Written by Ophir Gottlieb

This is a snippet from a CML Pro dossier published on June 8th, 2107.

LEDE

Today we are adding Oclaro Inc (NASDAQ:OCLR) to our 'Companies to Watch' list, with an eye on adding it to Top Picks if the company can execute and address the risks we will discuss below.

THE THEMES

As always, before we discuss any company, we first discuss the themes and markets it is pursuing.

DATA AND BANDWIDTH

Oclaro fits into a very similar space as another Spotlight Top Pick for CML Pro, and that means we start with data, speed, bandwidth, and the cloud.

Demand for bandwidth and low latency in the core network continues to explode, with video services, cloud computing, voice over IP and social media driving more network traffic.

As the company puts it, with the explosive growth of internet traffic, the amount of data generated in a single day has reached exabyte levels (1 exabyte = 1 billion gigabytes). Today, billions of dollars are invested annually by data service providers as well as other enterprises for building data centers to store and process unprecedented volumes of data known as "Big Data."

Borrowing from our dossiers surrounding two of our Spotlight Top Picks, this is how we try make the revolution that is data explosion feel like something understandable.

A revolution has been brewing in the Telecom and Datacom worlds. That revolution is speed. The speed at which data and telecom can move – to our homes, to the cloud for enterprises, from our IoT gadgets, for our streaming video and for the world's data to build artificial intelligence.

The cloud is, generally speaking, just a cluster of computers and hardware sharing resources to power the Internet, apps, video, IoT and anything else that is connected and has data. I always search for the best way to demonstrate the explosion that is coming in data.

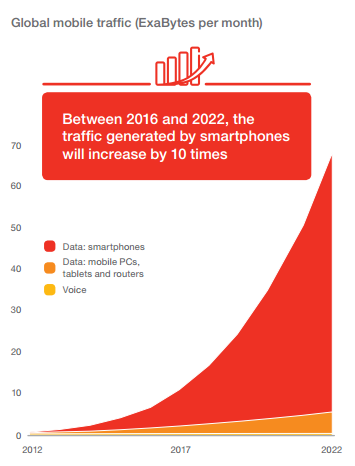

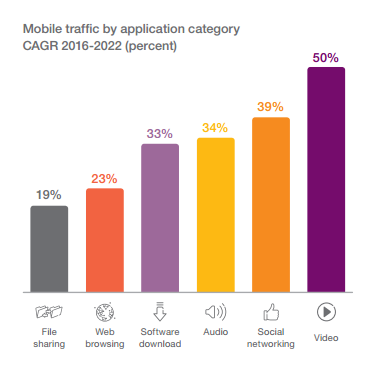

Here's a chart that illustrates traffic growth on mobile alone:

Source: Ericsson Mobility Report

The growth in traffic increasing 1,000% in six years. But here's how that translates into data.

In 2012 the Library of Congress estimated that all printed, audio, and video material came in at 3 to 20 petabytes. That means that one exabyte could hold a hundred thousand times the printed, audio and video material, or 500 to 3000 times all content of the Library of Congress.

By 2021, global traffic alone will generate 49 exabytes… per month.

That means that data that is the size of 14,700,000% of all the printed, audio and video material of all-time will be generated in a month on just mobile devices. Yeah, that's just mobile and every month. And if we take that even further out, to say, 2025, the numbers reach billions of percent a day.

This is the guts of technology and there will be winners.

More Data

Those words and that chart are hardly enough to encapsulate the data revolution, so we go further.

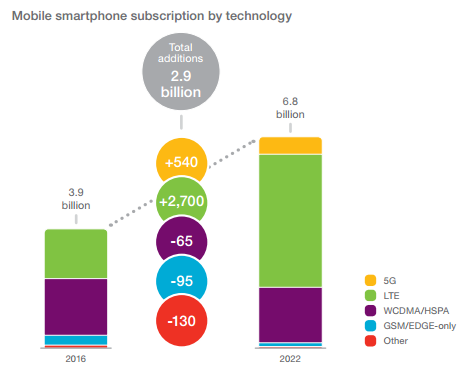

Now we turn more broadly to mobile smartphone subscription growth projections:

Source: Ericsson Mobility Report

I know this seems like it flies in the face of everything you've read from the main stream media, but, the main stream media often has no idea what it's talking about. In fact, it's that reality that likely led you to CML Pro.

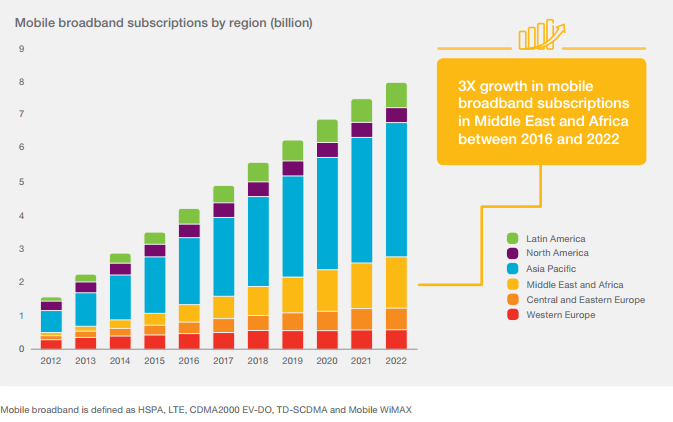

So, to be clear, projections call for nearly 75% growth in mobile subscriptions within six-years. Another easy way to look at this is to simply go year-by-year and examine mobile broadband subscriptions by region, by year:

Source: Ericsson Mobility Report

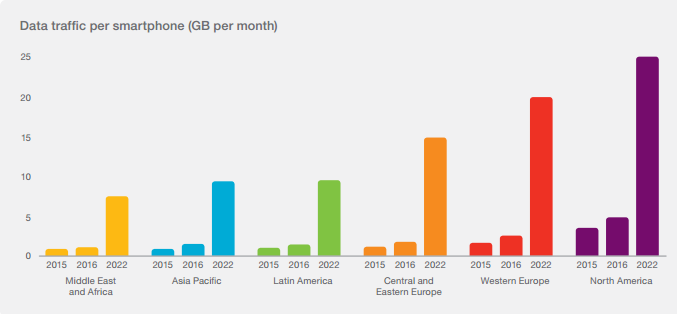

More broadband mobile subscriptions mean more mobile devices and more mobile data usage. Check out this next chart for data usage per smartphone:

Source: Ericsson Mobility Report

Keep in mind, that is per smartphone, so it's not just data consumption rising due to more subscriptions, but rather each subscription in and of itself is going to show massive growth.

Further, projections tell us that 80% of all our content consumption by 2020 will be video.

Source: Ericsson Mobility Report

That is 50% year-over-year compounded annual growth for six straight years for video data traffic. That translates into over 1,100% growth in six years. All of this information we just looked at is predicated on something very big — it is the next generation (often time called 'G') of mobile networks.

Alright, this is what we mean by "Big Data" and the data revolution. Now let's talk about how this data gets processed.

PROCESSING BIG DATA: THE CLOUD AND SPEED

Again, we turn to Oclaro's publications for much of this:

Processing Big Data requires the massive parallelism of Cloud Computing, where the computation core is the network of servers in a data center. A "Mega" Data Center can house over 100,000 servers, all of which are inter-linked to function as a flexible, parallel computation engine.

To realize efficient and powerful computing, interconnects between servers and switches must operate continuously at high speeds (40G-100G); negligible latency; low power; and over long distances. These features must be realized in a highly reliable, low cost product.

Optical fiber interconnects are the only way to meet such requirements. Oclaro has developed the world-leading InP optical devices technology that enables high speed optical interconnects.

The company's vertically integrated transceivers are a critical piece of the modern data center infrastructure and continue to give the edge needed by both cloud service providers and general enterprises to succeed in the age of Big Data.

This is the world we are living in with Oclaro, now let's talk abut the company.

OCLARO

Oclaro Inc is a provider of optical components, modules and subsystems for the core optical transport, service provider, enterprise and data center markets. The Company provides various solutions for optical networks and interconnects driving the next wave of streaming video, cloud computing, application virtualization and other bandwidth-intensive and high-speed applications.

Before we turn to detailed successes, failures and risks, we can start with the financials and how two charts have turned this into a CML Pro company to watch, and two other charts are equally important.

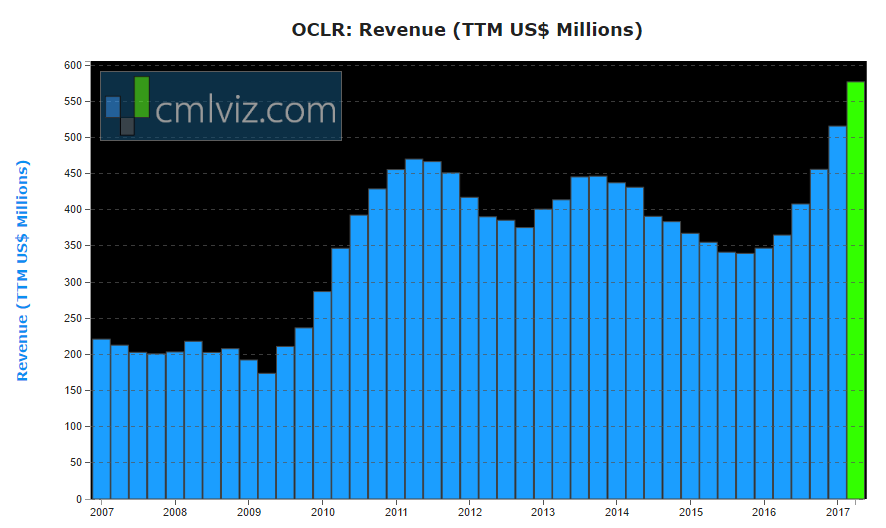

We start with revenue (TTM):

Revenue (TTM) has increased for seven consecutive quarters which triggers a "trend." Revenue has now reached $577 million compared to last year when it was $365 million, which is a 58.1% one‑year change.

But, this is not one of the two charts that compelled us to discuss the company.

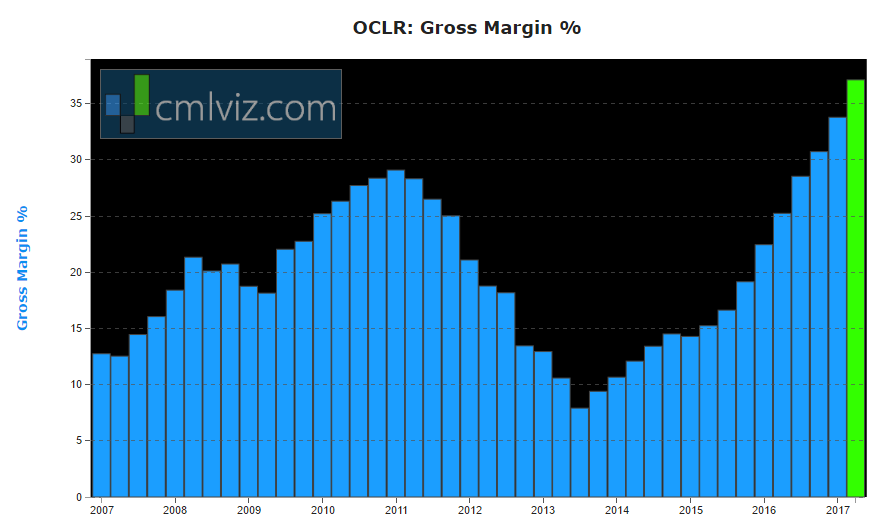

Next we turn to gross margin%.

Gross margin % for OCLR is 37.1%, up from 25.2% last year, which is a 47% one‑year rise. When dealing with companies that have hardware and services, we pay special attention to gross margins. If the measure is decreasing, we're looking at a company with weakening pricing strength – that means competition is coming.

With Oclaro, we see the opposite. We'll discuss why this is happening in the rest of this dossier. But, this too is not one of the charts that compelled us to write about the company today.

Why Now?

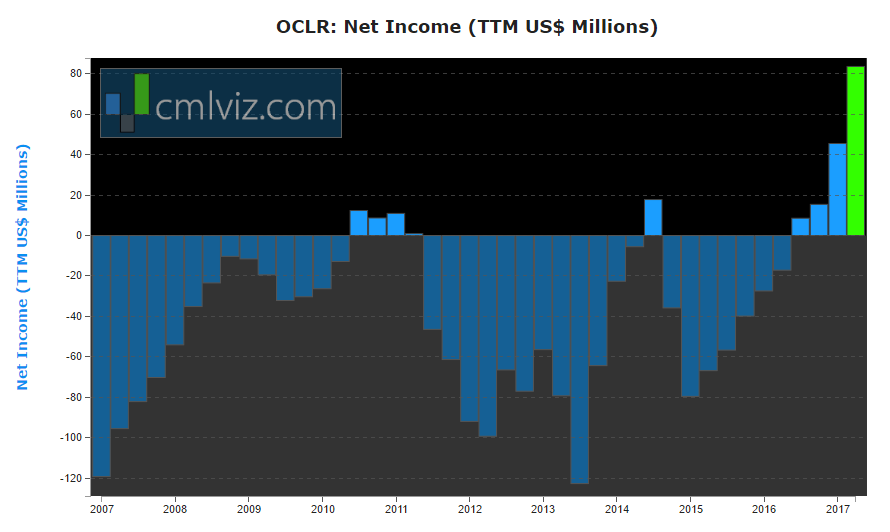

These are the two "why now" charts. We start with net income (TTM) , which is a fancy way of saying after tax profit:

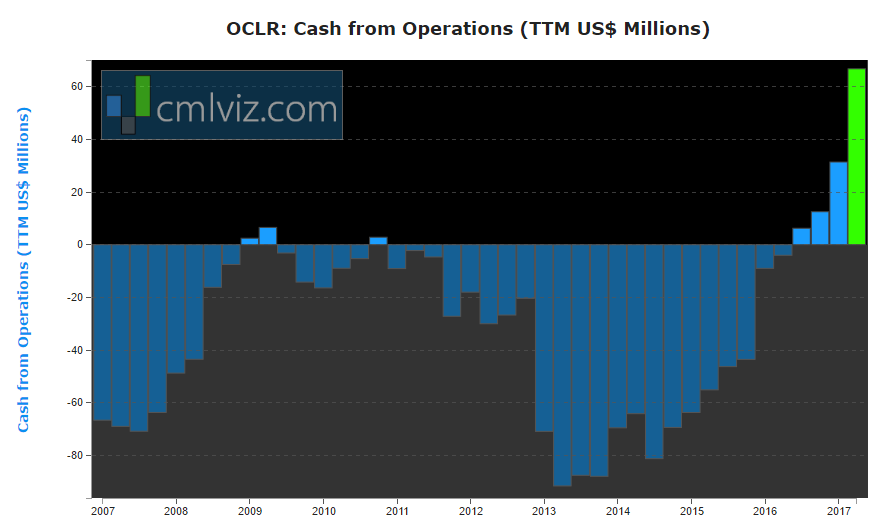

Net Income for Oclaro is now $83.7 – that is up from a $17 million loss. Yes, the company is now turning a profit. And, on the heels of net income, we watch cash from operations:

Cash from Operations (TTM US$ Millions) for OCLR is $66.8 million. Last year it was a negative $4 million. Yes, the company is now cash flow positive as well.

Those last two-charts are the "why now," and now we can take a deep dive into Oclaro – beyond some financial charts and talks about a thematic push.

OCLARO - THE DETAILS

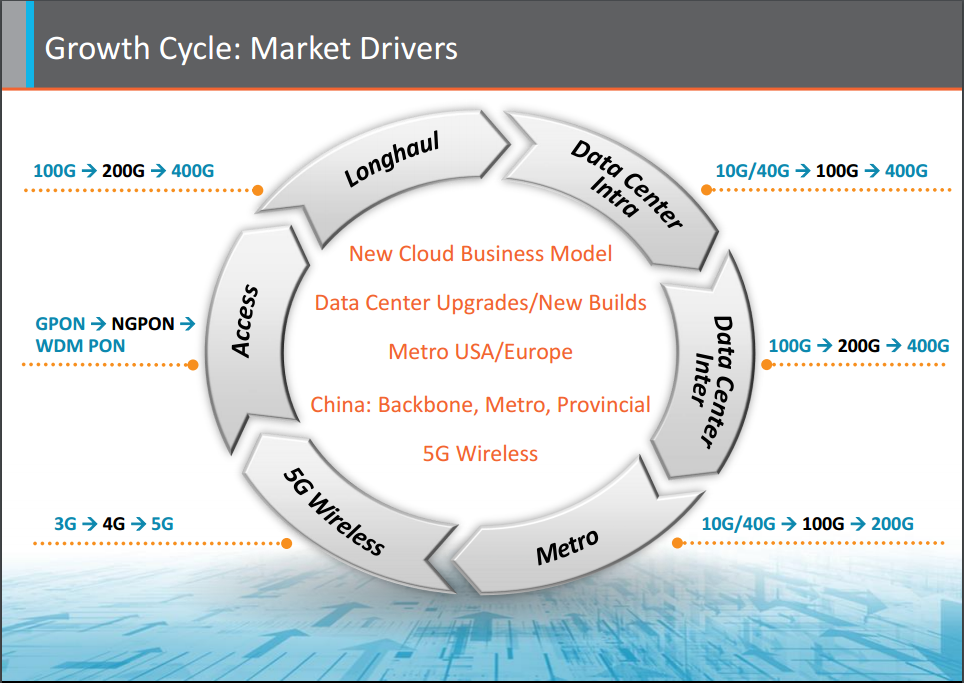

We will start with the growth cycle market drivers, as set out by the company:

In the center of that wheel we see the critical items – cloud, data center, metro, China and 5G.

Let's take these one at a time.

Data Center Interconnect (DCI) Market

Oclaro sees the total addressable market (TAM) growing at 47% compounded annual growth through 2020. That takes a $150M market to over $1 billion. Here is the chart:

Source: Oclaro

With nearly 7-fold growth, there is reason to be bullish.

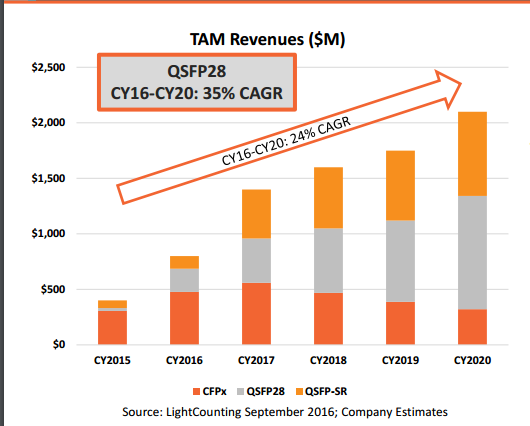

Client Side 100G Market

This gets at speed. Oclaro sees this TAM growing at 24% compounded annual growth. Here is the chart:

Source: Oclaro

This is $400M market going to over $2 billion by 2020 – or a five-fold rise.

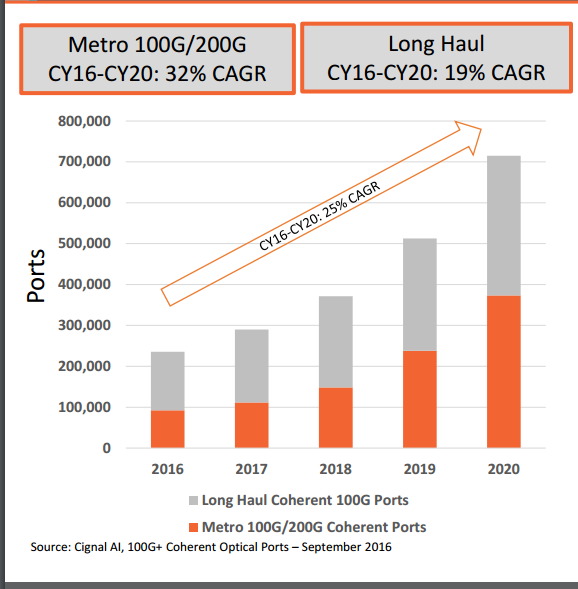

Port Count

Port count gets to the metro and 100G & beyond coherent market. Oclaro sees the TAM growing from 220,000 ports to over 700,000 ports by 2020, or 25% compounded annual growth.

Source: Oclaro

Global network traffic is growing at a rapid pace, fueled by bandwidth hungry applications such as video on demand or the wide use of smartphones. As a leading provider of transport components and solutions, Oclaro enables this growth through innovative high data rate products targeted for the metro and long-haul segments of the transport market.

The company's DWDM product portfolio ranges from 10G all the way to 200G, and includes direct-detect and coherent solutions in various configurations, such as line cards, MSA transponders, pluggable transceivers, and components.

PRODUCTS

All the above had some great charts, and a lot of jargon. This is much easier to understand when we look at Oclaro's product development – what they have and where they are going:

Source: Oclaro

We can see, across the speed spectrum, that Oclaro has products in production and in development to satisfy the bursting needs for speed and data handling.

Now, let's talk about what Makes Oclaro different from its competitors.

DIFFERENTIATION

Oclaro invests its R&D where their technology innovation delivers real value and differentiation for the customers they serve – that's how they put it.

The company's solutions, as we have discussed, are targeted at three distinct, large and growing markets:

* Telecom Optical Networks

* Enterprise Networks

* Data Centers

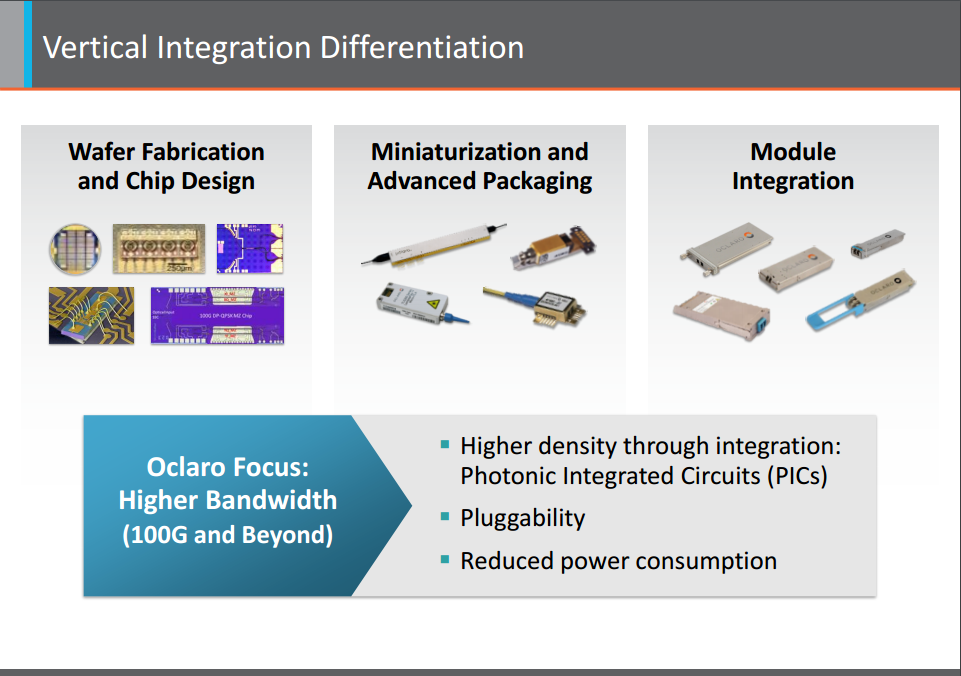

The company's differentiation comes not just from its advanced (and proprietary) technology in these areas, but also from vertical integration.

The integration goes from fabrication and design, to miniaturization and packaging, and finally actual integration.

In the optical network realm, the world is hungry for the bandwidth, speed, reach and flexibility to run new applications such as streaming video, social media, cloud computing and voice over IP. Oclaro supplies optical products at the component, transceiver, and module level, including tunable lasers, receivers, and modulators, that are needed for high-speed transmission, and we are leading the fastest growing 100G segment.

In the enterprise network and data center realm, Oclaro supplies client-side and short reach optical transceivers at 10G, 40G, 100G and, in some cases, less than 10G, into data communications and enterprise solutions.

This, holistically, is the Oclaro story. Now, we must turn to some serious risks.

RISK

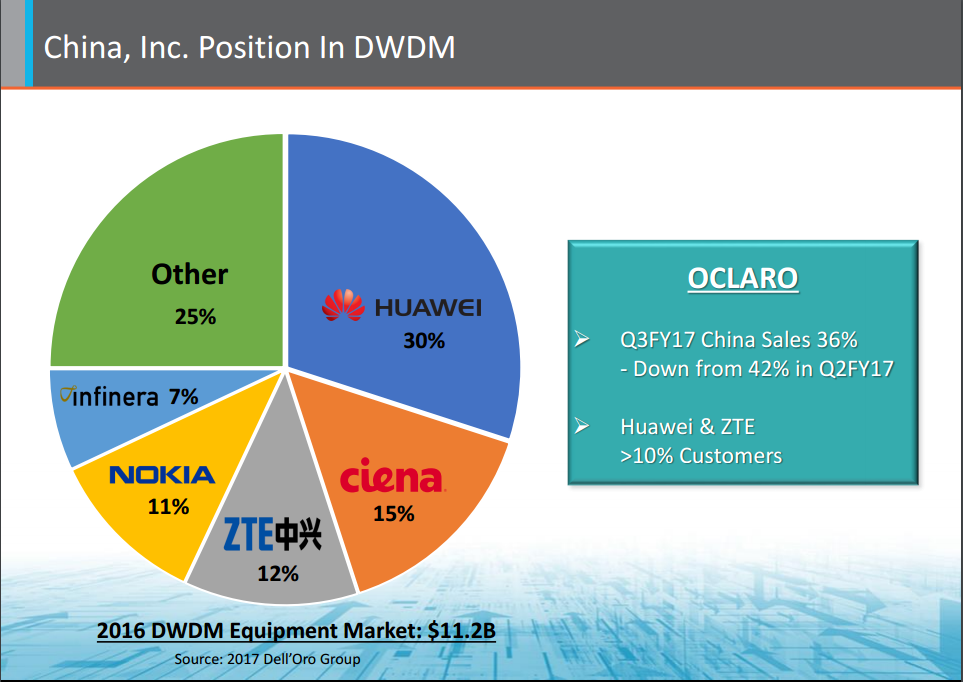

We start with customer risk. Oclaro leans heavily on China's Huawei and ZTE – both are customers that represent more than 10% of revenue. Even further, in the DWDM space, there are only a handful of large players:

This is pretty similar to the cloud world, where Amazon, Microsoft and Alphabet make up the lion's share of cloud platform revenue for the world.

But, for Oclaro, risk goes even further.

RISK: CHINA

Fully 36% of sales came from China in the last quarter, which is down from 42% in the quarter prior, but make no mistake, as China goes, so too goes Oclaro. Even further, ZTE and Huawei announced that they were building up an optical component inventory if the government sanctions Chinese telecom vendors.

Oclaro has this to say about China:

What We See In China

* China market growth rate much slower in CY17 than CY16

* Further compounded by inventory correction

* Currently expect inventory correction to be mostly complete in Q4CY17

* Expect China Mobile 100G coherent award to be released in June/July

* Provincial/Metro network buildouts

* Additional demand projected from China Unicom and China Telecom

But, then there is more risk, specific to Huawei.

Huawei Risk

The New York Time reported that Huawei, Chinese Technology Giant, Is Focus of Widening U.S. Investigation in late April of this year.

Here we go:

American officials are widening their investigation into whether Huawei broke American trade controls on Cuba, Iran, Sudan and Syria, according to an administrative subpoena sent to Huawei and reviewed by The New York Times.

The Treasury's inquiry follows a subpoena sent to Huawei last summer from the United States Department of Commerce, which carries out sanctions and also oversees exports of technology that can have military as well as civilian uses.

As of now, Huawei has not been accused of wrongdoing, but anything bad that happens to Huawei is bad news for Oclaro. There is similar trouble for ZTE. So, we live in a world where the two largest customers for Oclaro are under scrutiny and that means there is a potential black swan news event out there. It's low probability, it's a non-trivial possibility, and if news breaks, this stock could get crushed.

The other argument is, and should be, that if Oclaro's business is strong, the wild market swings that could come from weird U.S. court cases aren't a long-term risk – they are an intermediate-term risk.

SHAREHOLDERS

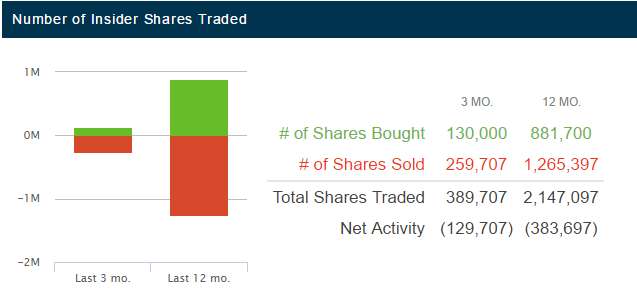

The company's insiders have neither been selling nor buying in one direction, rather there has been both:

While 11.92% shares are held by insiders and 5% owners, "only" 46.00% of shares are held by Institutional & Mutual Fund Owners.

SEEING THE FUTURE

It's understanding technology that gets us an edge, and then finding the gems that can turn into the 'next Apple,' or 'next Amazon,' where we must get ahead of the curve. This is what CML Pro does.

Each company in our 'Top Picks' has been selected as a future crown jewel of technology. Market correction or not, recession or not, the growth in these areas is a near certainty.

The precious few thematic top picks for 2017, research dossiers, and alerts are available for a limited time at an 80% discount for $19/mo. Join Us: Discover the undiscovered companies that will power technology's future.

Thanks for reading, friends.

The author has no position in Oclaro Inc.

Please read the legal disclaimers below and as always, remember, CML Pro does not make recommendations or solicitations for the sale or purchase of any security ever. We are not licensed to do so, and wouldn't do it even if we were. We share research and provide you the power to be knowledgeable to make your own decisions.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories ("The Company") does not engage in rendering any legal or professional services by placing these general informational materials on this website.