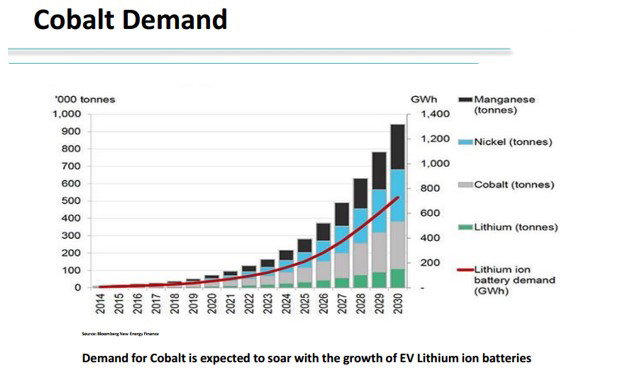

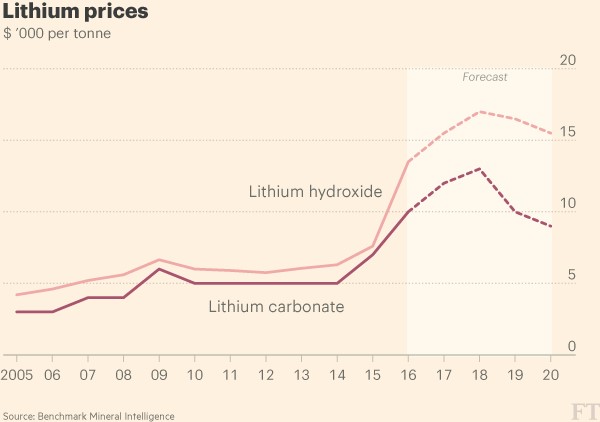

As the need for better and more efficient energy storage increases globally, various lithium ion battery technologies are coming to the forefront. This trend has resulted in significant increases in all energy metals commodity prices over the last five years. Front and centre is the lithium ion battery, and the attendant commodity price growth in both Lithium (Li) and Cobalt (Co).

This demand for Lithium and Cobalt has resulted in an ever-tightening global supply for these energy metals. Goldman Sachs made a claim that "Lithium is the new gasoline." The white and very light metal (lithium) is more like oil, because is not a power source. It is, however, critical to battery power storage while agnostic as to the source, be it solar, wind, water etc.

As well there is a debate (while not exactly raging) from various corners of the investment ring on 'Li or Co?' Also, the best areas and best types of lithium to have, hard rock? Brine? Or just Cobalt. The mind understandably boggles.

Here's a thought; how about getting an investment leg up on other junior companies who are pretty much one trick ponies with main claims to fame being high risk profiles?

"Given the accepted growth of hybrid and electric vehicles and a myriad of other growing electronic applications, the inclusion of lithium and cobalt are enjoying a supply deficit that should increase markedly over the next decade," states Tim Fernback, President and CEO of LiCo Energy Metals (TSX-V: LIC, OTCQB: WCTXF). "LiCo intends to add consistent shareholder value by focusing on the 2 major metals involved in the burgeoning growth of power mediums. As well, we lower exploration and investment risk by exploration and acquisition in politically friendly jurisdictions including lithium in Chile and Nevada and our Teledyne Cobalt Project in Ontario Canada. Management believes that it can first realize production particularly in Chile, the second largest lithium producing country in the world."

The global lithium-ion battery market is projected to grow to US$77.4 billion by 2024 from US$29.7 billion in 2015, according to a 2016 report by Transparency Market Research.

Lithium ion batteries will be the main driver behind increased cobalt demand, according to many other Cobalt producers of battery-grade cobalt salts. Recently Canada's Glencore PLC (LON: GLEN) has purchased the Mutanda Copper-Cobalt mine in the DRC for US$960M.

Fully 45-50 % of cobalt comes from the less than pleasant locale that is the DNC in Africa. Canada is the third largest producer behind China.

LiCo's Teledyne property is located within a historic mining camp that dates to 1903. This was one of the world's largest silver camps in the early 20th century. Historically, an estimated 18,000,000 kg of silver and 14,000,000 kg of cobalt has been produced here.

The previous owner, Teledyne Canada Ltd., completed a diamond drilling program consisting of 6 surface drill holes in 1979. Another 22 holes were drilled from the underground to confirm the previous surface drilling in 1980. Based on the 1979-1980 drilling results, probable and inferred reserves accessible from the current ramp are estimated to be more than 100,000 tons at 0.45% Co. Of note, these probable and inferred reserves were calculated prior to the creation of the current NI 43-101 standard.

The numbers seemingly change daily, but the truth is that daily supply/demand changes will result in significant shortages that already exist for lithium and coming shortly for cobalt—depending on what you read or to whom you speak.

A lot of companies in this unique space are basically simple closeology plays, hoping that a big boy will snap them up before they get their hands dirty.

Flagship Chile

LiCo, on the other hand looks forward to taking its exploration properties—the first being the Purictuka Exploitation Project in Chile— closer to feasibility over the next 12-24 months. Savvy investors will know this is ambitious, but management is confident they can get significant lithium carbonate after a planned NI-43-101 exploration program it hopes to complete within 12 months.

Chile is the number two lithium producer after Australia (12,000 Mt vs 14500 Mt respectively) and boasts impressive infrastructure not found in other South America countries, such as Argentina. Over half of the earth's identified resources of the mineral are found in South America's "lithium triangle", an otherworldly landscape of high-altitude lakes and bright white salt flats that straddles Chile, Argentina and Bolivia.

From the FT: July 2016:

"Under the salar, Chile has enough lithium to supply the world for decades, but government quotas have meant production has barely increased even as demand has risen. SQM, or Soquimich as it's known in Chile, has built over 44 sq. km of evaporation ponds. The company supplies almost all the major battery-material companies, which in turn produce parts for batteries that end up in electric cars. "Lithium you can find anywhere — the difference is how costly it is to take out," says the site's technical manager, Alejandro Bucher. He lists the facilities the company must provide for workers in such a remote location, from a specially built hospital to sunscreen. The company also takes care of the flamingos who roam the outer fringes of the salar; staff know each bird by name, says Bucher."

LiCo is on the threshold of conducting a geophysical survey this week followed by a drilling program on its Salar de Atacama Purickuta property in Chile that will likely give some preliminary figures. While the Company is confident in the likely resource size, they understandably aren't divulging any numbers until post drilling.

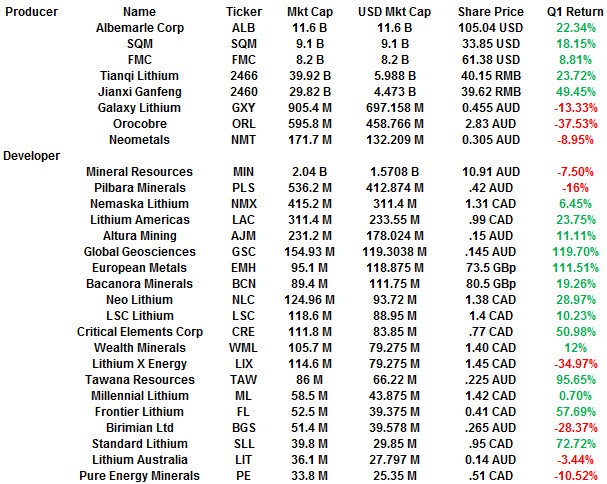

The Purickuta Project consists of 160 hectares and is one of a few "exploitation concessions" granted within the Salar de Atacama, home to approximately 37% of the world's Lithium production. Interestingly, all the Chilean production including behemoths Albermarle and SQM collectively produce over 62,000 tonnes of Lithium Carbonate Equivalent annually and account for 100% of Chile's current lithium output.

CEO Tim Fernback notes; "WE ARE EXCITED ABOUT THE OPPORTUNITY TO EARN A SIGNIFICANT INTEREST IN A LITHIUM CONCESSION LOCATED IN THE WORLD'S MOST PROLIFIC LITHIUM BRINE DEPOSIT, CHILE'S SALAR DE ATACAMA. HAVING TWO LITHIUM GIANTS, SQM AND ALBEMARLE, AS NEIGHBOURS IN THE SALAR GIVES US CONFIDENCE THAT WE WILL BE ABLE TO DEVELOP THIS CONCESSION ALONGSIDE OUR CHILEAN PARTNER, DURUS COPPER, FOR THE BENEFIT OF OUR SHAREHOLDERS."

Mitigating Risk with Quality Assets: Always a Good Thing

Alongside Chile and Canada, LiCo has two significant early stage properties in Nevada; Dixie Valley and Black Rock. The former yields seven characteristics of Lithium Brine deposits outlined in the USGS deposit model; however very little exploration work has been directed at lithium in this area. The lithium target model for Dixie Valley is a Clayton Valley style playa brine type deposit.

At Black Rock, the geologic setting combined with the presence of lithium in both active geothermal fluids and surface salts within the Black Rock Desert property match characteristics of lithium brine deposits at Clayton Valley, Nevada and in South America. Recent exploration results are highly encouraging and warrant a detailed exploration drilling for a Clayton Valley type brine deposit.

The Company is actively looking for more properties as well as potential partners. LiCo has no debt and sufficient monies to fund its initial work in Chile and the Teledyne Colbalt project, as well as to meet its public company corporate expenses. As results are known, it will embark on aggressive fund raising to bring Purickuta Property to a positive feasibility stage and carry out further development of the properties they are exploring in the very mining friendly locations of Nevada (lithium) and Canada (cobalt).

Conclusion

As the new world order unfolds and we move to the next generation(s) of power sources there is little doubt that growth is imminent and likely consistent. That said, the speculative end of the market will remain volatile and while properties are important for both lithium and cobalt, it will be the companies that keep an eye on costs (read low CAPEX and OPEX) as well as diversify holdings both in type of metal and geographic location. LiCo sits in the unique position of being in exactly that situation and intends to apply its expertise to add more properties and deals in this sector.

LiCo's compelling mix of metals, locations and money all result in an attractive risk-mitigating approach. That said it will still participate significantly in what could well be impressive growth. The execution of that plan makes for potent investment potential.

LiCo Energy Metals TSXV: LIC Mkt Cap C$14.6 Share Price C$0.14

Competitors:

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Although mining exploration is risky, LiCo Energy Metals reduces risk by having four projects, all of which are in prolific and mining friendly jurisdictions in Canada, US and Chile. Baystreet.ca has been compensated four thousand dollars for its efforts in presenting the LIC profile on its web site and distributing it to its database of subscribers as well as other services. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.