What’s it like to strike it rich?

It’s probably like finding gold in the middle of nowhere.

Well, that’s exactly what happened…in a corner of a West African country, where miners uncovered a nugget weighing 1 kilogram worth $45,400.

Then, it happened again: a second nugget, weighing 2.7 kilograms, worth $122,500...

And what’s still underground could change everything we know about the gold market.

It’s all happened at the Kobada mine in southern Mali, owned and operated by African Gold Group Inc. (TSX:AGG.V, OTCMKTS:AGGFF).

It’s a project that sits amidst one of the biggest mineral belts on earth, in a part of West Africa that has just become the capital of the global gold industry.

It’s a place where mining firms are spending hundreds of millions on new acquisitions.

And AGG hopes to use Kobada to strike it rich in the next big gold boom.

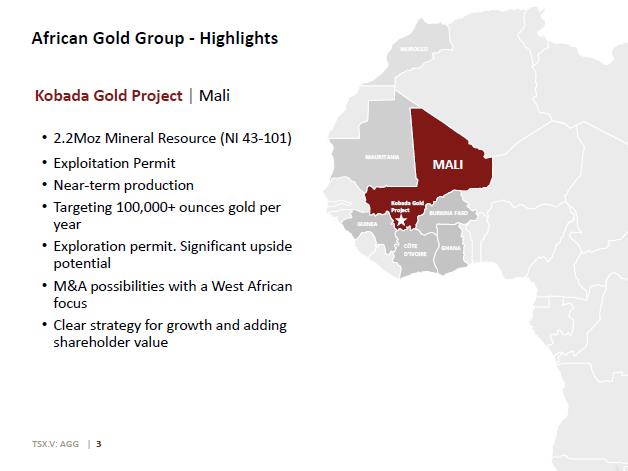

The company has everything going for it:

A project that is planned to come on-line soon, with a total resource base of 2.2 million ounces of gold worth billions of dollars.

A management team of dedicated professionals …led by a titan of the mining world who has turned tiny firms into multi-hundred million dollar powerhouses.

All this, at a time when gold prices look sure to hold steady, and maybe even increase.

So there’s every reason to bet that this tiny $12 million firm could realize a huge valuation or even potentially get gobbled up …delivering a massive upside to investors who get in on the ground floor.

It’s all happening for AGG (TSX:AGG.V, OTCMKTS:AGGFF). Here are five reasons to get excited:

##1 The Kobada Find…a $140 Million per Year Gold Mine in West Africa

The Kobada Gold Project is in southern Mali—which is important to note.

While Northern Mali has had some trouble, southern Mali is stable, safe, and extremely favorable to extractive operations.

In fact, Mali is Africa’s third-largest gold producer, and the southern belt near the borders with Cote d’Ivoire and Guinea is an ideal spot to set up shop.

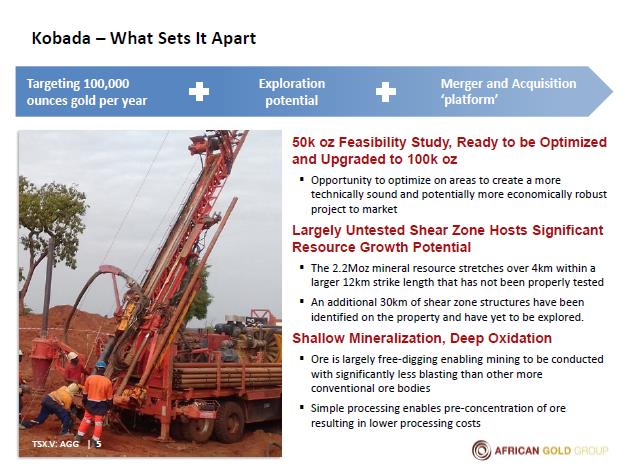

The belt stretches over 4 km within a larger 12 km strike length and is entirely owned by AGG. Studies have suggested a total resource base of 2.2 million ounces. The company believes it can hit 50,000 ounces a year and build upwards to 100,000 ounces a year in a short time frame, judging by initial technical and economic studies.

At current prices, that would be $140 million in gross revenue a year... for a $12 million firm.

And the company estimates the resource where these gold nuggets were just unearthed at 2.2 million ounces. And there could even be more, depending on what new tests may reveal.

Mineralization is evident at shallow depths, which means miners won’t have to sink big pits or blast away too much rock to get at the ore deposits. That means lower cost—and less time to market.

It used to be South Africa that got all the mining attention. But increasingly, investors are shifting their focus West... where the geology is just being discovered.

In Mali alone, there are at least twenty different mining companies setting up shop. And the regulatory environment couldn’t be more ideal—the Malian government has embraced mining, Mali’s biggest GDP contributor, and has streamlined the permit process.

Where in North America permitting can take as long as 5-7 years, in Mali companies can have permits in hand in a matter of months.

For Kobada, licenses acquired from the Malian government expire in 2045 and cover an area of 135.7 square km

The area around AGG’s (TSX:AGG.V, OTCMKTS:AGGFF) operation at Kobada is turning into a gold-mining hotspot. According to Mining Intelligence, 61 new assets are in production or construction stages, with 24 assets undergoing economic assessments…and a colossal 367 assets in exploration.

In fact, West Africa seems poised to become a new center for global gold mining—thanks to vast, untapped deposits, low costs and increasingly favorable regulatory environments.

Guinea, Mali and Burkina Faso already produce twice as much gold as South Africa…and things may only get better from here.

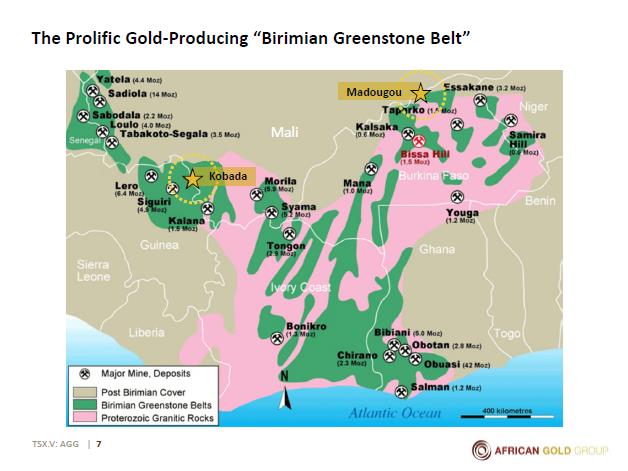

#2 AGG is Inside The Multi-Billion Dollar Birimian Belt

Kobada is part of a massive belt running across a huge swath of West Africa. Mining here has been particularly lucrative, with Resolute and Barrick hitting it big.

It’s called the Birimian Belt. And it’s paid out big time for companies who have gotten in on the action.

Take the Morila mine, in southern Mali, just east of Kobada. Operated by gold giant Barrick, the mine has been in operation since 2000.

Or what about Tongon in Cote d’Ivoire, also run by Barrick, where 230,000 oz was dug up…worth $322 million.

Or consider the Syama Mine, in Mali, operated by Resolute, which estimates it will produce 300,000 oz of gold per year. At current prices, that’s $420 million.

Kobada sits squarely in a belt of mines that have paid out to investors. Better yet, West Africa is only now growing into a new global gold hub…which means things will hopefully only get better from here.

Just this year, Ghana outpaced South Africa as Africa’s biggest gold producer. Mali isn’t too far behind.

There are potentially hundreds of new assets that lie untapped. That means AGG (TSX:AGG.V, OTCMKTS:AGGFF) could be even bigger than investors realize.

#3 A $4 Billion Find

The discovery of 1kg gold nuggets could be just the tip of the iceberg at Kobada…a hint of what’s to come.

Combined with the earlier discovery of a 2.7kg nugget in 2008, this discovery indicates the potential of the find…and it’s bigger than you could imagine.

First, take the company’s projected haul—50,000 oz a year.

Valued at the current rate of $1400 per oz, that’s revenue of $70 million. Not bad.

The company estimates the total haul for the Kobada property to be 2.2 million ounces, which at gold’s current prices could be worth as much as $3.1 billion in revenue.

Plus, consider the current outlook for gold. Despite recent news, including the decision by the Fed to cut interest rates, consolidation in the gold market means we can expect the $1400/oz rate to hold steady, or to trend upwards.

With China`s gold buying spree ramping up and increasing international trade tensions, industry experts expect the prices to go up to $2000.

That means the estimated gold at the Kobada property could be soon worth more than $4 billion.

And AGG (TSX:AGG.V, OTCMKTS:AGGFF) has a team that knows what it’s doing. They know how to execute on big projects.

#4 World Class -- Billion-Dollar -- Management Team

The team at AGG is an all-star group of mining industry professionals and financial whizzes who have spun iron ore into gold for decades…and are ready to do it again at Kobada.

Two directors, Sir Sam Jonah and Bruce Humphrey, have a hundred years of combined experience working the finances for mining operations. Jonah served as CEO of Ashanti Goldfields Company Ltd in the mid-1980s, while Humphrey was CEO and President of Desert Sun Mining and COO of Goldcorp, one of the world’s largest gold mining firms.

Working the heavy machinery is miner and geologist Danny Callow. Callow served as the number two mining head for Glencore’s Africa division, where he built a copper operation in Africa from green fields to a 210,000 ton producer.

But the real shocker here is Stan Bharti, the company’s new CEO. With thirty years of experience and a jaw-dropping resume, Bharti could lead AGG into a golden age.

His accomplishments include:

- Started and founded Desert Sun in 2002 at $0.40 a share sold 2006 $750 million or $7.50 a share (TSE: DSM)

- Started and founded Consolidated Thompson 2004 at $0.25 a share sold in 2011 for $4.9 billion or $17.50 a share (TSE: CLM)

- Started Avion Gold 2008 at $0.40 a share and sold in 2012 for $400 million or $0.88 a share (TSE: AVR)

- Started Sulliden 2009 at $0.40 a share and sold in 2014 for merged value of $464 million or $ 1.47 (TSE: SUE)

Companies under Stan’s leadership have uncovered 20 million ounces of gold, more than 3 billion ounces of iron ore and 1.5 billion ounces of potash. He’s amassed more than $3 billion in investment capital for his companies and released countless billions to his shareholders. And he’s got an eye for gold: Bharti correctly predicted that gold prices would bounce back in the mid-1990s and again between 2003 and 2015.

His prior experience in Mali was with Avion, acquired for $20 million in 2008. In the middle of the biggest financial crisis in history, Bharti turned Avion around and sold it off for $500 million in 2012.

That’s a 20x growth rate. And Bharti’s ready to do it again.

“It feels like we are in 2003 again,” Bharti said, “at the cusp of a great run in gold and gold stocks.”

“I have always bought or acquired undervalued assets in emerging markets. This gives our shareholders the best potential for HUGE returns. AGG (TSX:AGG.V, OTCMKTS:AGGFF) fits in that category very well.”

With Bharti and his friends injecting $3 million into the Kobada mine project, construction could start soon, under Danny Callow’s direction.

“The team is now complete,” he declared, “and we are ready to take this asset to the next level in one of the most bullish environments I have seen in my 30 year career in mining “

#5 Invest Now, Before it’s Too Late

West Africa could be about to become one of the world’s biggest gold mining hubs…and AGG hopes to ride the crest of a wave to build an asset that could be worth billions.

But while other miners are pulling up gold dust from millions of tons of ore, Kobada’s property has turned up nuggets, and it could hold more, waiting in shallow deposits.

Investors have taken note.

Gold mining stocks are soaring, and while gold majors are taking center stage, it’s the junior miners are really moving the needle.

The VanEck Vectors Junior Gold Miners ETF, one of the most popular small-cap mining ETF’s, has gone up 50% in the last 2 months.

FIRST, the price of gold won’t likely stay put for long. It’s been trending upward for months, and could go even higher. Mining expert and financial wiz Stan Bharti, the new chief of AGG, thinks it’ll hit $2000/oz.

SECOND, the company is about to announce the real potential of the Kobada mine…2.2 million ounces, worth as much as $3 billion, or more than $4 billion if the price goes up.

As Pope & Company noted, "The gold at the Kobada deposit is coarse and nuggety, which means the contained gold content is often under estimated."

The nuggets that have already been uncovered could be a sign of Kobada’s true, untapped potential.

This little $12 million market cap company with its billion dollar mine in Mali could see a colossal surge of investor interest.

That means this opportunity may not wait around forever.

This nugget is just waiting to be dug up…

Other miners looking to capitalize on big finds:

Endeavor Silver (NYSE:EXK) (TSX:EDR)

Endeavor operates three silver-gold mines in Mexico, but it’s also got three attractive development projects. Production has dropped and all-in sustaining costs have risen, leading to a negative cash flow. But the company has significantly reduced its debt, so its future is anything but bleak.

2019 could be a bit of a mixed bag for Endeavor Silver as earnings expectations remain negative for Q1. Its three mines in Mexico and a planned fourth mine in the Mexican state of Zacatecas are expected to see their output increase this year while the company has managed to keep AISC at reasonable levels last year, the question remains whether they can keep the costs low this year.

Near term catalysts should be expected from the El Cubo and Terronera projects in Mexico, but real share price gains can’t be expected until gold and silver prices break out.

Pan American Silver (NASDAQ:PAAS) (TSX:PAAS)

Pan American is a world-class mining operation with active projects in Mexico, Peru, Canada, Bolivia and Argentina. Though silver has seen better days, it is still a favorite among investors stocking up on safe haven assets.

Recently, Pan American made a major acquisition of Tahoe Resources, absorbing the company’s issued and outstanding shares.

Michael Steinmann, President and Chief Executive Officer of Pan American Silver, said: "The completion of the Arrangement establishes the world's premier silver mining company with an industry-leading portfolio of assets, a robust growth profile and attractive operating margins. We are also now the largest publicly traded silver mining company by free float, offering silver mining investors enhanced scale and liquidity."

Barrick Gold Corp. (NYSE:GOLD) (TSE:ABX) and Goldcorp Inc. (NYSE:GG)

All eyes are on the billion-dollar partnership these two giants are forming in Chile’s gold belt. Goldcorp is putting up $1 billion to get in on this deal as miners scramble for new sources of growth. This joint venture will see the two giant miners operate three properties in Chile’s Maricunga region, and these will be major catalysts for both.

Newmont Mining Corp (NYSE:NEM, TSX:NGT)

Founded over 100 years ago, Newmont Mining Corporation (NYSE:NEM) is one of the leading mining companies in the world. The company holds assets in Peru, Australia, Ghana, Indonesia, Mexico, and around the United States. Primarily focusing on gold and copper, Newmont has steadily carved out a name for itself among those in the industry. In Q1 2017 alone, the company secured over 1.2M ounces of gold. Definitely noteworthy for investors.

Turquoise Hill Resources (TSX:TRQ; NYSE:TRQ)

Turquoise is a mid-cap Canadian mineral exploration and development company headquartered in Vancouver, British Columbia. Its focus is on the Pacific Rim where it is in the process of developing several large mines.

The company mines a diversified set of metals/minerals including Coal, Gold, Copper, Molybdenum, Silver, Rhenium, Uranium, Lead and Zinc. One of the fortes of Turquoise hill is its good relationship with mining giant Rio Tinto.

Turquoise has seen its share price languish last year, and the successful development of its world-class Oyu Tolgoi project in Mongolia is of utmost important to the future of this miner.

In the short term, investors can expect the share price to come back somewhat as the company looks undervalued by any means. If oil prices break out above $1320 per ounce, Turquoise Hill Resources is poised to profit from it.

By. Ian Jenkins

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by2227929 Ontario Inc. to conduct investor awareness advertising and marketing concerning African Gold Group. Inc.2227929 Ontario Inc. paid the Publisher fifty thousand US dollars to produce and disseminate this and other similar articles and certain banner ads.This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The owner of Oilprice.com will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the company’s gold exploration and extraction activities, the size and growth of the market for the companies’ products and services, the companies’ ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditionsIf you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.