There is no commodity as essential and yet unknown as zinc, a metal that plays a central role in everything from infrastructure to military technology and even health care. But zinc will soon come out of the shadows, as a serious supply deficit looms and demand continues to grow.

The last two years have seen several millionaire-maker metals breakout, with both lithium and cobalt experiencing unprecedented growth. Now it is zinc's turn to enter a super-cycle, and the similarities cannot be ignored.

And it's not just that supply is low and stockpiles are diminishing—it's that demand is set to soar.

Major miners have been shuttering production and taking tons of zinc offline because prices were depressed between 2008 and 2015. But 2016 was an entirely different story. We burned through the stockpiles, and the mines remain shuttered, and some of them depleted.

Now it's a game of finding new supply, but the demand surge is at our doorstep.

Already in 2016 zinc smelting demand outpaced mine production, and end use demand outpaced smelting production and mine production combined. This is the beginning of the raging bull market.

China is going through record amounts of zinc, and American plans to spend a billion on infrastructure and military defense build-ups mean that zinc—though it's been used for ages—is more than ever our most vital go-to metal.

Against this fantastic backdrop for one of the tightest supply equations we're likely to see in coming years, here are our top 5 picks for zinc miners today:

#1 Hecla Mining (NYSE:HL)

This one is a bit of a dramatic story. This stock shot up 6% when the company showed a whopping 1300% jump in Q1 profits, which saw net income rise to $16.73 million, up from $1.17 million in the first quarter of 2016. Helca beat analysts' expectations by a long shot.

And this was all despite a strike at Helca's Lucky Friday Mine in North Idaho, that was still ongoing when the stocks shot up on Q1 results, so we can expect a further catalyst in the form of NOT bad news. Overall, the company was realizing higher prices for silver, lead and zinc. Oh, and Helca isn't just sitting back and waiting for the strike to end: It's using that time to make infrastructural improvements underground.

#2 Zinc One (TSX-V:Z; OTC:ZZZOF)

One of the cheapest and easiest ways to get in on the ground floor of the zinc boom is through this junior explorer, which has just completed an acquisition in Peru that gives it one of the highest-grade zinc deposits in the world. And it's got near term exploration and production potential.

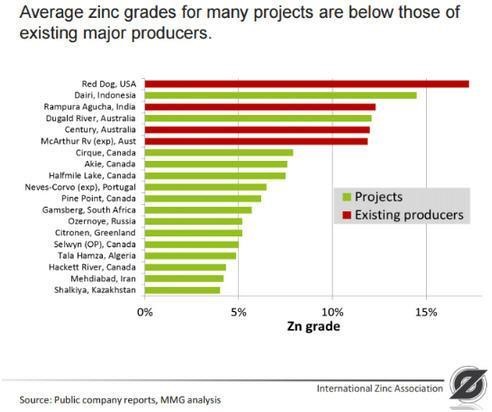

Their flagship project—Bongara--is remarkable because it not only has one of the highest grade deposits of zinc in the world, but it's right on the surface. We're looking at a zinc grade that is over 20%.

Bongara has significant exploration potential along some 2 kilometers strike length. Previous drilling and trenching suggests there is the potential for this mineralization to continue for double the length, which could add substantial size to the project.

Zinc One also has a secondary project right next door--the Charlotte Bongará Project with the same exceptional high grades of zinc.

What we like here is the deposit is on surface and the risk is low as the deposit was already in production. Going by previous production, recovery rates are greater than 90%, and the deposit sits on surface. Even better, the previous owner has already laid the ground work.

Advanced permitting is already underway and, in late July or August, Zinc One plans to carry out an extensive drill program to confirm the high grade near surface zinc oxide mineralization and provide the necessary information to complete a mineral resource estimate by year end. Upon completion of a favorable mineral resource estimate, Zinc One (TSX-V:Z; OTC:ZZZOF) will focus on moving forward a Preliminary Economic Assessment.

What we also really like here is a likely heavy volume of news flow. We expect to hear a lot of catalysts on this one in the coming days and weeks, and this is bound to boost valuation nicely. With all of these factors this one's already set up to move fast.

#3 Endeavor Silver (NYSE:EXK) (TSX:EDR)

We're going to with the counterintuitive on this one. There's been a major sell-off of Endeavor shares recently, causing it to drop 25%. The overreaction to poor Q42016 results, though, is going to bottom out, and this stock is likely to start climbing back up, so it's probably a prime time to get in on what is otherwise a solid company.

Endeavor operates three silver-gold mines in Mexico, but it's also got three attractive development projects. Production has dropped and all-in sustaining costs have risen, leading to a negative cash flow. We think the market overreacted on a quarter, and should have been more patient: After all, this company has consistently beat guidance. It's also significantly reduced its debt, so it's future is anything but bleak.

By 2018, with development in the pipeline, this stock might be prohibitively expensive again because there is plenty of near-term growth potential here. It's also got further upside with zinc and should get a boost in this coming bull market. Catalysts include positive reserve estimates for its fifth mine, the Terronera silver/gold project in Mexico's Jalisco state.

#4 Newmont Mining (NYSE:NEM)

Newmont Mining approved three new projects in 1Q17 and upgraded its long-term guidance as a result. The giant has reduced its net debt to $1.7 billion and it's sitting on $2.9 billion in cash, so the year is looking quite good. The only thing holding it back is the fact that Barrick and GoldCorp stole the show up until now, but Newmont is catching up nicely and should not be overlooked.

It has definitely been a strong year for Newmont, up over 32% in the past 12 months, though there's still room to improve on this. Share prices are still down from their highs, but climbing—which makes it a good game to get it on. Catalysts include some solid African expansion projects. But we're also keeping a close eye on Newmont's revival in the Yukon.

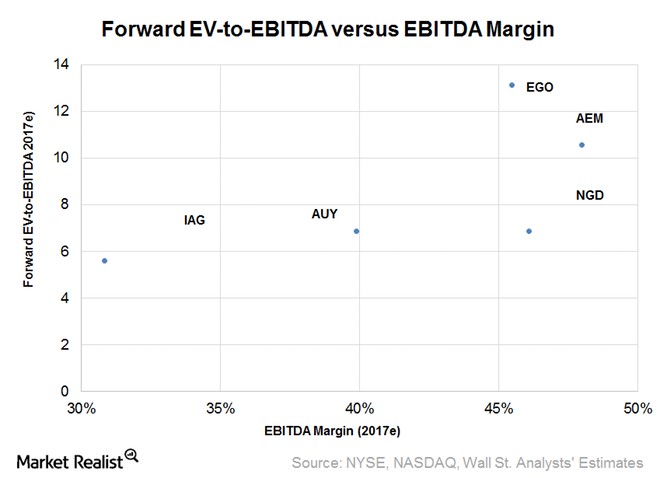

#5 Eldorado Gold (NYSE:EGO)

Eldorado operates two gold-producing mines in Turkey, an iron ore mine in Brazil and a silver-lead-zinc mine in Greece. It's fairly diverse in terms of terrain, but it's also got a solid balance sheet and zero net debt according to its Q1 earnings. Overall, this is a financially healthy company that is a good bet for investors who have more aversion to risk. There is a bit of safety in the liquidity here. If commodities take a turn for the worse, Eldorado can brave the bad weather.

While Q1 production might have been a bit disappointing—coming in just under analyst expectations, all-in sustaining costs have lowered, and it's making clear and steady progress at all of its developments, so this should be considered a nice handful of catalysts coming through the pipeline.

Ultimately, the rewards might not be as high with Eldorado, but the risk is easier to stomach.

Honorable Mentions

- California Resources Corporation (NYSE:CRC): What we like most here is that this company has maintained return on investment for the last 12 months at 6.61, beating even the Reuters industry average.

- Teck Resources (NYSE:TECK) (TSX:TECK): Zinc hasn't been Teck's best friend of late, but that looks set to change in the medium term, as supply continue to dwindle and as we hear news that the world's top producer of the metal—Glencore—isn't planning to bring shuttered mines back online. Supply will remain tight. Keep in mind this, though: Teck's Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there's been a 23% drop in production at its Red Dog mine due to lower grades of zinc.

- Pretium Resources (NYSE:PVG) (TSX:PVG): Major catalyst on this one as the British Columbia Brucejack mine is ready to launch operations just two years after getting the environmental green light.

- Silver Wheaton (NYSE:SLW): This stock offers great exposure to precious metals as the largest streaming company in the world.

- First Majestic Silver (TSX:FR): There's a lot of bullishness around this stock, with earnings growth expected to be high over the next 3-5 years.

- Royal Nickel (RNX): While investor attention is about to refocus on zinc, it's possible that nickel is being overlooked, and while this stock has been a recent top decliner, if nickel demand growth is overlooked, it could be a cheap play to get in on right now.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.