An exciting new green energy opportunity is beginning to unfold...yet it remains completely beneath the radar of most investors.

With a massive global shift underway towards greener, more sustainable energy solutions, one game-changing energy source could be on the verge of transforming green energy forever.

And one company in particular – an early leader in the space, being guided by a Hall of Fame-caliber leadership team – offers investors a unique opportunity to invest in the early stages of what could be the next major green energy source.

In fact, one massive industry has already begun to turn to this new energy source for its energy needs, triggering a significant opportunity that the mainstream press has almost completely ignored.

This high-upside new green energy opportunity is happening with ammonia.

That’s right – ammonia. The very same substance that most people think of for its use as a fertilizer and in many household cleaning products.

But the way we think about ammonia is about to change...in a huge way.

That’s because green ammonia has extraordinary potential as a clean energy source, and certainly now has the attention of global energy behemoths who are collectively betting on this space to make mankind’s dream of carbon-free energy a reality.

Now here’s where the early-stage investment opportunity comes into play:

One company has quietly emerged as a significant early mover in this space.

It’s a company that has already taken significant steps to capitalize on the “low-hanging fruit” in the ammonia space...and it’s being led by a forward-thinking CEO with experience at Ford Motor Company, Magna International, and NASA.

This company is AmmPower Corp.(CSE:AMMP; OTC:AMMPF) – and it could offer investors significant upside potential as ammonia production becomes critical to fueling our green energy needs.

AmmPower is now developing proprietary technology that aims to produce cleaner ammonia – more efficiently – and in a much more scalable way.

Here are 5 reasons investors should consider AmmPower immediately for its high upside potential:

Reason #1: Ammonia Offers Significant Potential as an Efficient Fuel Source

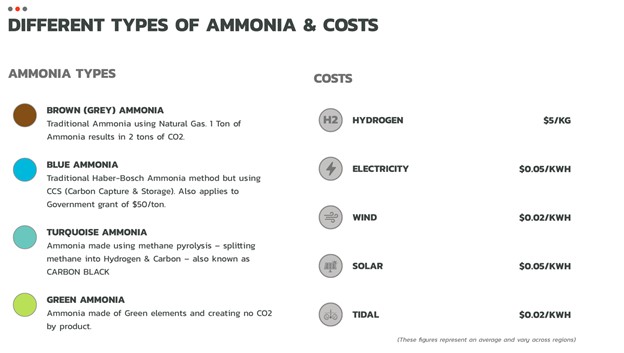

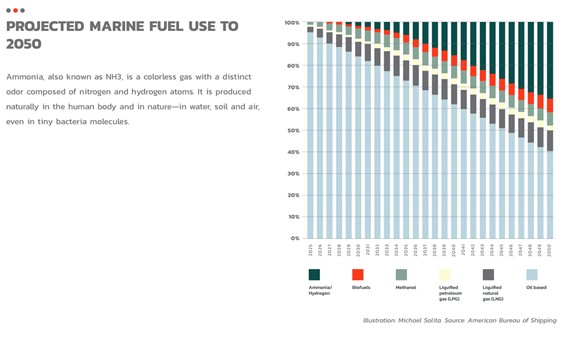

Ammonia, also known as NH3, is a colorless gas that is composed of nitrogen and hydrogen atoms. It is produced naturally in the human body and in nature – in water, soil, and air...even in tiny bacteria molecules.

Of course, its use as a fertilizer is what ammonia is best known for, as half the world’s food production depends on it for increasing crop yield.

But it’s ammonia’s future as a clean energy source that offers explosive upside potential.

That’s because ammonia has been shown to possess nine times the energy density of lithium-ion batteries...and 1.8 times the energy density of liquid hydrogen.

This higher energy capacity is what gives ammonia its potential as a significant carbon-free energy carrier.

Ammonia is also less flammable, easier to transport, and more cost-effective than hydrogen.

While many companies and innovators are looking to hydrogen as a potential source to meet their green energy needs, the fact of the matter is there is greater potential – and less competition – with ammonia.

At the moment, ammonia is the second most commonly produced chemical in the world, but existing processes for production produce a significant amount of carbon dioxide emissions.

AmmPower CSE:AMMP; OTC:AMMPF) is working to change the process of how ammonia is made by developing a proprietary process and chemicals to produce green ammonia with minimal by-products and residual contaminants.

Some of the world’s smartest minds are now predicting that using ammonia as a fuel source will play a massive role in the global war against climate change.

In fact, industry trade publication Chemical & Engineering News reports that “ammonia could come to the (climate change) rescue by capturing, storing, and shipping hydrogen for use in emission-free fuel cells and turbines. Efforts are also underway to combust ammonia directly in power plants and ship engines.”

Of course, among the smart minds who are predicting that ammonia could play a significant role as a green energy source is AmmPower’s excellent management team...

Reason #2: AmmPower CSE:AMMP; OTC:AMMPF) is Led by a Team with a Long Track Record of Success.

One of the most critical aspects when evaluating the potential for any company is the quality of its management.

In the case of AmmPower investors who examine this opportunity will find a team of successful professionals -- from large corporations – who have come together to help take advantage of a unique opportunity in the green energy space.

When such an impressive lineup of proven business leaders assembles to run a small company...it’s not because they think it’s a longshot. It’s because they likely believe in the company’s outsized growth potential.

Leading the group is Chief Executive Officer Dr. Gary Benninger, who recently stepped down from his position at Magna International Inc., a $40 billion USD automotive parts supplier, third-largest in the world.

At Magna, he held key management positions including Executive Vice President of Engineering and R&D for the Corporation and Division General Manager where he launched the automotive interior trim business and initiated the development of new technologies resulting in over $1 billion USD in sales.

Dr. Benninger also held key management positions outside Magna as the Chief Operating Officer of the North American Operations of the Becker Group, a $1.5 billion privately held automotive interior systems supplier where Gary managed fourteen manufacturing plants and as the Chief Executive Officer of the publicly traded Amerityre Corporation, a polyurethane tire developer and manufacturer.

Prior to joining Magna, he worked for Ford Motor Company as a product engineering manager, where he was awarded the Society of Plastics Engineers and the Society of the Plastics Industry Grand Awards and for the National Aeronautics and Space Administration (NASA) as a research scientist in the Energy Conversion and Materials Science Division of the Glenn Research Center.

Company President Rene Bharti began his career working in the mining industry, culminating in his role with start-up Avion Gold Corp., a West African gold company that was eventually sold for $300 million to Endeavour Mining.

Subsequently, Mr. Bharti founded ARHT Media, a technology company currently trading on the Toronto Stock Exchange, and Future Fertility Inc., an Artificial Intelligence company in the biotech space. Mr. Bharti has been responsible for helping raise over $500 million for various ventures over the past two decades, often serving as a consultant with fundraising and subsequent IPO processes.

Vice President of Technology & Government Relations Dr. Luisa Moreno has almost two decades of experience in Finance, Business Development, and Technical Research, with a focus on Technology, and Mining and Metals industries.

In addition, the company’s research and development team is led by a true innovator with a long track record of building successful R&D projects...

Reason #3: The Company’s Innovative Research & Development

AMMPower’s (CSE:AMMP; OTC:AMMPF) research and development team is headed by Dr. V.I. Lucky Lakshmanan, Ph.D., FCAE, MIMM, FCIM. The R& D team headed by Dr. Lakshmanan is responsible for over 69 patents filed and research publications in over 150 scientific publications to date.

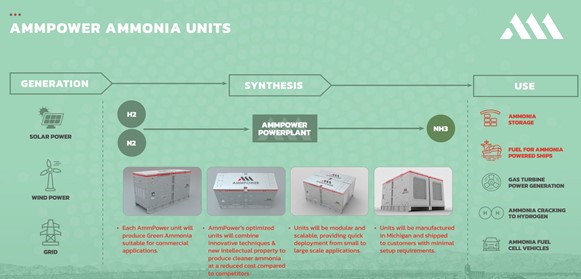

The team is working to develop a proprietary ammonia production process by incorporating innovative catalysts and refining processing conditions to more efficiently produce ammonia & cheaper economic prices.

The company is targeting intellectual property and patents in the following areas:

- AmmPower Green Ammonia units

- Retro-fit technology

- Optimized chemical production process of green ammonia

The company’s research and development was further enhanced by the recent announcement of an R&D agreement with Process Research Ortech, Inc.

As part of this agreement, AmmPower will work with Ortech to improve the efficiency of the ammonia synthesis process by incorporating new additives and catalysts to the production process and testing different methodologies to improve ammonia formation conditions.

In doing so, AmmPower hopes to develop a cleaner and more economically efficient ammonia production process.

The AmmPower team is focused on a process that can break water into its constituent hydrogen and oxygen atoms, and then add nitrogen from the atmosphere to create ammonia.

The company is committed to utilizing carbon-free energy sources to ensure an end-to-end clean, green ammonia production system that is efficient, mobile, and modularly scalable. To top things off, the company is finalizing technology to be able to efffeciently “crack” hydrogen from ammonia. Ammonia is the perfect carrying vessel for ammonia, as it is not only safer to move hydrogen as ammonia, but is also cheaper, as it allows more hydrogen to be moved as ammonia, then as hydrogen alone. Indeed, the business of “cracking” Hydrogen is large enough to be an industry in itself, if one believes in the green hydrogen economy.

This means Ammonia production and Hydrogen cracking could be located closer to the end-user in an integrated process designed to grow with the customer’s needs.

Reason #4: AmmPower Corp.(CSE:AMMP; OTC:AMMPF) Enjoys a Significant First Mover Advantage

While experts agree that there is massive potential in the green ammonia space, the fact of the matter is there aren’t many other companies currently looking to do what AmmPower is doing.

This means there’s very little competition in the marketplace as the company seeks to establish an early leadership position.

There are no other commercially available modular ammonia units, so if they are able to effectively commence construction of modular ammonia-producing units they will enjoy a significant first-to-market advantage.

Their ammonia-producing units are planned to be flexible to fit a wide array of customers from individual organizations, large marine ports, and distribution hubs.

The company is aiming to become a world leader in scalable proprietary production of green ammonia thanks to its...

- Commitment to secure a dedicated manufacturing facility near Detroit, Michigan...

- Potential of large manufacturing capabilities and large power capacity for on-site ammonia production and experimentation...

- And the potential for physical expansion of the facility into larger manufacturing space as required by customer demand and scientific success.

Reason #5: AMMPower Has a Strong Path to Revenue and is Targeting Low-Hanging Fruit

AmmPower Corp. (CSE: AMMP) (OTCQB: AMMPF) is focusing its initial efforts to bring green ammonia capacity to those industries in need of immediate solutions.

The global marine industry is a large, readily available market that has already begun turning to ammonia to help meet its energy needs. In, fact, AmmPower recently announced the creation of AMC – AmmPower Marine Corp., that is solely focused on opportunities in shipping and the worlds oceans.

Ship owners and industry analysts alike say they expect ammonia to play a pivotal role in the de-carbonization of cargo ships, which must reduce emissions by 50% from 2008 levels by 2050.

- Over 120 ports are already equipped with ammonia trading facilities...

- MAN Energy and Samsung Heavy Industries are part of an initiative to develop the first ammonia-fueled oil tanker by 2024...

- Viking Energy expects to become the first vessel propelled by ammonia fuel cells...

- And according to one consultancy report, ammonia could make up 25 percent of the maritime fuel mix by midcentury, with nearly all newly built ships running on ammonia beginning as soon as 2044.

The future of energy for the global shipping industry seems clear – and it looks to be heavily dependent upon ammonia.

Other companies to watch in the energy transition:

BCE Inc. (TSX:BCE) is a Canadian telecom giant. Founded in 1980, the company, formally The Bell Telephone Company of Canada is composed of three primary subsidiaries. Bell Wireless, Bell Wireline and Bell Media, however throughout its push into the position of one of Canada’s top telco groups, it has bought and sold a number of different firms.

BCE is also at the forefront of the Internet of Things movement in Canada. Its Machine to Machine solutions are being used by numerous businesses, including TaaS providers throughout North America and its new LTE-M network is sure to rapidly increase the adoption of these solutions. This also makes it an indirect player in the global energy transition.

Turquoise Hill Resources Ltd. (TSX:TRQ) is a key player in Canada’s resource and mineral industry. It is a major producer of coal and zinc, two resources with distinctly different futures. While headlines are already touting the end of coal, zinc is a mineral that will play a key role in the future of energy for years and years to come.

In addition to its zinc operations, Turquoise Hill is also a significant producer of Uranium. Uranium is a key material in the production of nuclear energy, which many analysts are suggesting could be a major component in the global transition to cleaner energy.

Though 2019 was a particularly rough year for Turquoise Hill, its downturn led to an opportunity for new shareholders to get in on the company at reduced prices. Since dropping from all time highs and settling at a low of just $5, Turquoise Hill has outperformed many of its peers, climbing by nearly 150% in 2020 alone.

Supply disruptions can impact anyone, even fossil fuel producers. Westshore Terminals (TSX:WTE) is a coal export terminal located at Roberts Bank Superport in Delta British Columbia. It is Canada's largest coal export facility, surpassing the combined coal shipments of all other terminals in Canada. The company exports thermal and metallurgical coals to markets around the world, including Japan, South Korea, China, India and Taiwan. Westshore also offers services to ship various bulk cargoes through its marine facilities. Westshore Terminals has been operating for over 30 years and employs more than 240 employees that work 24/7 shifts to ensure continuous operation.

Great-West Lifeco (TSX:GWO) continues to be a popular stock among short sellers on the TSX. This North American and European financial services holding company has seen its shares drop 8.9% year over year yet it still attracts interest from investors globally due to its healthy balance sheet, strong cash flows, and more.

Is the short interest justified? Their record as dividend payers is very strong: Great West has been paying out an average annualized return on investment (ROI) for stockholders since 1948 that currently sits just below 7%. It also offers a quarterly dividend yield with dividends paid every three months which equals about 6%, or more than five times what most people can expect to earn through investing in savings accounts today. This could emerge as a huge incentive to fight off the short sellers and keep the stock afloat for many loyal investors.

The Descartes Systems Group Inc. (TSX:DSG) is a Canadian multinational technology company specializing in logistics software, supply chain management software, and cloud-based services for logistics businesses. Recently, Descartes announced that it has successfully deployed its advanced capacity matching solution, Descartes MacroPoint Capacity Matching. The solution provides greater visibility and transparency within their network of carriers and brokers. This move could solidify the company as a key player in transportation logistics which is essential-and-often-overlooked in the mitigation of rising carbon emissions.

By: Lisa Potts

** IMPORTANT NOTICE AND DISCLAIMER -- PLEASE READ CAREFULLY! **

PAID ADVERTISEMENT. This article is a paid advertisement. GlobalInvestmentDaily.com and its owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by AmmPower Corp. (“AmmPower” or “AMMP”) to conduct investor awareness advertising and marketing. AmmPower paid the Publisher to produce and disseminate five similar articles and additional banner ads at a rate of ninety thousand US dollars per article. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on interviews with company management, and does not (to the Publisher’s knowledge, as confirmed by AmmPower) contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The Publisher owns shares in the featured company and therefore has an additional incentive to see the featured company’s stock perform well. The Publisher does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. The Publisher will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Forward looking statements in this publication include that the global demand for ammonia and hydrogen as commodities will continue to increase; that the research and development in the energy sector will lead to adoption of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future; that governments will continue to implement initiatives supporting reduced carbon emissions and that ammonia and hydrogen will gain traction and commercial viability as potential carbon-free or low carbon fuel alternatives; that AMMP will be able to develop an efficient process and proprietary intellectual property for the production of green ammonia and that AMMP’s process, if developed, will be adopted commercially to allow use of green ammonia and/or hydrogen as viable fuel sources; that AMMP will meet its proposed development program and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP will be able to complete and establish its proposed manufacturing facility and produce ammonia power units which will be sold as commercially viable fuel alternatives; that investors will continue to seek opportunities for investment in green technologies and that hydrogen and ammonia will be considered as viable investment opportunities in the future; and that AMMP can carry out its business plans. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include the global demand for ammonia and hydrogen may not actually continue to increase if other energy alternatives such as solar, wind or hydroelectric are favored over ammonia and hydrogen; that the research and development in the energy sector may lead to rejection of hydrogen and ammonia as commercially viable fuel sources for the automotive, aircraft, marine, industrial or other sectors in the future, and that research may find that other fuels or energy sources provide safer, more cost efficient and/or more viable fuel alternatives; that governments may not implement the anticipated funding and initiatives to support reduced carbon emissions sufficient for ammonia and hydrogen to gain necessary traction or commercial viability as fuel alternatives; that AMMP may be unable to develop an efficient process or any unique proprietary intellectual property for the production of green ammonia or, even if developed, may ultimately fail to be adopted as commercially viable for any reason; that AMMP may be unable meet its proposed development timeline and funding milestones to develop its technology process and produce the proposed AMMP power units; that AMMP may be unable to establish its proposed manufacturing facility and produce ammonia power units, or if such units are developed, that they may not be sold as commercially viable fuel alternatives; that investors favor other clean energy opportunities than hydrogen and ammonia or that other fuel alternatives such as solar, wind and hydroelectric may be considered more commercially viable; and that AMMP may, for any number of reasons, fail to carry out its intended business plans. The forward-looking information contained herein is given as of the date hereof and we assume no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://GlobalInvestmentDaily.com/Terms-of-Use. If you do not agree to the Terms of Use http://GlobalInvestmentDaily.com/Terms-of-Use, please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.