While Tesla and Volkswagen compete for EV buyers, a winner of their battles for customers may be another billion-dollar company that doesn’t even make cars called Facedrive.

That might come as a surprise after the banner year Tesla had in 2020.

In just the last 12 months, Tesla has seen an incredible 503% gain in its stock price.

And they’ve continued to dominate the industry in many parts of the world thanks to their superior battery costs and massive advantage in their cutting-edge software.

Volkswagen has been a late arrival to the EV scene but is quickly working to close the gap with Tesla.

By 2025, VW plan to scale up production to sell more than 2 million electric vehicles and become the second largest software company in all of Europe.

And as they ramp up, experts are now expecting they could just pass Tesla in terms of sales, selling 300,000 more electric vehicles than their competitor in the next few years.

In fact, they’re so set on putting their name behind the EV wave that they even joked recently about changing the name of their US arm to Voltswagen.

The battle for the throne of the EV world has become so contentious that headlines have been popping up non-stop featuring these two industry titans.

The New York Times says, “Volkswagen aims to use its size to head off Tesla.”

CNN reports, “Volkswagen could soon steal Tesla’s crown.”

And Bloomberg says, “If Tesla is the Apple of electric cars, Volkswagen is betting it can be Samsung.”

But it’s possible they’re both operating under a fundamental misunderstanding.

And while it’s hard to believe the electric vehicle craze could slow down after the hot streak the market has had throughout 2020 and into this year, the numbers don’t lie.

That’s because, for the first time in decades, private car ownership numbers are moving in the other direction.

So while Tesla and Volkswagen are ramping up to produce more and more electric vehicles, the number of no-car families is finally on the rise again.

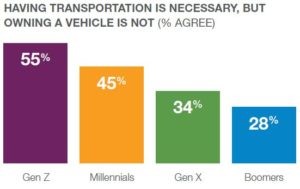

And many are voting that while transportation is still incredibly important in their lives, owning a car isn’t.

This is especially true for millennials and Generation Z, with around half of people in these groups saying they don’t see the need to buy a vehicle of their own.

That’s why Business Insider is calling it Car-pocalypse and reporting, “We’re already in the endgame for cars.”

US News is saying, “Say goodbye to owning your own car.”

And in the Wall Street Journal, author and entrepreneur Tony Seba predicted, “By 2030, [...] only 40% [of all light-duty vehicles] will be individually owned.”

Imagine a world where consumers own less than half of all vehicles on the road. That’s what many experts are expecting we’ll see within the next 10 years.

But who will benefit from the EV war when people don’t actually own cars?

Ridesharing Goes Electric

A major part of the shift away from car ownership is due to the rise of ridesharing and little known Facedrive (TSX.V:FD, OTCMKTS:FDVRF) is uniquely positioned to be one of the biggest beneficiaries of this huge social change.

As taxis are quickly getting swapped out for the more economical, user-friendly Uber model, the ridesharing industry surged ahead and never looked back.

Now Uber and Lyft have amassed multi-billion dollar market caps, despite having some serious issues trying to finally become profitable.

And in the new EV-dominant world, both of these companies are making the shift toward electric slowly but surely.

Lyft has pledged to have an all-electric fleet by the year 2030.

They've made clear that they won't pay drivers to make the switch but will at least help them access incentive funds provided by some outside party.

Uber is in a similar boat, making the same commitment to be 100% electric by 2030.

Their plan is to pay drivers an additional $1.50 per ride if they drive an electric vehicle.

Unfortunately, that added incentive comes at the cost of the rider, as they'll pay an additional surcharge to go green.

But Facedrive (TSX.V:FD, OTCMKTS:FDVRF) has a different plan to help people ride green without spending more in the process.

The eco-friendly rideshare company offers people the choice of riding in an electric vehicle, hybrid or a standard, gas-powered vehicle.

This way riders get the choice to go electric without paying any additional fees for the privilege.

While Uber and Lyft have plans to go green gradually over the next 10 years, it seems obvious that Facedrive could come out ahead as they’ve built this into their business model from day 1.

But ridesharing will only be a portion of the big picture when more decide to give up their keys for good.

New Models of Driving Use

When thinking through your normal daily routine, you'll surely come up with plenty of reasons why ridesharing isn't the cure-all in this EV future.

It may be a great solution for a night out or a ride to a friend's house. But It makes much less sense when you think about hailing a ride to and from work every day.

That's where Steer comes in with their unique model for driving EVs.

While a Tesla may cost you anywhere from $40,000 to $80,000 or more to buy it outright, you can rent a Tesla month-to-month for just a fraction of that through Steer.

It's a first-of-its-kind solution that offers far more flexibility than leasing and with a much smaller commitment as you're not locked into long contracts.

Subscribers just pay a simple monthly subscription fee, just like you would for Netflix or a gym membership...

And they have instant access to their pick of a whole fleet of electric vehicles.

Plus, if they feel like swapping it out for a different vehicle at any point, they have that option whenever they’d like.

This is the best of both worlds for the EV future, as you don't have to hail a ride every time you need to leave the house...

But you also don't need to lock yourself in and commit to owning an electric vehicle for tens of thousands of dollars.

These sorts of creative models are becoming even more popular as the younger generations show they're less interested in owning a car than those before them.

And that's why it's flourished as Steer has gone from the U.S. across the border.

As the service has been so successful in Washington D.C., Steer has now opened up operations in Toronto as well.

That means millions of people in these major metro areas now have the option of borrowing electric if they choose to.

While Tesla and Volkswagen continue to battle over who will sell more electric vehicles, their battle may benefit companies offering other models of ownership.

That’s because Facedrive (TSX.V:FD, OTCMKTS:FDVRF) has a hand in both ridesharing and this new subscription model after acquiring Steer late last year.

In the end, it appears people are still interested in electric vehicles, but the winners may be the companies like Facedrive who deliver them with more flexibility and less up-front costs.

Other ways to play the EV boom:

Maxar Technologies (NYSE:MAXR, TSX:MAXR), though not a car maker at all, is an important company to watch in the coming years. While space firm specializes in satellite and communication technologies, it is also a manufacturer of infrastructure required for in-orbit satellite services, Earth observation and more. So what does Maxar have to do with the transportation industry? Actually, a lot.

One of Maxar’s wholly owned subsidiaries, SSL is a designer and manufacturer of satellites used by government and commercial enterprises. It has pioneered research in electric propulsion systems, lithium-ion power systems and the use of advanced composites on commercial satellites. These innovations are key because they allow satellites to spend more time in orbit, reducing costs and increasing efficiency.

Maxar’s approach to batteries is important for the future. While presently, many people might not be thinking about a trip to the moon, this technology will fuel innovation on Earth, too. And who knows? Maybe your first space flight will be fueled by Maxar, as well!

Magna International (NYSE:MGA, TSX:MG) is an interesting roundabout way get in on the exciting resource and battery markets without betting big on one of the new unproven stocks captivating millennials right now. The six-decade-year-old manufacturing giant provides mobility technology for automakers of all types. From GM and Ford to luxury brands like BMW and Tesla, Magna is a master at striking deals. And it’s clear to see why. The company has the experience and reputation that automakers are looking for.

Over 10 years ago, Magna was already making major moves in the battery market, investing over half a billion dollars in battery production while the market was still in its infancy. At the time, electric vehicles as we know them had barely hit the scene, with Tesla launching its premiere car just two years prior.

Magna’s massive investment has paid if in a big way, however. Since its battery bet, the company has seen its valuation soar by tens of billions of dollars, and it has solidified itself as one of the leaders in the business. With the semiconductor industry in chaos, and another looming lithium and helium shortage, it will be interesting to see how Magna deals with these challenges.

Westport Fuel Systems (NASDAQ:WPRT, TSX:WPRT) isn’t necessarily a resource play, but it is an important company to watch as new fuels and new forms of energy take the spotlight. Especially as the world races to leave behind traditional gasoline and diesel-powered vehicles. That’s because, while it is a manufacturing play at heart, it offers a particularly unique way to gain exposure to the alternative fuels market. As a key manufacturer of the hardware needed to build natural gas and other alternative-fueled cars, Westport is definitely a company to watch in this scene.

Westport Fuel has been making major moves in the market over the past year, and its efforts are finally coming to fruition. Since February 2020, the company has seen its stock price rise by 348%, and with more potential deals like the one it has just sealed with Amazon to provide natural gas-powered trucks to its fleet, the stock has even more room to run in the coming years.

Blackberry Limited (NYSE:BB, TSX:BB) is one of Canada’s tech giants that will play a roundabout role in the EV industry and battery boom. While it has pivoted away from its iconic cell phones of yesteryear, it is still very much involved in pushing the tech industry. It’s even building a global digitized healthcare database leveraging blockchain technology. From its high-profile partnerships with the likes of Amazon and more, to its key posturing in the Internet of Things explosion, BlackBerry has a ton of potential. It even launched a new R&D arm, BlackBerry Advanced Technology Labs. “Today’s cybersecurity industry is rapidly advancing and BlackBerry Labs will operate as its own business unit solely focused on innovating and developing the technologies of tomorrow that will be necessary for our sustained competitive success, from A to Z; Artificial Intelligence to Zero-Trust environments,” explained Charles Eagan, BlackBerry CTO.

Teck Resources Limited (NYSE:TECK, TSX:TECK.B) is an important company to watch as EVs gain traction because it is one of Canada’s largest and most diversified resource companies, with operations across the globe. While its primary mining and mineral development plays focus on steelmaking coal, copper and zinc, Teck also has a major stake in renewable energy ventures. And it’s on the cusp of innovative, and potentially game-changing tech for the battery industry.

In a release on Teck’s website, the company explains some of its new technology: “Flow batteries – such as the zinc-air battery developed by ZincNyx, with its flexible and low-cost scaling, long-term storage properties and the ability to separate the energy storage function from the power generation source – could provide a more efficient alternative for large-scale energy storage.”

By. Natalie Carrick

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This publication contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this publication include that the demand for ride sharing services will grow; that Steer can help change car ownership in favor of subscription services; that Facedrive will be able to expand its subscription EV services; that Facedrive will be able to fund its capital requirements in the near term and long term; and that Facedrive will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that riders are not as attracted to EV rides as expected; that competitors may offer better or cheaper alternatives to the Facedrive businesses; changing governmental laws and policies; the company’s ability to obtain and retain necessary licensing in each geographical area in which it operates; the success of the company’s expansion activities and whether markets justify additional expansion; and the ability of the company to attract drivers who have electric vehicles and hybrid cars. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) own a considerable number of shares of FaceDrive (TSX:FD.V) for investment. This share position in FD.V is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the featured company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns a substantial number of shares of this featured company and therefore has a substantial incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any stock acquisition will or is likely to achieve profits.