Skepticism may well be a prudent approach when vetting Cannabis stocks. The regulatory environment along with lofty market growth forecasts seem to morph hourly. Some players, truth be told, are just along for the ride; and make it tough for those who know what they are doing.

Others have significant successes already and should garner a decent spot on the startup-focused, investor leader board. It's not about investing well or badly; it's about smart investing in an area that is still very much in flux. That said, there is little doubt the profit potential is more than compelling.

North America cannabis forecasts range, but seem to settle around a market value of $7 billion in 2016 and could see a 25% CAGR to north of $20 billion by 2021.

According to Chuck Rifici, CEO of Cannabis Wheaton Income Corp. (TSXV: CBW): "The model is simple: We provide funding for facility expansions, operations and initial construction in exchange for minority equity interests and a portion of the cultivation production. We provide the platform for growth so our partners can focus on innovation."

He continues; "Our streaming partners have access to our deep strategic and industry relationships to help create value, drive brand awareness and build their customer base. Our collective insights and experiences allow Cannabis Wheaton to provide our streaming partners real-world guidance for every stage of this ever-evolving landscape."

As the CEO and co-founder of Canopy Growth (TSX: WEED OTC: TWMJF) previously Tweed, Rifici along with a team that pioneered the Canadian cannabis market, steered WEED from relative obscurity into a C$1.5 billion powerhouse.

Salient Value Drivers:

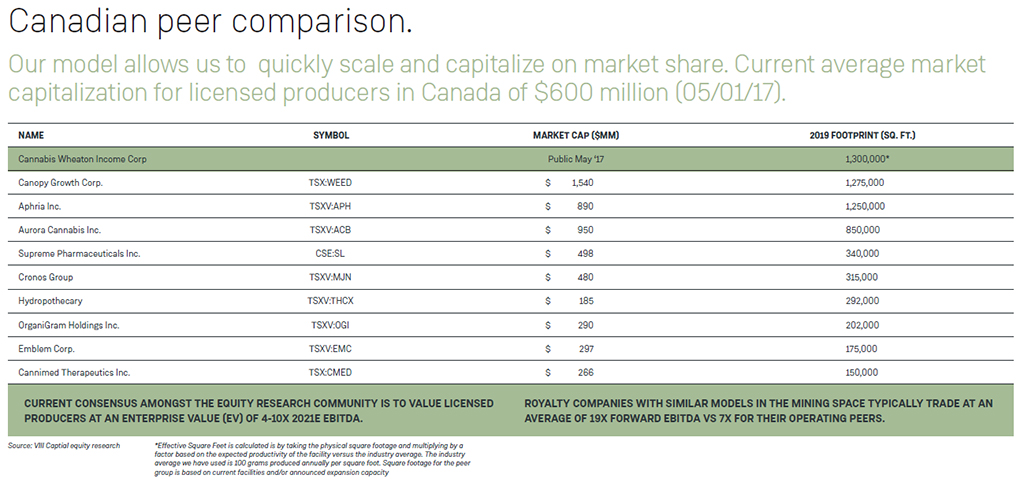

- 1.3 million-plus sq. of future cultivation capacity available

- 14 Streaming partners (either licensed producers or late stage LP applicants) in 6 provinces

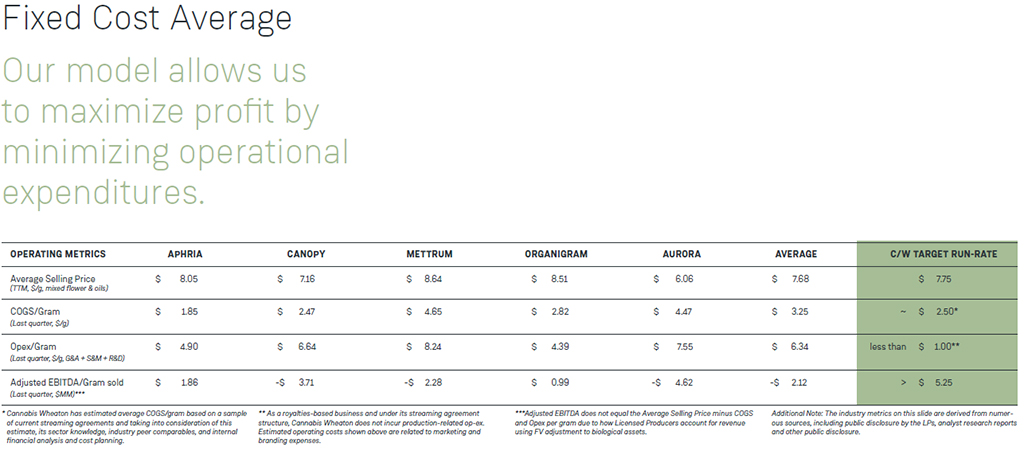

- Projected revenue/gram: $5.25 ($7.75 less $2.50 production cost)

- Coast to coast network to facilitate expedited distribution

- 39K-plus Clinic relationships

- Access to 30k-plus ACMPR patients

- Capitalize on both Medical and Recreational markets

- Multiple streams across Canada with 2018 production >15 MM grams.

- Cannabis Wheaton: single source, through its diverse streaming partners, for the most dynamic range of products and brands

- Delivers alternative and accretive financing to a sector practically devoid of traditional debt financing and dependent on often dilutive equity financing

The management team is comprised of industry first-movers, visionaries and experts dedicated to helping its streaming partners exceed their growth potential and achieve success.

The Company also believes that its business model is leaner, faster and more diversified than anything in the current landscape.

If Cannabis Wheaton had geared up a few years ago, likely it would have proven its business plan at that point. The fact that it has decided to launch now is probably more judicious as the flotsam, jetsam and carpetbaggers have pretty much vapored. Not to say that there won't be any volatility; au contraire, gentle reader.

With Rifici bringing this peerless expertise to Cannabis Wheaton -- being one of the early and enduring winners -- that provenance should position the Company for success as the recreational market speeds toward legalization.

Analogously, once in full sail, even though a public company, Cannabis Wheaton will look for all intents and purposes like an actively managed ETF or Mutual Fund -- without the fees. The diversification and management expertise should mitigate risk and the fact that it is a financier as well as distributor, will ensure its ear stays closely affixed to the proverbial ground; seeing trends and identifying early opportunities.

As with any other commodity, costs are the main determinant coupled with competitive pricing. Quality of cannabis is also a factor, but seems a safe bet that those with the best and/or organic product will come out ahead. Medical usage is such potential it is virtually impossible to quantify.

Once the discussion moves to hemp, CBD's etc., it becomes even more fascinating for investors and the rest of humanity, frankly.

How Does It Work? Who Gets What?

Streaming Partner: Once identified, Cannabis Wheaton could invest $30 million against an equity stake at a valuation of 3x market value. Funds used for 150k sq. facility with Cannabis Wheaton taking 1/3 of the 15k kg of annual production for distribution.

Cannabis Wheaton: Significant equity position participates in growth. Percentage of output at high margin sales adds to the internal rate of return, which the Company calculates at 62%-plus, rising to more than 70% once growth operation fully mature.

(Illustrative example only – results may vary.)

Not Even Close

Here are the three factors that provide significant barriers to entry as well as Cannabis Wheaton's market growth potential:

- Per gram cost

- Comparable Companies

- Management and Advisory

Significant Barriers to Entry

The Company Comparison table below pretty much speaks for itself.

Top Shelf Management

As well, the Cannabis Wheaton Advisory Board is exceptional.

Hugo Alves

Senior corporate and commercial Partner at Bennett Jones LLP.

Alves is Canada's leading advisor in the cannabis industry. He has represented a variety of global industry participants, including licensed producers, licensed producer applicants, licensed dealers, e-commerce platforms, seed-to-sale software developers, design and build firms, patient clinic businesses, equipment manufacturers and distributors, and cannabis branding companies.

Josh Kappel

Partner at the law firm Vicente Sederberg LLC

Mr. Kappel specializes in risk-assessment for multi-national corporations and financial transactions in the highly-regulated U.S. cannabis industry. Mr. Kappel was one of the drafters of Amendment 64 in Colorado which legalized cannabis for all adults.

Mike Lickver

Corporate and Commercial lawyer

Specializes in all aspects of domestic and international commercial transactions. Mike is one of Canada's leading advisors in the Canadian cannabis industry representing a variety of global industry participants.

Karamdeep Nijjar

Partner at iNovia Capital (www.inovia.vc).

Currently manages over $500 million in assets across various vehicles focused on venture stage investments in emerging Digital Services and Platforms. He works closely with both existing portfolio companies and potential future investees to identify and evaluate growth opportunities.

Conclusion

And since you have been patiently wondering why 'Wheaton' in the name? Wheaton River is synonymous with the Yukon Gold Rush of the 19th century. Impress your friends…

Rarely do you see a group of veteran industry individuals with a mandate to deliver exceptional growth in a platform that mitigates risk.

In Cannabis Wheaton's words, get ready for LP 2.0.

Legal Disclaimer/Disclosure: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Baystreet.ca assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Baystreet.ca has been compensated four thousand dollars for its efforts in presenting the CBW article on its web site and distributing it to its database of subscribers as well as other services. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.