Follow the money and you'll get to gold.

Not even 9/11 managed to create the global tension that we have now. The world is seething, the flames of war in the Middle East are being fanned excessively, North Korea has its finger on the nuclear trigger, and you can cut the tension with a knife. All the while, talk of recession intensifies. This is what gold—our safe haven metal—loves more than anything.

Legendary billionaire investor Warren Buffett, of Berkshire Hathaway Inc., who noted that the U.S. is "less well equipped to handle a financial crisis today than we were in 2008."

One of the world's biggest legends in mining, Canadian billionaire Frank Giustra, is pouncing on gold voraciously, and where his gold money goes, markets tend to follow. Giustra is putting his money where his mouth is—and so far, he's been spot on.

According to Giustra, the worsening political and economic uncertainty on the global stage was going to feed an incredibly bullish gold market--one that could quite possibly surpass the $1900 an ounce mark. So, says Giustra, if you're looking at gold as an investor, you've got to get in now because this window is closing fast.

Here are our 5 top picks for gold right now:

#1 Gold Corp Inc (NYSE:GG)

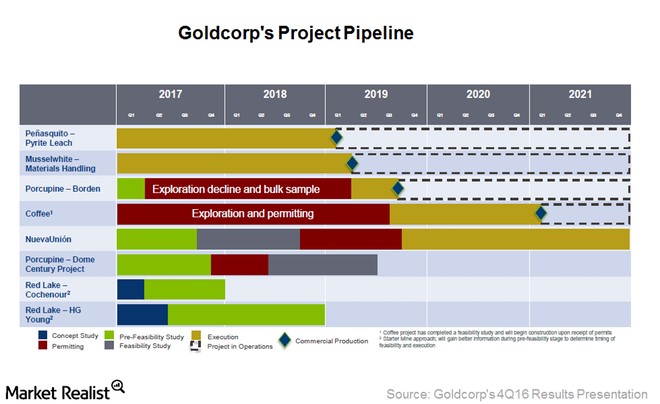

Gold Corp has seen lowering shares for the past three years, but it's now clearly on the rebound, with stocks climbing and management working hard at increasing shareholder value. The company has committed $1 billion to growth in a partnership with Barrick Gold. It expects to see production growth of 20% to 3 million ounces in the next five years.

With this pick, we're looking at some solid exploration catalysts. Most notably, the company saw positive results from drilling at its Cerro Negro project in southern Argentina. This is one of the largest gold mines in the world, with estimated reserves of 5.74 million ounces of gold and nearly 50 million ounces of silver.

It's also seen some other positive forward movement, including the launch of drilling at its Coffee Gold project in Yukon, and exploration progress at the Timmins Camp in Ontario.

And the partnership with Barrick (ABX.TO) in Chile will give it a stake in one of the biggest, most underdeveloped gold plays in the world.

GoldCorp is one of the top three players in the world for precious metals, and last quarter saw the Canadian giant swing into major profits.

#2 Fiore Exploration (TSX:F.V; OTC:FIORF)

This is the junior with the most on the gold scene. Fiore Exploration has been scooping up undervalued, unexplored and underexplored assets in known mining districts with multi-million-ounce deposits.

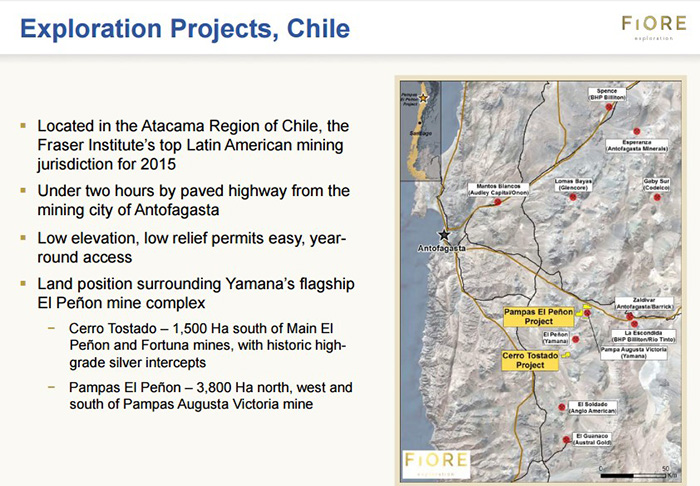

Right now, it has three major projects which surround giant miners and massive producing mines in Chile.

But at the end of the day, this company stands out because it is a junior explorer that has managed to do the impossible: secure highly prospective and massive exploration concessions that are almost always reserved by the major miners.

Fiore has scooped up almost all the best exploration territory surrounding the world-class El Penon gold mine owned by major player Yamana Gold. In fact, Fiore has acquired a massive land package of three separate blocks.

In the industry, 'closeology' is one of the deciding factor of success—and Fiore has it in droves.

Fiore now surrounds this massive mine on three sides, so they've inherited all the infrastructure, and a massive exploration patch in a known money-maker. Additionally, Fiore now has two other highly prospective projects in Chile: the Cerro Tostado—again, flanking Yamana, Anglo American's El Soldado mine and Austral Gold's El Guanaco mine—and Rio Loa, which it acquired in April sitting on Chile's prolific Maricunga belt. Rio Loa is also right next to Gold Field's 3.3-million-ounce Salares Norte discovery.

Fiore (TSX:F.V; OTC:FIORF) is backed by legendary financer Frank Giustra, so it's had no trouble raising the capital needed to drill, and drilling results will be coming in soon.

CEO Tim Warman is a 25-year mining veteran perhaps best known for closing a $1.2-billion deal with Kinross. Warman has a long track record of making multi-million-dollar discoveries and keeping his shareholders very happy, both with Aurelian Resources and Dalradian. In fact, Aurelian sold to Kinross for $1.2 billion, while Dalradian's stock hit a market cap of a couple hundred million dollars.

Kudos to this junior for pulling off a major play, and investors will be keen on the 'Giustra Premium'.

#3 Yamana Gold (YRI.TO)

There's plenty of reason to be bullish on Yamana's long term. This is a leader in the gold segment.

Yamana's El Peñón mine is one of the most prolific gold and silver mines in Latin America, whether we're talking about either size or grade. It's massive, and its high-grade.

El Peñón has produced over 3 million ounces of world-class gold and more than 90 million ounces of silver since it went into production in 2000. Annually, this mine accounts for 18% of Yamana's gold production, and annually it produces nearly 230,000 ounces of gold for the company. And there's still a lot to come: We're still looking at 2.4 million ounces of gold left in the mine, and another 77 million ounces of silver.

One catalyst in particular that we're looking at is the development of the Cerro Moro mine, which is expected to start producing early next year. The forecast is for 80,000 ounces of gold in 2018 and 130,000 ounces in 2019.

We don't give it the number one spot on this list, though because of the dilution of shareholder value. The company has not reduced its debt load as much as Barrick or its other peers.

#4 Newmont Mining (NYSE:NEM)

Newmont Mining approved three new projects in 1Q17 and upgraded its long-term guidance as a result. The giant has reduced its net debt to $1.7 billion and it's sitting on $2.9 billion in cash, so the year is looking quite good. The only thing holding it back is the fact that Barrick and GoldCorp stole the show up until now, but Newmont is catching up nicely and should not be overlooked.

It has definitely been a strong year for Newmont, up over 32% in the past 12 months, though there's still room to improve on this. Share prices are still down from their highs, but climbing—which makes it a good game to get it on.

Catalysts include some solid African expansion projects.

#5 Barrick Gold (NYSE:ABX)

Barrick is a solid long-term play. It's the largest producer in the world, and it's working hard to cut costs. Shareholders don't mind at all because it even raised dividends last year.

Of all the big miners, Barrick has one of the lowest cost structures.

And there are plenty of catalysts even beyond broader gold fundamentals. Word is that Barrick is considering the sale of all or part of its Lagunas Norte mine in Peru, which is potentially worth anywhere from $700 million to $1.4 billion.

As gold climbs, Barrick is extremely well-positioned to make attractive gains.

Honorable Mentions

- Kinross Gold (NYSE:KGC): We've been bearish on Kinross for some time, but it's management is looking to double it mineral reserve estimates by the end of this quarter, and it may be time to turn bullish soon.

- B2 Gold (TSX:BTO): This is the one of the most actively traded companies on the TSX, and its stocks are climbing.

- Alamos Gold Inc. (NYSE:AGI) (TSX:AGI): Alamos Gold, with a market cap of $2.47 billion, is also set to outperform.

- Franco-Nevada Corporation (TSX:FNV): This is a CAD$15.52-billion market cap company. Some investors like the fact that FNV ties returns to the price of gold without risky exposure to direct ownership and operatorship of mines. FNV ended 2016 with a relative bang. But this is a unique case because it doesn't own or operate any mines—so this is for the investor looking for a different kind of exposure to the metals rally: FNV secures precious-metal streams.

- Eldorado Gold (TSX:ELD): With a market cap of US$2.3 billion, this company didn't benefit from the late-2016 rally because of concerns about production and performance of its operations; but it's on track and the price is nice.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Baystreet.ca only and are subject to change without notice. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.