Far below the Nevada desert, past ancient mine shafts and rock-strewn caverns, there could be a fortune waiting to be made by one small company.

A fortune in silver.

A mine that inspired the silver rush in the 1880s, that was tapped once more in the 1960s, could again prove a boon to miners using the latest technologies to tap unexplored and unexploited mineral deposits.

It could prove to be a great re-discovery in the history of silver mining.

That’s what Montego Resources (CSE:MY; FRA:4MO1), has unlocked in the Taylor Mine & Mill, a high-grade gold and silver project in eastern Nevada, a region which has produced a bounty of silver and gold for more than one hundred years, and through the use of new technologies and new methods could do so once again.

Montego, a $11 million small market cap miner, could be sitting on as much as $1.2 billion in silver, a figure that could climb higher if silver prices rebound.

Here’s five reasons for investors to tap into Montego’s (CSE:MY; FRA:4MO1) new find:

#1: Big Potential Rewards

The veins uncovered at Taylor hold historic measured and indicated reserves of up to 20 million oz. of silver, worth $278 million at current prices. The mine has historically put out five million oz. of silver and already has $27 million invested from past ventures.

With mining, there’s always a lot of uncertainty. Pits are dug, shafts dropped and fingers crossed as miners hope their capital investments pay off with a rich find.

But with Taylor, there’s less need to worry: the mine has a long history of productivity behind it, and with $27 million already invested Montego may be able to invest only limited capital in before seeing a strong return on their investment.

Montego took over the Taylor Mine from Silver Predator Corp. earlier this year by way of option, and with an $11 million cap, this is a small company standing over a potentially big asset. While Taylor had produced silver and gold in ages past, no one knew how big the remaining deposits were before surveys were conducted in 2014.

Now it’s more clear: Montego (CSE:MY; FRA:4MO1) has up to 20 million oz. of measured and indicated silver under its feet, and that estimation could double to 32 million oz. if the company’s plans pay off, rising as high as 75 million oz if everything they hope for comes true.

That would be $1.2 billion in silver at today’s prices, for a $11 million cap company. To put things in perspective: Alexco, a silver exploration company operating in Yukon, has 68 million oz. of silver with a market cap of $179 million. Going off that market cap valuation metric alone, Montego could be worth $44.7 million.

And with so much already invested in the property, Montego doesn’t need to put huge dollars more into Taylor before it starts to pay off.

#2: New Tech to Unlock Old Silver

Mining at Taylor in the past was of the traditional sort: in the 1880s with shovel and pick, and again in the 1960s with truck and dynamite.

But now, new mining methods used by Montego and other area miners could unlock un-tapped veins of silver and gold, delivering rich rewards for a fraction of the cost.

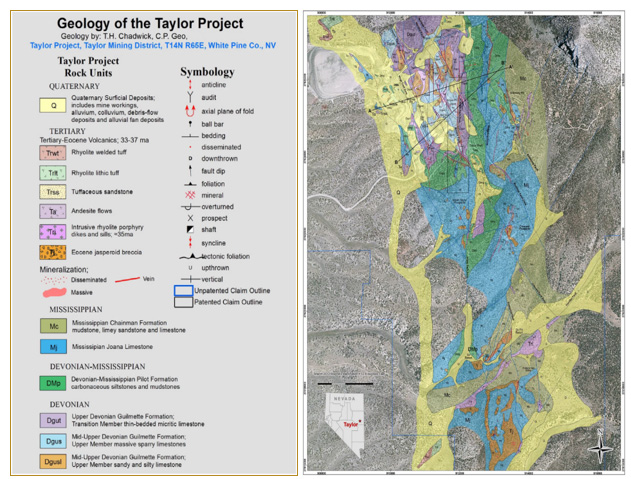

Modern mining utilizes digital mapping of the terrain, images and data collected by drones that can be used to construct 3D models of geologic architecture. Electrical currents run through the ground by sensors more advanced and sensitive than previous technologies, combined with above-ground, gives mineral geologists a clearer picture of what’s under their feet.

Then, it’s time for the robo-drill, a sophisticated and partially automated rig that collects mineral samples for analysis, detailing where the richest veins might be found.

Modern methods are cheaper, with drones capable of surveying immense areas of land in a fraction of the time it used to take surveyors operating from helicopters and spotter planes, and at a fraction of the cost. Technology used to survey underground can do so quicker, and with more reliable results, than in the past.

Miners used to sink pits and hope for the best. Now, companies like Montego can get a clear picture of what’s in store before they even pick up a shovel.

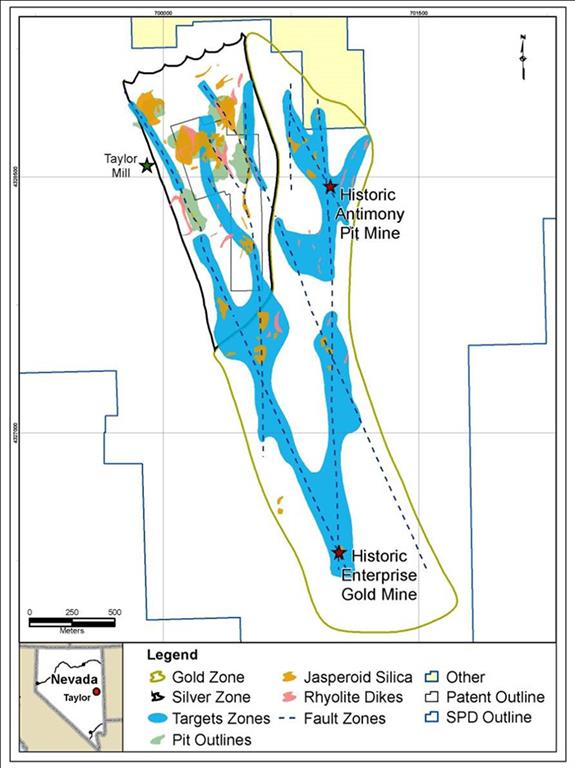

And while the Taylor Mine is primarily a silver find, Montego (CSE:MY; FRA:4MO1) has also decided to exploit the gold discovered in the mix, with 2014 investigations indicating potentially sizable gold deposits along with the immense silver lodes.

With more results coming in and more surveys still to conduct, who knows how much more Montego will find locked away under the Nevada soil.

#3: Managerial Excellence

Montego (CSE:MY; FRA:4MO1) has a leadership team marked with experience, technological savvy and mineral expertise.

Of the company’s three directors, three are experienced geologists well-versed in the twenty-first century methods of mining.

Director Bill Cronk is a professional geologist with more than 25 years in managing exploration projects for precious metals, base metals and uranium. In previous positions he’s worked across the globe for projects in Africa, Europe, North and South America, Alaska and the Canadian Arctic.

Director Chris Pennimpede has more than nine years’ experience in mineral exploration in Canada and the U.S., where he utilized cutting-edge technologies to make rich discoveries in Yukon, Alaska and Nanavut.

Michael Dufresne, the third director, is the president and principal of APEX Geoscience Ltd., and a master of the newest forms of mineral exploration. He’s worked as a consulting geologist for 25 years, and his work has taken him across North America.

These three directors brought their experience and know-how to Kenneth Tollstam and Anthony Jackson, two men who have both had tremendous success in Canadian mining and finance. The opportunity they found at Taylor, which had been previously developed by Silver Predator and was on the market, was too good to pass up.

Combined, the managerial leadership of Montego has raised millions for mining venture across Canada and the United States, while its geological team has made numerous discoveries in base and precious metals.

Suffice to say, the team at Montego should be more than capable of turning the Taylor project into reality, if the economics check out as expected.

#4: Results Imminent

Montego has had several months to cover the Taylor property, utilizing every trick in the miners’ trade book to survey the area. Plus, with millions already sunk into developing the mine by past owners and amid the highly-favorable extractive atmosphere of eastern Nevada, first results on targets from the Taylor property should be imminent.

First, consider the conditions of the mine itself. Taylor has historically produced 5 million oz. of silver. A portion of the open pit silver has been pre-stripped and is now exposed, rendering it highly accessible. Infrastructure has already been built up through the previous $27 million investment.

The mine is located 17 miles south of Ely, Nevada and only 2.5 miles east of US highway 50. That gives Montego excellent access to roads and water sources, which should make it a relatively cheap mine to operate.

The site contains 131 unpatented lodes, 5 unpatented mill sites and 4 patented sites covering 2,166 acres. While the site is expected to yield mostly silver, gold discoveries are expected in the outlying areas.

Since 2013, the site has seen 480 drill holes totaling 92,600 feet of drilling, according to a technical report filed by Silver Predator, who optioned the property to Montego.

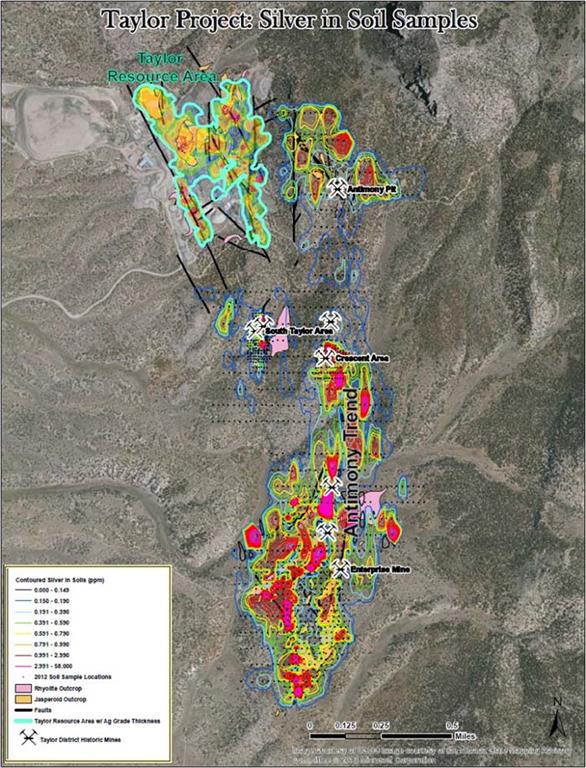

Before that, 119 holes were dug between 2006 and 2009 by Golden Predator and Fury Exploration. All that work has shown that significant deposits are likely available 300-700 feet below the surface based on stratigraphy, with soil samples showing strong signs of both silver and gold in areas of the site.

The immense amount of exploration and survey has allowed Montego to construct a detailed model of the entire site, before having to invest any of its own money to dig further holes.

And while Silver Predator was able to determine the site held up to 20 million oz. of silver, exploration by Montego (CSE:MY; FRA:4MO1) is hoped to turn up much higher projections. Thanks to their sophisticated surveying and exploration methods, Montego is hopeful of finding that there could be as much as 32 million oz., or perhaps even 75 million oz. of silver locked away at Taylor, as well as an undetermined amount of gold, if all the stars align .

All told, Montego with its $11 million cap is sitting on mineral resources that could be worth as much as $1.2 billion at today’s prices, if the CEO’s hopes for 75 million oz. of silver are realized.

The mining environmnet in Nevada is highly favorable, to say the least. The state is strongly in favor of allowing mining and political support for ventures like Taylor at the state and local level is strong. The Taylor project is relatively low risk, given how little needs to be invested to determine whether the mine can be viable, and the superb location makes it an attractive venture for additioanl investment.

Nevada, “the Silver State,” is a big mining state, and Montego is sure to benefit from existing and any possible further tax breaks and incentives from the state’s pro-mining government.

The price of silver, which cratered in 2015, could be poised for a rebound. In 2013 when demand was soaring, the price of silver exceeded $30/oz, and currently it fetches about half that, but if prices recover the discoveries at Taylor will be worth even more.

That’s a powerful reason for investors to take a close look at this oppportunity now, before Montego starts delivering results.

#5: We Should Know Soon

The clock is ticking…

With pits dug, drones and tech ready to survey more ground and equpment poised to start drilling, Montego is hoping to begin producing from the Taylor mine sooner rather than later.

The company has years of prior experience to go on, and it’s sitting on top of a mine that has already proven itself a winner more than once. Furthrmore, a lot of the leg-work has already been done. Previous companies sank $27 million into building up Taylor, and now Montego (CSE:MY; FRA:4MO1) has swooped in hoping to deliver on the mine’s sterling promises.

By utilizing the most avanced mining techniques, the managers of Montego will have the best shot at turning Taylor into the biggest silver play in recent Nevada history.

Honorable Mentions:

Endeavor Silver (TSX:EDR) operates three silver-gold mines in Mexico, but it’s also got three attractive development projects. Production has dropped and all-in sustaining costs have risen, leading to a negative cash flow. But the company has significantly reduced its debt, so it’s future is anything but bleak.

By 2018, with development in the pipeline, this stock might be prohibitively expensive again because there is plenty of near-term growth potential here. It’s also got further upside with zinc and should get a boost in this coming bull market. Catalysts include positive reserve estimates for its fifth mine, the Terronera silver/gold project in Mexico’s Jalisco state.

Pretium Resources (TSX:PVG): This impressive Canadian company is engaged in the acquisition, exploration and development of precious metal resource properties in the Americas. Pretium has an impressive portfolio and if you can catch the stock while the price is right, there could be huge opportunity for upside. Additionally, construction and engineering activities at its top location continue to advance, and commercial production is targeted for this year.

With Pretium’s variety of assets, this mining giant is a key figure in Canada’s resource realm. Investors know a good thing when they see it, and have definitely taken note of this company’s ambitious and forward-looking drive.

Teck Resources (TSX:TECK): Zinc hasn’t been Teck’s best friend of late, but that looks set to change in the medium term, as supply continue to dwindle and as we hear news that the world’s top producer of the metal—Glencore—isn’t planning to bring shuttered mines back online. Supply will remain tight.

Keep in mind this, though: Teck’s Q1 earnings and revenue fell short of expectations because of weaknesses at its zinc unit, sending it shares down about 6% in late April. In particular, there’s been a 23% drop in production at its Red Dog mine due to lower grades of zinc.

Cameco Corporation (TSX:CCO) Cameco is one of the largest global producers and sellers of uranium and nuclear fuel. Its operating uranium properties include the McArthur River/Key Lake, Cigar Lake, and Rabbit Lake properties located in Saskatchewan, Canada; the Inkai property situated in Kazakhstan; the Smith Ranch-Highland property located in Wyoming, the United States; and the Crow Butte property situated in Nebraska.

While many analysts see low uranium prices as a problem for miners, an OPEC like move from world uranium leader Kazakhstan to bump prices could benefit Cameco and its peers.

A strong push towards nuclear power from China, India and the Middle East could create further upside for this promising miner.

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

The company’s auto parts are distributed to heavyweights such as General Motors, Ford, Tesla, BMW, Toyota, Volkswagen and Chrysler. These huge deals provide a safe and steady profit stream for the company. It’s insightful, forward-thinking and smart value/low cost for shareholders.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for silver will retain value in future as currently expected; that Montego can fulfill all its obligations to exercise its Nevada property option; that Montego’s Nevada property can achieve drilling and mining success for silver and gold, and greatly increase the measured and indicated resources of silver and gold; that historical geological information and estimations will prove to be accurate; that high-grade targets exist in untested areas below the resource; that Taylor should be a relatively cheap mine to operate; and that Montego will be able to carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not be able to finance its acquisition of the Taylor mine project or its intended drilling program, aspects or all of the property’s development may not be successful, mining of the silver and gold may not be cost effective, Montego may not raise sufficient funds to carry out its plans, changing costs for mining and processing; increased capital costs; the timing and content of upcoming work programs; geological interpretations and technological results based on current data that may change with more detailed information or testing; potential process methods and mineral recoveries assumptions based on limited test work with further test work may not be viable; the availability of labour, equipment and markets for the products produced; and despite the current expected viability of its projects, that the minerals cannot be economically mined on its properties, or that the required permits to build and operate the envisaged mines cannot be obtained. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Safehaven.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Montego one hundred and twelve thousand five hundred US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Montego to conduct investor awareness advertising and marketing for CSE:MY; FRA:4MO1. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.