The world’s biggest consumer market is in the middle of a major disruption.

The auto industry is about to change in ways few investors fully recognize.

You’ve all heard of autonomous vehicles and electric cars, ride-sharing and ride-hailing. But beyond the headlines, there are hundreds of start-ups preparing products and services that will change the auto industry forever.

New technologies will transform the driving experience. That’s big news for an industry worth approximately $2 trillion. And even the big auto-makers are getting in on the action.

Here are five companies that are making big changes to the automotive industry:

#1 Tesla (NASDAQ: TSLA)

The top name in electric cars had a big year last year.

For the first half of 2017, Tesla stock surged to nearly $400. It has since fallen to $340, though that still gives Tesla a market cap of more than $50 billion. That makes it bigger than the Ford Motor Company.

Tesla’s success is linked to the roll-out of its new Model 3, an electric car designed to be affordable and available for mass production. Tesla CEO Elon Musk has faced some problems in getting the new car off the ground: sales have been slow, with only 1,500 units shipped in the last quarter of 2017. Tesla had estimated 5,000 would be sold, while Wall Street had hoped for at least 2,900.

Musk had tweeted in July 2017 that Tesla would be manufacturing 20,000 Model 3’s per month by December. Instead, Tesla production was only 2,425 units in the last quarter.

Still, 2017 was a banner year for the company, which shipped more than 100,000 units for the first time in its history. While that’s a small figure compared to some (Volkswagen sold 10 million cars in 2016 alone), it’s a sign that a company some have called over-hyped has the potential to become a major producer.

That means it’s earned its high valuation, and could go even higher.

#2 PowerBand Solutions (TSX.V:PBX) (Powerband will start trading on Friday 9th Feb)

A little company with big ambitions, PowerBand Solutions is planning to bring blockchain technology to the auto market and its innovative technology could transform how cars are bought and sold.

The company is using its software and data-management to cut out industry middle men and simplify the automotive auction process, reducing costs and freeing up billions of dollars currently wasted on middlemen in the U.S. every year.

Both the consumer and the dealers stand to win big, thanks to PowerBand’s innovative technology.

With the Livenet auction, the consumer can get more value for their trade, saving the consumer anywhere from $400 to $1000 on the purchase of a new vehicle.

Even more, the company has developed unique software to allow for faster and more streamlined auto purchases, with a plan to integrate blockchain technology to certify vehicle history, financing, mileage, servicing, accidents etc.

It has already lined up partnerships with some of the biggest names in the space, with a total of 125 unique customers having signed on to use PowerBand, giving it a direct sales growth of 15 percent per month since mid-2017.

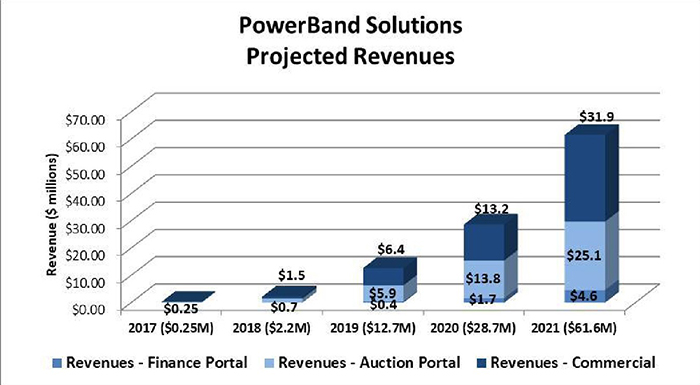

At that rate, Powerband can project sales to increase from $2.2 million in 2018 to $61 million in 2021.

These revenue gains come from the profit generated for its customers through Powerband’s transaction model, but it is also built to provide a gross profit margin for Powerband of up to 69.7 percent. Powerband hopes to expand its revenues by accessing more than 1000 dealers across North America. It’s already finished $8 million in financing to date and doesn’t expect to need much more investment before yielding a positive cash flow.

That means this little company, with a market cap of only $14 million, is projected to earn revenue of $61M by 2021, if Powerband can capture approximately 2 percent of the vehicle auction market.

The auto sales market could be transformed by this technology, marking the end of a slow and expensive process that has been dominated by middle men.

This could be a fantastic opportunity for investors if Powerband can accomplish what certainly looks possible for them to achieve.

#3 Aptiv (NYSE: APTV)

This brand-new company is disrupting the auto industry through its innovative self-driving technology.

Aptiv is the result of a split in Delphi Automotive Plc. Delphi divided itself into two companies, one focused on manufacturing and the other, Aptiv, on software. The move was designed to capitalize on the intense interest in self-driving technologies: suppliers like the new Aptiv have become hot commodities.

Aptiv has partnered with the ride-hailing company Lyft to design self-driving software that could revolutionize ride-hailing.

Aptiv and Lyft unveiled a self-driving car at the Consumer Electronics Show in Las Vegas this January, and reviewers were impressed with its performance.

If widely distributed, self-driving cars could completely change automotive transportation. Revenue from self-driving car companies is expected to grow by 39.6 percent by 2027, rising to $126.8 billion.

That makes a brand-new company like Aptiv, with a bevy of solid software and strong partnership deals, a tempting opportunity for investors.

#4 General Motors (NYSE: GM)

One of the largest American automakers, General Motors (GM) has seen a remarkable bounce back since the dark days of the 2009 financial crisis, when it required a federal bail-out to stave off bankruptcy.

GM has made a full recovery and along with other auto-makers enjoyed strong sales several years in a row, bolstering the stock price.

The company is getting ready to enter the auto industry’s most disruptive field. It’s promised 20 all-electric vehicles by 2023, and it has also promised an autonomous taxi for 2019.

The company’s AV subsidiary, Cruise Automation, is working hard to complete its independent AV software, and in November it was announced that the first GM AV will be ready for production by 2019.

And GM has set itself a high bar: rather than just operational, it wants to prove that it’s AV is safer than a human driver.

That means the company is planning on putting a big bet on AV technology becoming more widespread in the future. GM could end up as a major disruptor, and some have even predicted the company could be a better bet than Tesla in the long-term. Savvy investors should take notice.

#5 Fiat Chrysler (NYSE: FCAU)

A major competitor of GM, Fiat Chrysler enjoyed a solid 2017.

Like other auto-makers, the company was struck by declining sales, but the company’s stock enjoyed massive gains of 96.4 percent.

It’s translating those gains into further results, investing $1 billion and creating 2500 jobs for an auto plant near Detroit.

Despite its major gains, the company remains under-valued. It has out-performed three quarters in a row, presenting a tempting target for investors.

But the company is looking to the future. CEO Sergio Marchionne has warned the auto industry that in less than a decade widespread transformations will transform how cars are made, sold and driven.

In the short-term, that means that Fiat will be a safe, profitable bet for investors looking to avoid the pitfalls of wagering on a gamble.

More top companies disrupting their industries:

Magna International (TSX:MG) is based in Aurora, Ontario. The global automotive supplier is gutsy and innovative--and definitely tuned to the obvious future--clean transportation. A great catalyst is its development of a combo electric/hydrogen vehicle--a fuel cell range-extended EV (FCREEV). It’s not going to produce them (for now, at least) but plans to use the model to show off its engineering and design prowess and produce elements of the electric drivetrain and contract manufacturing.

The company’s auto parts are distributed to heavyweights such as General Motors, Ford, Tesla, BMW, Toyota, Volkswagen and Chrysler. These huge deals provide a safe and steady profit stream for the company. It’s insightful, forward-thinking and smart value/low cost for shareholders.

Avigilon (TSX.AVO): Avigilon develops, manufactures, markets and sells HD and megapixel network-based video surveillance systems, video analytics and access to control equipment. We expect strong continuous growth in the video analytics business and a company such as Avigilon is well positioned to capture market share in the Canadian markets.

As a key player in the digital security marketplace, it is clear to see why Avigilon made the list. With its technology continuing to move forward, investors can count in Avigilon to provide lasting value.

Sandvine Corporation (TSX:SVC): Ontario is seeing some vibrant cybersecurity growth, as well. Sandvine corp. is engaged in the development and marketing of network policy control situations for high-speed fixed and mobile Internet service providers. Products include Business Intelligence, Revenue Generation, Traffic Optimization and Network Security.

The company’s high-quality products and solidified place in the stock market has helped Sandvine company has grown 52% year-to-date and we expect strong growth throughout 2017.

Pivot Technology Solutions Inc. (TSX:PTG): Pivot focuses on the strategy to acquire and integrate technology solution providers, primarily in North America. It sells and supports integrated computer hardware, software and networking products for business database, network and network security systems.

Pivot has seen explosive growth so far this year and we expect the current cyber threats to add to the already strong sentiment in cyber security stocks, making the company one sure to draw investor interest.

Absolute Software Corporation (TSX:ABT): This Vancouver-based company offers endpoint security and data risk-management solutions, and this year has seen a share price jump of over 27%. Revenues are also up, and it looks like it’s on a path of securing strong new customers. The pipeline looks great, and forecasts for next year have been increased.

With strong management and an innovative team, Absolute Software is drawing growing investor attention. Absolute has seen a strong 21% stock growth year to date and is expected to see strong growth as the cyber security market grows at a rampant pace.

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Disclaimer for Forward-Looking Information

Certain statements in this press release are forward-looking statements and are prospective in nature. Forward-looking statements are not based on historical facts, but rather on current expectations and projections about future events, and are therefore subject to risks and uncertainties which could cause actual results to differ materially from the future results expressed or implied by the forward-looking statements. Forward-looking statements in this news release include expected continued success in software development, access to qualified sales force, continued involvement of current management, automotive industry activity levels remaining constant, receipt of required regulatory approvals, statements that Powerband’s cost savings technology will save new car sellers $400 to $1000 per vehicle, that Powerband could realize as much as a 69 percent profit margin on certain vehicle sales on its revenues, that the enterprise value of Powerband can rise substantially, that Powerband can increase revenues by 3000 percent to $61M by 2021, that Powerband’s technology can be employed by over 1000 dealers by 2021, that Powerband will be able to develop a blockchain system for providing accurate information about a vehicle, that recent revenue growth trends can continue, and that Powerband will continue to sign new partners.

Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. Such forward-looking statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements including, without limitation, risks with respect to: that Powerband’s technology may not achieve the expected results and its accomplishments may be limited, that Powerband may not establish a market for its services as expected; competitive conditions in the industry; general economic conditions in the US, Canada and globally; the inability to secure additional financing; competition for, among other things, capital and skilled personnel; potential delays or changes in plans with respect to deployment of services or capital expenditures; the possibility that government policies or laws may change; technological change; risks related to Powerband’s competition who may offer better or cheaper alternatives; Powerband not adequately protecting its intellectual property; interruption or failure of information technology systems; and regulatory risks relating to Powerband’s business, financings and strategic acquisitions. The Company disclaims any intent or obligation to update publicly any forward-looking information other than as required by applicable securities laws.

DISCLAIMERS

PAID ADVERTISEMENT. This communication is a paid advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Company”) has been paid by the profiled company or a third party to disseminate this communication. In this case the Company has been paid by Powerband ninety thousand US dollars for this article and certain banner ads. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. Gains mentioned in our newsletter and on our website may be based on end-of- day or intraday data. We have been compensated by Powerband to conduct investor awareness advertising and marketing for (TSX:PBX.V). Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. The third party, profiled company, or their affiliates may liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price is likely to occur.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our communications and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public and non-public sources but is not researched or verified in any way whatsoever to ensure the information is correct.

DISCLOSURE. The Company does not make any guarantee or warranty about what is advertised above. This article and the information herein are provided without warranty or liability.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you agree to the terms of this disclaimer, including, but not limited to: releasing The Company, its affiliates, assigns and successors from any and all liability, damages, and injury from the information contained in this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

RISK OF INVESTING. Investing is inherently risky. While a potential for rewards exists, by investing, you are putting yourself at risk. You must be aware of the risks and be willing to accept them in order to invest in any type of security. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities.