Written by Ophir Gottlieb

LEDE

Red Hat Inc (NYSE:RHT) just beat earnings and the stock is ripping to new all-time highs, but the real opportunity with options wasn't earnings -- it's right after earnings.

The Trade After Earnings

Selling a put spread every month in a stock that is rising, in hindsight, obviously looks like a great idea. But, there is a lot of risk in that trade, namely, the risk of an abrupt stock drop and a market sell-off that takes all stocks with it. So, we want to reduce the risk while not affecting the returns.

One of our go to trade set-ups starts by asking the question if trading every month is worth it -- is it profitable -- is it worth the risk? There's an action plan that measures this exactly, and the results are powerful not just for Red Hat Inc, but for Apple Inc (NASDAQ:AAPL), Facebook Inc (NASDAQ:FB) and Alphabet Inc (NASDAQ:GOOGL) as well.

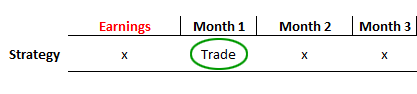

Let's test the idea of selling a put spread only in the month after earnings. Here's what we mean:

Our idea here is that after earnings are reported, and after the stock does all of its gymnastics, up or down, that two-days following the earnings move and for the next month, the stock is then in a quiet period.

If it gapped down -- that gap is over. If it beat earnings, the downside move is already likely muted. Here is the set-up:

More explicitly, the rules are:

Rules

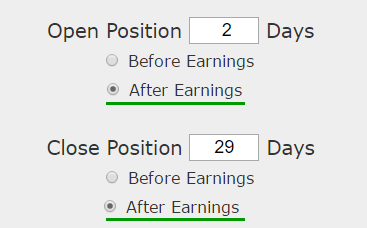

* Open short put spread 2-days after earnings.

* Close short put spread 29-days later.

* Use the option that is closest to but greater than 40-days away from expiration.

And here are the results of implementing this much finer strategy:

Tap Here to See the Actual Back-test

We see a 29.4% winner that only traded the month following earnings and took no risk at all other times. The trade has won 7 of the last 8 times, or a 87.5% win-rate.

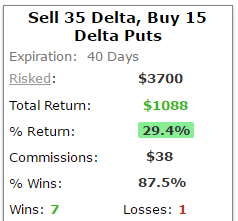

Here is how the strategy has done over the last year:

Back-test Link

It turns out the return is really coming from a streak of wins in the last year. We see a 47.5% return, winning each of the last four earning cycles. That 47.5% return is based on just 4-months of trading, so it's more than 160% in annualized returns.

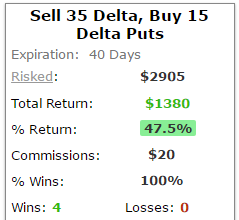

Here's what we see over the last six-months:

Back-test Link

Now we see a 28.9% return over the last two earnings cycles, winning both times.

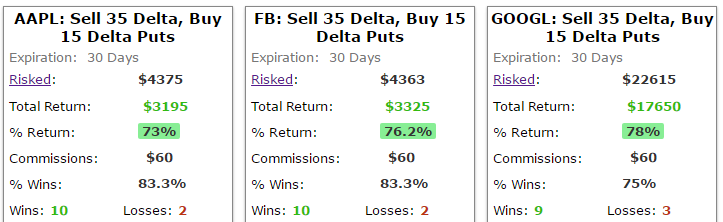

As an aside, this logic of finding the month of lowest risk to sell put spreads also worked remarkably well and remarkably similarly across the board in Apple Inc, Facebook Inc and Alphabet Inc.

Back-test Link

WHAT HAPPENED

This is it. This is just one of the ways people profit from the option market -- optimize returns and reduce risk. To see how to do this for any stock and for any strategy, including covered calls, with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Red Hat Inc as of this writing.