NVIDIA Corporation (NASDAQ:NVDA) stock has set the world on fire with its explosive GPU technology but a clever option trade has done very well simply betting that the stock "won't go down very much."

As the stock has risen more than any stock in the S&P 500 last year, we now we find ourselves in a position where, perhaps an aggressive bullish bet isn't appropriate, but given the latest earnings crush, perhaps a bet that it "won't go down that much," is appropriate.

While that sounds tame, the results, when done correctly, are anything but tame -- in fact, they show 240% returns in a year.

A CLEVER OPTIONS STRATEGY

Instead of buying calls in NVIDIA Corporation and betting on a large stock rise, we can look the other direction, and examine selling puts. But, of course, that has a massive risk associated with it. Now, here's how we get around it.

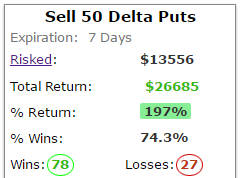

First, selling a weekly at the money put (50 delta) in Nvidia for the last two-years has done very well. Here's the set-up:

And here are the results:

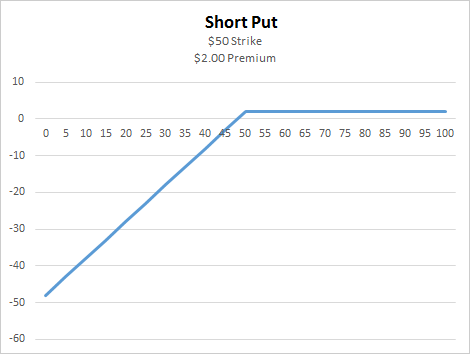

A 197% return with 78 winning trades and 27 losing trades looks pretty nice. But, the elephant in the room is that short puts have a tragically negative downside. This is what the payoff of a normal naked put looks like - a payoff we will not accept.

We can do better than that.

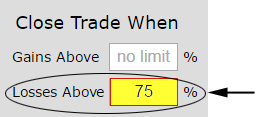

We can take that same strategy in NVIDIA Corporation, but rather than leave an open ended downside risk, we can cap it by putting in a stop loss. In this case, we will put in a stop loss at 75%, meaning that if the short put hits a 75% loss, we buy it back, and wait until the next week to trade.

Here's how we do it:

And here are those results:

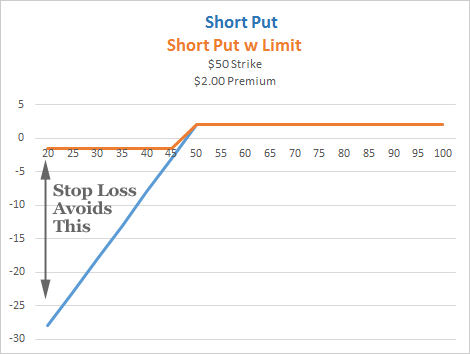

We have just cut the risk of short put off at the knees, and what we find is our return, with less risk, rises from 197% to 232%. Yes, less risk with greater returns.

More broadly, here is what the general payoff of a short put with a stop loss looks like:

We can see how a little preparation, before we ever set a trade, has radical results on the return and the risk. And, for the record, here's how this stop loss shorty put has worked over the last year in NVIDIA Corporation (NASDAQ:NVDA), trading weekly options.

That's 241% return, winning on 75% of the trades, profiting on the stock "not going down." Now this approach goes much further than Nvidia, short puts, and stop losses -- to the very heart of option trading. Winning is on purpose -- it takes a little bit of effort -- for a lot of return -- and it leads to the deeper reality.

THE KEY

The key here is to find edge, optimize it -- in this case by putting in a stop loss -- and then to see if it's been sustained through time. For Visa Inc (NYSE:V) it has, and that makes for a powerful result.

We've just seen an explicit demonstration of the fact that there's a lot less 'luck' and a lot more planning in successful option trading than many people realize. Here is a quick 4-minute demonstration video that will change your option trading life forever: Tap here to see the Trade Machine in action

Thanks for reading, friends.

The author is long shares of NVIDIA Corporation (NASDAQ:NVDA) at the time of this writing.

Risk Disclosure

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.