LEDE

Wells Fargo & Co (NYSE:WFC) has earnings due out on July 14, 2017 before the market opens. And, just like our prior dossier on JPMorgan, the real opportunity with options isn't earnings -- it's right after earnings -- and we see a trade that has won three straight years without a loss, returning 154%.

The Trade After Earnings

One of our go to trade set-ups starts by asking the question if trading every month is worth it -- is it profitable -- is it worth the risk? There's an action plan that measures this exactly, and the results are powerful not just for Wells Fargo & Co(NYSE:WFC) but also for JPMorgan, where it has won for three straight years without a loss.

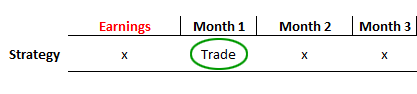

Let's test the idea of selling a put spread only in the month after earnings. Here's what we mean:

Our idea here is that after earnings are reported, and after the stock does all of its gymnastics, up or down, that two-days following the earnings move and for the next month, the stock is then in a quiet period.

If it gapped down -- that gap is over. If it beat earnings, the downside move is already likely muted. Here is the set-up:

More explicitly, the rules are:

Rules

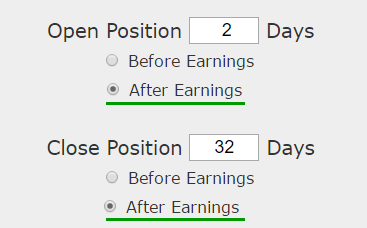

* Open short put spread 2 calendar days after earnings.

* Close short put spread 30 calendar days later.

* Use the option that is closest to but greater than 35-days away from expiration.

We see a 154% winner that only traded the month following earnings and took no risk at all other times. The trade has won all 11 of the last 11 earnings cycles times, or a 100% win-rate.

The results are incredibly consistent, so much so that we need to take a step back and still examine the potential pitfalls here.

NO GUARANTEES

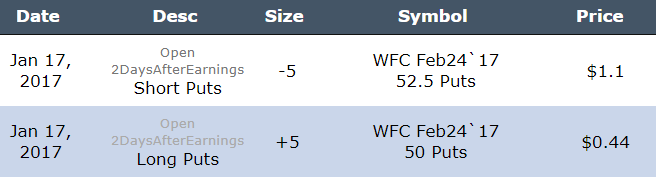

There are no guarantees to this trade, but it does appear to a very high probability investment, but even as such, it does have some drawbacks. If we look at the trade six-months ago in this back-test, we actually tested this trade (January 2017):

That is, selling a 52.5/50 put spread @ $0.56. This trade, as constructed, had a maximum win amount of $0.56 (the credit received), but it had a maximum loss of $1.94, which is the difference in the strikes (52.50 - 50) minus the credit received ($0.56). That means the max gain: max loss ratio was about 1:4.

And yes, the trade worked out well, closing that February for $0.02. But, we do, at the very least, need to be aware of the trade we are examining.

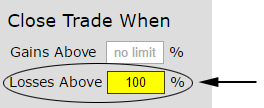

TAKING RISK OFF

One clever way to get that max profit: max loss ratio back to something more manageable, is to put in a stop loss at the exact amount of credit we received. In Trade Machine, the way to test this is to put in a 100% stop loss, like this:

In English, if we took that same trade from January 2017, and put a stop loss in at $1.12 (which is a 100% loss relative to the $0.56 credit), then our max gain would have been $0.56 (the credit) and the max loss would have been $0.56 (the credit - stop).

All of a sudden, we have a 1:1 max gain: max loss trade, and over the last year, which was four post earnings trades, the results are identical to the trade without a stop loss. Not too shabby.

WHAT HAPPENED

This is it. This is just one of the ways people profit from the option market -- optimize returns and reduce risk. To see how to do this for any stock and for any strategy, including covered calls, with just the click of a few buttons, we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

The author has no position in Wells Fargo & Co (NYSE:WFC) as of this writing.