Written by Ophir Gottlieb

LEDE

If we apply risk controls to a very common option strategy in Advanced Micro Devices Inc (NASDAQ:AMD), we find better returns with less risk.

PREFACE

While Nvidia Corporation (NASDAQ:NVDA) is rightfully garnering all of the headlines for its successes in end-to-end machine learning and artificial intelligence that are driven by its GPU processors, there is a smaller technology company that is competing -- Advanced Micro Devices Inc (NASDAQ:AMD).

While AMD stock has been ripping, there is a risk conscious approach to options that benefits from the stock "not going down a lot," and it has performed exceedingly well.

Advanced Micro Devices Inc (NASDAQ:AMD)

What we're about to look could feel uncomfortable, not in that it's difficult, but rather that's it's this simple -- and it is a glaring example of how the top 0.1% have been dissecting retail traders for decades. But its objective data -- this is how option professionals find the edge they require to keep going.

When trading options we need to answer three critical questions -- what to trade, when to trade and when to close the trade. Here's how knowing the answer to those questions has meant more than 200% returns over the last year in Advanced Micro Devices Inc.

What to trade: Let's examine selling out of the money puts in AMD.

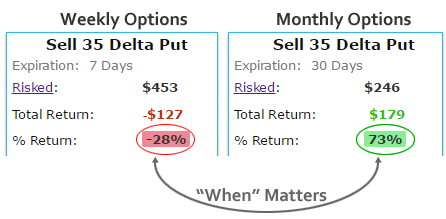

When to trade: Let's now compare examine selling the monthly options versus the weekly options.

It might have felt like a trivial difference -- to trade weekly or monthly options -- but it isn't trivial at all. Selling a weekly out of the money put in AMD over the last two-years has returned -28% while simply switching to the monthly option has returned 73%. But we are just beginning our journey to discovery.

Now that we know the what to trade and the when to trade, we must objectively answer when to close.

Reduce Risk

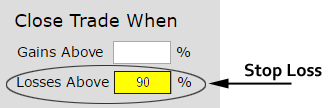

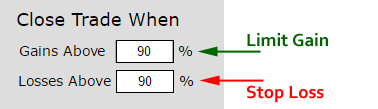

A short put actually has tremendous downside -- so we need to make a risk adjustment to this strategy. While a short put can see a several hundred percent loss in any given trade, we can put a stop loss on each trade to limit that black swan risk. That answers when to exit the downside.

We also need to answer "when to close on the upside." It turns out that if a put was sold for, say $1.00, closing that put out once it goes down to $0.10, has had a large impact on results as well. Here's how we account for both our stop loss and limit gain:

And now, the results:

We have now fully answered the what to trade, when to trade it, and when to close it specifics of our option trades. The final question we need to answer is if this is just luck.

Is This Really Analysis, or Just Luck

Skepticism is natural -- trading isn't a game and that means we have to prove to ourselves that this isn't luck or happen stance.

What we need to do now is look at this short put over various time periods. We see that it has worked over the last two-years, now let's look at the last year:

A 176%% return, when we chop the risk down and close at the right time, has turned into a 202% return over the last year in Advanced Micro Devices, Inc (NASDAQ:AMD).

It's not a magic bullet -- it's just easy access to objective data.

Finally, we look at this short put over the last six-months, these are the results:

While the risk reduction strategy actually didn't help returns, the point is that it didn't really hurt returns -- we are seeing similar reward for far (far) less risk. Yet again, when we have access to objective data, our what to trade, when to trade, and when to close rules have worked.

What Just Happened

If you've made it this far then you recognize that this is how people profit from the option market - it's preparation, not luck.

To see how to do this for any stock or ETF and for any strategy, with just the click of a few buttons, we welcome you to watch this 4-minute demonstration video:

Tap Here to See the Tools at Work

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.