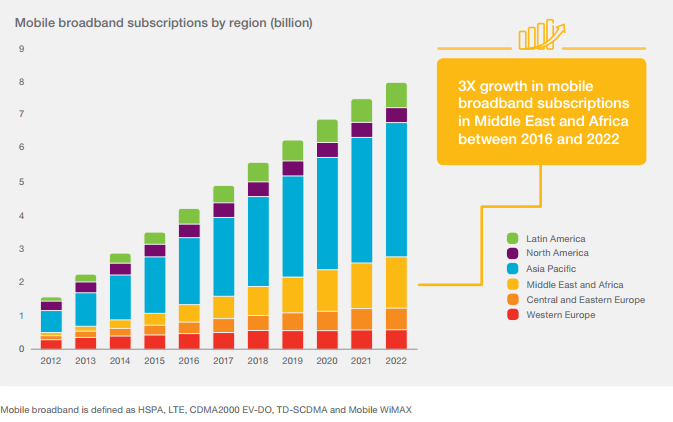

Another easy way to look at this is to simply go year-by-year and examine mobile broadband subscriptions by region, by year:

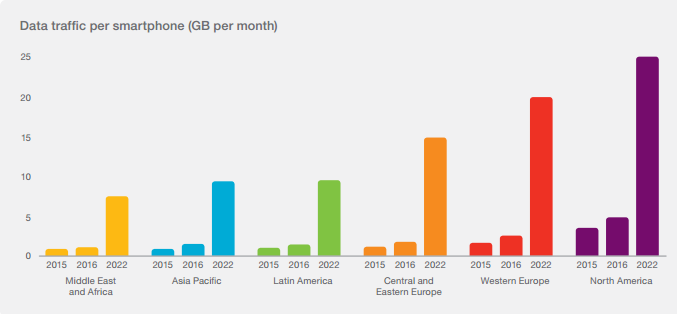

More broadband mobile subscriptions means more mobile devices and more mobile data usage. Check out this next chart for data usage per smartphone:

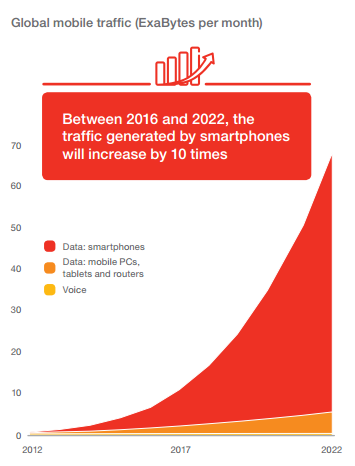

Keep in mind, that is per smartphone, so it's not just data consumption rising due to more subscriptions, but rather each subscription in and of itself is going to show massive growth. Here's that same information in a single chart -- note the dark orange area is data from smartphones:

As the caption reads, "between 2016 and 2022, the traffic generated by smartphones will increase 10 times." Now is the time to remember that Apple Inc iPhone users drive the huge majority of app usage, even with just a 15% market share of total smartphones.

While the number of apps downloaded favors Google Play by about two to one, Apple Inc (NASDAQ:AAPL) iPhones generate nearly twice as much revenue as Google Play. To put that into perspective, for every $1 dollar of app revenue driven by Google Play, Apple Inc (NASDAQ:AAPL) generates about $4. If we see greater data consumption per smartphone, we likely see a greater benefit to Apple Inc than any other smartphone.

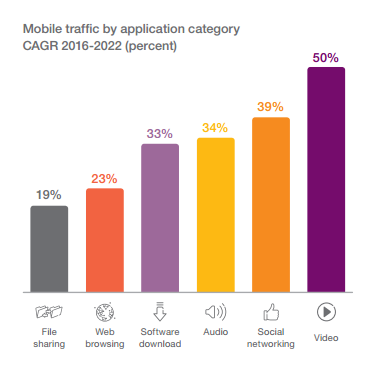

Now, further projections tell us that 80% of all our content consumption by 2020 will be video. Yep, video will replace essentially everything we do online. Here's a nice little chart to visualize some of that growth:

That is 50% year-over-year compounded annual growth for six straight years for video data traffic. That translates into over 1,100% growth in six years (1.5^6, for you math heads).

Skyworks Solutions Inc (NASDAQ:SWKS) Earnings Highlights

Here are the highlights that stood out for us:

* Skyworks is gaining momentum. Our outlook for Q3 reflects accelerating performance.

* We delivered revenue of $852 million, up 10% year-over-year and above consensus, with gross margin of 50.4% and operating margin of 36.7%.

* We achieved earnings per share of $1.45, up 16% year-over-year and $0.05 better than consensus.

* Cash flow from operations was $236 million, an increase of 53% year-over-year.

* We ended the second quarter with a cash balance of $1.4 billion and no debt.

* In addition to our financial performance, we are aggressively expanding our design win pipeline.

* In mobile, we are extending our reach across all premier smartphone OEMs. Specifically, we enabled Huawei's P10 and P10+ models with low, mid and high-band SkyOne solutions, along with antenna tuner, carrier aggregation switching and power management devices.

* We powered Samsung's Galaxy S8 platform with proprietary DRx and SkyOne solutions, as well as GPS and DC/DC converters.

* In IoT, we supported Cisco's enterprise-grade MIMO gateways, delivered analog control ICs across Nintendo's gaming platforms, captured Wi-Fi mesh networking wins at Google and Plume, deployed high-power smart meter devices for Itron, and we launched custom solutions for Fitbit, Garmin and LG.

* We secured strategic design wins at three leading automotive manufacturers, leveraging our advanced LTE modules supporting high-reliability connectivity, GPS and data transport capabilities.

* Skyworks is capitalizing on powerful macro trends, diversifying across new markets and advancing our technology leadership.

The stakeholders in these ecosystems are monetizing vast flows of data, while fostering entirely new wireless-centric business models.

This dynamic is creating a new trillion-dollar economy, underpinned by e-commerce, mobile advertising, social media, and cloud-based services.

* High-speed, reliable, always-on connectivity is at the heart of this secular trend.

* Within the mobile market, we facilitate the data creation and storage that allow today's smartphones to transmit and receive immense amounts of content.

* We continue to address a growing set of vibrant end markets across developed and emerging economies, covering both mobile and IoT. At the same time, we are preparing for a significant 5G upgrade cycle, yet another catalyst fueling our business while leveraging our technology depth and systems expertise.

And now we turn to the critical issue of Skyworks Solutions' reliance on Apple Inc (NASDAQ:AAPL).

* During Q2, we had three greater than 10% customers.

* Obviously, our largest customer, which was slightly below 40% of total revenue, and then Huawei and Samsung, each of them which were slightly above 10% of total revenue.

So that was from the company. We also add:

Further, Skyworks Solutions Inc (NASDAQ:SWKS) noted that the second half of calendar 2017 should see accelerating growth. "The real big part of our year is the second half of the calendar."

As we noted above, the company sees the mobile world driving technology forward, and that is exactly what Skyworks Solutions wants to see happen.

Back to the company's commentary:

* We are absolutely convinced and have great deal of visibility into the trends around mobile and IoT and where the markets are going.

* A tremendous cast of major, major players that thrive on a mobile economy.

* We're seeing IoT proliferate and we're seeing a Wi-Fi portfolio, our Bluetooth portfolio, our ZigBee portfolio move into more and more end markets and expand our customer set.

* Gross margin came in at 50.4%. That was 20 basis points higher than what we expected and guided to.

We maintain our Spotlight Top Pick status on Skyworks Solutions Inc (NASDAQ:SWKS) and irrespective of the small stock dip after the earnings release, we see growth accelerating -- not just in the second half of the year, but for the next several years.

We still hold to our call when the stock was at $77 -- It's Time to Pay Attention to Skyworks Solutions.

WHY THIS MATTERS

It's finding the technology gems that will turn into the 'next Google,' 'next Apple,' or 'next Amazon,' where we have to get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' is has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at a 80% discount for $19/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author is long shares of Skyworks Solutions Inc (NASDAQ:SWKS).

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if we have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.