Artificial intelligence and Blockchains are the two biggest game-changing technology spheres that--even separately--could be bigger than the Internet breakout of the 1990s for investors.

Our future—which is already here—is about maximum automation, algorithmic data and extremely efficient streamlining.

From an artificial intelligence (AI) perspective, it’s about everything from self-driving cars to a possible cure for cancer.

And when it comes to Blockchain, it’s about streamlining absolutely every kind of transaction in the world—from money, which will be crypto currency, to paperwork, which along with middlemen, will probably cease to exist.

It’s all in the ether, and it all cuts across multiple industries.

Artificial intelligence is being advanced for self-driving cars by companies like Tesla Motors (NASDAQ:TSLA), Alphabet (NYSE:GOOGL) and Apple (NYSE:AAPL). It’s also got endless possibilities in healthcare, from algorithms that can process massive amounts of data for enhanced disease diagnosis, to a possible cure for cancer, according to Zeta Global CEO David Steinberg.

Things like Apple’s Siri and Amazon’s Alexa voice assistants are almost family, and are set to advance even further, right along with other smart home innovations.

And while stocks of companies working on AI are surging at the prospects, some working on Blockchain technology are already deep into this game—even if most investors haven’t quite figured out how to get in on it yet.

Blockchain—a record of transactions verified by multiple computers that allows users to make transactions quickly and without middlemen—is being used by the biggest of the big, including IBM and Wal-Mart, and the government is working hard to leverage the same technology for everything from digital passports to all documentation under the sun.

Blockchain technology promises to be the most disruptive market force we’ve seen since in a century. Almost every existing industry could be forever changed by it. It means simplicity, transparency and trust—for everything from … well, everything.

It’s automation and collaboration on steroids, and it’s already transforming every industry from global shipping, prescription drugs and healthcare to automotive, aviation, manufacturing, banking, finance--and even governments.

Here are 5 stocks that are harnessing or pioneering our high-tech future, and impressing investors along the way…

#1 Nvidia (NYSE:NVDA)

Nvidia is the hottest stock on the market right now, and the top performer across the entire S&P 500. This stock has gone in only one direction—up.

NVDA designs graphics processing units for the gaming and professional markets, as well as system on a chip units for the mobile computing and automotive market.

There are a lot of naysayers because this stock is already up to over $190 a share (as of Wednesday afternoon), but there were skeptics when it was much lower and it just keeps climbing. It’s gained over 186 percent over the past year.

Nvidia’s chips are the best out there—at least the fastest. Nvidia’s chips are at the top of the list for artificial intelligence (AI), and they’re used in self-driving vehicle projects and Amazon’s Echo speaker—among many other things. Nvidia’s chips are central to the gaming industry, and it’s expected to report strong gaming segment sales thanks to demand for Nintendo Switch.

This company’s future pipeline is also something to get excited about. In the third quarter, Nvidia is expected to start shipping its next-gen Volta GPU architecture for artificial intelligence. This could extend Nvidia’s lead over others in this hot subspace.

At the same time, this stock is trading at 50 times earnings anticipated over the next year, and growth is expected to slow. But everyone’s know this for some time, and still—the stock continues to climb.

#2 Global Blockchain Technologies (TSX: BLOC.V; OTC: BLKCF)

If you’re tired of missing out on the massive blockchain and cryptocurrency profits that have seen Bitcoin turn a $100-investment into $75 million or Ethereum turn a $100 investment into $94,000 in just two years—Global Blockchain Technologies may just be the investment for you.

This company is on our top list of creative investing because it’s offering something many investors have been waiting for (while they watch profits pass them by): A basket of holdings within the blockchain space, that can add these hotter-than-hot crypto-currency and blockchain companies to any brokerage account.

BLOC just announced trading of the first-ever investment company which plans to provide investors access to a basket of holdings within the blockchain space on the TSX Venture Exchange—so it’s a huge step ahead of Wall Street. It means getting in on this before the next wave of money comes into a blockchain market poised to reach $26 billion by 2025.

Global Blockchain is poised to become the first-ever vertically integrated originator and manager of startup Blockchains and digital currencies, with plans to diversify exposure and remove a lot of the uncertainty by balancing blue-chip companies with the best high-growth potential small-caps.

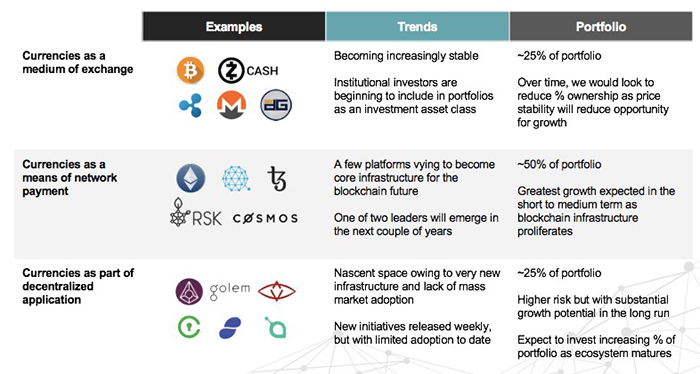

Here are Global Blockchain’s planned investments:

Its business plan incorporates a diverse basket of holdings within the Blockchain space, from $70-billion market cap Bitcoin, Bitcoin Cash ($10 billion), Ethereum ($30 billion) and Ripple ($8.8 billion), to Litecoin ($2.7 billion), IOTA ($2.3 billion), NEM ($2.3 billion), Dash ($2.3 billion, NEO ($2 billion) and Ethereum Classic ($1.4 billion).

However Global Blockchain’s business plan incorporates much more, and there’s nothing else like it that’s public. BLOC plans to set itself apart as a technology company building solutions as an incubator for startup companies based on the token economy. This smart asset allocation has the potential to completely change this space for investors.

That’s because it’s run by some of the most important blockchain and crypto currency pioneers in the world. These are people who have a huge amount of crypto-currency and blockchain experience on the markets. BLOC Chairman and CEO Steve Nerayoff was the creator of Ethereum’s crowsdale which helped lead to its ICO (initial coin offering).

He’s an early leader in the blockchain industry, and there’s a high level of confidence in his pioneering investment and incubator company.

It may be all about getting in early because this is a high-speed market that isn’t waiting for the SEC to figure out coin ETFs. If the SEC approves crypto ETFs, it will likely push digital currencies even higher, with some analysts predicting that as much as $300 million could pour into a bitcoin ETF in its first week, Bloomberg reports. The biggest profits could come between now and then.

#3 Alphabet (NYSE:GOOGL)

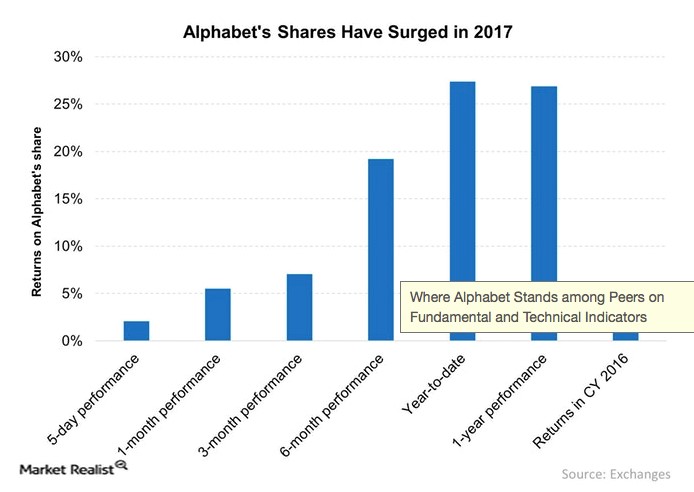

We’re about to get Google’s Q3 fiscal results, in the last week of October, and all indications are that we’re going to see it outperform again. Shares are poised to cross the $1000 threshold for the third time this year.

With Google’s stock up more than 25 percent so far this year, it’s been outperforming NASDAQ, which is up 22 percent.

One word of caution amid the resounding optimism, though: Profit margins are declining, and while many analysts are optimistic that Q3 will be the turnaround quarter, it is possible that Google will come in below the consensus estimate of $8.40 per share.

But keep in mind that Google is in this for the long-haul, and its growth focus is on artificial intelligence and machine learning—which cuts across all of its business efforts. And it’s now planning to expand into healthcare in a much bigger way that Amazon—which wants to sell others’ drugs—can. What Google has in its pipeline is world-changing, and it’s definitely in the driver’s seat.

There’s enough optimism that Credit Suisse analyst Stephen Ju has assigned a $1,350 price target to Alphabet. That’s a 35 percent upside. Google might have been asleep over the summer, but that was likely just the rest for this stock before the fall onslaught.

Just one of many AI catalysts include Google Assistant, which was named “smartest digital assistant this year”, and it looks poised to become the industry leader for voice-based AI—an industry for which revenue is predicted to reach $15.8 billion by 2021.

#4 Square (NYSE:SQ)

FinTech has taken the banking, payment services, digital currencies, investing and insurance industries by storm. That’s why Fintech funding hit $19 billion in 2015—with massive growth sped up by legacy players and their tech partners sitting on the cutting edge of business ideas and major first-mover advantage.

In the first half of this year alone, FinTech companies in the U.S. raised $3.5 billion, according to KPMG. Investors pounced on this scene in droves. And in the U.S. alone, there are more than a dozen Fintech unicorns with valuations over $1 billion.

With a market cap of $9.7 billion, the Square mobile payments processor run by Jack Dorsey, is currently trading for around $31.71, with a 52-week high of $31.85 and a low of $10.88—and it has rewarded its investor this year with outsized returns.

Square is a definitive front-runner in the FinTech space, and its stock has soared an amazing 177 percent over the past year.

Square’s genesis was all about smartphone plug-ins (hardware) targeting food truck vendors and other small businesses that needed an easier way to accept credit cards, or face losing major business. They filled a niche that did not exist and was urgent. Since then, the company has started targeting much larger businesses with an array of services and software—all geared to merchant convenience, which in turn translates into bigger revenues for all parties. They offer everything from loans to food delivery and inventory management software.

This summer, Square opened its first physical store in New York to offer hands-on support for merchants using its technology. It also aims to lure in more merchants with a physical place to more easily showcase what they offer.

Most people associate square with its credit-card reading hardware, but this represents only 5 percent of its revenues. The hardware is just a tool to lure in merchants, and sometimes they even give it away. It’s the software that brings in the money.

This is one of those start-ups major tech personalities wish they had invested in earlier. That goes for LinkedIn co-founder Reid Hoffman, who won big with PayPal, but steered clear of Square because of the ‘minefield’ that was the payments space. He missed out on Square, and regrets it, he recently told CNBC.

#5 Applied Materials (NYSE:AMAT)

Up around 17 percent over the past month, AMAT is one of the top-performing stocks in the tech sector and it’s got strong fundamentals to support this bull run.

Catalysts are mounting, particularly with an inflection-focused innovation strategy driving growth steadily. AMAT is continually advancing its semiconductor and display technology, and now it’s ramped up to 3D NAND, which has boosted its market share attractively. And it’s not just about semiconductors: it’s also gunning for new market opportunities with advanced display tech, like OLED.

It’s also winning market share in China, and nice investments from Chinese manufacturers are pushing this stock higher and higher.

So where does the artificial intelligence come into play? It will provide more opportunities for AMAT’s diversified product line. The amount of computing power and semiconductors/silicon necessary to start meaningfully analyzing all the data being generated in the world is enormous, and AMAT is well-positioned to steel a big chunk of this demand.

AMAT is one of the best back-door plays into AI.

Honorable Mentions

Power Financial Corp (TSX:PWF): Montreal-based Power Financial Corp has been in the finance industry since 1984. The company operates in three segments: Lifeco, IGM and Pargesa Holding SA (Pargesa). And, with its holdings in a diversified portfolio spanning the United States and Europe, Power Financial is a leader in its field.

Focusing its investments in the emerging FinTech industry, Power Financial stands to benefit by riding this wave into the future. The company’s forward-thinking attitude and liberal approach to technology is sure to leave investors satisfied.

We like PWF because it owns 60 percent of Wealthsimple, a leading robo-advisor for investing in ETF portfolios.

Mogo Finance Technology Inc. (TSX:MOGO): This is a new spin on unsecured credit, which is a burgeoning sub-segment of FinTech. Providing loan management, the ability to track spending, stress-free mortgages, and even credit score tracking, Mogo is at the forefront of an online movement to assist users with their financial needs.

Mogo’s software analyzes borrowers instantly and greatly reduces the traditionally cumbersome underwriting process for loans. It’s online only, so there’s very low overhead and a ton of cash to spend on marketing. Labeled as “the Uber of finance” by CNBC, Mogo is definitely turning heads.

With increasing membership growth and revenue lines continuing to improve, and a platform which many banks have failed to offer, Mogo could well become an acquisition target in the near future.

The Descartes Systems Group Inc. (TSX: DSG) (commonly referred to as Descartes) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. The company is making waves in the tech industry with its futuristic products and visionary leadership.

As a key stock in Canada’s tech boom, Descartes Systems is a smart choice for investors. The company has a huge market cap of $2.6-billion and the stock has grown by nearly 20% YTD.

EXFO Inc (TSX:EXF): EXFO isn’t new to the Canadian tech sector. The company was founded in 1985 in Quebec City, and its original products were portable testing products for optical networks. Since then, the company has acquired and build 3G, LTE, protocol, copper/xDSL, IMS, and VoIP test and service assurance products.

Recent developments from EXFO are promising for long term growth potential. The new baseband unit emulation technology which is sure to be adopted on a large scale, as the tech offers operators a reduction of costs and a faster revenue stream.

EXFO Inc is a model in the telecommunications industry. With a market cap of $273-million, EXFO is strong, but still growing.

Kuuhubb Inc. (TSXV: KUU) is a company active in the development and acquisition of lifestyle and mobile video game applications. Its strategy is to create sustainable shareholder value through undervalued, but proven applications with robust long-term growth potential.

The company is headquartered in Helsinki, Finland and operates in both U.S. and Asian markets.

The company has seen its stock increase after a few recent acquisitions and currently trades at $1.60.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable securities laws. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" "intends" or variations of such words or indicates that certain actions, events or results "may", "could", "would", "might" or "will be" taken, "occur" or "be achieved". Forward-looking information includes, but is not limited to the impact of the management and advisor appointments of BLOC.V; BLOC.V's projected asset allocations, business strategy and investment criteria; the size and scope of cryptocurrencies and Initial Coin Offerings ("ICO's"); the rate of cryptocurrency adoption and the resultant effect on the growth of the global cryptocurrency market capitalization; and the risk reduction strategies of BLOC.V. Readers should be aware that BLOC.V has no assets except cash from a recently completed financing and its business plan is purely conceptual in nature: there is no assurance that it will be implemented as set out herein, or at all. Forward-looking information is based on certain factors and assumptions about BLOC.V believed to be reasonable at the time such statements are made, including but not limited to: statements and expectations regarding the ability of BLOC.V to (i) successfully engage senior management with appropriate industry experience and expertise, (ii) gain access to and acquire a basket of cryptocurrency assets and pre-ICO and ICO financings on favorable terms or at all, (iii) successfully create or incubate its own tokens and ICO's, and (iv) execute on future investment and M&A opportunities in the cryptocurrency space; and such other assumptions and factors as set out herein. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of BLOC.V to be materially different from those expressed or implied by such forward-looking information, including but not limited to: risks related to changes in cryptocurrency prices; the estimation of personnel and operating costs; that it will receive required regulatory approvals; the availability of necessary financing; permitting of businesses that it intends to invest in; general global markets and economic conditions; risks associated with uninsurable risks; risks associated with currency fluctuations; competition faced in securing experienced personnel with appropriate industry experience and expertise; risks associated with changes in the financial auditing and corporate governance standards applicable to cryptocurrencies and ICO's; risks related to potential conflicts of interest; the reliance on key personnel; financing, capitalization and liquidity risks including the risk that the financing necessary to fund continued development of BLOC.V's business plan may not be available on satisfactory terms, or at all; the risk of potential dilution through the issuance of additional common shares of BLOC.V; the risk of litigation; and the risk that cybercrime may severely damage the value of any or all of BLOC.V’s investments. There may be many other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. We undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by law. Investors are cautioned against attributing undue certainty to forward-looking statements.

BLOC.V has no assets except cash from a recently closed financing and this article is based on the business plan of BLOC.V which at this point is purely conceptual in nature. There is no assurance that the business plan will be implemented as set out herein, or at all.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by BLOC.V ninety four thousand two hundred fifty US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. If we own any shares we will list the information relevant to the stock and number of shares here. We have been compensated by BLOC.V to conduct investor awareness advertising and marketing for CSE:BLOC.V and OTC:BLKCF. Safehaven.com receives financial compensation to promote public companies. This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non- compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor awareness efforts. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur. Our emails may contain forward looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, it is certainly possible for errors or omissions to take place regarding the profiled company(s), in communications, writing and/or editing.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. The Company is not affiliated with, any specific security. While the Company will not engage in front-running or trading against its own recommendations, The Company and its managers and employees reserve the right to hold possession in certain securities featured in its communications. Such positions will be disclosed AND will not purchase or sell the security for at least two (2) market days after publication.

The opinions expressed in this article are exclusively those of the author and have in no way been approved or endorsed by BLOC.V. This article and the information herein are provided without warranty or liability.

SHARE OWNERSHIP. The owner of Safehaven.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Safehaven.com will not notify the market when it decides to buy more or sell shares of this issuer in the market, but will not trade on material information that has not been disclosed to the public. The owner of Safehaven.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results