Gold prices were already on a tear amid wild pandemic, economic and electoral uncertainty, with big banks predicting $3,000 gold …

Or even $5,000 gold …

Right before Biden’s electoral victory, JPMorgan had called another 5% price hike in a “blue wave”.

Though Trump loves gold and adorns everything with the precious metal, the precious metal itself was banking on a Biden win.

Why? Because what it loves more than anything is the Biden-backed promise of monetary stimulus.

Historically, gold has risen consistently on similar economic packages…

And today is no different.

But the best way to take advantage of a transformative year for gold is at the center of the next major discovery …

Where will the next major gold discovery be?

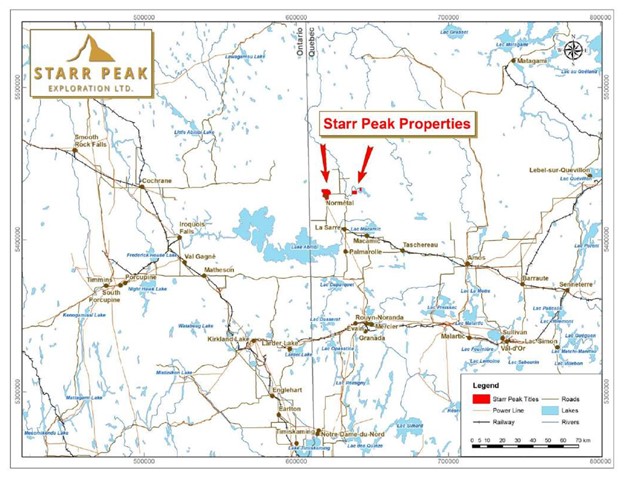

The Canadian province of Quebec has long been renowned as a hotspot for gold seekers across the globe….

But that doesn’t mean its time in the spotlight is over just yet.

Home to 30 major gold-mining venues and 160 exploration projects, Quebec is the undisputed queen of gold.

But even with that title, only 40% of the province’s mineral potential has been tapped into.

That makes it ripe for the next big discovery.

And it isn’t just ripe, it’s already in major new discovery mode.

Amex Exploration Inc has made a monstrous discovery

And the next in line could be Starr Peak Exploration, which hopes to be like Amex’s twin brother after gobbling up the most sought after properties adjacent to their property.

Source: Northerminer.com

In times like these, gold isn’t just a safe haven, it may be a massive opportunity.

And the most rewarding opportunities are often found among the junior mining stocks, which are set to outperform the market in this environment.

But the biggest prize is the junior miner that makes the next huge gold discovery--and it’s sitting on gold that’s likely worth billions more than its market cap.

We recently saw a stunning high-grade gold discovery by Amex Exploration (TSX.V:AMEX) in one of the most prolific venues in the world--Quebec. You missed the massive 7,000% rally on that one.

But another company is gearing up for a repeat, and even some Amex directors and shareholders are piling into it.

The company is Starr Peak Exploration Ltd. (TSX:STE.V; OTC:STRPF) and they are getting ready for a drill campaign right next to Amex’s discovery.

As legendary gold voices predict $3,000 or even $5,000 per ounce prices in our uncertain future, there’s probably no better place to be than on the edge of the next big discovery in a venue that is both prolific and largely untapped.

And there’s not much time left before this news goes mainstream, and Starr Peak’s stock has already gained 600% this year.

Want to Ride the Gold Train? Head to Quebec

Quebec is already home to at least 30 major venues and 160 exploration projects.

Yet, only some 40% of the province’s mineral potential is known today.

The province’s Abitibi Greenstone Belt is where Amex Exploration recently hit very high-grade gold in its Perron Gold Project.

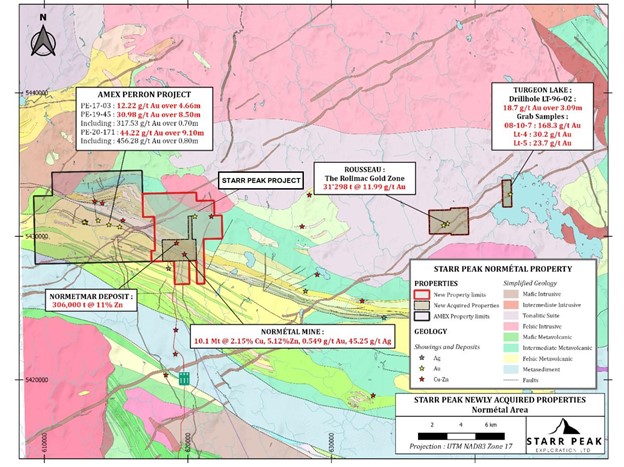

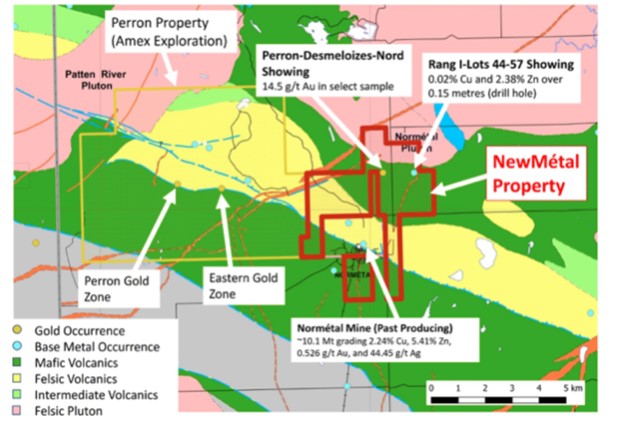

In a perfectly timed move, Starr Peak swooped in and scooped up land adjoining and adjacent to Amex right before the big discovery.

From then on, Starr Peak has been aggressively making acquisitions to expand its position.

Starr Peak didn’t stop there. In what could be considered to be a major coup amongst junior gold companies, Starr Peak was successful in acquiring the past-producing gold mine on the other side. Now, it’s got 74 mining claims on some 2,280 hectares in one of the world’s hottest gold venues.

- The NewMétal Property contains 53 mineral claims covering 1,420 hectares of highly prospective ground adjacent to the AMEX discovery.

- The Normétal Mine is a past-producing mine from which approximately 10.1 million tonnes grading 2.24% Cu, 5.41% Zn, 0.526 g/t Au, and 44.45 g/t Ag were extracted periodically between 1937 and 1975.

- The Normetmar mine shows a historic resource of 306,000 t grading 11% zinc, of which only ~48,000 t has been mined since 1990. It also shows several gold intersections.

- Rousseau is a bloc of 12 claims covering over 470 hectares in the Rollmac gold zone of 31,298 tonnes grading 11.99 g/t Au (historical) …

- Turgeon Lake gives Starr Peak two more claims covering almost 113 hectares with samples at the water line assaying up to 168.3 g/t Au, 30.2 g/t Au and 23.7 g/t Au (GM 52490) and a drill hole assaying 18.7 g/t Au over 3.09 m, including 68.9 g/t Au and 10.48 g/t Ag over 0.4 m. (historical).

From there, it’s easy to follow what could come next:

Right now, Amex is drilling with a vengeance. And it’s drilling closer and closer to Starr Peak’s property line. In fact, Amex is now drilling within 750 meters of Starr Peak’s property line. As they keep drilling towards Starr Peak the grades keep getting higher and thicker.

In other words, Amex is drilling closer and closer to Starr Peak and each time it announces new results, Starr Peak looks like it’s sitting on an even sweeter gold play. That’s why the stock bounces every time Amex makes an announcement.

Fully Funded to Drill

But Starr Peak (TSX:STE.V; OTC:STRPF) isn’t just banking on Amex results here. Far from it. Starr is fully funded to drill. Why? Because the Amex land deal wasn’t just a simple land-grab—it even convinced some Amex directors themselves to jump in on Starr as shareholders.

Right now, Starr Peak is identifying targets.

In August, the company signed on top geological consulting firm Laurentia Exploration--the same firm behind the Amex discovery.

In early September, Starr launched VTEM (Versatile Time Domain Electromagnetic) system surveys on the main block of its NewMétal property. It also launched high-resolution drone mag geophysics surveys over the entire property, including its new plays of Rousseau and Turgeon Lake Gold.

Small-Cap Companies Behind Supermajor Discoveries

After years of cost-cutting, gold miners are now ready to spend, spend, spend on exploration - globally.

But not in the way you would expect …

This isn’t a supermajor game anymore.

Mining majors don’t really explore these days. Instead, they let the junior miners do all the heavy lifting and then buy them up when they make a major discovery, or when they prove it up in the development phase.

That’s why there’s so much upside to junior miners--so much so that Wall Street is expecting them to outperform the market and even short-sellers are now giving them a wide berth.

The upside is found in some very simple math: When you’re a junior miner with a tiny market cap and you make a discovery showing you are sitting on a potentially massive gold discovery, your stock is headed for gains that are out of this world. This is where millionaires are minted in the end.

In this case, we’re looking at a small-cap miner sitting right next to another gold discovery. That miner has moved fast to expand its position in a flanking movement.

And now, Amex--which has already announced high-grade gold discoveries--is drilling closer to Starr Peak, and the winds of discovery could well be blowing in its favor.

Other Companies Looking To Capitalize On The Gold Rally:

Yamana Gold (TSX:YRI)

Yamana, has recently completed its Cerro Moro project in Argentina, giving its investors something major to look out for. The company ramped up its gold production by 20% through 2019 and its silver production by a whopping 200%. Investors can expect a serious increase in free cash flow if precious metal prices remain stable.

Recently, Yamana signed an agreement with Glencore and Goldcorp to develop and operate another Argentinian project, the Agua Rica. Initial analysis suggests the potential for a mine life in excess of 25 years at average annual production of approximately 236,000 tonnes (520 million pounds) of copper-equivalent metal, including the contributions of gold, molybdenum, and silver, for the first 10 years of operation.

The agreement is a major step forward for the Agua Rica region, and all of the miners working on it.

Eldorado Gold Corp. (TSX:ELD) is a mid-cap miner with assets in Europe and Brazil. It has managed to cut cost per ounce significantly in recent years. Though its share price isn’t as high as it once was, Eldorado is well positioned to make significant advancements in the near-term.

In 2018, Eldorado produced over 349,000 ounces of gold, well above its previous expectations, and boosted its production even further in 2019.

Eldorado’s President and CEO, George Burns, stated: “As a result of the team’s hard work in 2018, we are well positioned to grow annual gold production to over 500,000 ounces in 2020. We expect this will allow us to generate significant free cash flow and provide us with the opportunity to consider debt retirement later this year. “

First Majestic Silver (TSX:FR)

Though First Majestic recently took a significant blow, as a strong dollar weighed on precious metals resulting in a poor quarterly earnings report, there’s still a lot of bullishness surrounding the stock. Adding to the negative numbers, however, was a string of highly valuable acquisitions which are likely to turn around for the metals giant in the mid-to-long-term.

While it’s primary focus remains on silver mining, it does hold a number of gold assets, as well. Additionally, silver tends to follow gold’s lead when wider markets begin to look shaky. And with analysts sounding the alarms of a global economic slowdown, both metals are likely to regain popularity among investors.

Wheaton Precious Metals Corp. (TSX:WPM)

Wheaton is a company with its hands in operations all around the world. As one of the largest ‘streaming’ companies on the planet, Wheaton has agreements with 19 operating mines and 9 projects still in development. Its unique business model allows it to leverage price increases in the precious metals sector, as well as provide a quality dividend yield for its investors.

Recently, Wheaton sealed a deal with Hudbay Minerals Inc. relating to its Rosemont project. For an initial payment of $230 million, Wheaton is entitled to 100 percent of payable gold and silver at a price of $450 per ounce and $3.90 per ounce respectively.

Randy Smallwood, Wheaton's President and Chief Executive Officer explained, "With their most recent successful construction of the Constancia mine in Peru, the Hudbay team has proven themselves to be strong and responsible mine developers, and we are excited about the same team moving this project into production. Rosemont is an ideal fit for Wheaton's portfolio of high-quality assets, and when it is in production, should add well over fifty thousand gold equivalent ounces to our already growing production profile."

Pan American Silver (TSX:PAAS)

Pan American is a world-class mining operation with active projects in Mexico, Peru, Canada, Bolivia and Argentina. Though silver has seen better days, it is still a favorite among investors stocking up on safe haven assets.

Recently, Pan American made a major acquisition of Tahoe Resources, absorbing the company’s issued and outstanding shares.

Michael Steinmann, President and Chief Executive Officer of Pan American Silver, said: "The completion of the Arrangement establishes the world's premier silver mining company with an industry-leading portfolio of assets, a robust growth profile and attractive operating margins. We are also now the largest publicly traded silver mining company by free float, offering silver mining investors enhanced scale and liquidity."

By. Shawn Yandell

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements /

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for gold will retain value in future as currently expected, or could rise based on political considerations; that Starr Peak can fulfill all its obligations to acquire its Quebec properties; that Starr Peak’s property can achieve drilling and mining success for gold; that historical geological information and estimations will prove to be accurate or at least very indicative; that high-grade targets exist; and that Starr Peak will be able to carry out its business plans, including timing for drilling. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that politics don’t have nearly the strong effect on gold prices as expected; the Company may not complete all the property purchases for various reasons; it may not be able to finance its intended drilling programs; Starr Peak may not raise sufficient funds to carry out its plans; geological interpretations and technological results based on current data that may change with more detailed information or testing; and despite promise, there may be no commercially viable minerals or ore on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The writer of this article is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.