A large canyon separates Elon Musk's dream of converting all drivers to electric vehicles (EVs).

The lithium supply gap.

Last week, CNN reported a "severe" shortfall of battery packs, made with new technologies on new production lines. Tesla Motors (NASDAQ: TSLA) needs a steady stream of lithium in order to meet its growing line of orders.

The timing came in conjunction of the happy announcement of the delivery of increasingly affordable Tesla Model 3, expected to hit roads later this month.

In order to meet the demand growth, Tesla knows the lithium gap must be bridged—and fast.

EV demand is rising in many places of the world, including Norway, where more than a third of all new cars are either fully electric or plug-in hybrids.

Though there is lithium production in the United States already, there isn't much of it.

The supply needed to bridge the gap is likely to come from Chile and Argentina.

And with Chile's recent internal delays, major lithium producers such as SQM (NYSE: SQM) are shifting focus mostly towards Argentina.

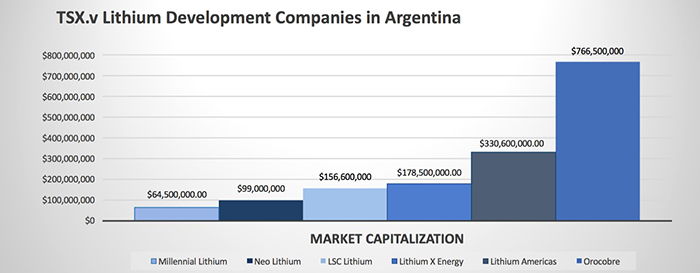

The region has also welcomed in companies on their way to production, such as Lithium Americas (TSX-V: LAC), and those looking to follow in a similar path including Lithium-X (TSX-V: LIX), Neo Lithium (TSX-V: NLC) and Millennial Lithium (TSX-V: ML).

So for lithium investors, this is ground zero for the development of new lithium production.

ARGENTINA'S LITHIUM SECTOR

Despite being the 4th largest lithium producer in the world, Argentina is still playing catch up.

With a major course correction made after the country ousted socialist-leaning former President Cristina Fernández de Kirchner, Argentina has made positive changes to the business climate—in the mining sector in particular.

New(ish) president, Mauricio Macri, has already eased up on the previous regime's self-defeating currency controls, and scrapped export taxes.

With lithium carbonate prices doubling since 2015 due to the supply gap, Argentina has picked a good time to make up for past mistakes.

And it's done so arguably quite well, to the benefit of mining outfits, large and small.

Companies such as Orocobre (TSX: ORL) who already paved the way to commercial production in 2015 on their Olaroz facility, and are now being rewarded with a respectable $766 million market cap.

There are others to follow, such as Lithium Americas (TSX: LAC) (OTC: LACDF), who are set for production on their own Cauchari-Olaroz in late 2019, Lithium X Energy (TSX-V:LIX) (OTC: LIXXF) which is in the Preliminary Economic Assessment phase on their Sal de los Angeles project and Millennial Lithium (TSX-V: ML) (OTC: MLMNF) which is expecting both a inaugural resource estimate and Preliminary Economic Assessment this year.

LITHIUM PASTURES

The literal translation of Pastos Grandes—Millennial's 6,000-hectare flagship property—is "Large Pastures".

But unlike a pasture just used for grazing, Pastos Grandes has some of the best infrastructure in what's known as the Lithium Triangle.

Road access, power, water, natural gas…

Pastos Grandes has accessible points to it all.

More importantly, Pastos Grandes has grade, with sampling completed down to 550 meters, returning brines that yield lithium grades of 400mg/l to 600mg/l.

Some values of the sampling have grade values exceeding 3000mg/l lithium.

And just this week, extended pumping tests confirmed the Pastos Grandes Aquifer's robustness. The flow rates were quite strong.

Overall, it has the markings of a world-class asset.

With a resource estimate due to come in the second half of 2017, it will be interesting to see if Millennial's Pastos Grandes Project garners a similar valuation as that of Lithium X and their Sal de los Angeles Project.

The two projects are only 50km away from each other, on the same N-S trend, each with a very similar grade.

A major difference at the moment being, Lithium X is trading at $170 million market cap, while Millennial Lithium is still trading under $70 million.

HOW ARGENTINA LITHIUM HELPS MUSK AND TESLA

Tesla is set to begin production and shipping of its first mass market electric car—the Model 3.

Even with the opening of its first massive Gigafactory in Nevada earlier this year, Elon Musk admitted production needs to be ramped up, indicating that growth in lithium demand isn't going to slow on his account.

Tesla expressed a company goal of as many as 4 new locations for more "Gigafactories"

But the pressure on lithium supplies forced Musk to change his tune, from the year before when he referred to lithium as the "salt on the salad".

Last month when speaking to Henry Sanderson of Financial Times, Vice-Chairman of Lithium Americas, John Kanellitsas, remarked, "There's a pivot. There's much more consensus on demand; we're no longer even debating demand. We're shifting to supply and whether, as an industry, we can deliver."

According to Goldman Sachs, in a report called "What If I Told You…" from December of 2015, declared:

"We estimate that a 1% increase in battery electric vehicle (BEV) penetration would increase lithium demand by 70,000mt of LCE/year (or roughly half of current global demand for lithium)."

This was more than 18 months prior to Musk's launching of the Model 3.

So the question is, how does that lithium gap get bridged?

A surge in Argentina's lithium sector surely doesn't hurt. Growing demand from the Teslas of the world acts as a wind in the producers' sails.

CLOSING THOUGHTS

Growth in companies seeking lithium in Argentina has been positive for the most part since 2015.

While larger companies such as Lithium Americas and Orocobre lead the way with near-term production, the long game is on the smaller (but not too small) outfits.

In particular Lithium X and Millennial Lithium.

It's important to note that Millennial's recently appointed CEO Farhad Abasov has somewhat of a connection between the two companies.

Abasov was the Executive Chairman of Rodinia Lithium, whose lithium brine assets went on to become Lithium X's flagship project— namely Sal de los Angeles itself.

In fact, Abasov's career is bolstered by multiple successful development stories that led to important acquisitions.

So with a 43-101 Resource due later this year, a PEA soon to follow, and a CEO who sold his last three deals, Millennial Lithium could be an interesting takeout target for a major that's looking to scratch Elon Musk's lithium itch.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated four thousand dollars for its efforts in presenting the ML profile on its web site and distributing it to its database of subscribers as well as other services. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.