PREFACE

The market has a new-found volatility and that means the trusted long-only strategies may start to fail more often.

But, for the investor that is interested in turning a profit with some homework, this new found volatility does mark an opportunity for several stocks with options, and in this case study we look at Workday Inc (NYSE:WDAY) in depth, and then Google and Amazon to reinforce the learning.

This is an evergreen approach that can be used, when appropriate -- don't get too distracted by a case study.

JOINING THE ELITE

Simply buying near-the-money options and selling further out-of-the-money options is a trade that looks for market volatility. It has a fancy name, "Iron Condor." The elite funds hope that just the name will scare you off.

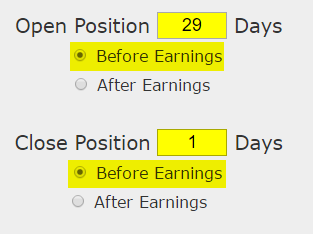

If we did it in Workday Inc, it would have been a disaster. Here are the results over the last 3-years:

Yep -- a 50% loss over three-years while the stock was soaring.

But there is a much smarter way to approach this and it's easiest seen with a stock chart. What we're looking at below is a 2-year stock chart for Workday Inc, with the earnings dates highlighted by the blue "E" icon, and circled.

What we can see, totally irrespective of the earnings move, is that the month before earnings, the stock tends to trade with volatility.

We can see that with the yellow arrows drawn in the month before each earnings announcement. Take the time to study that chart for a little while -- it's simple and reinforces the idea behind this hedge: stock gymnastics the month before earnings.

Now, we don't care if the stock goes up or down, what we care about is that the stock does something. Watch what happens to our iron condor option strategy when we only trade the month before earnings.

Here's the set-up, to be perfectly clear what we're testing:

And here are the results:

Go to this back-test

That 50% losing trade, when we isolate it to just the month before earnings, now returned 92.8%. Yes, that is a total and utter reversal of the original approach and for the record, the stock itself is only up 29% in those three-years.

The first attempt we checked is what everyone else is doing. The second approach is what the top 0.1% are doing.

GOOGLE AND AMAZON

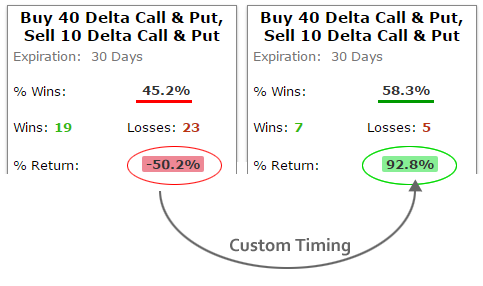

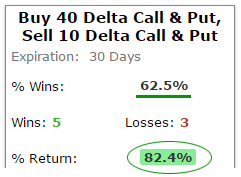

We have more to discuss with this approach, but to motivate this beyond just Workday, here are the 3-year results for Alphabet Inc (GOOGL) and Amazon.com Inc (AMZN).

Alphabet Inc (NASDAQ:GOOGL)

Amazon.com Inc (NASDAQ:AMZN)

Now, onward...

CONSISTENCY

Here is how this pre-earnings iron condor has done over the last two-years:

Go to this back-test

That's a 82.4% return, with 5 wining trades and 3 losing trades.

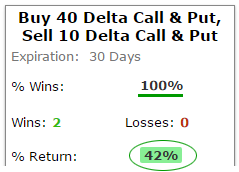

For completeness, here are the results over the last six-months, which is really just two earnings announcements, one-month before each, for a total of two-months of trading:

Go to this back-test

Now we see a 42% return in just two-months of trading, with the last two pre-earnings trades both winning.

WHAT HAPPENED

You have now seen the realities of option trading. The wealthiest and most successful funds and algos get ahead by using intelligence like this. If you have the desire to do it as well, then you too can find the patterns that drive profits and make option trading less about luck, and more about knowledge.

And, if weird names like "iron condors" feel a bit out of your comfort zone, that's OK, this type of intelligence even works for covered calls and much less complex ideas. To learn more, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.